Income investors love to own big dividend stocks, but sometimes it’s worthwhile to diversify into companies with smaller albeit growing dividends that also offer significant price appreciation potential. This article reviews one such opportunity that we believe has the opportunity to grow dramatically over time both its dividend and especially its price.

Skyworks Solutions (SWKS):

Yield: 1.03% (and growing)

Overview:

Skyworks designs and manufactures semiconductors used in applications spanning smartphones, cellular infrastructure, broadband networks, the automobile industry, industrial markets, and others (although smartphones are the most significant). The company and the industry have experienced rapid growth in recent years as wireless data applications have expanded dramatically, particularly smart phones. Further, the industry will continue to grow rapidly as only 4.8 billion people worldwide subscribe to a mobile service (approximately two-thirds of the world’s population) with that number expected to reach 5.6 billion unique subscribers by 2020. Further, the number of Skyworks semiconductor products per phone (and smart device) is growing significantly as complexity increases. Further still, new smart products will drive demand for Skyworks products further.

Skyworks is expected to participate in the continued growth because its relatively large size and technological sophistication allow it to compete for large cutting-edge semiconductor business that some smaller firms are not able to deliver. In the long-term, Skyworks as enormous growth potential as semiconductor technology and uses will continue to evolve in ways almost unimaginable today.

Dividend History:

The blue line in the following chart show SWKS dividend per share, which was initiated in 2014, and has been raised three times since then already.

The orange line shows the dividend yield, which increased with the dividend increases, but has since declined because the share price has increased (mathematically, as the share price increases, the dividend yield declines). We believe the share price increase is a good thing because there is a lot more to come in the long-term, and we also believe there are significantly more dividend increases coming in the years ahead too. For example, the company only pays out a small portion of its free cash flow as dividends (22.3% in 2016) because it has opportunities to spend that cash on growth (good for the stock price) and it still has cash to keep raising the dividend (good for income investors).

Growth:

Skyworks is positioned to profit from the continuing growth in 4G LTE mobile services because its relatively large size, supply chain and technological sophistication allow it to meet growing marketplace demand. Further, Skyworks is positioned to profit in the long-term (again due to its relatively large size, supply chain and technological sophistication) leading up to the release of 5G, which would enable powerful new (and high margin) applications (beyond mainly mobile phones) including smart cars, smart cities, and the Internet of Things (IoT).

Valuation:

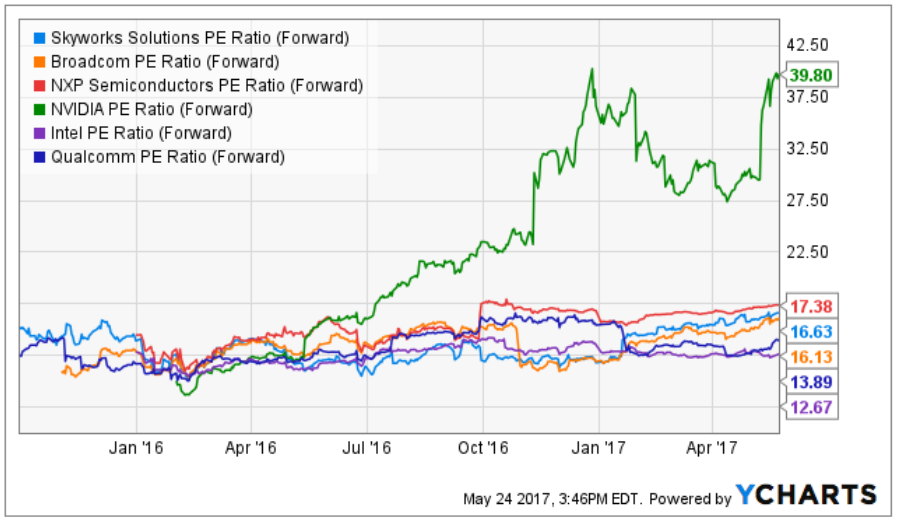

Compared to recent history and peers, Skyworks’ current valuation is not unreasonable, especially considering the high future growth estimates by analysts covering the firm. For example, at 16.6x forward earnings, SWKS is valued consistently with its own recent history and relative to other large chip makers.

Also, the 5-year analyst EPS growth estimate for Skywork’s is 33.8% versus 8.5% for Intel, 52.5% for Broadcom, 3.5% for Qualcomm, 34.1% for Nvidia, and 34.9% for NXP Semiconductors.

Discounting Skyworks’ free cash flow ($1.147 billion) by its WACC (11.85%) implies the market is expecting the company to grow by 6% per year, which seems low, and implies the stock is undervalued. More specifically, if the stock were to grow free cash flow at only 17% per year for the next 5 years (roughly half the analyst EPS growth estimate above), and then grow by 2% thereafter into perpetuity, it’s worth $25.5 billion, giving the shares roughly 30% upside. This 30% upside suggests Skyworks’ will participate in the growth of 4G over the next 5-years, but ignores the enormous growth potential of 5G if/when it arrives.

Also, if SWKS grows its EPS by 33.8% annually over the next five years (per the analyst estimates above) then it currently trades at only 5 times 2021 EPS estimates, and the price could rise significantly.

From a trailing and forward P/E standpoint, Skyworks is priced reasonably for the continuing global expansion of 4G mobile services, but it is very inexpensive from a 5-10 year perspective depending on the pace and size of the 5G evolution.

Competition:

Skyworks differentiates itself from smaller industry peers because it has the scale (and supply chain) to meet the needs of large customers. Also, Skyworks is technologically sophisticated compared to some peers, and is able to deliver higher margin solutions as shown in the following graph.

Skyworks’ competitors include Analog Devices, Broadcom, Maxim Integrated Products, Murata Manufacturing, NXP Semiconductors, QUALCOMM and Qorvo, most of which are larger companies. Worth noting, the following table includes large market capitalization semiconductor companies and omits over 80 semiconductor companies with smaller market capitalizations.

Management- (Capital Allocation):

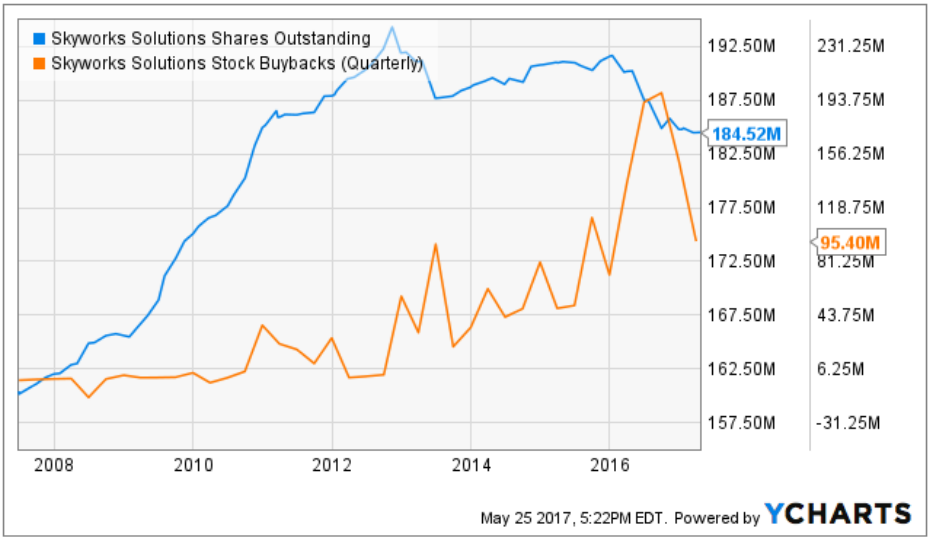

Skyworks has no long-term debt, and has been paying a growing dividend. Additionally management has been buying back shares ($95.4 million last quarter), and the number of shares outstanding has declined recently to 184.52 million (the most recent quarterly buyback was roughly 0.5% of shares outstanding).

Skyworks has a history of acquisitions including larger moves in 2011 to acquire SiGe Semiconductor and Advanced Analogic Technologies, which have successfully expanded products, revenues and margins. Skyworks also acquired Panasonic's filter business. Skyworks was outbid in its attempt to acquire PMCSierra.

Liam Griffin has been Skyworks' CEO since May 2016. The former CEO (since 2002), David Aldrich, became executive chairman.

Catalyst:

The main near and intermediate-term catalyst for Skyworks is the continued growth in 4G LTE wireless networks to which Skyworks supplies RF content. Wireless markets have experienced rapid growth in recent years, but have room for significantly more growth from increased demands for mobile connectivity. As more devices become connected, Skyworks will find new growth opportunities. In the long-term, as a 5G network evolves it will open vast opportunities for Skyworks to supply content in ways that are practically unimaginable today, but may become reality within the next 5-10 years depending on the speed of technological advances.

Another potential catalyst is a buyout of Skyworks by an even larger semiconductor company. Consolidation within the industry is increasingly common, and we recently saw one of the biggest M&A deals ever with the merger of Broadcom and Avago.

The Capital Structure:

Skyworks has no long-term debt. Some of Skyworks’ peers do have long-term debt outstanding, and this could work to their disadvantage as interest rates rise. However, it also means the peers have given away less equity to fund their businesses. Skyworks return on equity has been very high, recently 24.1% and in a range of 10.9% to 28.2% over the last 5-years, according to Guru Focus.

Recent Price action:

Skyworks’ share price continue to climb rapidly. The shares are up another 42% so far this year. Short interest was as high as 6.7% in January, but has declined recently to 3.7%.

According to StockRover, the SWKS’s money flow index sits near neutral at 65 (money flow index is a technical measure of price and volume, or money flow over the past 14 trading days with a range from 0 to 100. A value of 80 is generally considered overbought, or a value of 20 oversold).

Special/Unique:

Skyworks is uniquely positioned to benefit from the ongoing changes, growth and technological advances in semiconductor products because of its scale, sophistication and healthy financial wherewithal. The company describes itself as “a global leader in providing integrated systems” as well as “leveraging our Mobile Scale to Capitalize on IoT.”

The Last Downturn:

SWKS is a high beta stock (1.7), and thereby has a relatively high sensitivity to market conditions and cycles. SWKS was down with the market during the financial crisis, but has since then rebounded many times greater than the overall market. Also, SWKS rode the tech bubble up (the SWKS price was sky high during the bubble), and then came crashing down when the bubble burst.

Insider Activity:

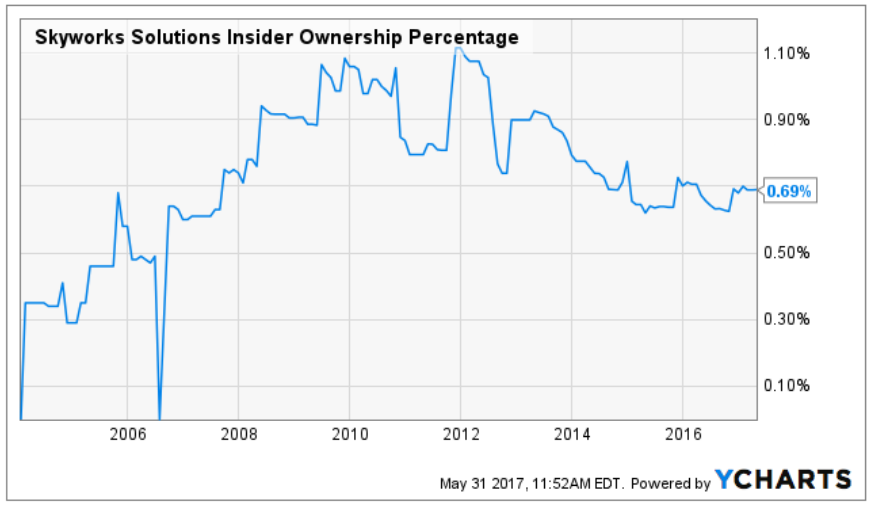

The inside ownership percentage of SWKS has historically been (and is currently) not large, as shown in the following graph (however, 0.69% of a $19.74 billion market cap is still significant at $136 million).

Risks:

Skyworks faces a variety of risks. For example, in 2015 Apple made up 44% of revenues. And customers like Apple (and Samsung) could exert significant price pressure on Skyworks and/or switch vendors altogether for new products. Further, competition in the industry is fierce considering the many players, and a handful of them are larger (with better economies of scale) than Skyworks.

Conclusion:

Despite the risks, we believe investors may consider initiating a small position in this powerful growing company that currently trades at a reasonable valuation based on mid-term growth prospects, and it is very inexpensive based on its long-term growth prospects (Skyworks has enormous long-term growth potential). We expect the shares to be more volatile than higher-dividend companies (that’s why we’re suggesting nibbling at Skyworks by initiating a small position), but we do believe both the dividend and the share price will grow significantly over time, and it is an attractive way to add valuable diversification to your investment portfolio.