This week’s new investment idea is CVR Partners (UAN). It’s a small-cap, variable-distribution, master limited partnership (MLP) that owns and operates a nitrogen fertilizer business. We believe CVR Partners is undervalued for two main reasons. First, the nitrogen fertilizer market is currently at a low point in its business cycle. And second, CVR Partners price has been overly beat up because of some misleading valuation metrics, particularly relative to its industry peer, Terra Nitrogen (TNH). CVR’s price is down 14.3% since announcing earnings on July 27th, and we believe this makes for an attractive entry point for diversified, long-term, income-hungry investors (the current distribution yield is 9.9%).

Overview:

CVR Partners operates in North America through its nitrogen fertilizer manufacturing facility in Coffeyville, Kansas, and through its recently acquired facility in East Dubuque, Illinois. Its principal products are urea-ammonium nitrate (UAN) and ammonia. The products are used by farmers to increase crop yield (primarily corn production).

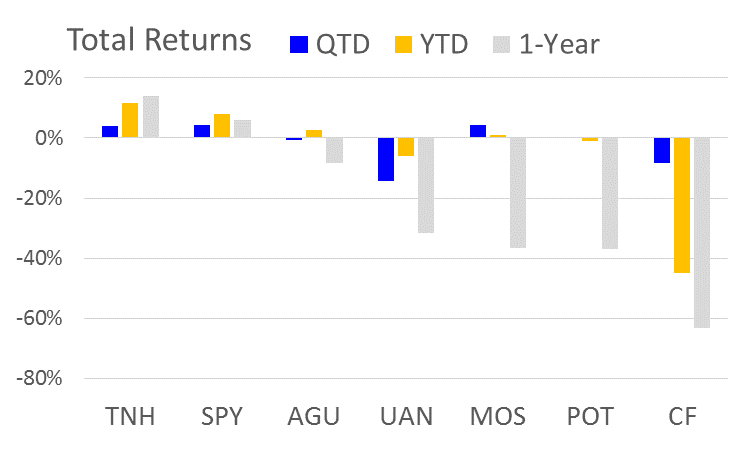

As the following chart shows, the recent performance of CVR Partners (and many other fertilizer companies) has not been great.

Most recently, UAN announced a second quarter 2016 net loss of $17.0 million, or 15 cents per fully diluted common unit, on net sales of$119.8 million, compared to net income of $27.0 million, or 37 cents per fully diluted common unit, on net sales of $80.8 million for the second quarter a year earlier. A variety of factors contributed to the loss:

Low UAN and Ammonia Prices: The biggest driver of poor performance has simply been lower prices. For example, according to the company’s second quarter earnings release:

“For the second quarter of 2016, consolidated average realized gate prices for UAN and ammonia were $199 per ton and $417 per ton, respectively. Average realized gate prices for UAN and ammonia for the Coffeyville facility were $269 per ton and $546 per ton, respectively, for the same period in 2015.”

Ammonia and UAN prices were lower due to a variety of factors including greater nitrogen supply driven by global capacity additions, combined with lower manufacturing and ocean freight costs, and softer global ammonia demand from industrial users.

Planned Turnaround: Another reason for UAN’s poor performance has been a planned plant turnaround whereby they installed a new ammonia converter which increased productivity rates, but also cost the company $6.6 million in related expenses.

Recent Acquisition: UAN recently acquired Rentech Nitrogen Partners, and this had a negative impact on short-term performance. For example, in the second quarter the acquisition resulted in a $5.1 million loss on extinguishment of debt and a net charge of $13.0 million associated with inventory valuation and deferred revenue purchase price accounting adjustments.

Misleading Valuation Metrics:

We believe another reason for UAN’s recent market price declines is simply that a variety of basic valuation metrics appear more negative than they really are. For example, the negative net income (and subsequent price decline) the company achieved in the second quarter has a lot to do with short-term operational opportunities, and it is not necessarily a symptom of bigger problems. Specifically, net income was negative in quarter two which appears like a very bad thing. But in reality the net income was negative for a variety of short-term reasons that are actually positive in the long-run such as the recent acquisition (and associated charges) of Rentech as we described above. Also, UAN’s planned plant transition negatively impacted production and profitability in the short-term, but in the long-term it will increase efficiency and profitability.

Similarly, when UAN is compared to its peer Terra Nitrogen (another small nitrogen fertilizer MLP) it appears less attractive than it really is. Aside from UAN having negative net income and Terra Nitrogen having positive net income, Terra Nitrogen also has zero debt whereas UAN’s debt-to-assets ratio is approaching 50%. However, UAN has a reasonable cost of debt (~5.5% according to GuruFocus data), and a significant portion of the debt was taken on to acquire Rentech.

Additionally, UAN just lowered its upcoming distribution whereas Terra Nitrogen increased theirs. This can be misleading to investors without recognizing the distribution is variable, and UAN’s reduction has more to do with short-term conditions (plant turnover, acquisition) than it does with the long-term health of the company. Further, we expect the UAN distribution to return higher in the future.

Further, Terra Nitrogens EV to EBITDA ratio (5.95) seems much more appealing than the same ratio for UAN (21.09). However, this is another symptom of short-term business activities than long-term opportunity. Specifically, the ratio is again high for UAN due to the planned plant turnover.

Industry Acquisitions:

Worth noting, UAN management expects further future consolidation in the industry. UAN already acquired Rentech, and Terra Nitrogen is already part of the larger CF Industries. The acquisitions and consolidations increase profitability via economies of scale. We’d not be surprised to see UAN eventually acquired by CF Industries (they’ve proven an appetite for acquisitions). And ultimately, we’d not be surprised to see CF Industries was acquired by the much larger Mosaic. Mosaic currently operates in two of the big three fertilizers (potash and phosphate, but not nitrogen), and acquiring a nitrogen business would allow Mosaic to more effectively compete with Agrium and Potash (both do business in all three fertilizers) throughout the market cycle. And remember, the small companies usually get acquired at a premium to their current market price which is nice for unit holders and shareholders of smaller companies.

Long-Term Growth:

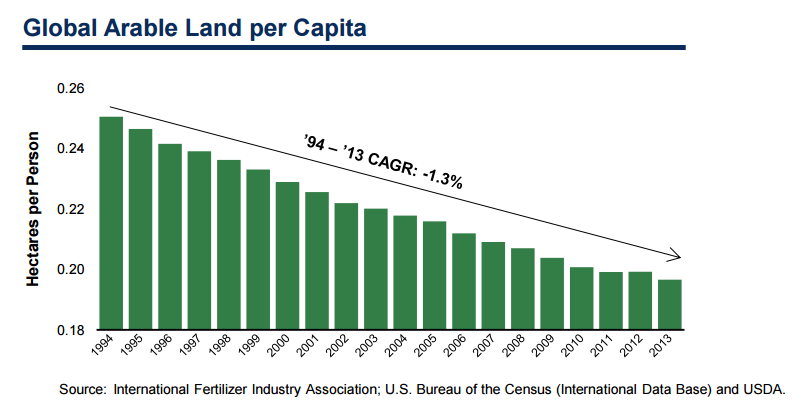

Another reason why we like UAN is simply because the nitrogen fertilizer industry should grow over the long-term as the world's need for food grows and global arable land per capita shrinks. For example, this first chart shows the historical growth in global fertilizer consumption.

And these next two charts show the decrease in global arable land per capital and the expected growth in future nitrogen consumption.

These trends should put a strong tailwind at the back of UAN (and the industry in general) helping drive future profitability. Important to note, UAN has access to distribution infrastructure in the US in particular that makes global imports less competitive. Additionally, lower natural gas prices (natural gas is an input for nitrogen fertilizers) from US technological advances makes it easier for the US to deliver competitive prices. Further, UAN enjoys an alternative and reliable source of input for nitrogen fertilizer from the coke byproduct of its nearby sister refining company CVR refining.

Risks:

UAN certainly faces a variety of risks. For example, nitrogen fertilizer markets could still get worse before they get better. Also, because UAN has only two main facilities, an outage at either facility (for any reason) could significantly impact profitability. Additionally, UAN’s increased debt level creates risks. For example, if interest rates rise, maintaining the debt could become more challenging. Also, if profits decline, the debt could become unmanageable. Additionally, because UAN is a variable-distribution MLP, the distributions will vary from quarter to quarter, and there could be quarters when cash is not available to make distribution payments. For reference, UAN’s quarterly distribution has varied up and down since its high of $0.61 in 2013 to its current low of $0.17.

Also important for investors to recognize, UAN is organized as an MLP which gives it certain tax benefits, but it also means you’ll receive a K-1 tax form at the end of the year. Investors should consult their financial adviser before holding an MLP in a tax-advantaged account such as an IRA. In many cases, it’s better to hold MLPs in non-IRA accounts.

Conclusion:

We like CVR Partners (UAN) because we believe the market is overly pessimistic, and the company has better days ahead. Not only will it benefit as the overall global population grows, but it will benefit as it rebounds from its current low point in its business cycle. We believe the recent price decline makes now an attractive opportunity for income-focused investors to pick up this big 9.9% variable distribution yield. Plus, its price should rise as business picks up, or from a potential future acquisition (a bigger company may eventually buy UAN at a premium) as the industry consolidates. This investment does not come without volatility, but it does offer a big quarterly distribution, and big long-term price appreciation potential.