This week’s new investment idea is a $21 billion engineering company based out of Switzerland that trades on the New York Stock Exchange. The stock is still down 10% since the Brexit news as it has still not recovered as quickly as the S&P 500 or the iShares Switzerland ETF. We expect this stock to recover quickly in the days and weeks ahead, and we also expect it to be a long-term outperformer. Plus, it offers an attractive 2.6% dividend yield,

About TE Connectivity:

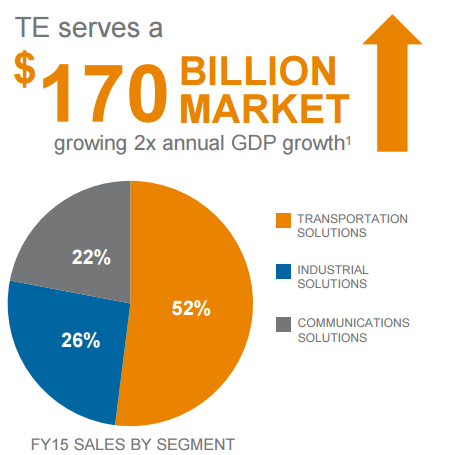

TE Connectivity (TEL) designs and manufactures connectivity and sensors solutions. It operates its business through three segments:

- Transportation Solutions, which offers various products, including terminals and connector systems and components, relays, circuit protection devices, sensors, and application tooling, among others;

- Industrial Solutions, which include terminals and connector systems and components, heat shrink tubing, relays, wire and cable, and

- Communications Solutions, which include terminals and connector systems and components, circuit protection devices, antennas, relays and heat shrink tubing.

It markets its products to manufacturers and distributors in a number of markets, which include automotive, industrial equipment and consumer devices.

Why we like TE Connectivity:

Aside from its recent price dip (i.e. buying opportunity) and its big dividend, we like TE Connectivity because of its big attractive margins and growth. The following chart shows the company’s gross and operating margins, which are both attractive.

Additionally , in 2015 the company earned a return on capital of 22.0% versus its cost of capital of only 5.6%- this is impressive because it means the company is generating huge profit for each new dollar it invests.

Valuation:

We use a discounted cash flow model to value TEL at $99 per share, ore than 70% higher than its current share price. Specifically, we discount 2015 free cash flow of $1313 ($1913 cash from operations minus $600 capex) by the firm’s 6.2% cost of equity minus a conservative 2.5% growth rate. This values the equity at $25.5 billion, and then we divide by the 357.5 billion shares outstanding to arrive at the $99 per share valuation. This valuation is only a rough estimate, but it gives credence to the notion that TE Connectivity has a lot of price appreciation potential.

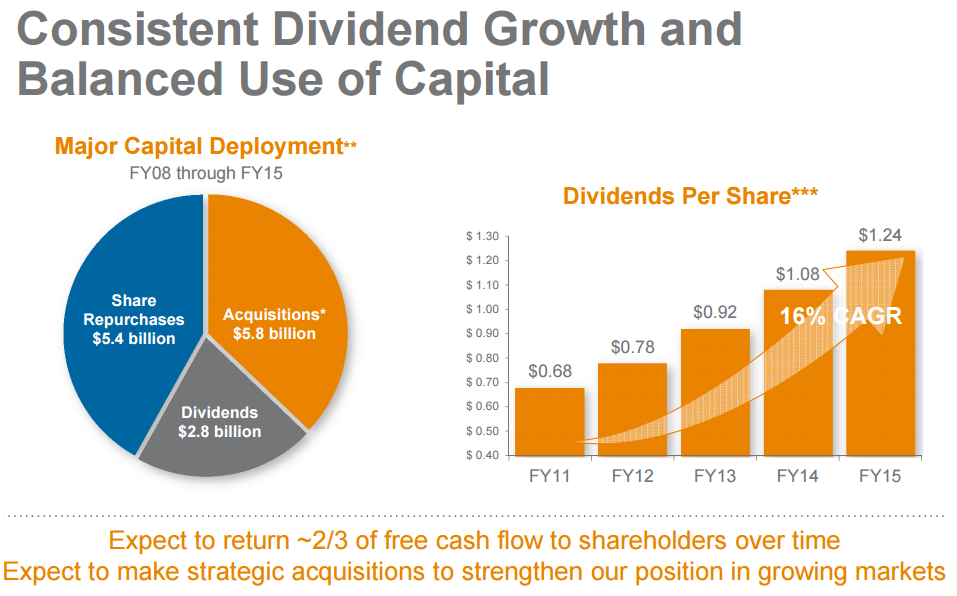

Dividends and Share Buybacks:

We also like TEL because it has been consistently able to grow its dividend as well as buyback shares. The following chart shows the split between buybacks, dividends and acquisitions. TEL is a cash generation machine, and this is a very good thing for shareholders.

Risks:

TE Connectivity does face a variety of risks that are worth considering. For starters, it operates internationally, and has to deal with the risks of foreign currency fluctuations as well as the costs of their foreign currency hedging program. Additionally, the company is exposed to volatile commodity prices, particularly metal prices. TEL’s business is also exposed to the cyclical natural of economic conditions. For example, TEL’s beta is above one (1.44) demonstrating it is particular sensitive to market conditions. Lastly, TEL doesn’t have particularly significant competitive advantage or economic moat. The barrier to entry and switching costs are not particularly high in the industry in which TEL operates.

Conclusion:

We like TE Connectivity because it’s a profitable, high-margin, growing business that pays a big dividend and the stock trades at an attractive price. Further, the stock still has not recovered from the recent Brexit-induced volatility relative to the rest of the market. We don’t currently own shares of TE Connectivity in any of our Blue Harbinger strategies, but we’ve placed it high on our “watch list,” and we may purchase shares in the future.