With AI-related stocks experiencing dramatic price increases (see table below) there is increasing fear of an AI bubble (that could soon burst). However, considering the five new signals of growth for leading AI chip maker, Nvidia (NVDA), the risks of a bubble seem overblown. After reviewing the new signals and risks, as well as Nvidia’s current valuation, I offer my opinion about investing in Nvidia and the “AI bubble.”

Nvidia Overview

Unless you’ve been living under a rock, you know Nvidia is the leading AI Graphics Processing Unit (“GPU”) chip maker, and the shares have experienced truly breathtaking growth in recent years (see table above) as the company fuels the AI and cloud datacenter megatrend. Revenue growth has been tremendous (see below), and Nvidia is now the largest US stock by market cap at over $4 trillion.

However, considering a lot of people are increasingly worried about Nvidia and AI bubbles, here are five new developments signaling continuing strong growth.

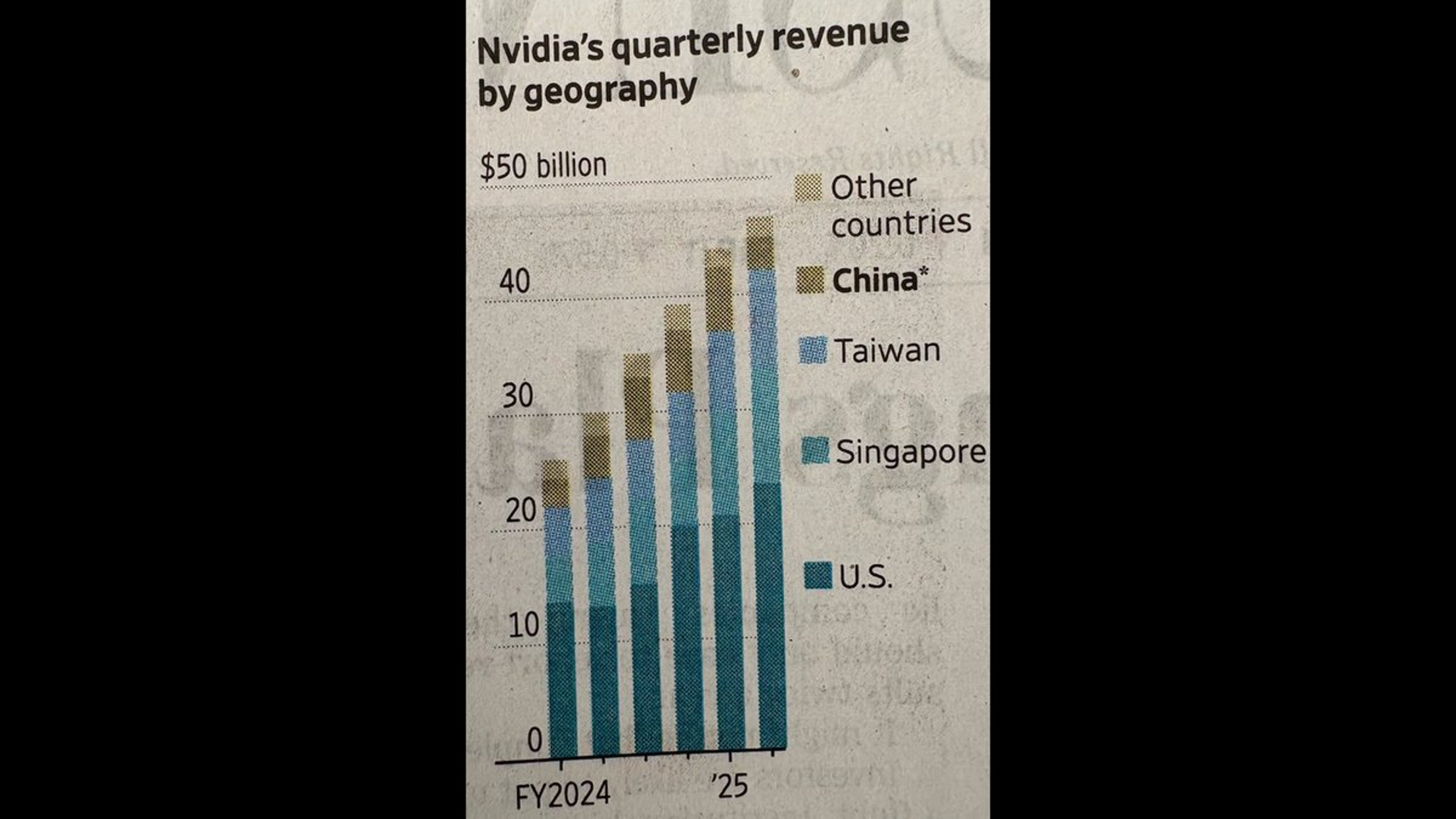

1. China Concerns Overblown

Perhaps the biggest concern for many Nvidia pundits is President Trump’s so-called trade war and its negative impacts on US-China trade in particular. For example, just this past week, China’s market regulators accused NVIDIA of violating anti-monopoly laws (related to its 2020 Mellanox acquisition), and thereby escalating US-China trade tensions. However, Nvidia is already forecasting zero China revenues this quarter, which may prove an overly conservative estimate considering a recent US trade deal does allow H20 chips to be sold in China.

Further, Nvidia relies less and less on China for revenue anyway, as you can see in the following Wall Street Journal chart.

As such, Nvidia-China fears may be overblown.

2. UK Footprint Expanding

Nvidia recently announced significant investment in the UK’s AI ecosystem. For example, Nvidia is partnering with CoreWeave (CRWV), Microsoft (MSFT), and cloud platform Nscale to build advanced AI infrastructure using Blackwell Ultra GPUs. Also, the Stargate UK project with OpenAI aims to deploy GPT-5, and importantly signals Nvidia’s (and AI’s) strategic expansion in Europe. This is a good sign for continuing growth.

3. Trump Is Supporting Nvidia and AI

According to Nvidia founder and CEO, Jensen Huang, President Trump has big plans to support AI and Nvidia in particular. And that includes also the President’s plan for AI energy dominance (more on this later). And just this past week, a massive new deal was announced for Nvidia to partner with (and take a 5% ownership interest in) US chip maker Intel (INTC). Nvidia basically ate Intel’s datacenter lunch over the last decade (GPUs are better than CPUs in datacenters), and the push to work together is a good sign that the need for AI (and quality semiconductor chips) has more long-term growth ahead.

4. Nvidia SK Hynix Partnership looking up

A lot of investors realize the demand for Nvidia AI chips has been insatiable (a good thing for Nvidia’s pricing power). However, many of them wrongly believe the supply of Nvidia chips is limited by Taiwan Semiconductor (TSM) (the foundry that produces Nvidia chips) or by ASML (ASML) (the company that builds the machines that TSM uses to produce the chips). In reality, neither TSM or ASML is the bottleneck, but rather it is SK Hynix (the Korean company and Nvidia’s primary provider of High Bandwidth Memory, or “HBM,” which requires costly advanced machines for precise “chiplet stacking,” and this has limited global supply).

The good news is that SK Hynix just announced they completed development of the more efficient HBM4 (i.e. the next-generation HBM for AI applications) and it is ready for mass production. For perspective, SK Hynix is sold out through 2025 on HBM3E (for Nvidia Blackwell chips), but the company’s partnership with Nvidia, including exclusive deals, positions Nvidia for strong growth as they address HBM shortages in the face of insatiable AI chip hunger. This is good news for Nvidia, especially considering the HB4s have 40% improved power efficiency compared to HBM3E (as energy use is the next big constraint on AI growth).

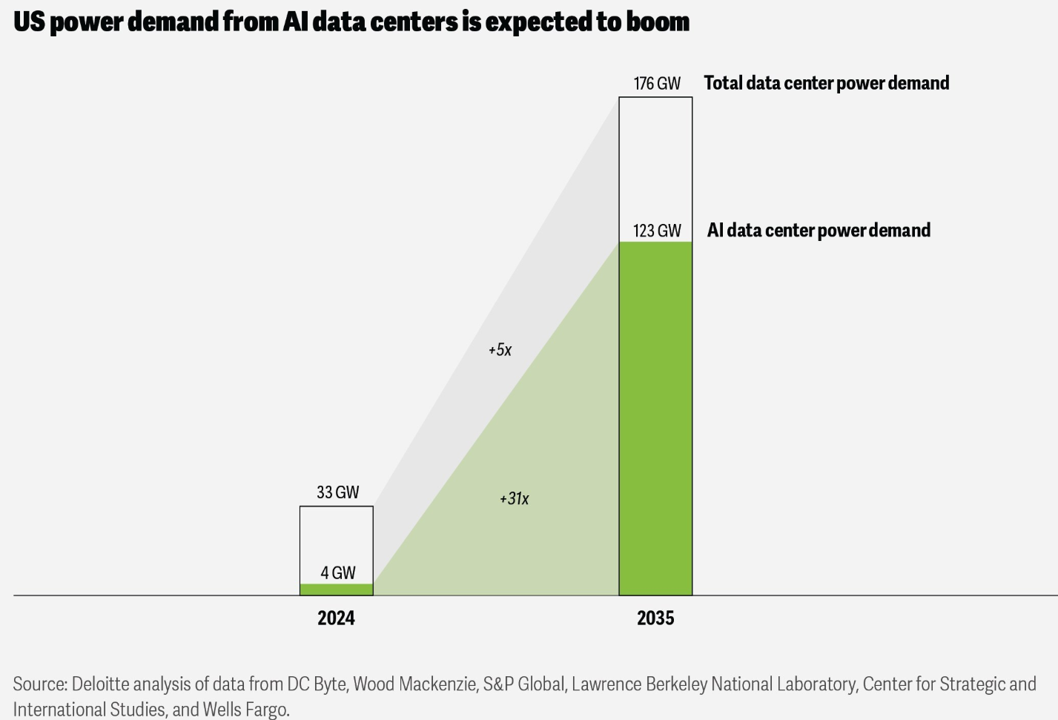

5. Surging AI Energy Demand Signals Growth

According to the International Energy Agency, global electricity demand from datacenters is projected to more than double by 2030, reaching around 945 terawatt-hours (roughly equivalent to Japan's current total power usage). Further, Deloitte forecasts that AI-specific datacenter power needs could grow 30-fold by 2035 (basically fueled by hyperscalers like Microsoft (MSFT) and Alphabet (GOOGL)). In the US, datacenters already consume over 4% of electricity, potentially rising to 12% by 2028 (and thereby pushing utilities and enterprising innovators towards nuclear and increasingly efficient infrastructure solutions).

The surging energy needs for datacenter AI is a good sign for Nvidia and the AI megatrend (but it also creates new challenges and opportunities for growth, as I shared a few top ideas here).

Valuation Fear

Just because a stock price goes up a lot, that does NOT mean the shares are overvalued. Rather, from a valuation standpoint (as you can see in the earlier table) Nvidia trades at a very reasonable valuation multiple (price compared to earnings, sales and growth) as compared to other leading megacaps. For example, it’s low 0.6x forward PEG ratio is compelling. Nvidia also has strong competive advantages (it’s the leading AI chip maker, by a very wide margin). For example, Oracle’s (ORCL) Larry Ellison recently emphasized Nvidia’s GPUs as critical to its AI infrastructure, and Oracle’s new $4B deal with OpenAI (powered by Nvidia chips) underscores the sustained demand.

Risks

In addition to trade wars (which appear overblown) and valuation concerns (which also seem unwarranted), Nvidia also faces risks from competition (as hyperscalers and other companies work to create their own AI chips), from the threat of new (more efficient) AI models which require less compute (China’s DeepSeek already spooked the market once), new computer technologies (e.g. quantum computing), and the simple risk overbuilding (this is why I assume hyperscalers outsource to companies like CoreWeave (CRWV), Nebius (NBIS) and Applied Digital (APLD) instead of just buying them), none of these risks appear overly ominous on the horizon just yet. Nvida still appears to have plenty of room to run.

Conclusion:

AI is a megatrend, Nvidia is the premier leader, and both are showing signals of continued strong growth. In my opinion, rather than thinking about selling Nvidia (I continue to personally own a large position), investors should be considering new opportunities to invest in the companies that will benefit from (and grow with) Nvidia, such as dramatic AI-energy needs (for datacenters) in the coming years.

However, at the end of the day, you need to do what is right for you, based on your own individual situation. Disciplined goal-focused long-term investing continues to be a winning strategy (and Nvidia and AI continue to be a big part of mine).