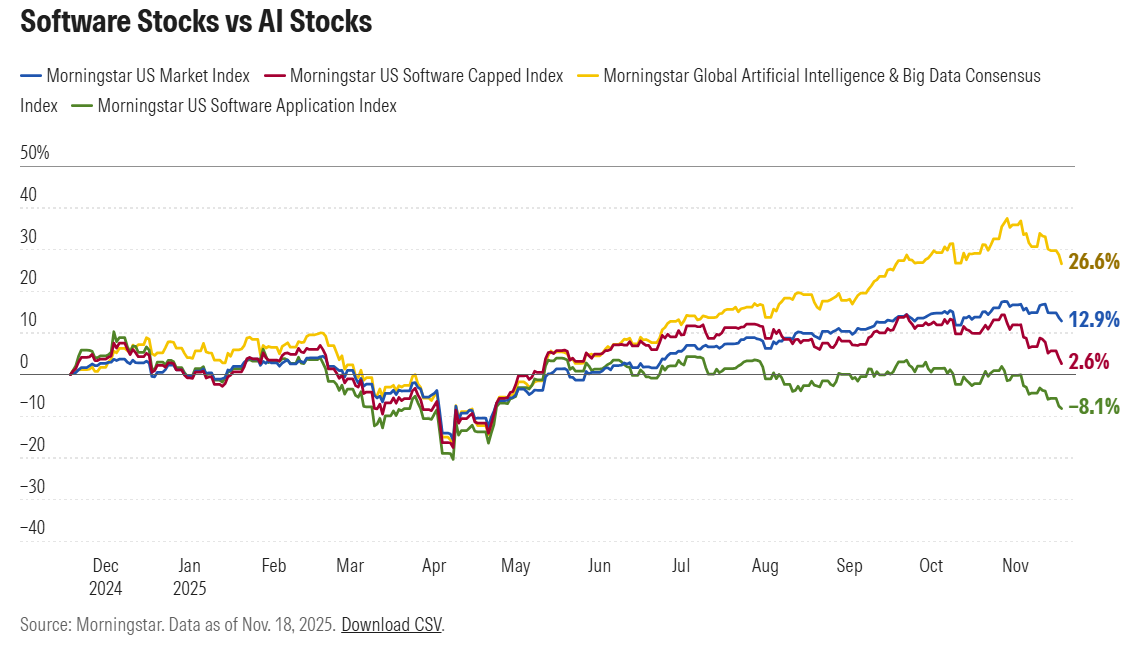

As the AI megatrend continues to grow, one of the lesser-noticed side effects within the technology sector has been the flow of dollars out of otherwise attractive software companies and into AI stocks. As a result, a lot of really attractive software stocks (those with high growth and high profits) are actually significantly underperforming the market and trading at increasingly attractive valuations.

While some investors believe this is warranted (as the AI megatrend continues to grow), certain GARP (growth-at-a-reasonable-price) investors are salivating at the opportunities to buy attractive long-term business at very reasonable (attractive!) prices.

(click the image above to launch the full PDF).

ServiceNow (NOW):

Names that standout are ServiceNow (NOW), Adobe (ADBE) and even Microsoft (MSFT). For example, with a 20% revenue growth rate (this year and next) a very healthy 14% net profit margin, and an “A” rating (with 40% price upside) from 38 Wall Street analysts, ServiceNow is compelling (especially as the shares also appear recently oversold with a 14-day money flow index hovering very low—near oversold territory).

This report (link above) includes data on those name and other increasingly "interesting" software stocks. Wall Street is expecting significant gains (as you can see in the report), and I continue to own several of these top ideas (in my BH Disciplined Growth Portfolio) too.

Remember however, that some investors will choose to double down on full-throttle AI stocks (let your winners run!) while others will appreciate some diversification into attractively-valued software stocks (which most certainly do have significant exposure to AI—in a good way—they're just not necessarily pure play AI stocks).

We don't know when the AI megatrend will end (my belief is not for many years), but that doesn't mean a lot of pure-play AI stock prices won't get ahead of themselves—there will be volatility!

Furthermore, the top AI stocks now won’t necessarily be the top AI stocks a decade from now (we certainly saw this phenomenon during the internet megatrend at the turn of the century—for example, AOL and Yahoo! were once believed unstoppable, but Google and Facebook (now Meta) came along later in the game and solidly proved otherwise.

As always, be smart people—and do what is right for you.

*You can see my BH Disciplined Growth Portfolio using the links on the site.