With AI-related stocks experiencing dramatic price increases (see table below) there is increasing fear of an AI bubble (that could soon burst). However, considering the five new signals of growth for leading AI chip maker, Nvidia (NVDA), the risks of a bubble seem overblown. After reviewing the new signals and risks, as well as Nvidia’s current valuation, I offer my opinion about investing in Nvidia and the “AI bubble.”

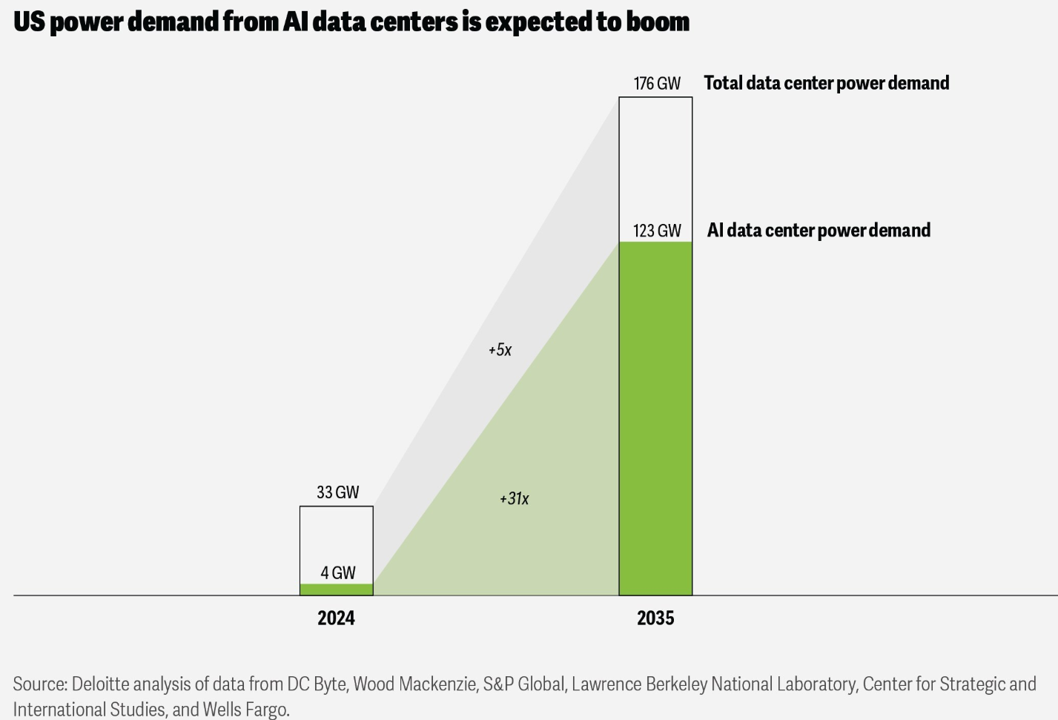

AI is a megatrend, and the datacenters powering it need massive energy. This disruption will continue to create exceptional investment opportunities (ranging from nuclear energy to infrastructure and supporting technologies). This report ranks my top 10 AI energy stocks set to benefit from the megatrend, starting with #10 and counting down to my very top ideas. Enjoy!

Market styles can ebb and flow, but it’s still underlying fundamentals that ultimately drive business and economic growth. Big tech and the “Mag 7” have dominated in recent months (and years) and they are absolutely not going away. But, if you are looking for some non-mega-cap stock ideas, that will also benefit from the biggest secular trend (call it a mega-trend) in many years (i.e. the cloud and artificial intelligence), here are 10 top non-mega cap names (explained and ranked, with current attractive value propositions highlighted), especially as the megacaps may be about to give back a little, relatively speaking, in that ongoing “ebb and flow” cycle (as you can see in the chart below).

The Schwab US Dividend Equity ETF (SCHD) is increasingly popular (total assets have zoomed to over $70 billion), yet it has significantly underperformed the market (SPY) and especially the tech-heavy Nasdaq 100 (QQQ). This report reviews the SCHD strategy, including its attractive qualities and big risks, and then concludes with my strong opinion on investing.

Healthcare stocks currently offer compelling contrarian value opportunities, as titans like Warren Buffett and David Tepper recently took large stakes in industry stalwart UnitedHealth, for example. And abrdn's Healthcare Opportunities Fund (THQ) offers another compelling way to play the sector (including UnitedHealth), but also with a big 13.3% yield and an attractive price discount versus net asset value. This report reviews the fund strategy, valuation, dividend safety and risks; and then concludes with my strong opinion on investing.

Business Development Companies offer income-focused investors access to big-yield private credit opportunities, traded on the public market. And Hercules Capital is a standout among the group for its differentiated strategy, consistent long-term growth, and big quarterly dividend payments to investors. This report reviews Hercules' business strategy, growth, dividend safety, valuation, and risks, and then concludes with my strong opinion on investing.

On social media, the line is often blurred between attractive growth stocks and ugly (emotionally-charged) meme stocks. And when you throw in an overly-sensationalized dose of internet fear mongering and logic-defying greed, investors are often left in the lurch. In this report, I rank and countdown my top 10 disruptive growth stocks, including an attractive mix of blue-chip megatrend leaders as well as lesser-known up-and-coming market disruptors (carefully balancing current valuations against long-term potential, and thereby keeping emotions in check). Enjoy!

Recent reports indicate the Trump administration is preparing executive orders to boost power supplies for the AI industry; Vistra, the largest competitive power generator in the U.S., is uniquely positioned to benefit. Adding intrigue, former House Speaker Nancy Pelosi reportedly purchased ~$1 million in Vistra call options earlier in 2025, signaling strong confidence in its growth trajectory. This report reviews Vistra’s business model, its AI-driven growth, valuation, risks, and why it’s a compelling play in the AI energy revolution.

If you are getting AI revolution fatigue… don’t. While some names are more volatile than others, this megatrend is still just getting started and there are plenty of stocks that still have lots of disruptive upside. In fact, I rank and countdown my top 10 in this report, starting with an “honorable mention” and finishing with my very top ideas.

While Wall Street has been bashing Palantir hard, the longs (including Wedbush Securities’ Dan Ives) have been right all along as the artificial intelligence (“AI”) megatrend continues. This report reviews Palantir in detail (including its wide-moat business model, AI growth trajectory, current valuation and risks), compares the shares to the other top 10 growth stocks in Ives’ new AI Revolution ETF (IVES), and then concludes with my strong opinion on investing.

We've all been the target of anger, but few as much as Tesla (TSLA) CEO, Elon Musk, after he purchased Twitter and joined forces with Trump. However, an examination of his body of work at Tesla reveals he brilliantly created the modern electric vehicle ("EV") industry in anticipation of renewable energy becoming a significantly larger portion of the US electric grid (see chart below) and thereby enabling EVs to ultimately be powered more by clean energy and less by the dirty fossil fuels that dominated the grid and powered EVs when that industry began. It was a brilliant innovation that improved quality of life in the US, and he seems, presciently, about to do it again. This report is about the existential total addressable market opportunity Full Self-Driving (“FSD”) technology creates for Tesla, including competitive advantages, valuation, risks and concluding with my strong opinion on investing.

The most important company in the world right now is Nvidia (NVDA), and it’s set to announce earnings on Wednesday, May 28th after the close. Governments, other companies (large and small), and billions of people all rely increasingly on Nvidia’s computer chips directly and indirectly. And considering the massive Artificial Intelligence (AI) megatrend, demand for Nvidia’s Hopper (H100 and H200) and Blackwell chips dramatically exceeds supply (as incredible value-adding use cases are only just beginning to be discovered). This report reviews Nvidia’s business, growth potential, five important channel checks (suggesting Nvidia will surpass its revenue and EPS guidance), valuation, big risks, and then concludes with my strong opinion on investing.

I like the lessons in children’s stories (ranging from “The Little Engine that Could” to “The 3 Little Pigs”). This article is about another one, “The Emperor’s New Clothes” as it relates to 5 popular but terrible investments, and I suspect it will tick a lot of people off. However, opposing viewpoints can be valuable, so keep that in mind as I run through these 5 investments which I believe have virtually no place in practically everyone’s investment portfolio.

It’s a cloud-AI world, and the companies capitalizing on this will dominate in market performance for years to come. What’s more, tariff fear has created more attractive buying opportunities as this turmoil too shall pass and stocks are eventually going higher (some of them much higher). This report ranks our top 10 growth stocks, starting with #10 and counting down to our very top ideas. Five years from now, people will wish they had been buying more stocks in 2025, and this report highlights a few very top ideas for you to consider.

In case you have been living under a rock, the stock market is down big, thanks (in large part) to turmoil caused by President Trump's new tariffs. Without arguing the pros and cons of these draconian tariffs, it has most certainly created a lot of fear. And fear creates opportunity. Like every other market crisis, we believe this too shall pass. But before it does, investors may want to take advantage of the attractive "buy low" sales prices it has created (in select big yield opportunities). This report ranks our top 7 big-yield investment opportunities (currently on sale) starting with #7 and counting down to our very top ideas.

The Reaves Utility Income Trust (UTG) is a special, utility sector focused, closed-end fund (“CEF”) offering big, tax-advantaged, monthly income (7.6% yield) and unique exposure to the AI datacenter megatrend, which has just pulled back and thereby offers some compelling price appreciation potential (not to mention it also trades at a small but attractive discount to net asset value (“NAV”)). This report reviews the fund’s strategy, holdings, distribution safety, valuation (and megatrend exposure) and risks, and then concludes with our strong opinion on investing.

The market has been primed for a correction for quite some time (e.g. valuations were rich and investors were overconfident in continuing high growth), and President Trump just pushed stocks over the edge with his draconian tariffs. We don’t know when the selloff will end, but we can estimate the three phases of this trade war. We can also say with significant confidence, the economy is still growing, and stocks will eventually trade higher (likely much higher). In this report, we count down our top 10 highly-attractive stock rankings, which includes an alternating mix of high-growth and high-income opportunities, to help you customize your portfolio to take full advantage of the impressive opportunities being created by this rip-your-face-off market correction.

Nvidia is ground zero for the Artificial Intelligence (“AI”) megatrend and Trump’s draconian trade war tariffs. The shares are now down nearly 40%, but this whole mess is far from over. In this report, I review the US trade imbalance and the AI megatrend through the lens of Nvidia’s massive business growth, current valuation and risks. I conclude with my strong opinion on investing.

As you can see in the 10-day return column (below), Artificial Intelligence (“AI”) stocks have been particularly volatile. Much of this volatility is fear-driven and has thereby created select attractive opportunities, as the AI megatrend is still fully intact (i.e. it’s in its early innings). In this report, I share my top 10 AI growth stock rankings, starting with #10 and counting down to my very top ideas.

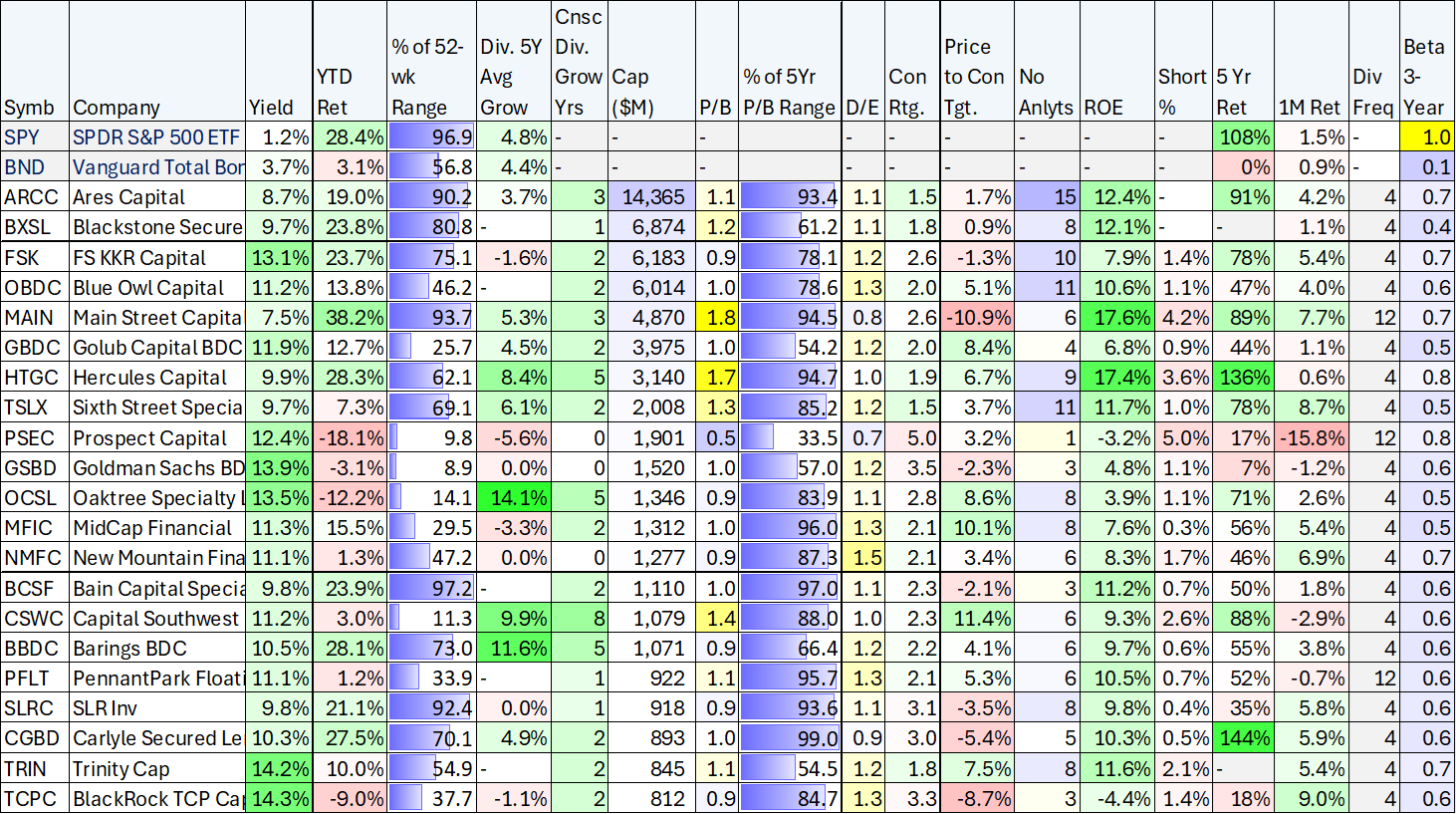

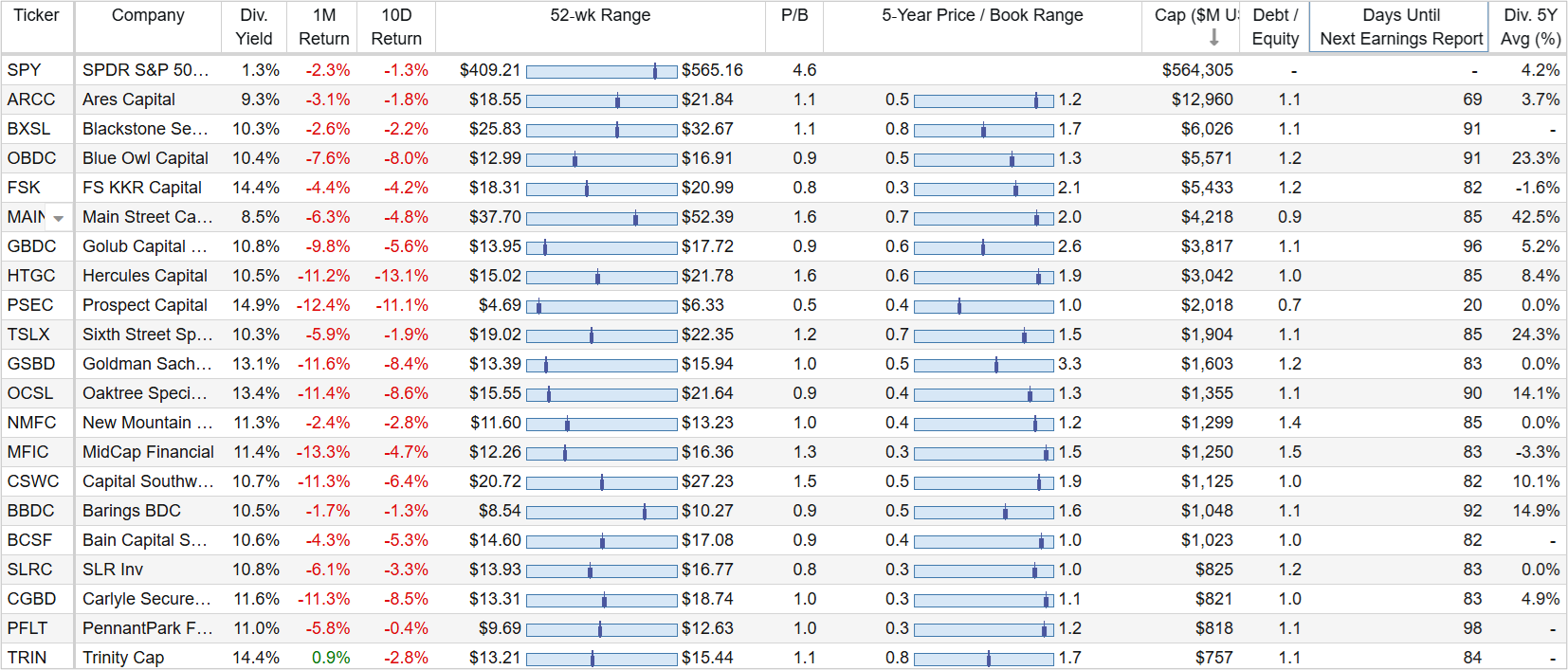

This note shares updated data on big-yield BDCs (including yield, P/B, recent performance, ROE, dividend growth and more). Performance has been mixed for the group this year, but select leaders remain particularly attractive. Yields range from 7% to over 15%. The list is sorted by market cap.

Despite macroeconomic concerns, the stock market has continued to post strong gains this year thereby leaving some investors wondering if it’s time to take some chips off the table. In this report, we provide an overview of “frothy” market conditions (e.g. valuation metrics) and then countdown our top 10 big-yields (including BDCs, stock and bond CEFs, REITs and more). We conclude with a critical takeaway that is sadly overlooked by many.

They often say “you don’t want to see how the sausage is made,” but in this report we are going to look under the hood at PIMCO’s Dynamic Income Fund (PDI) to see how this popular closed-end fund (“CEF”) really generates that big 13.1% “yield” (paid monthly). We put “yield” in quotes because it’s really an artificially manufactured “distribution” that recently included a massive amount of taxable return of capital (“ROC”) something many investors try to avoid like the plague. After reviewing the fund, the distribution and the risks, we conclude with our strong opinion on investing.

Quick Note: For your consideration, sharing data on 100 big-yield CEFs, including: premium-discount versus NAV, leverage, yield, strategy, performance and more.

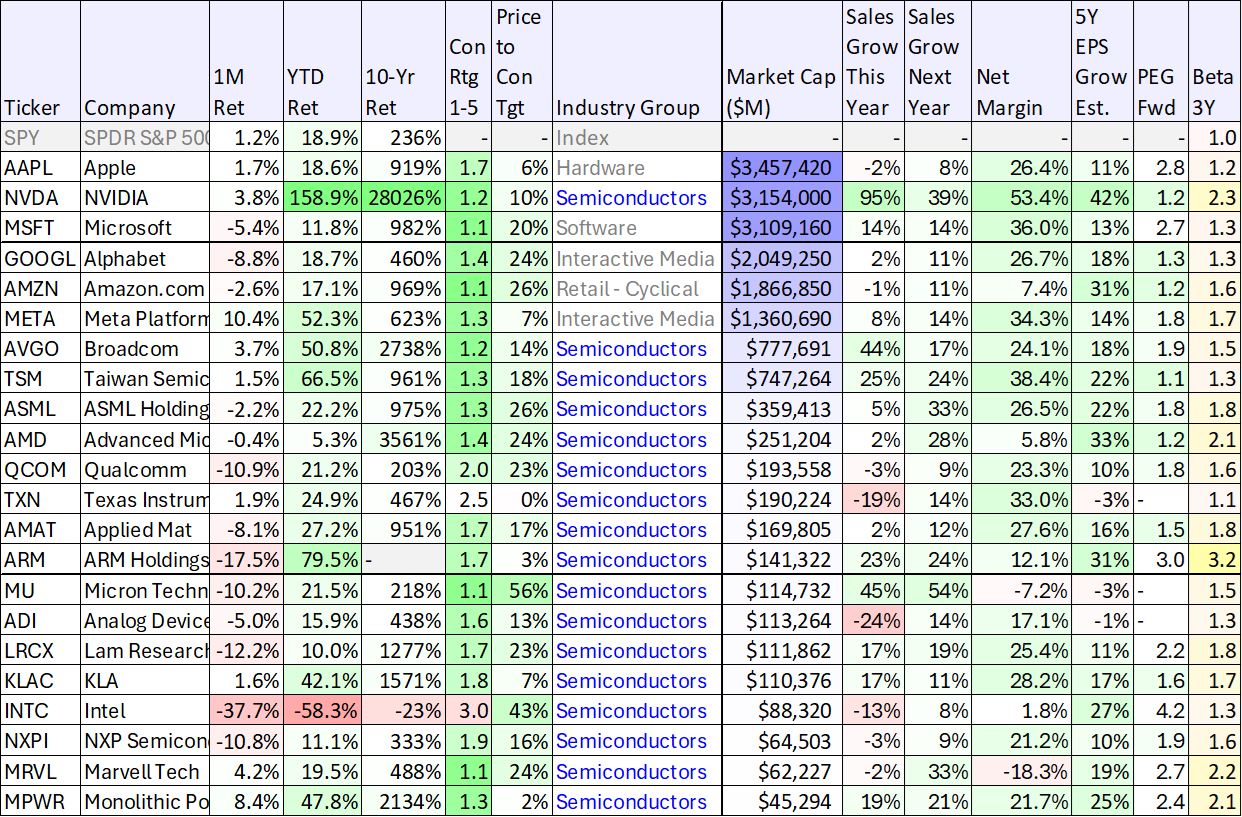

Quick Note: Sharing updated data on 50+ top semiconductor stocks (such as Nvidia, Broadcom and AMD). The data is sorted by market cap, and you can see performance has been quite weak over the last month (despite strong analyst ratings, which are also included). Hopefully this data is helpful as you research ideas.

Sharing Updated Data: Big-yield BDCs have been particularly weak over the past few weeks (following earnings), especially in light of widening credit spreads (i.e. lending risk) and a looming rate cut by the fed (which will negatively impact some floating rate recipients more than others). Sharing updated comparison data on 35+ big-yield BDCs, plus a brief opinion on whether now is the time to buy or head for the hills.

The closed-end fund (“CEF”) we review in this report offers a big, steadily-growing, monthly-paid, tax-advantaged distribution (currently yielding 8.2%). And the fund does so by owning utility-sector stocks (known for lower volatility and steady dividend payments). In this report, we review the fund (overview, philosophy, investment process), its advantages (tax favorability, monetary policy impacts and datacenter AI tailwinds) as well as risks (expenses, leverage, price premium). We conclude with our strong opinion on who might want to consider investing.

There comes a time in every investor’s life when they realize chasing high growth stocks makes absolutely no sense whatsoever. Sure, if you’re 25 and want to roll the dice (on “the next big thing”) go for it. But if you’ve built a nest egg, and you just want your investments to produce big steady income, this report is for you. We countdown our top 10 big yield investments (including REITs, BDCs, CEFs and more) with a special focus on why each opportunity is uniquely attractive right now.

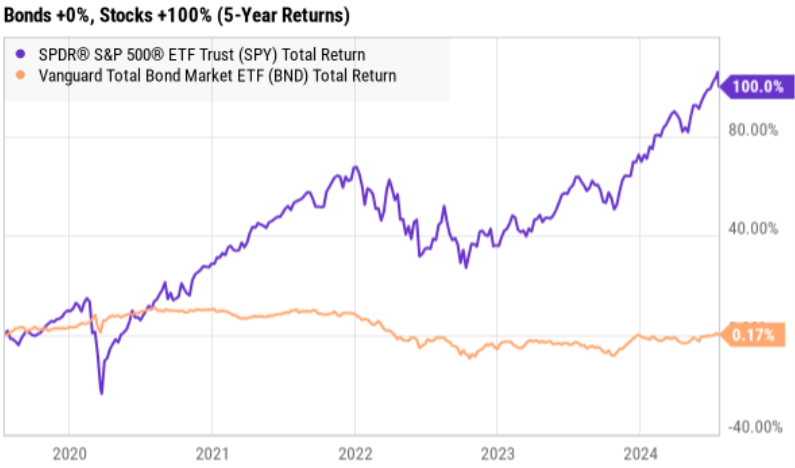

The conventional widsom among so-called investment people is to invest in a “balanced portfolio.” That means to invest in a prudent mix of stocks and bonds (such as 50/50 or 60/40) based on your personal goals and your tolerance for volatility. But over the last 5 years, the balanced portfolio has been horrible, with stocks up 100% and bonds up 0%. Why would anyone want bonds in their portfolio!?

For better or worse, emotions can have a big impact on investment decisions. In this update, we share ten (10) things emotionallly intelligent investors don’t do.

Nvidia is the dominant seminconductor leader powering explosive megatrend growth in the great cloud migration and now artificial intelligence. And these truly massive megatrends are not coming to an end anytime soon. However, there are multiple glaring “red flags” for Nvidia. In this report, we review the business, growth, market size, current valuation, moat and then four massive red flags investors need to consider. We conclude with our strong opinion on investing.