PIMCO’s big-yield bond funds are often an income-investor favorite because of their large 9% to 13% yields. Some investors have been traumatized in recent years as prices fell hard (when the fed rapidly hiked interest rates) while other investors haven’t cared as long as the big monthly income payments kept rolling in. This article provides an update on PIMCO bond funds now, and my opinion on which may (or may not) be worth considering for investment, mainly in light of how PIMCO is sourcing the distribution payments to investors.

Why PIMCO Bond Closed-End Funds (CEFs)?

Briefly, a bond CEF is basically a pooled investment vehicle that gives you instant exposure to a variety of individual bonds. However, unlike Exchange Traded Funds (ETFs) and mutual funds (which trade in the market at a value very close to their net asset value, i.e. the aggregate value of all of the individual underlying bond holdings), CEFs are closed-end and therefore can trade at wide premiums and discounts to NAV based on supply and demand. PIMCO is the market leader in bond CEFs (because of their large size, vast resources and history of success) and therefore often (but not always) trade at a premium to NAV (because of the strong demand from investors).

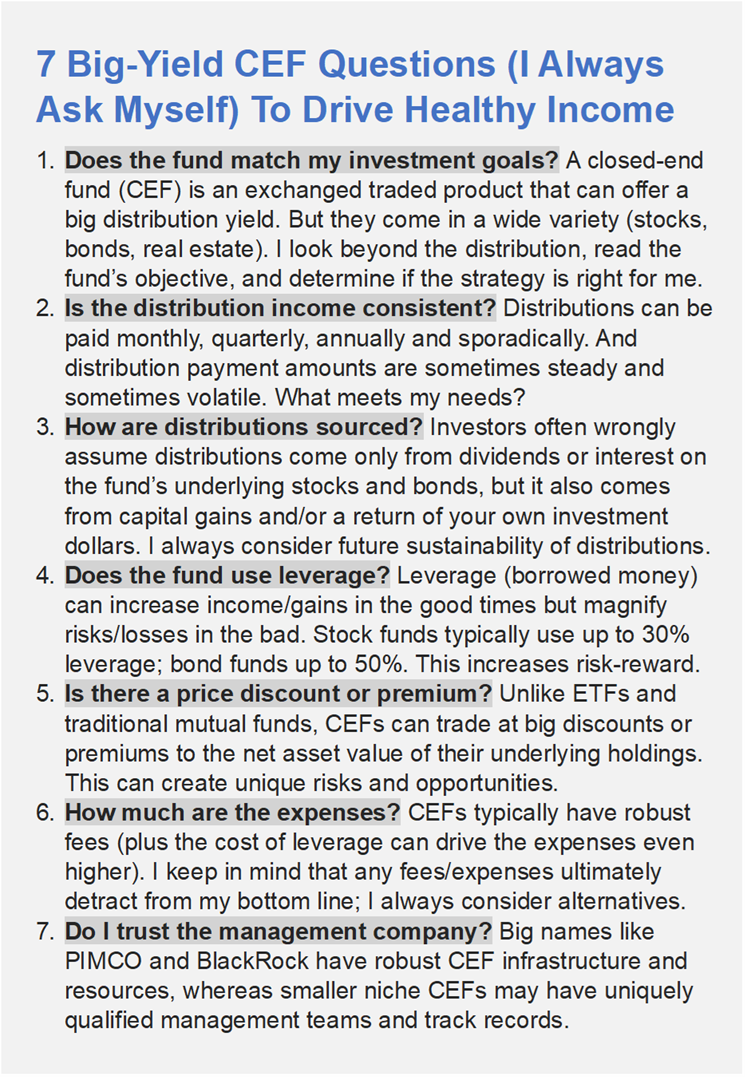

7 Big-Yield CEF Questions I Always Ask Myself:

From a high level, there are 7 questions I always ask myself before investing in any CEF, as you can see in the following graphic.

How are PIMCO Bond Fund Distributions Sourced:

The remainder of this report focuses mainly on how PIMCO is sourcing the distributions for its bond funds because that is extremely important and less obvious to a lot of investors. For starters, here is a look at how well (or not well) the distributions of these funds are covered by net investment income (“NII”). NII is a critical factor because if a fund isn’t generating enough NII to cover the distribution payments then eventually (in one way or another) the net asset value of the fund must fall (and that is typically not a good thing over the long term). And as you can see below, none of these popular funds are generating enough NII to cover their big monthly distributions.

For example, in the column titled “Estimated Undistributed Net Investment Income UNII/Estimated (ROC)” you can see every fund is negative meaning they’ve been paying out more than they have been earning. Notably, the word “ROC” stands for return of capital, something that hurts investors badly if it happens consistently over the longer-term.

In my estimation, PIMCO *hates* to use the word ROC because it has such extremely negative connotations to investors (investors don’t want distribution payments sourced from a return of their own investment capital). And PIMCO uses a variety of derivative instruments (including paired swap transactions) in an effort to delay the recognition of ROC in hopes that it will be cancelled out by NII gains before the ROC needs to be recognized. This has been particularly challenging for PIMCO over the last few years (as interest rates rose at an unprecedented rate), and here is how they explain it in their own disclosures:

Although accounted for in the Fund’s internal tax accounting records as income, certain gains from paired swap transactions are included within Paid-in Surplus or Other Capital Sources in the table above in light of the corresponding capital losses associated with such transactions as described above. Consequently, common shareholders may receive distributions and owe tax at a time when their investment in the Fund has declined in value, which tax may be at ordinary income rates and which may be economically similar to a taxable return of capital. The tax treatment of certain derivatives may be open to different interpretations. Any recharacterization of payments made or received by a Fund pursuant to derivatives potentially could affect the amount, timing or character of Fund distributions. In addition, the tax treatment of such investment strategies may be changed by regulation or otherwise

In a nutshell, the funds have not been covering their distributions with NII and this is not a good thing in the long run.

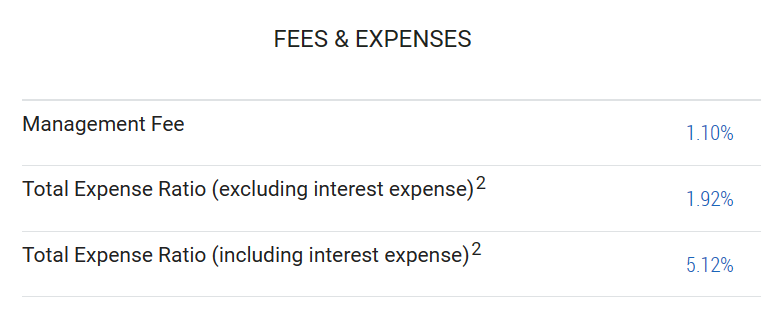

Interest Expenses:

Compounding the distribution sustainability challenges of rapidly rising interest rates is the increased expense of borrowing. Specifically, PIMCO bond funds typically use 30% to 40% leverage (borrowed money) or more, and as interest rates have risen, so too has the cost of borrowing. As you can see in the table below, the total expense ratio on popular fund PDI is now over 5% due to the high cost of borrowing (i.e. interest expense).

In theory, this higher interest expense should be offset by higher interest rate earnings on investments (it is the spread between the two that matters), but logistically speaking there is a lag time for the spread to adjust as the funds hold bonds that don’t mature for years and as rates rise the value of those bonds fall (i.e. as rates rise, bond prices fall, all else equal). This also creates challenges as these funds back up against the regulatory 40% leverage limits and thereby can be forced to sell holdings at lower prices to keep leverage below the limit (yuck—a bad situation that the fund has been dealing with for the past two years as rates rose, and a big part of the reason NII hasn’t covered 100% of the distributions).

Making matters even worse, in my estimation, these funds *loath* reducing the distribution payments to investors (unless they absolutely have to) because they know many investors view a distribution cut as a red flag and may sell out of their position as a result.

The Bottom Line:

PIMCO is the best in the business, but I still wouldn’t dare put all my investment eggs in the PIMCO basket. I fully expect PIMCO’s skilled fund managers will effectively use interest rate swaps (and other derivative instruments) to deal with the challenges of interest rate volatility and distributions that exceed NII. The return of capital (ROC) to investors has not been as transparent as some might expect (i.e. me) because the funds are able to delay recognition (and sometimes delay the dreaded Section 19 ROC notices for years, only sending them out retroactively) through said derivatives. But I believe the team at PIMCO is smoothing out the challenges as best they can to keep distributions high and to minimize ROC (and “Paid in Surplus or other Capital Sources” as they call it before ROC is realized from an accounting standpoint).

I continue to own PAXS, PDI, PDO and PTY within my “High Income NOW” Portfolio, and I have no intention of selling at this time. For your reference, you can see their current yields, premiums (versus NAV) and price performance using the links below.

PDI (Premium to NAV: 11.1%, Yield: 14.1%)

PDO (Premium to NAV: 3.4% , Yield: 11.8%)

PAXS (Premium to NAV: 3.1% , Yield: 11.6%)

PTY (Premium to NAV: 24.9%, Yield: 10.2%)

View the “High Income NOW” Portfolio.