Time to sell your winners and buy the losers? Some contrarians might think so. Here's our view on the Dow Jones stocks we own in the Blue Harbinger 15:

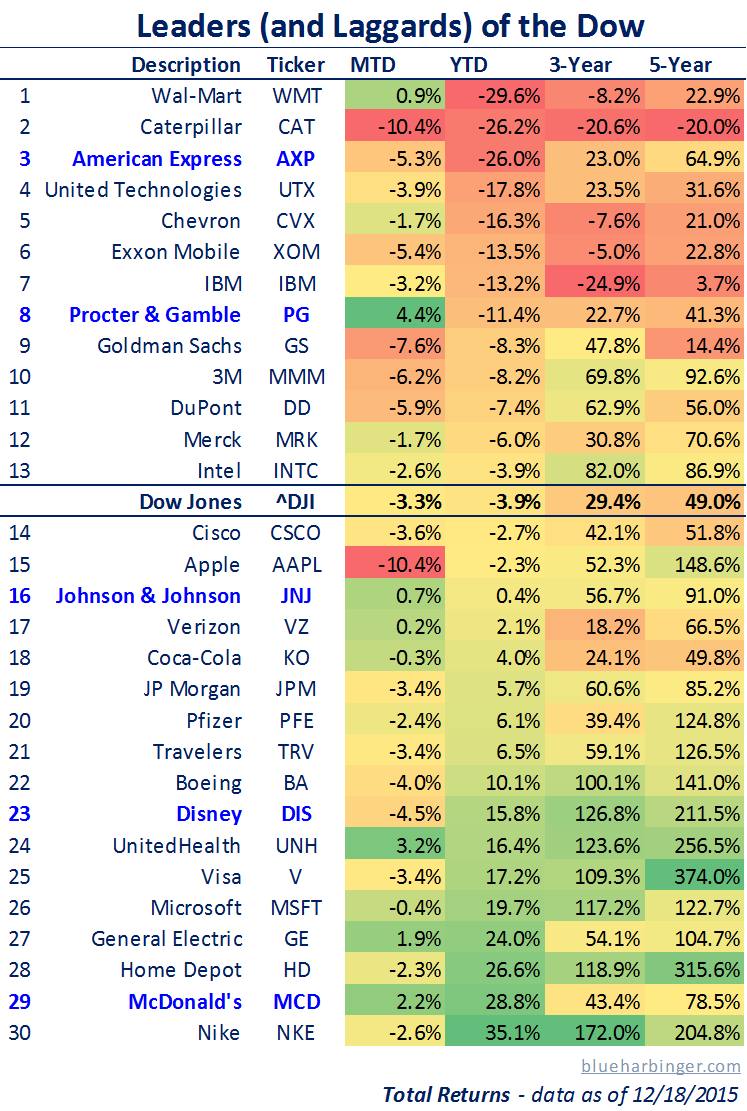

For starter, we do own McDonald’s (MCD) in our Blue Harbinger 15 strategy, and it’s been a great performer this year. However, it’s a name we may consider selling and replacing in the next several months. We believe McDonald’s has outperformed for several reasons. For example, Chinese meat supplier issues are further in the rear view mirror, and the market is already giving the stock credit for all day breakfast even though it hasn’t yet been reflected in a quarterly earnings announcement. We also recognize that FX headwinds may be stabilizing now that the Fed has started raising rates (as expected) and the ECB will eventually pull back meaningfully on its own quantitative easing. As we’ve mentioned several times, we may replace McDonald’s with Chipotle once the smoke has cleared and we have more visibility into the impacts of that company’s E. coli issues. Stay tuned.

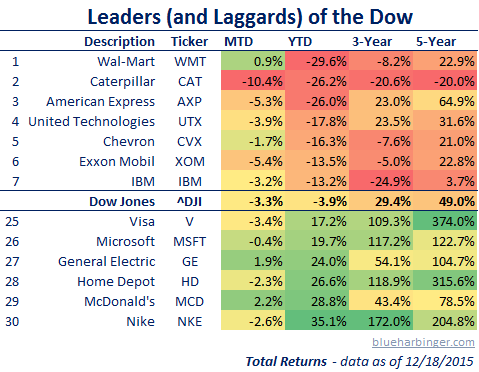

For reference, here is the full Dow Jones performance chart…

We also own Walt Disney (another strong performer) and we’ll likely continue to own this one for a while. The fear with this stock is that people are dumping cable which continues to hurt Disney’s ESPN business. However, long-term, this company owns unparalleled brand names that will pay dividends for a very long-time to come.

Procter & Gamble is another Dow Jones stock we own in the Blue Harbinger 15, and we will continue to own it for several reasons. First, it has mildly underperformed this year, and we believe this makes the stock attractive (especially considering its dividend yield is near record highs). PG is finishing up a multiple year restructure, under a new CEO (this CEO was the old CEO until he came back out of retirement). The restructuring is shedding less profitable brands so the company can be more focused and profitable. Also, this stock has suffered enormously from the strong US dollar because so much of their business is outside of the US. We believe this headwind has slowed, and may likely eventually turn in the company’s favor and actually add significantly to profits.

We own Johnson & Johnson because it is a blue chip among blue chips. It provides important diversified exposure to the healthcare industry, a nice dividend, and we have no intention of selling anytime soon.

We own American Express in the Blue Harbinger 15 as a contrarian play. We believe this stock has been overly beat up as it recently lost an exclusivity deal with Costco, and it also lost a legal battle whereby the federal government is now allowing merchants to discriminate against certain credit card companies (such as American Express) because they charge higher discount rates or processing fees. Also, unlike other credit card companies (e.g. Visa and Mastercard) American Express is a bank (it owns its own loans) and the company will benefit as interest rates rise. Further, it is an exceptional brand name that is currently on sale.

Paylocity is not a Dow Jones stock, but it is a name we own. We covered several Paylocity competitors (such as Paycom and The Ultimate Software Group) in this week’s Stock of the Week: “ADP’s Cloud Competition: Cash Cows Looming.” Based on Paylocity’s future growth opportunities (and revenue guidance provided by management) this stock has huge upside. Specifically, if revenue continues to grow at 35 – 40% for only the next five years, and the company eventually stops spending so extremely heavily on “Sales and Marketing,” then the company will turn into a cash cow. By 2020, the company has 150% upside (if it achieves its growth objectives, slows up on “Sales and Marketing,” and receives the same 28 times price-to-earnings ratio as ADP). The stock is up big this year, but has pulled back slightly in the last couple week’s thus creating a better buying opportunity.

Lastly, “rebalancing” your investment portfolio is very important, but don’t overdo it because that gets expensive. For example, when we buy a stock our goal is to own it forever. However, if any individual name becomes more than 10-15% of your portfolio then it is time to consider selling some of it because you don’t want to be putting too many of your eggs in one basket (because it’s just too risky!). Also, be cognizant of your trading costs. First of all, statistics often show retail investors often buy and sell at the exact wrong times (they get scared and “sell low” or they get greedy and “buy high”). And remember, every time you trade, you are putting more money in Wall Street’s pocket. Personally, I’d rather not give any more money to Wall Street than I need to. Be smart.