Many investors love PIMCO’s Dynamic Income Fund because of its strong track record of paying big monthly distributions. Whereas some others are traumatized by the dramatic share price volatility (mostly related to interest rates) in recent years. In this report, we review the fund, the distribution and price volatility sources, the section 19 notices (the distributions have been exceeding investment income and gains) and risks (misleading outside data sources, tax considerations, and the risk of a distribution “right sizing”). We conclude with our strong opinion on who might want to invest.

Overview: What PDI Does

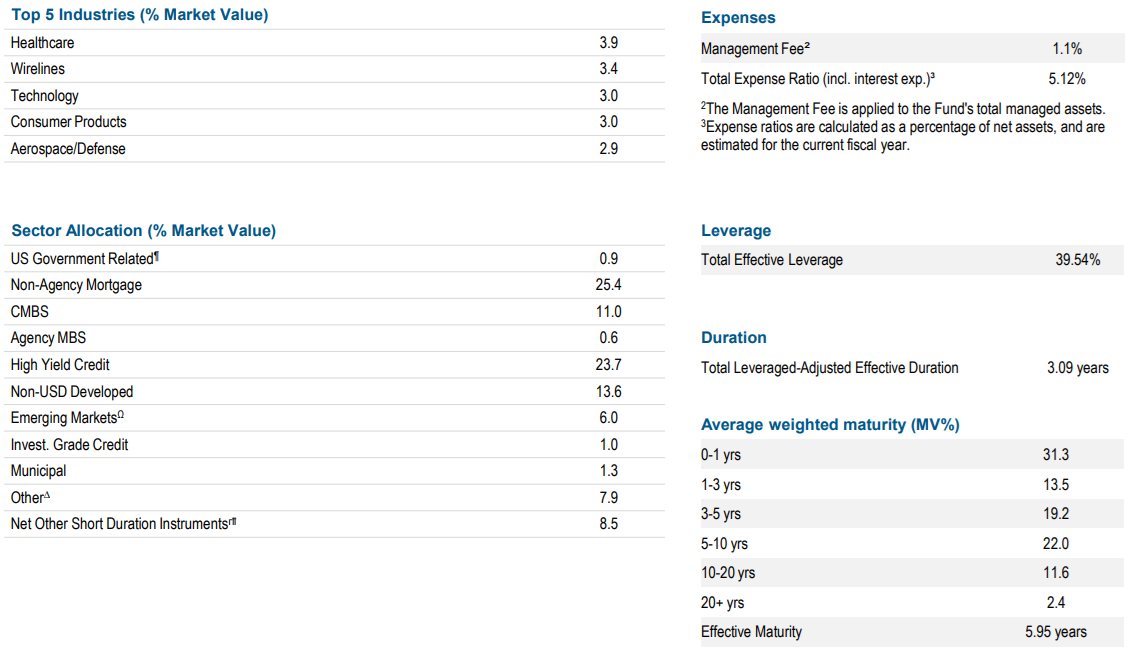

The PIMCO Dynamic Income Fund pays investors big monthly distributions. It does so by owing bonds from a variety of sectors (that are often not feasible for individual investors to access on their own). And by applying leverage (borrowed money) to magnify the income (more effectively and efficiently than individual investors could do on their own). Here is a snapshot of PDI characteristics from PIMCO as of the most recent quarter end.

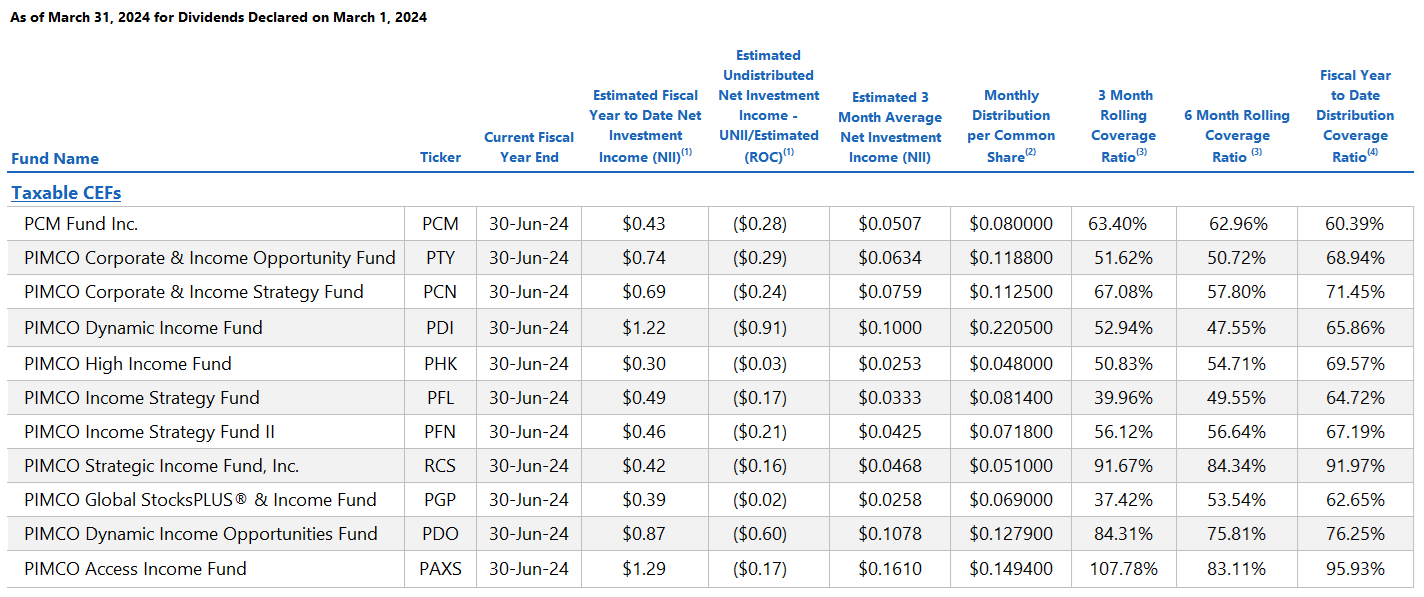

And you can see how PDI compares to a variety of other big-yield bond CEFs (and a few equity CEFs) in the following table.

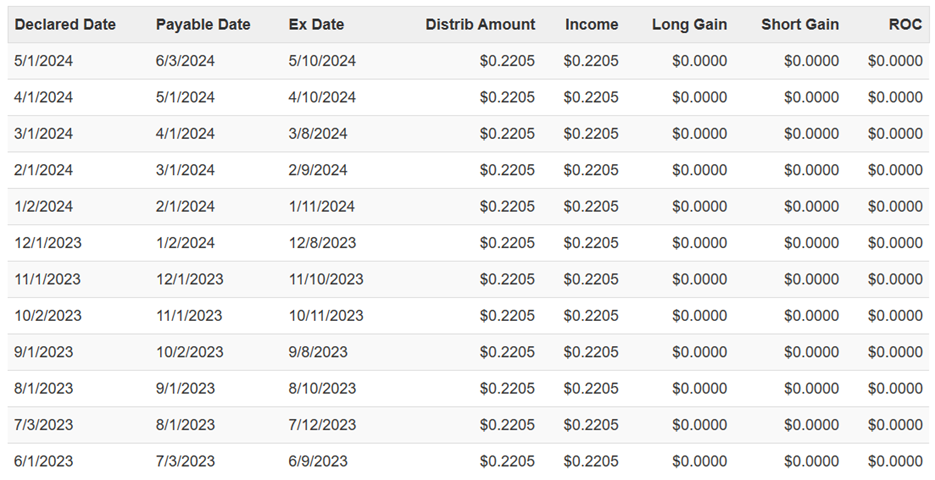

Why Many Investors Love PDI: Income Consistency

There are few investment in the market that can match this fund’s track record of big steady monthly income payments. And importantly, what a lot of people don’t understand, is that as long as this fund keeps paying those big steady monthly income payments, a lot of investors don’t care in the least what happens to the price (again, share price volatility means nothing to them as long as those big monthly income payment keep rolling in).

Why Some Investors are Traumatized: Price Volatility

Of course some investors in PDI have been completely traumatized in recent years because of the extreme volatility and price declines. As most readers know already, when interest rates rise, bond prices fall (all else equal). And the US fed’s historically rapid interest rate hikes in recent years (to combat high inflation) reaked havoc on the share price of PDI and many other bond funds (especially those that use leverage—which essentially magnified the price pain).

Distributions > Income + Gains

Another consideration that has many investors concerned is that PDI (along with many other bond funds) has not been covering its monthly distributions with net investment income and/or price gains. Specifically, healthy funds typically use income from their underlying bond holdings, combined with price appreciation on those bond holdings, to cover the dividend. However, PDI (like many bond funds) has had losses (not gains) on its bond fund holdings (because rates rose so quickly) and has therefore not been able to cover those big monthly distributions, as you can see in the following table.

Section 19 Notices: ROC versus Paid in Surplus

The term “Section 19 Notice” is emotionally charged for some investors because it can imply danger and/or risk. According to T. Rowe Price (emphasis ours):

“Section 19(a) of the Investment Company Act of 1940 requires the payment of any distribution to be accompanied by a written notice that discloses the sources of a payment if it is made from any source other than the fund's net income.”

And PDI has recently been adding the Section 19 notices to its website. Interesting, a “Return of Capital” (“ROC”) also evokes a negative emotion for many CEF investors becuase it also suggests a fund isn’t properly covering its distribution.

Interestingly, PIMCO has been using a different term in recent months and quarters. Specifically, PIMCO discusses “Paid in Surplus or Other Capital Sources” instead of ROC specifically becuase they’re not technically the same thing (even though they “may be economically similar to a taxable return of capital,” according to PIMCO). More specifically, the Paid in Surplus is generally related to derivatives (mainly paired swap transactions) that are used specifically to generate near-term gains which may (or may not) result in loses (and ROC) in the future. According to PIMCO’s website:

The Fund may enter into opposite sides of interest rate swap and other derivatives transactions ("paired swap transactions") for the principal purpose of generating distributable gains on the one side (characterized as ordinary income for tax purposes) that are not part of the Fund's duration or yield curve management strategies, with a substantial possibility that the Fund will later realize a corresponding capital loss and potential decline in net asset value with respect to the opposite side transaction (to the extent it does not have corresponding offsetting capital gains).

Overall, PIMCO bond CEFs are using more leverage and more derivatives transactions than some of its bond CEF peers (such as BlackRock), and this is adding a layer of complexity and risk, but also resulting in avoiding the immediate recognition of a significant amount of the dreaded ROC.

Verify Your Data Sources:

CEF Connect and CEF Data are two popular sources for data on CEFs, and interestingly they both report amounts of ROC for PDI that are different from each other and also different from what PIMCO reports.

For example, here is what CEF Data reports for ROC for PDI:

And here is what CEF Connect reports:

https://www.cefconnect.com/fund/PDI

And both of the above data points are different from what PIMCO reports on its own website (linked earlier in this report, see secion 19a Notices).

Tax Considerations:

One of the problems with Return of Capital is that it can decrease an investor’s cost basis, thereby increasing the tax you own if/when you sell. For example, if you buy for $15 and ROC reduces your basis to $10, then you recognize as $5 capital gain ($15-$10) if/when you sell.

One way some investors deal with the tax risk is to own PDI in a tax-advantaged individual retirement account (“IRA”). This way, no capital gains are recognized (even if you buy then sell PDI) because traditional IRAs are only taxed when you withdraw money.

Also, you won’t get taxed on monthly PDI distributions in an IRA (again, because traditional IRAs are generally only taxed when you withdraw money). This can be doubly beneficial (depending on your situation) because PDI’s distributions generally are not eligible for the lower “qualified dividend” tax rate (but if you own in an IRA, you generally won’t pay any taxes on the PDI distributions anyway).

And if you own PDI in a Roth IRA, you’re generally never taxed on the money again (because you’re taxed on it before you contribute to a Roth IRA).

Of course, none of this is tax advice, and you should talk to your tax pro before investing.

The Risk of a Distribution “Rightsizing”

Another risk is that PDI may eventually need to slightly reduce its distribution because paying out more distributions than you earn on investments is not sustainable over the long term. And as net asset value (NAV) decreases, the fund is also reducing its future earnings power (because they’re working off a smaller base). Here is a look at PDI’s NAV over time (i.e. it has declined, especially as interest rates rose).

Of course PIMCO hopes interest rates move in such a way (generally lower) so the value of the underlying bond holdings increase, and thereby allow capital gains to be used to support more of the distributions thereby eliminated the need to use ROC or “Paid in Surplus.”

We are confident PDI’s distributios will remain large, but at some point the distribution may need to be reduced somewhat (which is fine).

Bottom Line:

Despite the section 19 notices (which some investors view as very negative), PDI remains an attractive big-yield investment (even though the yield may need to be reduced slightly at some point in the future, it will continue to be big).

There is a good reason why PIMCO is considered the premier bond fund manager in the industry, and it’s because of the company’s impressive track record of success combined with a skilled management team and deep resources to support their investment strategies.

Most importantly, do what is right for you (based on your personal situation). Disciplined goal-focused long-term investing continues to be a winning strategy.