Closed-end funds (CEFs) aren’t for everyone, but if you like high income, discounted prices, special dividends, and attractive strategies, we’ve highlighted four compelling opportunities in this article. We currently own all four of them.

Important Caveat:

Before getting into the update on our four current CEF holdings, we believe it’s important to share the following caveat:

Close-End Funds are NOT for everyone, however they can be extremely compelling depending on your specific situation.

The main benefits of the CEF’s we invest in is that they can generate very large, steady, tax-aware cash distributions for income-focused investors, and they can trade at uncommonly attractive prices based on their discounts to their net asset values (“NAV”) and based on their particular strategies. However, if you have no need for income (you’re simply focused on long-term price appreciation) and you have no interest in benefiting from discounted prices that are likely to rebound, then you should stay away from CEFs simply because the fees they charge to implement their strategies (to generate big steady efficient income) are unnecessary for you.

Without further, ado, here are our four current CEF holdings, along with an explanation about why their high-income strategies are currently so compelling…

1. Adams Diversified Equity Fund (ADX), Yield: 7.8%

The Big Annual Distribution is Coming…

We’ve written about the attractiveness of the Adam’s Diversified Equity Fund in detail in the past. You can read our previous write-up on the fund here, however we’ve listed some of the up-to-date highlights below:

- Big Special Distribution Soon: Each year, this fund pays three smaller quarterly distributions in March, June and September, followed by a much larger quarterly distribution in December. This year’s large distribution is expected later this quarter, and based on the year-to-date performance (the fund is beating the S&P 500 significantly, read the press release here), we expect December’s distribution to take the annual rate well-above the 6% minimum annual distribution level (it was 7.8% in 2016). Said simply, we’re expecting a big special distribution payout in December. The fund is expected to go ex-distribution in late November, so there is still time to buy in and receive the big upcoming distribution payment.

- Long Successful Track Record: This found was founded in 1929, and it’s been paying a distribution for over 80 years.

- Low Expense Ratio: ADX has a low expense ratio of only 0.64%

- Discounted Price: ADX trades at a compelling discount to its NAV (-13.7%).

- Overlooked Opportunity: Google Finance misreports this fund’s distribution yield because Google incorrectly takes last quarter’s distribution payment and annualizes it (remember, ADX pays an outsized year-end distribution).

- Strong Management: We like this fund’s management team as well as its current sector allocations. This information is available in the ADX fact sheet here.

2-3. Royce Value and Micro Cap Trusts (RVT) (RMT)

Yields: 6.8% and 6.9%

The Small Cap Value Rally is Just Getting Started…

We currently own shares of both of these closed-end funds offered by Chuck Royce and team. We wrote about these funds in detail a few months ago (read the write-ups here and here). However, to summarize, we believe they are both very attractive, and here are some highlighted reasons why…

- Small Cap Value Rally: As we explained in detail in our recent report (Tectonic Market Shift Starting - Are You Ready?), we believe that last month’s very strong performance by small cap value stocks is just the beginning. In fact, we believe the small cap value rally has legs, just like it has across every other market cycle. Despite the recent strong performance, both RVT and RMT have a lot more upside ahead.

- Unique Exposure: These Royce Funds are the only small cap CEF’s with big distribution yields that we are aware of. And based on the market, we believe they are a very compelling place to invest right now.

- Discounted Prices: Both funds currently trade at attractive discounts to their NAVs as shown in the following graphs (we much prefer to buy things on sale (a discount) instead of paying a premium).

- Low Management Fees: Chuck Royce and his team are extremely highly regarded investment managers, and these funds charge relatively low fees, especially for small cap funds. RVT’s expense ratio is only 0.62% and RMT’s is only 1.02%. Here is a recent video by Chuck Royce (and don’t worry if he looks old enough to retire soon… he has great support from his team, and honestly they’ll have to carry him out in a pine box before he retires).

In addition to our previous reports on RVT and RMT (links provided above), Morningstar offers valuable data on these two funds here and here.

4. Tekla World Healthcare Fund (THW) Yields 9.6%

The Distribution and NAV Discount is Still Very Compelling…

We are invested in the Tekla World Healthcare Fund (THW). We bought it initially for the diversified healthcare exposure, an allocation that has worked out quite well for us so far. However, the fund also presents other important qualities we look for in a good closed-end fund, such as…

- Discounted Price: as mentioned previously, we like to buy things on sale, and this fund is currently trading at a discount to its NAV, as shown in the following chart.

- Reasonable Management Fee: The fees on this fund is relatively low for a CEF at 1.47%.

- Healthcare Sector Exposure: We continue to believe healthcare stocks are compelling going forward, and this fund offers an attractive way to play the sector.

- Detailed Metrics: Morningstar offers very helpful and detailed data on this here.

And we have previously written in more detail about these Tekla fund here.

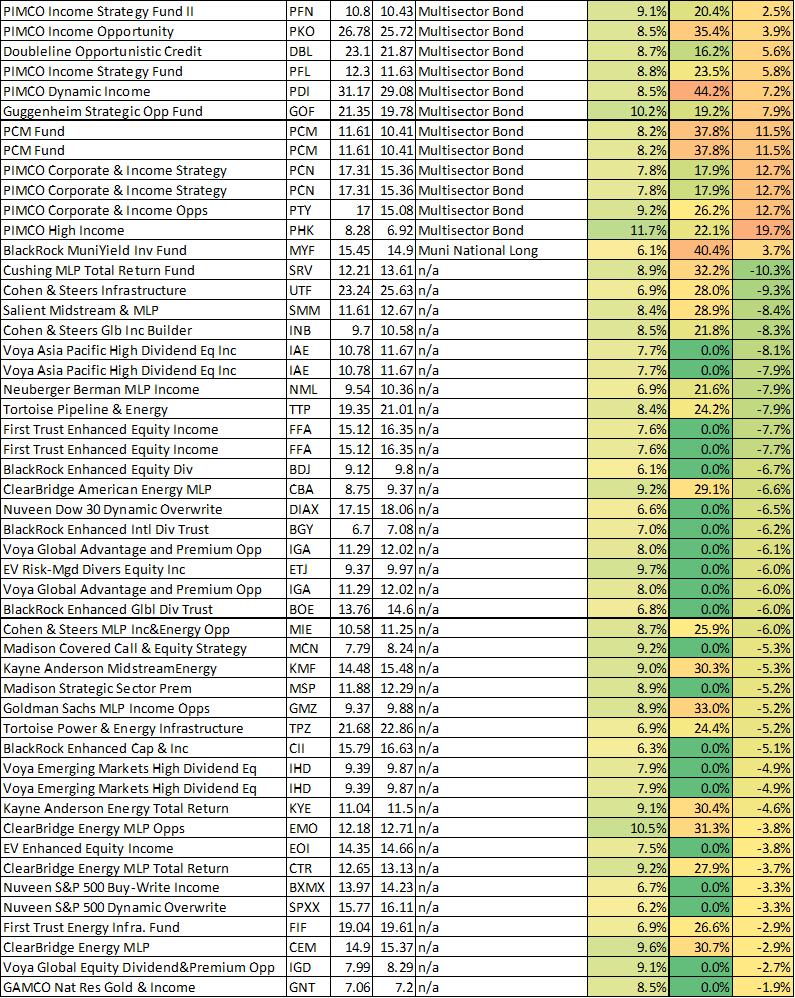

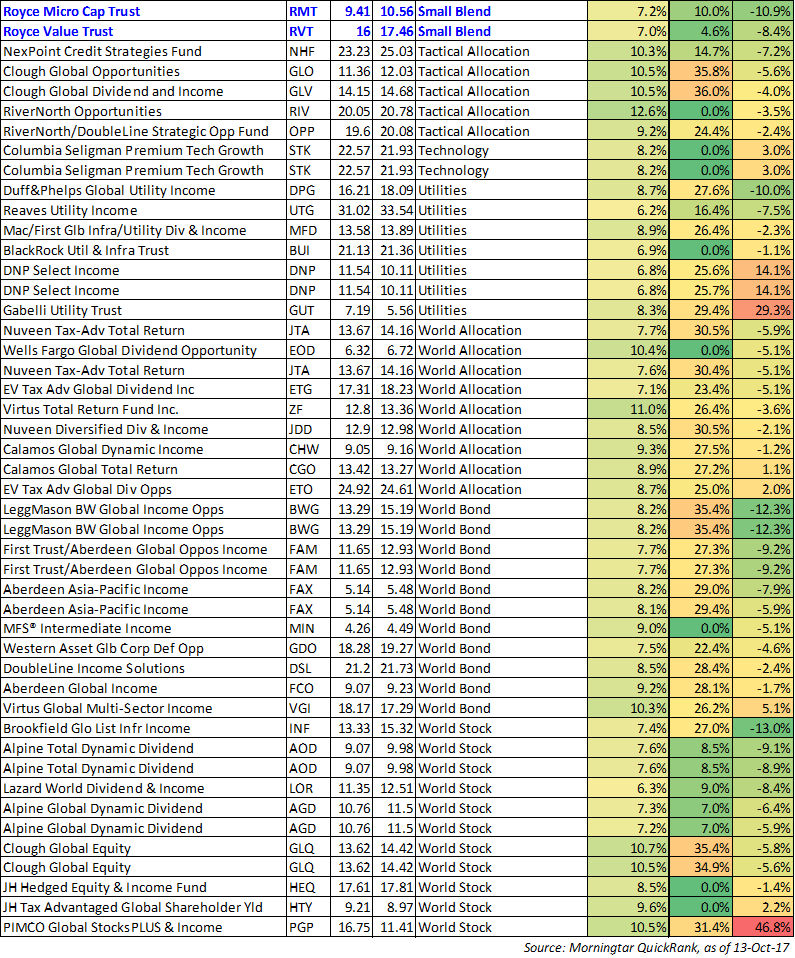

For your reference, here is a table that includes data for 250 CEFs yielding 6.0% or more. We already highlighted the five we own (above), and we provide a link to a new compelling CEF that we have just added to our watch list in the conclusion of this article.

Conclusion:

CEF’s are not for everyone, but if the strategy fits your needs, then the four described in this article are worth considering. We currently own all four, and you can view all of our current holdings here.