We don’t know why Warren Buffett increased his stake in Phillips 66 two months ago (he went from owning approximately 11% to owning nearly 15%), but we do know why we consider Phillips 66 (PSX) to be an extremely attractive long-term investment to purchase right now. For starters, the stock price is under-performing the market this year because crack spreads are temporarily low, and the market is incorrectly lumping Phillips 66 in with other (less diversified) refiners instead of giving the company more credit for its growing investments in chemicals and midstream. Additionally, it pays a big 3.34% dividend yield (the dividend was increased again this year), it has a very attractive capital structure, it generates tons of free cash flow (and allocates it prudently), and its long-term investments in non-refining businesses warrant a much higher valuation multiple than the market is currently giving it. If you don’t already own shares, now is a great time to consider purchasing Phillips 66.

Why Phillips 66 Has Under-performed Recently:

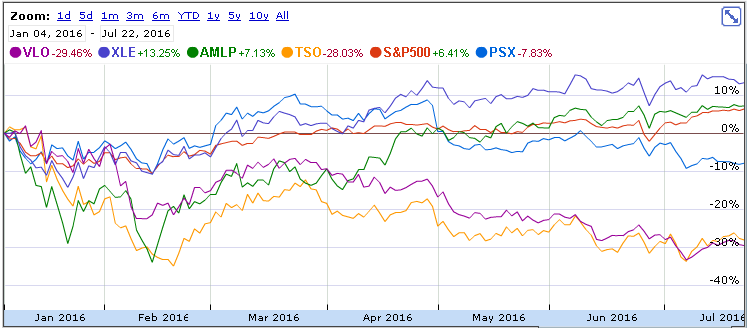

We believe the under-performance of Phillips 66 this year (particularly over the last three months) is providing an increased margin of safety (an attractive entry point) for long-term investors. For starters, here is a graph of PSX versus the S&P 500, the Energy Sector ETF (XLE), the Alerian MLP Index (AMLP) and two big refiner “peers” Valero (VLO) and Tesoro (TSO).

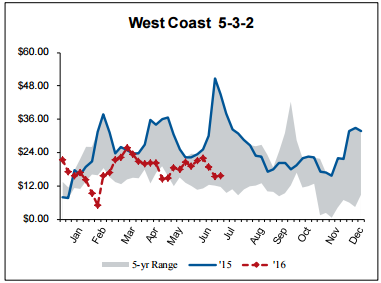

The first thing to notice is that PSX and the other two refiners (VLO and TSO) are underperforming everything else. The reason for this underperformance is the crack spread. According to Wikipedia, the crack spread is “the differential between the price of crude oil and petroleum products extracted from it - that is, the profit margin that an oil refinery can expect to make by "cracking" crude oil. And as the following chart show, the crack spread is currently (temporarily) very low.

The crack spread is low not because the price of oil is low, but rather because the price of oil has been volatile, and this has temporarily resulted in low profit margins for refining companies. There is a time lag from when oil is extracted to when the refiners can process it and actually sell it. This makes refiners less profitable for the time being, but it is not a permanent or long-term trend. It has temporarily driven refiner prices lower, but they will rebound (the crack spread can still be large even when oil prices are low). Worth noting, PSX is diversified into other non-refining businesses (chemicals and midstream) and this is one of the reasons PSX price has not fallen as much as more pure play refiners like VLO and TSO.

The next thing to notice about our year-to-date performance chart (shown previously) is that the Alerian MLP index (AMLP) has actually performed well. This is a business (midstream MLPs) that PSX is growing in to. Basically all of PSX growth capex is being spent on midstream (and chemicals) which is a much more attractive business from a volatility and a valuation standpoint (it’s less volatile and tends to receive significantly higher valuation multiples). Yet the market is still not giving PSX enough credit for its ongoing transition (you’re supposed to value a company based on future earnings, not current earnings). Basically, the PSX refining segment is driving short-term performance, but chemicals and midstream (better businesses in our view) will drive long-term performance (and they generally receive much higher valuation multiples- a good thing!). Here is a chart showing the how the market values the different segments and suggesting PSX will likely deserve a higher valuation in the future.

Uses of Free Cash Flow:

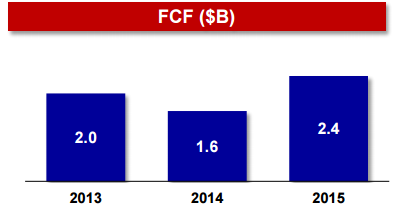

PSX generates lots of free cash flow (cash from operations less capital expenditures) as shown in the following chart.

Free cash flow can generally be used to either invest in the business or it can be returned to shareholders via dividends and share repurchases. And as this next chart shows, PSX huge free cash flows allow it to continue to invest heavily in its business while also returning significant cash to shareholders.

And this next chart shows PSX’s historical dividend payments (they were able to easily increase the dividend again this year).

The Dividend Yield currently sits at 3.34% as of Friday 7/22/16.

Also worth noting, PSX has an investment grade credit rating, and it does not carry a lot of debt as shown in the following chart.

Also worth noting, PSX generates a return on capital (+14.16%) that is significantly higher than its cost of capital (9.48% according to the reasonable assumption at GuruFocus). This is a testament to Phillips 66 ability to generate very strong profits as it continues to grow.

Conclusion:

In a nutshell, we believe Phillips 66 is significantly undervalued because the market is placing too much focus on its current refining business (which is temporarily suffering from low crack spreads) and not enough emphasis on it transition into more chemicals and midstream businesses (which will reduce volatility and deserve a significantly higher valuation multiple). Of course there are risks to Phillips 66’s business (e.g. crack spreads could fall further in the short term, and they may not be able successfully or cost-efficiently build out their chemicals and midstream businesses). However, we believe this is a stock that is likely to outperform the rest of the market (e.g. the S&P 500) very significantly over the next 5+ years. It also pays a very attractive growing dividend, the company continues to buy back shares, and investors are in good company considering Warren Buffett recently increased his stake so he now owns nearly 15% of Phillips 66.

Phillips 66 is set to announce earnings this Friday (7/29) at 9:30 am EST. We own it in our Blue Harbinger Income Equity strategy.