If your primary objective as an investor is to generate attractive total returns from which you can source steady income payments, then you may want to consider the closed-end fund (“CEF”) described in this article. However, our upfront caveat is that CEFs are NOT for all investors. In this particular case, there are many highly attractive qualities (e.g. big monthly income distributions, discounted price versus NAV, compelling real estate market conditions, no risky leverage, and a long-term track record of success, to name a few), however investors should be aware that a portion of the income distributions are sourced from capital gains (in a tax-efficient manner), so don’t expect the value of this investment to climb dramatically over the long-term, unless you’re reinvesting those big juicy monthly distribution checks.

Cohen & Steers Total Return Realty Fund (RFI)

Yield: 7.1% (Paid Monthly)

As mentioned above, this fund is attractive for a variety of reasons (not the least of which are the big monthly distribution payments, the discounted price, and the attractive sector exposure), but before getting into those attractive qualities (and more), here is how the fund manager (Cohen & Steers) describes the fund:

“The investment objective is to achieve a high total return through investment in real estate securities. Real estate securities include common stocks, preferred stocks and other equity securities of any market capitalization issued by real estate companies, including real estate investment trusts (REITs) and similar REIT-like entities.”

And for some flavor, here is a list of the fund’s top 10 holdings:

Further, you can view the fund’s complete holdings list here.

What is a CEF?

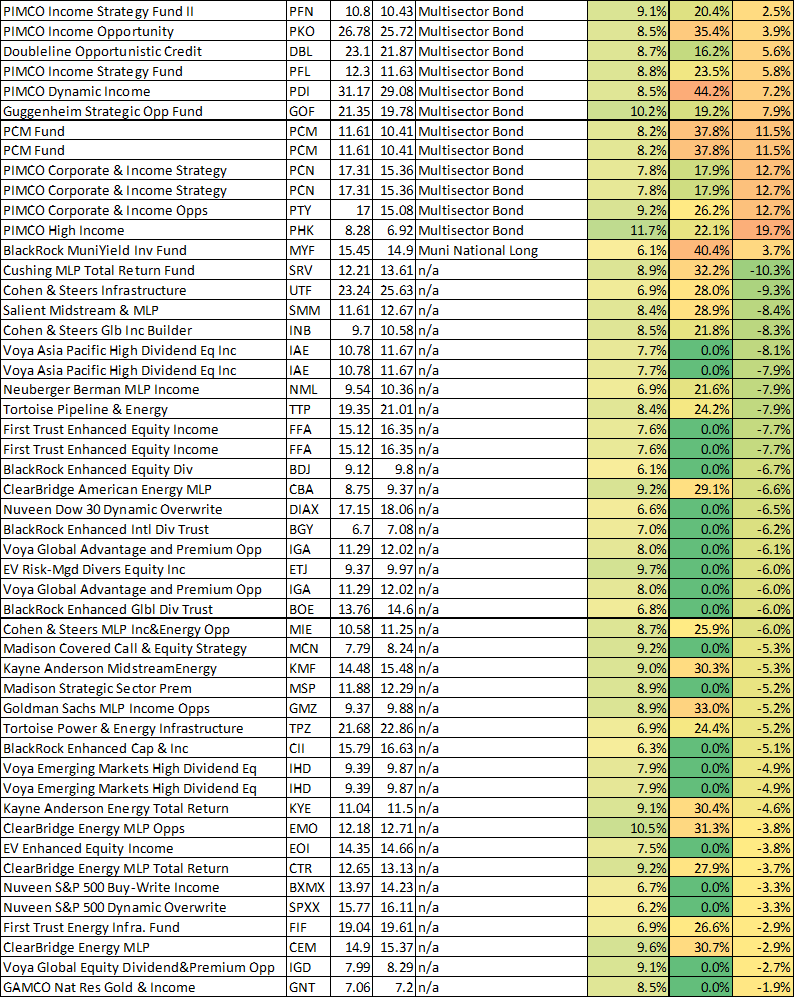

Briefly, for those of you who don’t know, a closed-end fund (“CEF”) is a collective investment model that issues a fixed number of shares. And unlike open end funds (e.g. mutual funds and exchange traded funds), CEF shares are not redeemable from the fund. This is a critical differentiator because it allows CEFs to trade at significant premiums or discounts versus their net asset values (“NAV”). NAV is basically the aggregate market value of all the individual holdings with in the fund. For some perspective, the following table shows the current premiums and discounts (among other characteristics) for 250 different CEFs that are currently yielding 6% or above.

INSERT TABLE

5 Reasons Cohen & Steers Realty CEF (RFI) Is Attractive:

1. Big Monthly Distributions

Often times, the main reason investors are attracted to CEFs is because of their big distribution payments. And with a 7.1% annual yield, paid monthly, RFI is no exception. And perhaps even more compelling, this fund has been making healthy distribution payments to its investors since the 1990’s.

You may be wondering how the fund can support a 7.1% distribution yield when the securities it holds, on average, offer dividend yields lower than 7.1%. The answer, which is common to most CEFs, is the distribution payments are comprised of a combination of income (dividends and/or interest) as well as capital gains (sometimes short-term, sometimes long-term) and occasionally a return of capital. For example, the following graphics show the recent and historical distribution payment breakdown for the Cohen & Steers Realty Fund.

If you are an income-focused investor, these sources of income may be attractive to you because it saves you the trouble of having to go in and raise income (via selling some of your holdings) to meet your monthly income needs. Further, management is able to generate the income in a tax-sensitive approach (i.e. understanding that long-term and short-term capital gains are generally taxed at different rates). It’s important for investors to understand that these are the sources of income because if you are uninformed you could be unpleasantly surprised when you figure it out down the road.

And just so you know, this fund has adopted a level rate distribution policy. It will pay regular monthly cash distributions to common shareholders at a level rate, which may be adjusted from time to time, based on the projected performance of the fund.

If you are looking for big steady distribution payments, and you understand the sources or the income, then this fund is worth considering.

2. Discount to NAV

Another reason the Cohen & Steers Realty Fund is attractive is because it is currently trading at an attractive 6.2% discount to its net asset value. As described earlier, this is a critical characteristic to understand when investing in CEF. We greatly prefer to invest in CEFs when they trade at a discount (not a premium), and we like it even more when the discount is larger than normal for no main reason other than “market noise” because that suggests to us some positive “mean reversion” may be on the horizon. For perspective, here is a look at the historical discount for RFI:

We like that RFI is trading at a discount, but also that the discount is currently more significant than normal

3. We like Real Estate Right Now

Another reason we like RFI is because we believe publicly traded real estate securities are currently attractive for a variety of reasons. For starters, we believe the overly fearful investors have prevented real estate securities prices from rising higher. Specifically, investors are afraid rising interest rates will be too much of a headwind for real estate to overcome (i.e. most real estate securities rely heavily on borrowing in order to grow, and as interest rates rise, the cost of borrowing goes up thereby hampering real estate securities). However, in reality, if interest rates keep rising that also means the economy is doing well, and therefore real estate prices (and the income they generate) will be rising thereby offsetting the higher cost of borrowing. Secondly, we are contrarians I nature, and we like to buy low. For perspective, here is a look at the performance of the real estate sector versus the S&P 500 over the last year, and as you can see, Real Estate has significantly underperformed (as contrarians, we like this).

4. No Leverage

Leverage (or borrowing money) is a risky practice that many other CEFs employ (RFI uses no leverage). Leverage can magnify your returns in the good times, but is can also magnify your loses in the bad times thereby creating all kinds of additional problems (not to mention the cost of leverage/borrowing is rising). As shown in our earlier table of 250 CEFs, the majority of them use some sort of leverage. We actually like that RFI uses zero leverage, and generally keeps its level of leverage very low. We consider this less risky, and for an income-focused investor that can be very important.

5. Low Expense Ratio / Management Fee

The total expense ratio on RFI is only 0.85% annually, which is very low for a closed-end fund. This expense ratio covers all of the operating expenses for the fund, including the highly qualified management team that strategically selects securities and makes tax-aware trading decisions to support the big monthly distributions payments, so you don’t have to. For perspective, it’s not uncommon for many other CEFs to charge expense ratios of 1.5% - 2.0%, or more.

For your consideration, the current management team for this fund (pictured below) has the experience to prudently manage this fund.

And for your reference, these portfolio managers’ biographies are available here. Further still, this fund has a long-term track record of success, as shown in the following table.

As value investors, we like to be prudent with our spending, and RFI’s low expense ratio is yet another reason why we like this fund.

Conclusion:

If you are an income-focused investor, RFI is attractive and worth considering. We have added it to our watch list. Across all of our Blue Harbinger portfolios, we currently own only four CEF’s (RFI is not one of them at this time). However, like RFI, all of the CEFs we do own were purchased at attractive discounts to their NAV’s, they all have low expense ratios, and we believe their strategies are very compelling. You can view our latest CEF holdings write-up here: 4 Compelling High Income CEFs (we own all 4 of these CEFs). And you can view all of our current holdings here.