If you like to generate steady high income from your investments, Closed End Funds (CEFs) may be on your radar. For example, equity CEFs often generate steady quarterly distributions in excess of 7% (annualized) derived from a combination of dividends, capital distributions, and sometimes conservative leverage. If you are a young person saving for retirement, it’s generally best to avoid CEFs, but if you’re already retired, CEF’s can be worth considering. This article highlights 30 equity CEFs (many trading at attractive discounts), and we also share our views on how CEFs can be useful if used correctly.

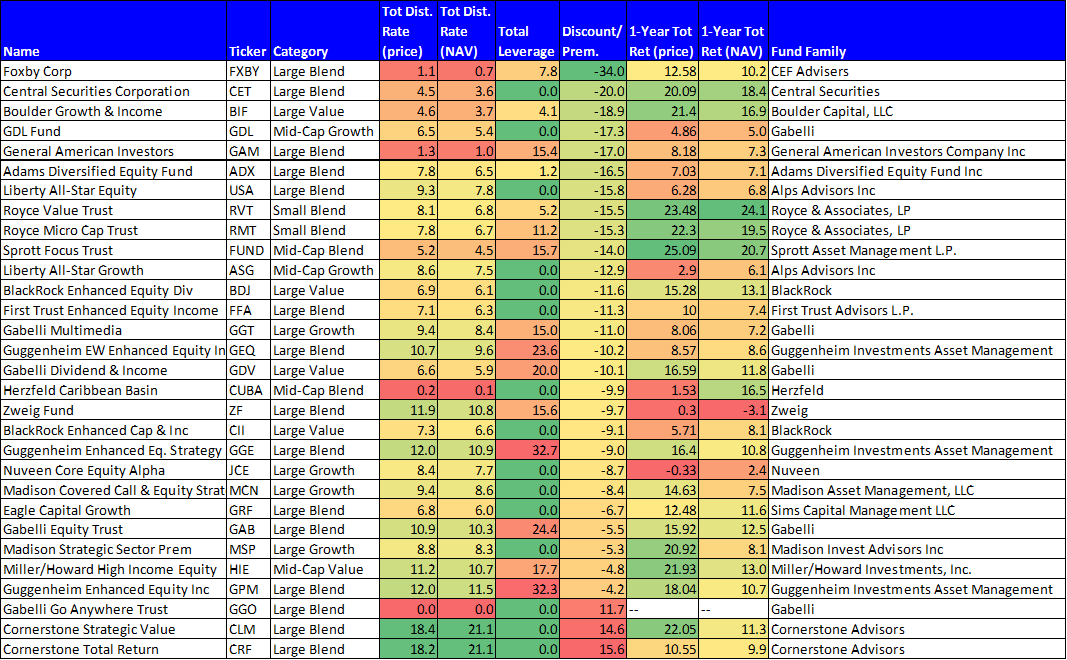

Source: Morningstar, data as of 1/1/2017.

What is a Closed-End Fund?

A closed-end fund is an exchanged traded product. Its price fluctuates throughout the course of the trading day based on a combination of its net asset value (the value of the individual securities in the fund) and supply and demand. The supply and demand dynamics of a closed end fund can cause it to trade at a significant premium or discount versus its NAV throughout the course of the day, especially versus exchange traded funds (ETFs). Unlike CEFs, ETFs have creation units where ETF management can create more shares of the ETF through the open market which helps keeps the discount/premium on an ETF small. On the other hand, CEFs have no creation units (they’re closed-end) and therefore CEFs can trade at large discounts and premiums relative to their NAVs as shown in our table above.

Who should invest in CEFs?

Generally speaking, if you are a younger person saving for retirement CEFs are NOT a good investment for you because the fees are somewhat high. If you are retired (or semi-retired) it may be worth your while to pay these fees because the CEF management team delivers the regular income payments you need so you can sleep well at night.

Specifically, a CEF management team identifies high income securities (so you don’t have to), and the management team generates additional income through prudent sells and capital distributions (again, so you don’t have to). Said differently, it you are retired (or semi-retired) and you need steady high income, then a CEF can be worth its fees because the management team worries about identifying the right securities and generating the steady income you need so you can sleep well at night.

On the other hand, if you’re a younger person still saving for retirement then you’re likely better off investing in very low fee exchange traded funds (ETFs) because you don't need to worry about generating high steady income yet, and therefore you shouldn’t be paying for it (as you are with most closed-end funds).

How to pick a good CEF:

There are many hundreds of CEFs to choose from. Our table above lists 30 equity CEFs (i.e. they invest mainly in stocks), but there are also bond CEF’s, balanced CEFs (stocks and bonds), commodities CEFs, options CEFs, and many more (we hope to cover other categories of CEFs in the near future). In addition to picking the right category (e.g. equity, bonds, commodities, etc.), other things to consider are the distribution yield, the discount/premium, the amount of leverage, and the management fee.

Distribution Rate/Yield:

As shown in our table (above) equity CEFs offer high income. Typically speaking, individual stocks offer only around a 2% dividend on average which is much lower than the +7% distributions in our table above. Granted, some categories of individual stocks (e.g. REITs, BDCs, MLPs) can offer yields that are comparable to CEFs, the CEFs are much more diversified and arguably much safer. For example, Adams Diversified Equity Fund (ticker: ADX, row #7 in our table) top holdings are diversified across many stocks (the top 5 and their weights are shown in the following table).

You may have noticed the top 5 holdings don’t pay dividends anywhere near the fund’s distribution yield of 7.8%. This fund achieves the high distribution yield through a combination of dividends and capital gains (i.e. the fund’s management team generates some income by selling stocks that have appreciated in value and then distributing those gain to owners of the CEF on a regular basis (this is a “sleep well at night” feature for investors).

Discount/Premium:

Another important consideration for CEF investors is the discount or premium the fund is trading at. In the case of ADX, it trades at a 16.5% discount. This means you can buy shares of ADX for 16.5% less than its Net Asset Value (i.e. the value of all the individual holdings in the fund). A discount is generally an attractive time to buy (because if/when the discount is reduced, investors experience gains). However, it’s important to remember, there’s no guarantee the discount will ever go to zero, and it could actually get worse. For consideration, here is some history on ADX’s discount:

Leverage:

Another feature of CEFs is they can use some leverage (borrowing) to magnify returns and distribution yields. However, keep in mind the leverage is generally very conservative, and regulations generally prevent CEFs from using more than 30% leverage (i.e. they can buy a $1.30 worth of securities for every $1.00 they have). This feature helps the funds deliver attractive yield to investors. ADX’s leverage (as shown in the table above) is only 1.2%.

Management Fees:

Management fees are another important consideration when investing in CEFs. At Blue Harbinger, we generally despise management fees (because they detract from long-term performance), and we work very hard to eliminate or minimize management fees as much as possible. However, in the case of CEFs, some investors are comfortable paying the fees in exchange for the high income and “sleep well at night” peace of mind that CEFs can offer.

In the case of ADX, the expense ratio was 0.96% in 2015. If this were an ETF, we’d say this fee is way too high, and we’d advise investors to stay away. However, because this is a CEF we acknowledge that it may be acceptable to some investors, particularly those that are already retired (or semi-retired) and need the steady income to meet ordinary living expenses (i.e. they are less concerned with maximizing long-term capital appreciation because they’re already retired and taking distributions).

Conclusion:

Closed-end funds can be an attractive investment for some investors when used correctly. Specifically, don’t buy CEFs if you’re young and still trying to grow your nest egg, but they can make sense if you’re already retired (or semi-retired) and you need the steady “sleep well at night” income to meet your ordinary living expenses. Depending on your situation, it can make sense to own a few CEFs within your overall investment portfolio as another source of income and diversification if you’re cognizant of the fees (and risks) you’re paying in order to achieve the benefits (steady high income). We plan to dig deeper into the specifics of a variety of individual CEFs over the coming weeks, and to share a few of our favorites with readers. Stay tuned...