This attractive company is nearing the end of a very large strategic capital expenditure program, and on a trajectory for very strong EBITDA growth. And its preferred stock offers strong stable income thanks to the company’s structure. This article provides an overview of the company and then considers the potential returns, growth prospects, developments and risks. Overall, if you are an income-focused investor, this one is absolutely worth considering for a spot in your prudently diversified long-term portfolio.

NuStar Energy Preferred Shares (NS-C), Yield: 9.1%

Overview:

NuStar Energy LP (“NS”) is engaged in the transportation of petroleum products and anhydrous ammonia, and the terminalling, storage and marketing of petroleum products. NS is one the largest independent terminal and pipeline operators, which owns ~9,850 miles of pipeline and has a storage capacity of 61.5 million barrels as of Q2 2019. The company’s pipeline business is growing at an impressive pace with throughputs increasing by 30.3% and 18.5% year-on-year in 2018 and 2017 respectively. While maintaining sustained growth, the company has laid the foundation for expansion with vast potential while also reducing leverage.

Important to note, NS operates as a Master Limited Partnership (“MLP”). Under this structure, NS does not pay corporate taxes since it generates 90% of its income from a natural resources based business. Additionally, being an MLP, the company is obligated to payout almost all cash generated from business operations to investors as distributions. This means a distribution from NS is nearly a certainty, and the current high distribution is very strong (as we will cover in detail later in this report).

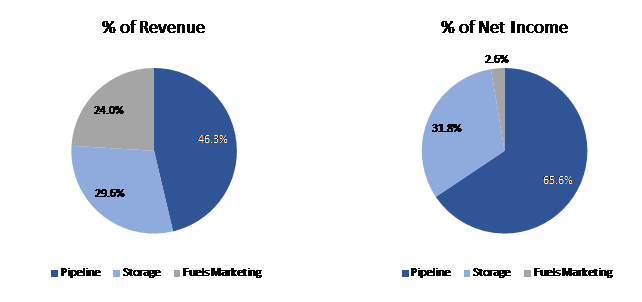

NS has three business segments: Pipeline, Storage and Fuels Marketing, with Pipeline being the largest and most profitable, followed by Storage. The below charts summarize the contribution of these segments towards the company’s revenue and operating income respectively.

With regards to customer concentration, Valero Energy Corporation accounted for 30% of the company’s pipeline revenue and 20% of the storage revenue for the year ended 2018. Valero Energy Corporation is a Fortune 500 international manufacturer and marketer of transportation fuels, other petrochemical products, and power. NuStar’s customer base is otherwise well diversified with no other customer accounting for more than 10% of revenue.

Attractive preferred shares

The Series C Preferred Stock offers a 9.0% distribution yield on face value (2.25% quarterly) and as most preference shares, is currently trading very close to its par value at $24.01 (face value: $25.00) with a yield of 9.37%. While preferred stock is prioritized over common stock in the capital structure it is still second to the company’s debt.

Capital investments to bear fruits for years to come

In 2019, NS has a strategic capital expenditure program totaling between $500 - $550 million, which marks a high point in the company’s historical capital spending. Of this amount, management plans to spend ~$175 million on the Permian Crude System, ~$150 million for the Northern Mexico refined products supply projects and ~$105 million for Corpus Christi North Beach terminal export projects. A majority of these investments are backed by contracts which are expected to add materially to EBITDA in 2020.

With a majority of the capital projects being completed in 2019, management expects a significant ramp-down in capital expenditures in 2020. During the Q2 earnings call, President and CEO Bradley Barron said:

“I can tell you that next year, as the cash flows from those completed projects ramp up fully, we’re also planning to spend significantly less strategic capital which we expect will lead to another solid year.”

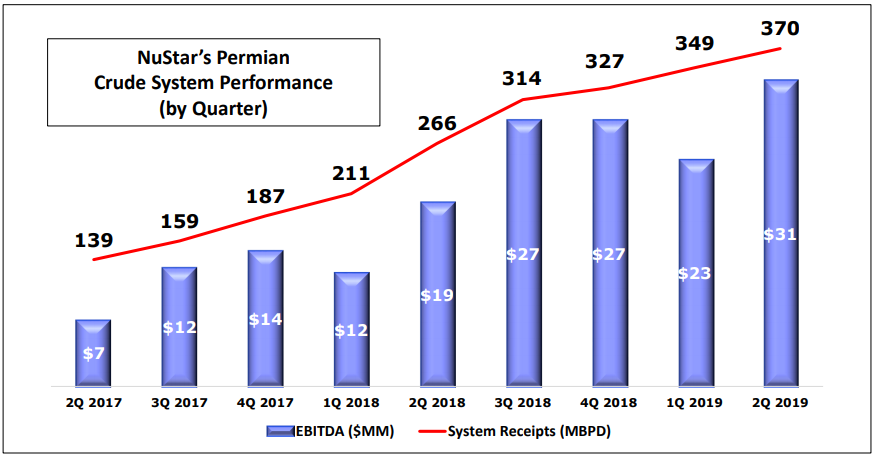

Development in the Permian Basin key to sustained growth

NS has incurred substantial capital expenditure to extensively develop its Permian Crude System, connecting it to new wells and third-party pipelines as per customer needs. The company’s investment has paid off well as receipts and EBITDA generated from the region have continued to grow rapidly, as shown in the chart below.

As a midstream company with long-term contracts, NuStar is less affected by short-term oil price volatility, but it is affected in the long-term as is has a significant impact of new contracts when the existing ones expire. However, per industry experts, the resilience and efficiency of the Permian will ensure healthy growth for the company within the basin even if WTI oil prices were to fall to $50.0 (for reference, they’re currently around $58).

Corpus Christi port set to become global export hub

At Gulf Coast export facilities like the Permian Basin, producers and shippers remain constrained by limits of long-haul capacity to the coast. The introduction of new long-haul pipelines during the second half of 2019, will help producers to ramp up production, driving Permian production up to 5.6 MMbpd (million barrels per day) by year-end 2021 from the current 2.5 MMbpd.

Due to the lack of capacity with regional refiners, a significant proportion of the additional 2.1 MMbpd volumes to be transported on the of new long-haul pipeline capacity from the Permian to the Corpus area will be moved out over Corpus dock facilities. Corpus Christi, historically a regional refinery and domestic marine delivery hub, is expected to become the largest US crude export hub by mid-2020 with exports forecasted to grow from the current 0.5 MMbpd to 2.0 MMbpd by 2020. NS is well positioned to take advantage of this with considerable capital expenditures incurred on its export project to connect the Corpus Christi North Beach terminal to long-haul pipelines transporting crude oil from the Permian Basin in 2019.

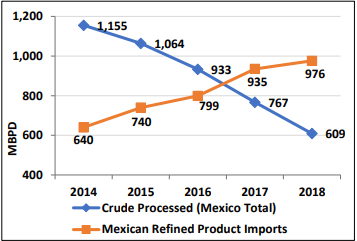

Stepping in, to fix the supply imbalance in Northern Mexico

Mexican refineries currently operate at ~30% of nameplate capacity due to weak returns and historical under-investment. With limited domestic supply, Mexico’s gasoline and diesel supply imbalance (shown in the chart below) has grown from 520 MMbpd in 2015 to 865 MMbpd projected in 2019, further opening the door for imports. NS is currently executing two projects - Nuevo Laredo Project and Valley Pipeline Expansion - to address this supply imbalance in Northern Mexico. This opens up another major avenue for growth for NS.

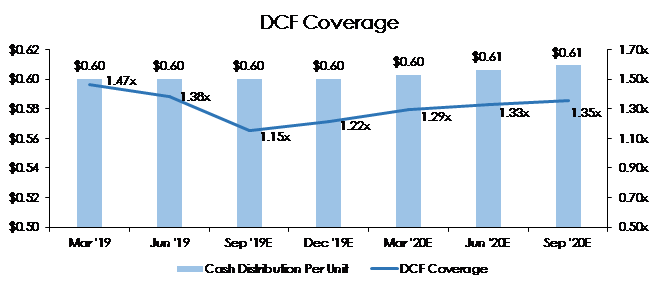

Well covered distributions

Distribution coverage is the ratio of the distributable cash flow (“DCF”) generated in a period to the total amount of cash distributions paid by the company in the same period. It highlights a company’s ability to pay distributions from the total cash it generates. A coverage ratio consistently below 1.0x could indicate that the company may not be able to maintain its distribution, while a higher coverage ratio (above 1.0x) enhances investors’ confidence in the company’s ability to continue paying or growing its distribution.

NS has a distribution coverage of 1.4x which indicates that distributions are well covered. As an investor, what is even more encouraging is that, the general partners are not entitled to incentive distribution rights. This leaves a higher amount available for distributions to shareholders.

Distributions on the Series C preferred units are cumulative from the date of original issue and are payable quarterly in arrears on the 15th day of March, June, September and December of each year, as and if declared. Since the first distribution in March 2018, the company has not missed out on any distribution payment.

Valuation:

The table below summarizes the company’s valuation metrics in comparison to the industry standards.

The majority of research analysts reporting to FactSet have given a ‘hold’ rating to the NS common stock, indicating their confidence in the company’s ability to continue healthy operations. Since preferred stock ranks higher than common stock in the capital structure, this provides further confidence that the distributions will be easily paid.

High leverage could be a concern, but…

NS operates in an industry which is capital intensive where the company holds a significant asset base. Additionally, the MLP corporate structure requires the company to payout almost all of its earnings as distributions. In this situation, with heightened capital expenditure and large distributions, NS has generated negative free cash flows. The company is forced to hit the capital markets for liquidity and expansion needs which are often funded through a combination issuance of equity, preferred instruments and debt or through asset sales. Due to a significant amount of financing raised as debt, the company is currently operating with elevated leverage.

However, NS has been taking steps to reduce its leverage burden. In the last 9 months the company has raised in excess of $500 million through divestitures of its UK/Europe operations and the sale of St. Eustatius operations. The proceeds were utilized to lower debt, and to help fund high-return projects comprising the 2019 strategic capital program. These measures have helped NS to reduce its leverage from 4.7x in Q2 2018 to 3.9x in Q2 2019, which is a substantial improvement. In 2020, as the strategic capital program is completed, capital expenditures are expected to decline significantly while operational efficiencies are expected to kick in, further improving leverage. According to President and CEO Bradley Barron during the Q2 2019 earnings call:

“In 2020, we plan to execute on a smaller scale capital program on low-cost, low-multiple projects to enhance our existing assets, while providing world-class service across our footprint, so we can continue to build financial flexibility, improve our debt metrics and strengthen our balance sheet.”

Another point highlighting the company’s credit worthiness is the fact that NS partially refinanced its higher interest bearing 7.65% notes by issuing lower interest bearing 6.00% senior notes, while raising $500 million. Additionally, the company’s outlook was changed from negative to stable by the three credit rating agencies – Fitch, Moody’s and S&P.

Conclusion:

NuStar is nearing the end of a very large strategic capital expenditure program, and on a trajectory for very strong EBITDA growth. And its preferred shares offers attractive, strong, stable income thanks to the company’s MLP structure. If you’re an income-focused investor, this one (NS-C) is absolutely worth considering for a spot in your prudently diversified long-term portfolio.

Note: We are currently long shares of NuStar series C preferred shares. To view all of our current holdings, please click here.