As we reported on Friday afternoon (see also Emerson Electric “Part 1”) the new stock we purchased is Emerson Electric (EMR). To some, this may seem like a boring company that has not performed well over the last two years. However, in our contrarian view, this is a tremendous time to buy. The stock is cheap for two reasons. One, it’s at a lower point in its market cycle (it’s better to buy low, than high), and this is causing many investors to overlook it. And two, it has been repositioning its strategy this year to evolve with changing market conditions, and this has other investors nervous and/or scared. However, Emerson’s big dividend is very safe (they have plenty of cash to cover it, and they’ve actually increased it for more than 25 years in a row), plus they really do have significant growth opportunities ahead.

Why has Emerson’s Stock Underperformed?

For starter, here is the 5-year stock price performance of Emerson versus the S&P 500, and as you can see it has clearly underperformed the market over the last 30 months.

The reason for the underperformance is twofold. First, we’re at a lower point in the market cycle. As the following chart shows:

Specifically, Emerson’s price tends to track its sales, and its sales ebb and flow over time. Emerson is currently rebounding from a lower point in its market cycle due to slower global conditions, and especially due to challenging energy related market sales. Roughly 40% of Emerson’s revenues have been tied to oil and gas, and with that sector struggling (due to lower prices and lower demand), Emerson’s price has declined. However, Emerson is taking wise steps to address this challenge (more on Emerson’s repositioning strategy later).

The other reason Emerson’s price has underperformed is because Wall Street analyst are still nervous in the SHORT-TERM about Emerson’s repositioning strategy (Emerson has been divesting of some of its businesses and acquiring other business to strategically reposition its overall business). Specifically, here are a couple examples of Emerson Electric short-term downgrades following its recent earnings announcement and decision to acquire business from Pentair:

"The purchase of Pentair’s (PNR -1.6%) Valves & Controls business adds definitive risk to Emerson’s (EMR -3.8%) earnings over the next several years," says Buckingham Research's Joshua Pokrzywinski, downgrading Emerson to Underperform from Neutral, and cutting the price target to $44 from $49.“We believe the strategic overlap is less than ideal."

Also downgrading is Credit Suisse, to Neutral from Outperform. The price target remains at $57. “Investors will be rightly cautious of this pitched ‘strategic deal’ at the wrong time of the cycle,” says Stifel's Robert McCarthy as he maintains his Buy rating. "The perception [will be] that Emerson has caught a falling knife in the same general end market where it struggled for the past two plus years.”

And for reference, we believe the Pentair acquisition is being made at an appropriate time. Specifically, like Emerson, Pentair is at a lower point in its market cycle as shown in the following chart:

For reference, here is an overview of the Pentair acquisition plan:

And here is an overview of how its fits with the company’s portfolio repositioning strategy:

Emerson may continue to face a challenging near-term market environment, but the business is strong and it will rebound hard and thrive over the longer-term. We’re not trying to exactly time the bottom here, we’re acknowledging we believe we’re likely closer to the bottom than the top, and we believe the long-term prospects of Emerson are outstanding.

Why is Emerson an Attractive Long-Term Investment?

Emerson is attractive over the long-term for a variety of reasons. For example, Emerson’s Return on Invested Capital (18.7%) is exceptional, and it greatly exceeds its cost of capital (8.4%). This allows Emerson to grow profitably, a feat many other companies cannot boast. Additionally, we believe the company’s current strategy repositioning (whereby it repositions SOME of its business segments) will help maintain the strong ROIC going forward.

Economic moats help Emerson maintain its exceptionally high return on invested capital, and they are another reason the company is an attractive long-term investment. For example, high switching costs on products with multiple year/decade lifetimes help Emerson retain its customers. Also, Emerson’s service infrastructure spans the globe and includes 352 process management centers, 277 network power centers, and 22 climate technology centers. This helps maintain customers and a strong brand. Economies of scale also benefit Emerson (and for example, the recent Pentair acquisition helps build economies of scale in particular areas of expertise- valves and controls). Additionally, Emerson is working to strengthen its already strong brand as shown in the following chart:

Long-term growth opportunities, particularly in emerging markets, also help make Emerson an attractive investment opportunity. Specifically, Emerson’s commitment to and experience in emerging markets develops strong roots and brand recognition in fast-growing regions of the world.

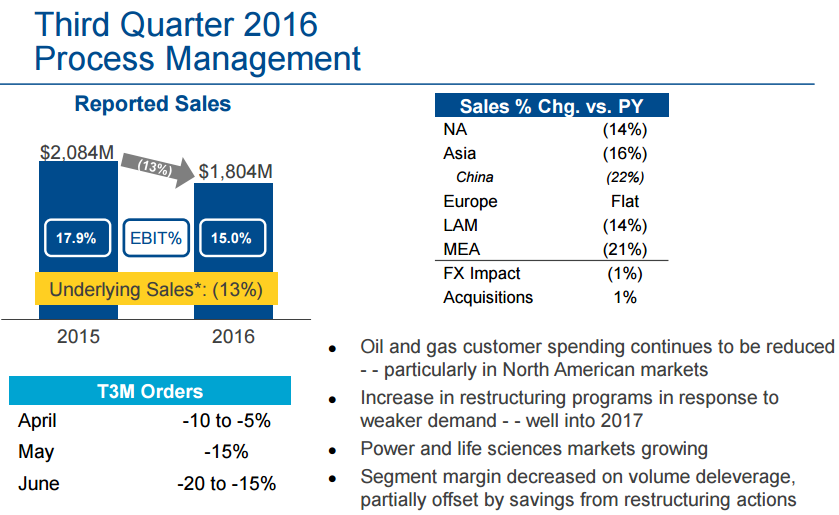

Additionally, despite challenges is some of Emerson’s business segments, (e.g. particularly the “Industrial Automation” and “Process Management” segments’ exposure to oil and gas industries as shown in the following graphic), Emerson continues to grow in other segments.

One segment where Emerson is growing is “Network Power” where is has been benefiting from favorable demand in data center and telecommunications infrastructure, as shown in the following graphic:

Also, the following chart provides an overview of Emerson’s growth opportunities and drivers in the years ahead.

Emerson’s Attractive Dividend:

Emerson offers a big, safe, growing dividend. For starters, the dividend is a whopping 3.54% (well above the S&P 500 average of around 2.1%). Also, Emerson is a “Dividend Aristocrat” meaning it has increased its dividend every year for more than 25 years in a row. Additionally, the dividend payment is very safe in our view. Specifically, Emerson has been paying out around $1.27 billion annually in dividend payments, and its recent free cash flow has been around $1.84 billion (this is a nice cushion). Additionally, free cash flow has been considerably higher in the past (prior to the market challenges we’ve described previously that have contributed to Emerson’s recent relative underperformance). Further, we expect Emerson’s free cash flow per share to climb higher in the future as it progresses and eventually completes its portfolio repositioning strategy. According to Yahoo Finance, professional analyst surveyed expect earning to grow at a rate of 5.7% for each of the next five years.

Risks:

Obviously, Emerson faces a lot of risk factors. For example, Emerson will remain challenged in the months ahead as it continues to execute its repositioning strategy which the market may or may not react positively to. Another risk factor is simply the market cycle. Emerson faces operating volatility as the market cycle ebbs and flows. In particular, its beta is above one. However, its diversified business segments help damped some of the risks. Plus its big dividend helps keep shorter-term volatility lower because dividends can help smooth total stockholder returns. Another risk is Emerson’s international operations, particularly emerging markets. Non-U.S. markets face different regulatory considerations as well as different competition and operating environments. Additionally, foreign currencies can create new risks and increase operational costs. And of course another risk is Emerson’s current exposure to the energy sector, although the company’s repositioning strategy is reducing the company’s exposure to this sector in favor of more attractive long-term opportunities.

Conclusion:

We’re not trying to call a bottom in Emerson Electric, but we do realize it’s a highly profitable business that generates enormous free cash flow, pays a big dividend, and has attractive growth opportunities ahead. We’ve purchased shares of Emerson within our Blue Harbinger Disciplined Growth strategy, and we expect to hold the shares (assuming no significant strategic/operational changes to the business) for many years to come.