At Blue Harbinger, we write a lot about income investing. However, this article is not one of those times. Instead, this article is about a disciplined growth stock with very large price appreciation potential. If you’re looking for an income investing idea, stop reading this article.

However, if you’re looking to add a little diversity to your investment portfolio, then this stock is worth considering, especially after the market wide sell-off. This stock is high on our watch list, and we may purchase shares soon.

This is NOT an Income Investing Idea…

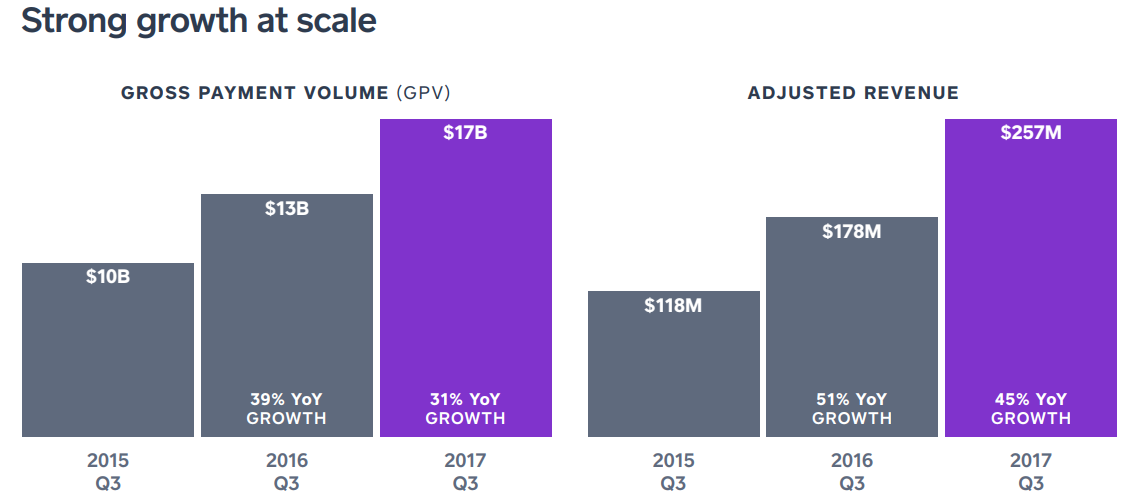

To the chagrin of value investors everywhere, this 2-year old stock has negative net income. However, what it does have is an extremely high growth rate (see revenue growth chart below), a large total addressable market (estimated at $60 billion, current annual revenues are just over $2 billion) and the shares are priced more attractively considering our recent market wide sell-off has pulled the share price lower (the shares are down 15.6% in the last 7 trading days).

Square (SQ), Yield: 0.0%

The high-growth investment opportunity we are talking about is point-of-service payment processor, Square (SQ).

The reason we like this company is because they’re solving a big problem for small and mid-size businesses (Square basically invented a way to address a market that was traditionally ignored by credit card acceptance thereby creating a new addressable market), and the total addressable market is large (i.e. there is A LOT of room for Square to grow).

The problem that Square is solving is the daunting checklist to start a business (e.g. payment processing, receipts, invoices, finance, marketing, employees, and analytics).

Square has built a system to simplify this process.

And Square is growing rapidly (as shown in our earlier revenue chart), as small and mid-sized businesses seize the value provided by Square (again, these businesses were traditionally ignored by credit card companies).

Square’s Business:

Square generates most of its revenue (~71% in 3Q17) from processing payment transactions through its platform, ~25% from its value-added software/services, and ~4% from hardware sales, as shown in the following chart.

And the majority of revenue is earned in the US (96%). Here is a look at how much money Square actually makes for processing payments:

For more perspective, here is a look at Square’s growth in payment processing and revenues.

And here is some perspective on the upfront costs versus future revenues and profits for acquiring new customers (this bodes well for Squares future revenue and profit potential—remember they’re still in quarter zero for a significant amount of customers).

Valuation:

The reason many investors refuse to invest in Square is because its valuation is already very high relative to other payment companies, as shown in the following chart and table:

However, Square has been growing much faster, and has far more room to run (we believe Square’s total addressable market is even larger than the company estimates--Square has far more growth opportunities than peers).

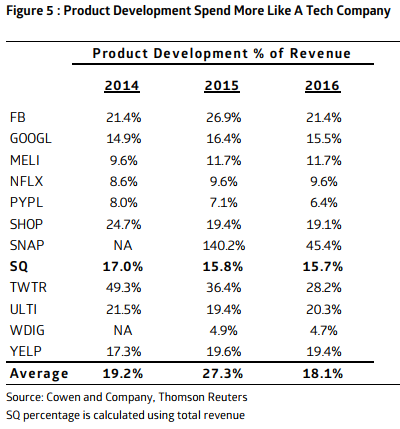

Plus, Square has a variety of attractive characteristics that will help it grow. For example, Square spends more like a technology company than a payment processing company when it comes to product development (as shown in the following chart) and we believe this is a very good thing for Square’s future innovation and growth potential.

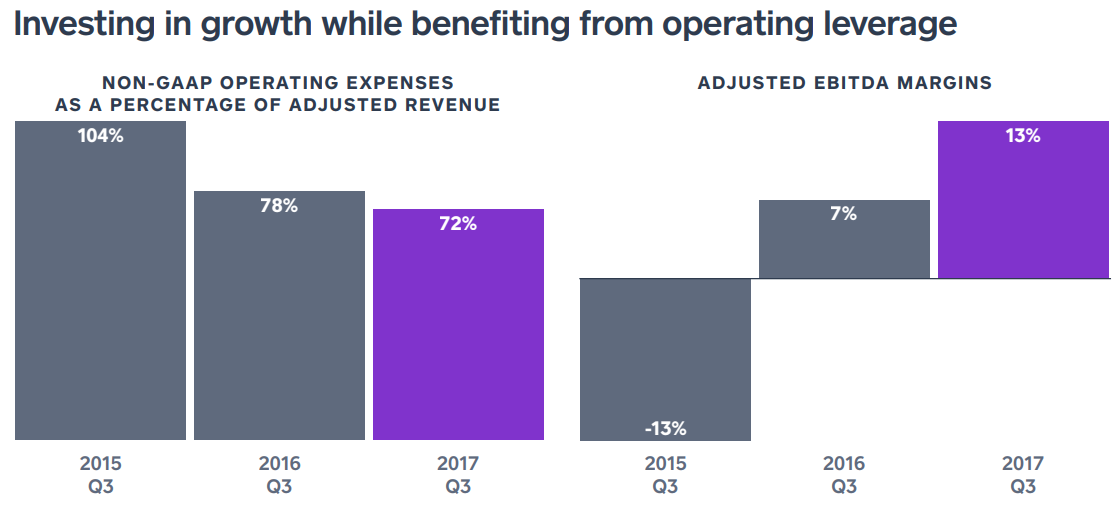

And as Square invests in growth it is benefiting from its increasing operating leverage.

Further, Square has a strong balance sheet (very little debt) which will ensure it has the cash to grow both organically and inorganically. For example, Square recently acquired Caviar, a rapidly growing company that delivers food from top local restaurants not otherwise available via delivery (this was basically a way for Square to bring more merchants into its ecosystem). Square’s strong balance sheet will allow more accretive acquisitions in the future.

Also worth mentioning, Square’s “Build With Square” strategy allows developers to create more customized solutions which should also contribute to future growth and customer satisfaction. Square’s brand is highly recognized and ranks highly among users.

Further still, “Square Register” will allow the company to grow into more larger businesses. For example, According to recent Guggenheim research report:

“We believe Register-related revenue accretion can add 6% to Square's market value over the next twelve months. $79M in new Register-related revenue at an 11x multiple implies $866M in market value - which would add 6% to SQ's shares based on its current market capitalization.”

In our view, if revenues grow by 30% in 2018 thereby achieving $2.85 billion (this is consistent with street estimates), and the stock trades at 7.5 times sales, that gives it a $21.375 billion market cap, or approximately 39% upside. Specifically, we believe the shares can easily trade above $55 this year, they currently trade at just under $40. Further, as the company continues to grow (remember the large total addressable market) Square shares can trade far above $55 in the long-term.

Concerns:

Our three biggest concerns for this stock are price volatility, valuation, and the potential for future shareholder earnings dilution. Regarding volatility, Square is not your typical low volatility dividend stock (remember, it pays zero dividend). Square is an aggressive growth company and its price is very volatile. Here is a look at its price versus the S&P 500 over just the last 3 months.

Recently, shares have been whipped around by news items such as its last earnings release (it beat estimates), its decision to process Bitcoin payments (this contributed to stock price gains and then losses), and Square’s recent sell-off as the overall market sold off. However, from a technical standpoint, we believe now is an attractive entry point (it’s sold-off more than the market), and from a long-term investor standpoint, we believe now is an attractive entry point as well. Here is a look at Square’s performance since it became publicly traded.

Valuation is another concern (i.e. Square already trades at high valuation multiples, for example, EV/EBITDA as shown earlier). However, given the company’s rapid growth and large total addressable market, we are not uncomfortable with the current valuation. Also worth mentioning, the company’s strong valuation gives it more negotiating power/currency when structuring future acquisitions, such as Caviar (i.e. a high share price makes for strong currency in deals, and deals can help the company create further growth).

Finally, shareholder dilution is another concern. Specifically, the following table shows Square’s shareholder based compensation (“SBC”) as a percent of EBITDA and relative to other companies.

Square’s high SBC will have some dilutive effects to shareholders, however, considering the significant growth potential of the company, we do not believe SBC is prohibitive.

Conclusion:

Given Square’s rapid sales growth, large total addressable market, and recent price pullback, we believe this is a stock that is worth considering if you’re looking to add some diversity to your investment portfolio (and if you’re looking for some big upside price appreciation potential).

We believe Square is a highly innovative disrupter, and they may continue to surprise the market when they announce earnings on February 27th (and for years after that as well). We’d not be surprised to see the shares trading over $55 by the end of this year, and well above $55 in the years that follow (it currently trades at just under $40, its 52-week high is $49.56).

Said differently, we believe Square (SQ) shares reasonably have 40% upside this year, and far more upside in the long-term. We do not currently own shares of Square, but it is high on our watch list, and we may purchase shares soon.