On social media, the line is often blurred between attractive growth stocks and ugly (emotionally-charged) meme stocks. And when you throw in an overly-sensationalized dose of internet fear mongering and logic-defying greed, investors are often left in the lurch. In this report, I rank and countdown my top 10 disruptive growth stocks, including an attractive mix of blue-chip megatrend leaders as well as lesser-known up-and-coming market disruptors (carefully balancing current valuations against long-term potential, and thereby keeping emotions in check). Enjoy!

Meme Stock Bubble?

Before getting into the top 10 ranking and countdown, it’s worth first asking the question…

…Are we in a (meme stock) bubble?

From a short-term perspective, and if you haven’t been paying attention, you might not realize the market is up 20% (S&P500) since the depths of the Trump tariff turmoil 3 months ago. And select high-growth stocks (arguably “meme” stocks) are up dramatically more (see table below).

Some media pundits are arguing we’re in a bubble, while others suggest “this time it’s different.” I’ll argue my case for when this “meme stock” bubble will burst (and how you might want to play it) in the conclusion of this report.

Entire Market Bubble?

And from a longer-term perspective, two of the most common arguments I hear to suggest we’re in an “entire market” bubble are market valuations (such as price-to-earnings ratios—they’re at historical highs) and the massive size of the top 10 US stocks by market cap (in percentage terms relative to the rest of the market).

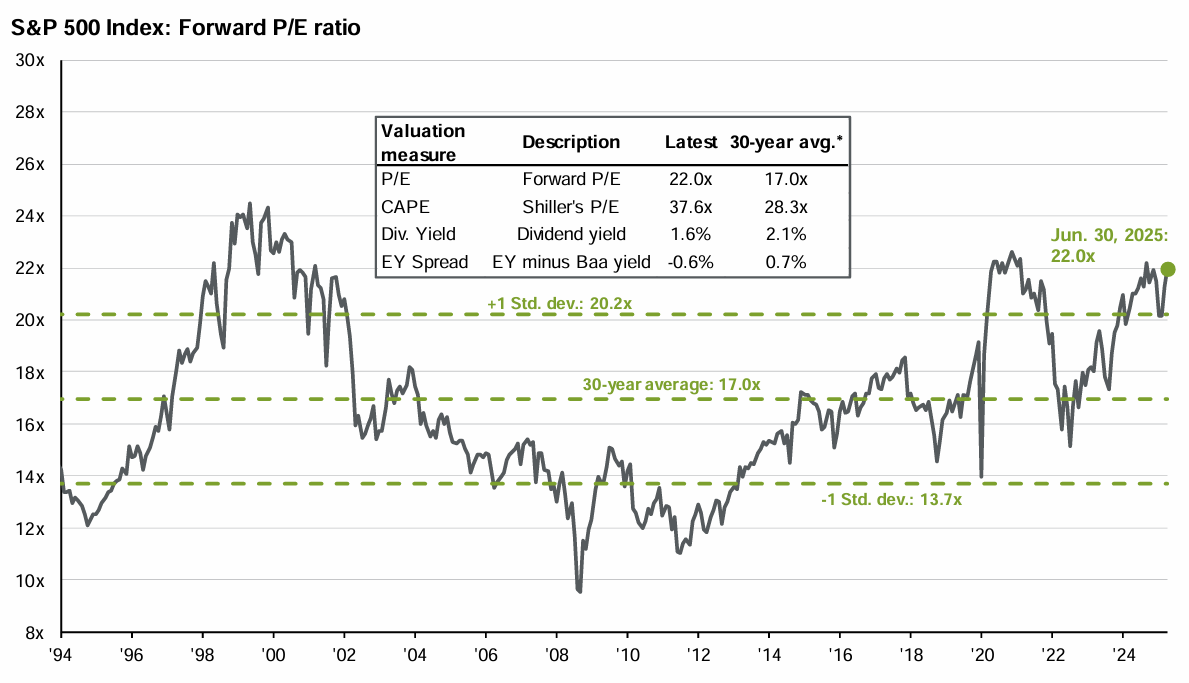

For example, you can see in the following chart (as of June 30th) forward P/E ratios on the S&P 500 are well above the 30-year average (and they’ve only gotten higher as stocks are up so far this month—and quarterly earnings season is only just beginning).

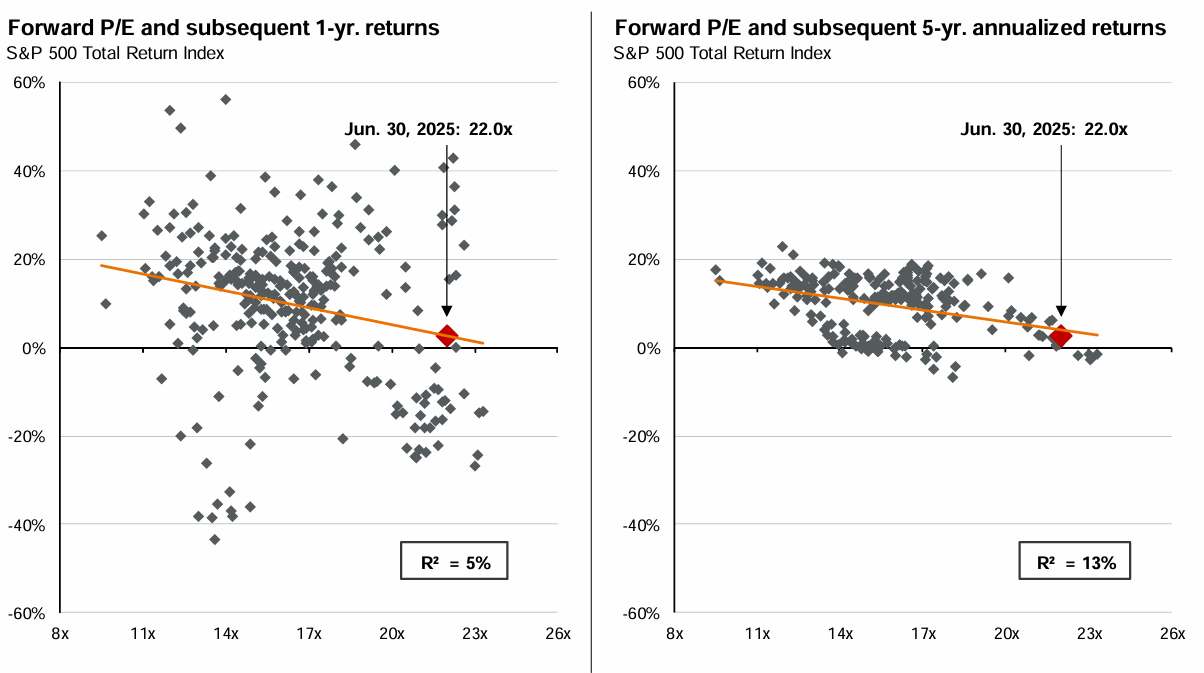

And then of course subsequent stock market returns are lower when the P/E ratio is higher, as you can see in this next chart.

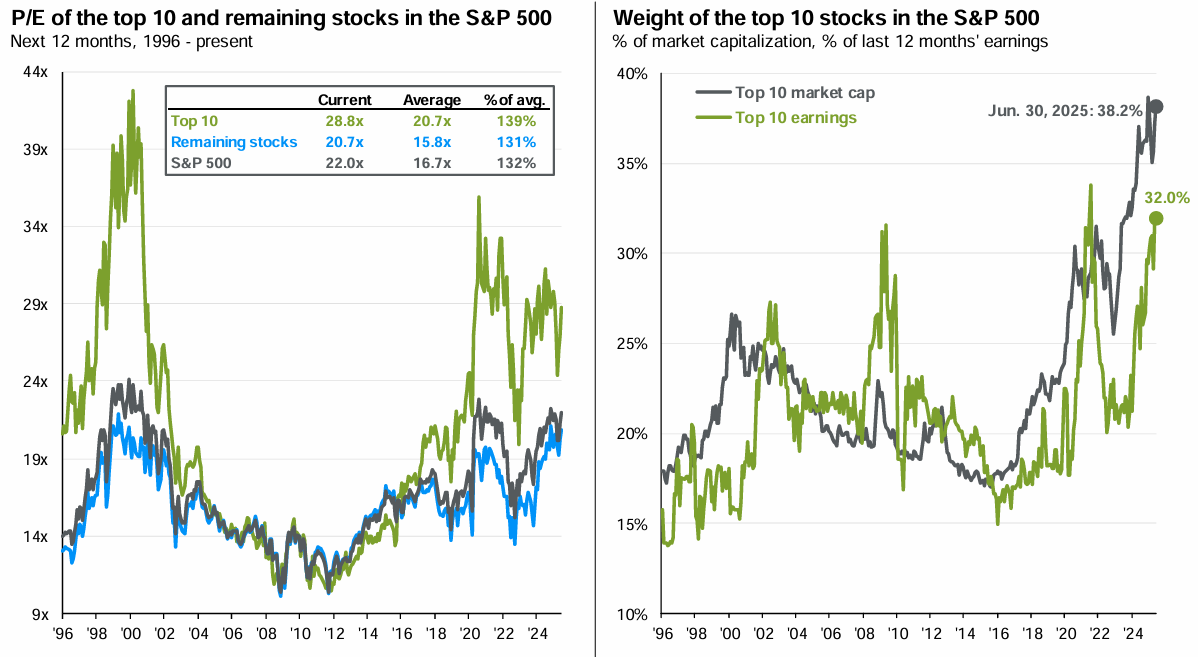

And then here is a look at just how big the top 10 US stocks (by market cap) are related to the rest of the S&P 500 (i.e. they’re really big right now, and their P/E ratios are really high).

So by traditonal, high-level metrics, the stock market is a little “frothy” right now, to put it mildly (more on this in the conclusion).

Top 10 Disruptive Growth Stocks (Ranked):

So with that backdrop in mind, and remembering that not all disruptive growth stocks are meme stocks (select names are supported by extremely healthy fundamentals), let’s get into the top 10 ranking and countdown.

10. SoFi Technologies (SOFI):

SoFi is an impressive disruptive growth stock effectively capitalizing on fintech opportunities and millennials' distrust of traditional finance. It continues to release innovative new products (such as cryptocurrency and private equity) beyond just student loans (which remain an attractive first product for the company to get its foot in the door with future high earners). The shares are up more than 200% over the last year, which makes some investors nervous, but the market opportunity remains large.

You can view my full report on SoFi here.

9. Meta Platforms (META)

If ever there was a company that symbolized “revenge of the nerds,” this would be it. Nerdy CEO Mark Zuckerberg grew his Facebook app (which stalks user data and sells it for advertising revenue) into Instagram (more social media creepiness) and WhatAp (the grand daddy of creepy stalker-ness because AI listens to your phone calls and is just now beginning to unlock this massive new advertising revenue source). Plus, Zuckerberg is relatively young for a CEO and still seems dead set on growing his creepy empire of social media stalker-ness). At 25x forward earnings, with double digit growth and incredible margins, this megacap still has lots of room to run.

You can view my latest full report on Meta here.

8. Vertiv (VRT)

Vertiv basically makes electrical components for datacenters, and this positions the company (a leader in the space) smack dab in the middle of the AI megatrend. Demand is high and will likely remain so as the AI megatrend continues to need data centers. However, the valuation, relative to the demand growth, is low (a good thing). Trading at 6.3x sales and 31.1x forward earnings (with a double-digit revenue growth rate), Vertiv is worth considering.

You can view my previous full report on Vertiv here.

The Top 7…

The top 7 disruptive growth stocks are reserved for members only, and they can be accessed here. The top 7 includes an attractive mix of disruptive blue-chip leaders and lessor-know up-and-coming disruptors. Enjoy the top 7!

How should you play the current “Frothy” market conditions?

So with those rankings in mind, the “boring” answer (to the above question) is that you should play the market according to your own personal goals. If you cannot handle another 20% or 30% or more pullback and market correction—then for goodness sake don’t put everything you own in the stock market (especially growth stocks!).

But if you have a longer-term horizon (7-10 years or more) then stay invested. Don’t try to time the market’s short-term moves. You WILL get it wrong (despite armies of media pundits and sales people that will tell you otherwise—hint: they just want your money).

How am I playing the current “Frothy” market conditions?

As mentioned, I currently own most of the top 10 (see my Disciplined Growth Portfolio), but I am NOT being overly aggressive right now (but I am sticking to my long-term goal-focused strategies).

For example, my Disciplined Growth Portfolio is still overweight megatrend themes I like (such as AI, the cloud and related businesses), but I am not being overly aggressive (I still have exposure to other market sectors and business strategies) and I am absolutely NOT going all in on meme stocks right now.

And in my High Income NOW” strategy, I am not being overly risky compared to usual, but I am still staying exposed to a prudently-concentrated portfolio of high-income opportunities. I know that both strategies seem very different, but they are both still affected by the same market volatility and economic conditions.

And I also know that all investment decisions should be driven by your own personal situation and goals.

The Bottom Line

Yes, we’re in a bubble. It’s driven by inflation, fiscal and monetary policies and high-valuations (particularly by social media exuberance for meme stocks).

But that does NOT mean it will burst tomorrow, next month or even next year. In my opinion, now is NOT the time to bet your livelihood on meme stocks, but it is time understand your personal situation and stick to a prudent, long-term, goal-focused strategy.

*You can view all of my current holdings (including portfolio weights) here.