OneBeacon (OB) is a boring, low beta, low volatility, property & casualty insurance company that offers a big safe dividend yield (6.4%). Because of the nature of its business, it is a great diversifying “widows and orphans” stock, and it that can be very valuable within the constructs of a diversified, income-focused investment portfolio. The stock is down 8.5% in the last year while the S&P 500 is essentially flat over the same time period, thus creating a more attractive entry point for long-term, income-hungry investors.

About:

OneBeacon Insurance Group, Ltd. is a Bermuda-domiciled holding company that is publicly traded on the New York Stock Exchange under the symbol “OB.” Its underwriting companies offer a range of specialty insurance products sold through independent agencies, regional and national brokers, wholesalers and managing general agencies.

Ten Reasons to Own It:

We believe OneBeacon is an exceptional big dividend stock to own, and we’ve listed ten reasons why below.

10. Objecting Policyholders Case Closed.

In January of 2016, the Commonwealth Court of Pennsylvania definitively closed a case by some objecting policyholders to reverse the sale of a runoff business. The matter was resolved in OneBeacon’s favor. And with the case now in the rear view mirror, OneBeacon is left with one of the cleanest balance sheets in the property and casualty business.

9. The Price has Declined (Buy Low).

Even though the stock experienced a bit of a pop in January after the case (above) was closed, the price of OneBeacon is still down over 8.5% in the last year while the S&P 500 is essentially flat. We believe this price decline is temporary and it provides some margin of safety for potential buyers of the stock.

8. Bermuda Based Tax Advantages.

Because the company is domiciled in Bermuda, some of its operating business are not subject to US taxes. Granted, the majority of the Company's subsidiaries file consolidated tax returns in the United States. However, income earned or losses generated by companies outside the United States are generally subject to an overall effective tax rate lower than that imposed by the United States. This works to the advantage of OneBeacon’s profitability.

7. Deferred Tax Assets.

In addition to its Bermuda-based tax advantage, OneBeacon also holds a significant amount of deferred tax assets, which could prove extremely valuable to soften any potential big taxable profits in the future. Specifically, at year-end One Beacon held $140.2 billion in deferred tax assets. And while they may not be able to use all of these (to offset taxes) before they expire, it’s nice to know they’re there.

6. Strong Balance Sheet.

As shown in the following chart, OneBeacon has a strong history of maintaining its book value per share while also paying out big dividends. It’s important to note that the big dividend payments are not preventing the business from operating profitably and growing in the future.

5. Consistently Well-Run.

As the strong book value (above) helps demonstrate, OneBeacon has been a well-run business. The company’s four main operating principles are:

• Underwriting comes first

• Maintain a disciplined balance sheet

• Invest for total return

• Think like underwriters

They’ve done an excellent job sticking to these principles as evidenced by the strong balance sheet, their consistent dividend payments, their consistent (and growing) net written premiums and their well-managed combined ratio (as shown in the following charts)

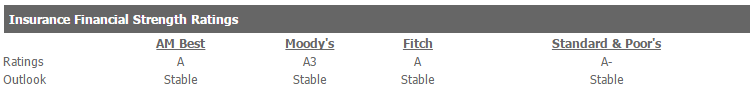

4. Strong Insurance Financial Ratings.

Outside ratings agencies also recognize OneBeacon’s well-managed financial strengths as shown in the following ratings table.

3. Low Volatility

As the following table shows, OneBeacon compares favorability to other big dividend stocks in terms of volatility. Specifically, it ranks very highly (low volatility) versus its peers over a variety of time periods. This is extremely important if you are looking for safety and consistent returns on your investment.

2. Low Beta

As the previous table also shows, OneBeacon has a low beta. This means it tends to not follow the ups and downs of the market as much as other more typical stocks do. This is extremely important within the constructs of a diversified investment portfolio because it helps reduce overall market-related volatility.

1. Big Safe Dividend

The number one reason to own OneBeacon is its big safe dividend. OneBeacon’s very high 6.4% dividend yield is extremely hard to find for a company as safe and “low-volatility” as OneBeacon. If you are a low-risk income-hungry investor, OneBeacon is absolutely worth considering your portfolio.

Risks:

We’d be remiss if we didn’t mention the risks associated with OneBeacon. For starters, OneBeacon faces many of the same risks as a typical property and casualty insurance company. This means the company’s investment portfolio may suffer reduced returns or losses which could adversely affect operations and financial condition. Also adverse changes in interest rates, equity markets, debt markets, or market volatility could result in significant losses to the fiar value of the company’s investment portfolio. The property and casualty insurance industry is highly competitive and cyclical, and OneBeacon may not be able to compete effectively in the future. Also the company’s loss reserves simply may not be enough to cover liabilities for the cost of claims, and this would materially impact financial results, the stock price, and possibly the dividend.

Additionally, OneBeacon faces unique risks such as those related to the tax treatment of the company’s Bermuda operations. For starters, they may become subject to taxes in Bermuda after 2035. Additionally, US tax laws could change to materially impact OneBeacon’s non-US operations. Also worth noting, White Mountains beneficially owns all of OneBeacon’s Class B common shares, representing 96.9% of the voting power of the voting securities and 75.5% of our total equity as of December 31, 2015. White Mountains is a larger insurance company ($4.2 billion market cap versus OneBeacon’s $1.2 billion market cap) that may significantly influence OneBeacon’s operations.

Bottom Line:

The benefits far outweigh the risks, and OneBeacon’s big, safe, dividend could make an extremely valuable addition to a diversified, income-focused, investment portfolio.