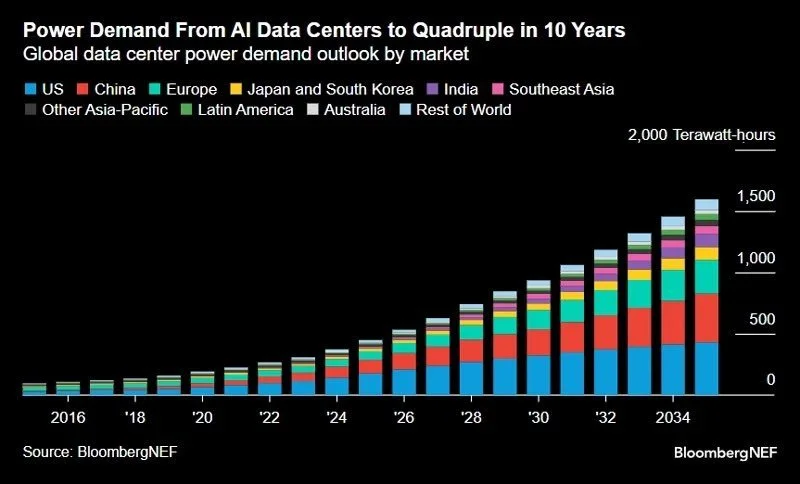

In the accelerating race to build-out artificial intelligence (AI) at scale, just a small handful of companies hold the literal "on/off switches" for the infrastructure powering it all. Dubbed "chokepoint kings," these firms control irreplaceable elements (from chip design and fabrication to lithography and thermal management) amid surging demand for AI data centers (projected to consume 8% of global electricity by 2030). Here are the four AI Chokepoint Kings, including a description of what they do, how they are currently being valued by the market, and my strong opinion on investing.

1. Nvidia (NVDA):

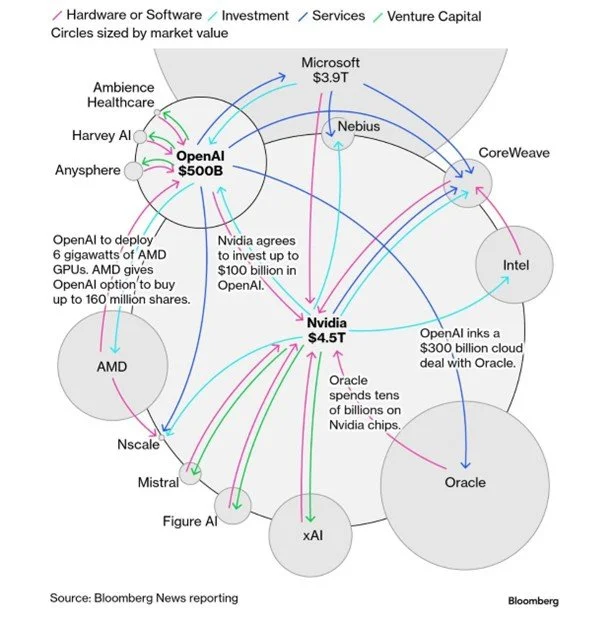

Nvidia reigns supreme in the AI software-GPU stack, commanding 80% market share with its CUDA ecosystem locking in developers. The Hopper and Blackwell architectures fuel training for models like GPT-5, while inference chips target edge AI. Despite rivals like AMD's MI450 gaining traction, Nvidia’s $182 gross margins and $100B+ 2025 data center revenue underscore its moat. CEO Jensen Huang warns of supply constraints, but partnerships with OpenAI signal sustained dominance, even as growth may peak mid-2026. Currently trades at only 0.5x PEG(f)—attractive!

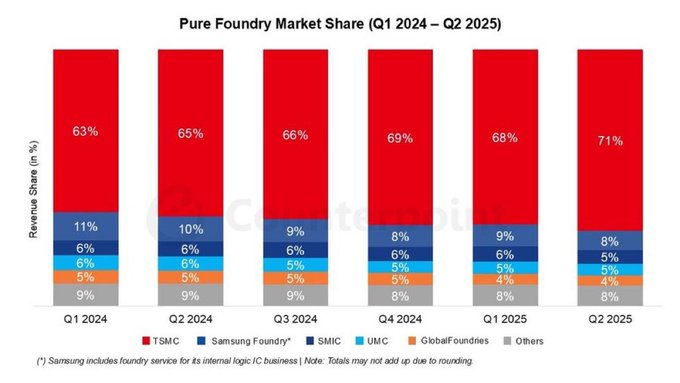

2. Taiwan Semiconductor Manufacturing (TSM):

TSM is the foundry powerhouse, fabricating 66% of advanced chips via 3nm nodes (now in volume) and 2nm slated to ramp soon. Its CoWoS packaging resolves AI's multi-chip integration woes, with capacity doubling to 660,000 wafers amid Nvidia and AMD orders. AI now exceeds 20% of revenue, up from 15% in 2024, backed by $40B capex for 12 new Taiwan fabs. Geopolitical risks linger, but US expansions mitigate them.

3. ASML (ASML):

ASML has an EUV monopoly (>90% share) etches sub-7nm features essential for dense AI logic, with High-NA systems enabling 2nm+ scaling. No scalable rivals exist, despite US-backed xLight's 2028 ambitions. Q1 2025 sales hit €7.74B (up 46%), with €60B annual run-rate from AI alone.

4. Vertiv (VRT):

Vertiv commands liquid cooling, now mandatory for 150kW+ AI racks where air fails. Its CoolPhase Flex hybrid systems, debuting in 2025 via Compass partnership, flex between air/liquid for seamless upgrades. The $3B market by 2026 aligns with hyperscalers' $392B capex; Vertiv's services portfolio supports 120kW densities globally.

The Bottom Line

These four stocks are virtual monopolies, and they all have very strong pricing power. They are basically all “buy and hold” stocks, especially on any near-term share price weakness.