As per a reader’s request, this report focuses on the attractive qualities and big risks of the Cohen & Steers Real Estate Opportunities and Income Fund (RLTY). This closed-end fund (“CEF”) yields 9.0% and currently trades at 12.0% discount to NAV. However, there are some nuances and big performance factors readers should consider before investing. After reviewing all the details, we conclude with our strong opinion in investing.

RLTY Overview (9% Yield, 12% Discount to NAV):

This fund invests mainly in real estate securities, consisting typically of around 66% public equity real estate investment trusts (“REITs”), but also in preferred shares and bonds. The primary investment objective of the fund is high current income, and the secondary objective is capital appreciation. Here is a look at the fund’s recent top holdings (you’re likely familiar with many of these REITs already).

Limited Term:

One of the unique characteristics of this relatively new fund (its inception date is in 2022) is that it is a limited term fund. Specifically, per the prospectus:

“the Fund intends to terminate as of the twelfth anniversary of the effective date of the Fund’s initial registration statement, which the Fund currently expects to occur on or about February 23, 2034”

At or around this time, the fund will liquidate its holdings and return the cash to investors. This is a critically important characteristic (that is somewhat unique for RLTY versus other CEFs) because it will eventually help investors recover from the current discounted price (i.e. RLTY trades at a 12% discount to NAV). Upon liquidation, the holdings will be liquidated at NAV, and shareholders will essentially be “made whole” versus the current discounted price.

Of course there are nuances to this. For example, the management team has the option to push the liquidation data back one to two years. However, overall this is an attractive characteristic that helps solve the perpetual discount problem that many of CEFs (without set termination dates) suffer from.

We like that this fund has a limited term.

Share Repurchases:

Another thing we like about this fund is that is that it is authorized to buy back its own shares in the open market at a favorable price (i.e. the shares trade at a discount). This can also help keep the discount from getting wider (a good thing for existing investors). According to the fund:

Cohen & Steers believes that the stock repurchase program will benefit shareholders as it enables the Fund to acquire its own shares at a favorable discount. In addition, the share repurchase program may benefit existing shareholders by reducing the discount to net asset value (“NAV”) at which the Fund’s shares are currently trading.

Attractive Tax-Advantaged Income

Another attractive characteristic of this fund is that it provides attractive tax-advantage income for multiple reasons. For starters, it is a registered investment company (“RIC”) and the fund is therefore eligible to pay zero taxes. As per the prospectus (emphasis ours):

Taxation of the Fund. The Fund intends to elect to be treated as, and intends to qualify each year to be treated as, a RIC under U.S. federal income tax law. In order to qualify and be treated as a RIC, the Fund must derive at least 90% of its gross income for each taxable year from “qualifying income” as defined in the Code and meet requirements with respect to diversification of assets and distribution of income and gains. If the Fund does so, the Fund generally will not be required to pay federal income taxes on any income it distributes to shareholders.

Additionally, some of the income paid by this fund as distributions to investors is eligible for lower taxation (i.e. the portions that are long-term capital gains, dividends and in some cases qualified dividends). As per the prospectus:

“Dividends paid out of the Fund’s current and accumulated earnings and profits will, except in the case of distributions of qualified dividend income (“QDI”) and capital gain dividends described below, be taxable to a U.S. shareholder as ordinary income.”

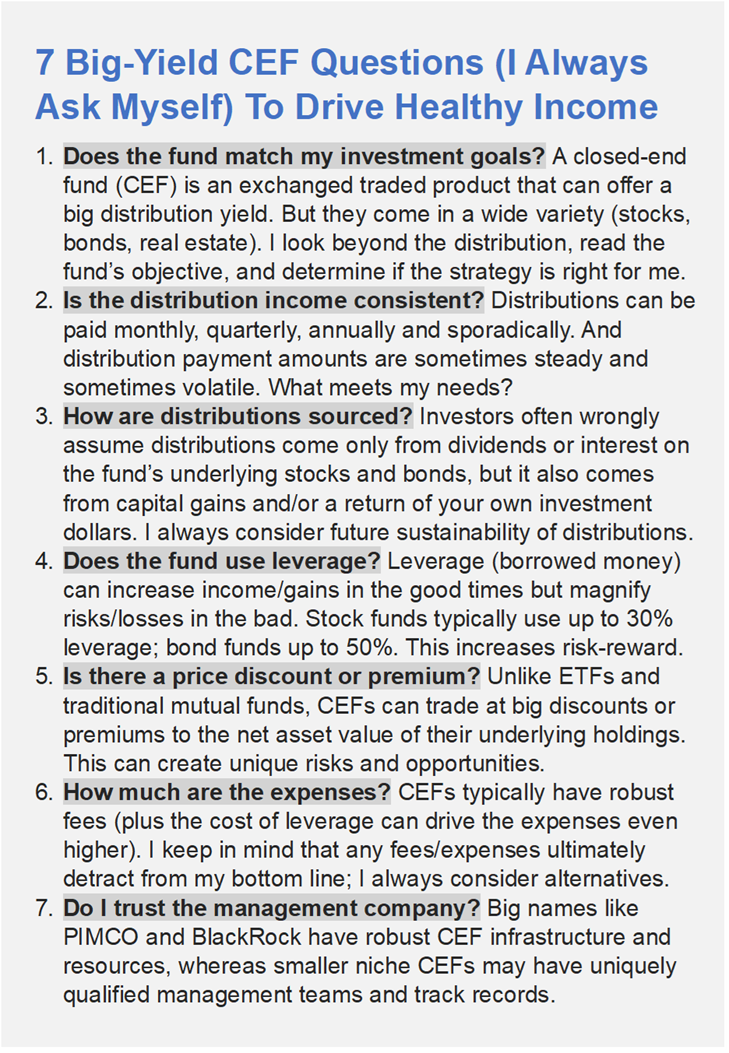

Additional CEF Considerations:

Here are a few additional questions you should always ask yourself before investing in any CEF:

Distribution Consistency and Sources:

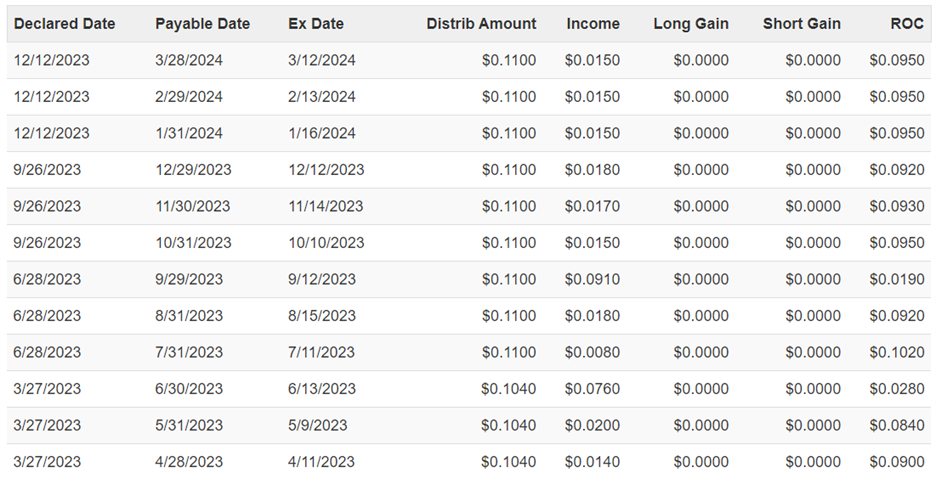

RLTY has actually increased its distribution to shareholders significantly once since its inception in 2022. So the fund is attractive in terms of steady-and-growing income payments. However, the source of the distribution has included a significant amount of “Return of Capital” (“ROC”), as you can see in the graphic below:

A little ROC is okay from time to time, as long as it helps keep the steady distribution in place. However, over time, ROC can weaken the fund’s ability to sustain the distribution because it lowers the asset base on which the fund can earn income. Here is how the fund describes ROC in its prospectus:

“Under accounting principles generally accepted in the United States of America (GAAP), it is estimated that $0.078 per share of the distribution is net investment income and $0.032 per share is a return of capital. A return of capital occurs when a portion of the money that you invested is paid back to you and should not be confused with “yield” or “income.”

As a relatively new fund, it makes sense that RLTY has been forced to use ROC (because the real estate market has largely been in decline during the two years of this fund’s existence), however that still doesn’t make it nice. We hope to see the ROC stop as the real estate market recovers in 2024 (knock on wood).

Leverage and Expenses:

Two more important considerations are leverage and expenses. For starters, leverage (i.e. borrowed money) can magnify returns in the good times, but also magnify losses in the bad times. RLTY recently had a leverage ratio of ~35%. This is a bit on the high side for this type of CEF (thereby adding to the risk/reward potential), but not unreasonable considering the mix of mostly REITs (~66%), but also the diversification of bonds and preferred stocks too.

Leverage also increases the total expense ratio of the fund because it costs money to borrow (and the cost of borrowing has increased as interest rates have risen over the last two years).

Recently, this fund’s common assets expense ratio was 2.03%, and this is significant. Plus the total expense ratio is higher (recently ~3.14%, according to CEF Connect, when you factor in the cost of leverage). Here is a look at some additional leverage facts for your consideration (from the fund’s Factsheet).

Real Estate Market Risks

As mentioned, this fund invests mainly in real estate securities, and that poses a major risk to investors. Specifically, real estate has been under pressure for a variety of reasons (such as rising interest rates and secular changes, such as work-from-home and online shopping).

Some investors believe interest rates have now stabilized, and REITs present a very attractive contrarian opportunity, but of course there is no guarantee that real estate doesn’t get even worse from here (especially some sub-sectors of real estate more than others).

Active Management Team

RLTY does have an experienced management team, actively selecting individual securities and supported by the resources of Cohen & Steers. This active management team is part of the reason for the fund’s hefty expense ratio, and some investors get comfort from having an experience team and company at the helm for their investments.

Conclusion:

Overall we see the Cohen & Steers Real Estate Opportunities and Income Fund (RLTY) as potentially one attractive piece within a larger income-focused investment portfolio. For example, we like the big distribution yield and the price discount (combined with share repurchases and a set termination date to eventually bring the price up to the NAV).

However, we also recognize the real estate market pain may not be over, and the leverage and high fees add to the risks. Nonetheless, if real estate rebounds this year (as many contrarians expect it to) the active management team on this fund may come out looking like heroes (i.e. the fund may deliver healthy income and price gains this year, especially if ROC can be stemmed).

We don’t currently own shares of RLTY because we own another Cohen & Steers real estate CEF instead, RQI (read our report on that one here). RQI has a lower discount, a lower yield, and has NOT been using the dreaded ROC to support the distribution. However, considering market conditions may be improving, now could be an attractive time to consider making the switch to RLTY instead.

Overall, if you are an income-focused investor, we believe that prudently-concentrated, goal-focused, long-term investing will continue to be winning strategy.