Triton International (TRTN), Yield: 5.0%

If you like income, Triton International (TRTN) is worth considering. Not only does this intermodal container leasing company offer an outsized 5.0% dividend yield, and juicy premium income for selling puts, but the business has made great strides to reduce its risks and increase the potential price appreciation rewards for shareholders. However, before you go diving into Triton headfirst, this article reviews the attractive qualities of this big-dividend business, as well as some of the significant risks that investors may want to consider. We conclude with our views on three attractive ways to “play” Triton (i.e. buy now, wait for a dip, or sell put options to generate attractive income).

Overview of Triton International (TRTN):

If you are not aware, Triton is the world's largest lessor of intermodal containers (large, standardized steel boxes used to transport freight by ship, rail or truck).

Triton was formed a little over one year ago when Triton Limited and TAL International combined in an all stock merger. The company now enjoys significant economies of scale versus its competitors. For example, here is a look at Triton’s selling, general and administrative expenses relative to its peers

And for more perspective, here is a look at some of Triton’s post-merger cost cutting activities.

Further, Triton has a large market share compared to peers, as shown in this next chart.

And for perspective, the company has extensive global reach following the merger, as shown in this map.

About Triton’s Big Dividend:

Triton currently offers a big 5.0% dividend yield. And while this may seem large, this yield has come down significantly over the last year because its stock price has gone up sharply.

The stock price has climbed significantly mainly because Triton is one of the most-healthy companies in the industry right now (many others are still recovering from the very challenging market conditions of 2015-2016). In fact, Triton has been snagging attractive new business largely uncontested because the competition simply doesn’t have the financial wherewithal to compete. For example, Triton has recently issued new shares of stock to fund attractive new business growth (more on this later).

The following question and answer during Triton’s recent quarterly conference call provides a lot of worthwhile color on Triton’s big dividend and its heavy capital spending (the quote is long, but worth the read):

Doug Mewhirter

Thanks. And my last question, a little bit bigger question but still financial related. It looks like you spent or you at least allocated about $900 million to new CapEx. It looks like on the cash flow statement this quarter, you spent about $260 million, means there's a little bit to go. And I know you actually deleveraged a little bit sequentially, but do you feel comfortable in your capital position to make the CapEx that you need to make and still pay that very generous dividend?

Brian Sondey (CEO)

Yes. So obviously, as you mentioned, we have spent a lot or committed to spend a lot of money this year to support what we think are great investments and support our customers. We do have a lot of cash flow from this business. So even in the first quarter paying $250 million for CapEx, again, had very limited impact and maybe even a little deleveraging in the balance sheet. As that number grows, at a certain point there starts to be some tension between the dividend level, our leverage and how much more growth we can pursue. We don't feel we have gotten to that point yet. But again, we love the investments we are making. We do think that we are going to continue to be in a unique environment for the next couple of months with perhaps a lot of customer opportunity and less than usual competitive pressure. At some point, if we continue on this very high pace of CapEx, there starts to be some tension and we would have to consider what to do about it, but we certainly haven't gotten there just yet.

The above comments from Triton management are important because they acknowledge the unusual situation of having a large dividend and still spending heavily on growth. Management believes the stock price will rise and the heavy spending on growth with eventually slow, thereby leaving plenty of extra cash to support the dividend. However, they appear to be withholding their right to cut the dividend if they need cash to fund more attractive growth opportunities. This is a very different situation than if they needed to cut the dividend just to pay the bills. And in reality, cutting the dividend to fund attractive growth opportunities is actually a good situation to be in (because it means the stock value is expected to increase significantly). Nonetheless, if you are an income-focused investor, you need to keep a potential dividend reduction on your radar.

The following comment from management (from the quarterly call) adds a little more color to the dividend situation…

Brian Sondey

Yes, when we look at our quarterly dividend, we're paying out roughly, I think it's low $30 millions per quarter. That compares to the normalized profitability that John described of around $30 million in the third quarter. And so, effectively, we're paying out something in the range of 100% of our normalized profitability right now, based upon current profitability and the current dividend.

Looking back historically at TAL, we paid much more a share of our ongoing profitability as a dividend just to retain capital to fund our growth. The point I was trying to make is that we don't really want to be a company that pays out 100% of our earnings as a dividend, but we do see things improving a lot right now, both in our market as well as in our performance.

Certainly the hope is that the earnings will improve to the point that the dividend is again rightsize relative to what our earnings will be. If that doesn't happen, if the market doesn't turn up and our performance doesn't improve, we'll have to reconsider the dividend at that point. But as I mentioned, we've got a fair bit of financial flexibility and things are moving in the right direction.

Again, the dividend is nice, and management is optimistic, but it’s something to keep on your radar. Also important to keep in mind, Triton’s dividend is categorized as a “return of capital.”

More Attractive Triton Qualities:

Economies of Scale and Financial Strength:

It’s not just the big dividend that makes Triton attractive, the company has a variety of additional attractive qualities. For example, as we mentioned earlier, Triton is benefitting from a variety of economies of scale following the merger with TAL International, and the company is also benefiting because it has the financial wherewithal to snag new growth opportunities at a time when the competition is financially weaker and recovering. According to management, Triton has been able deploy close to $1.9 billion of new capital and purchase in excess of 1.1 million TEU (20 foot equivalent unit) of new and used equipment since its merger in July of last year (not bad for a company with only a $2.8 billion market cap).

Purchase Accounting Improvements:

Another attractive Triton quality is that its purchase accounting is still getting better. For example, management expects the accounting impacts of the merger to shift from a small net expense in the second quarter to a small benefit in the third quarter. On the margin, this is a source of incremental improvement for Triton (Triton is expected to announce earnings on November 8th).

High Fleet Utilization:

Also worth noting, Triton’s overall fleet utilization is very high, currently at 97.5% and is still climbing.

Longer-Term Leases:

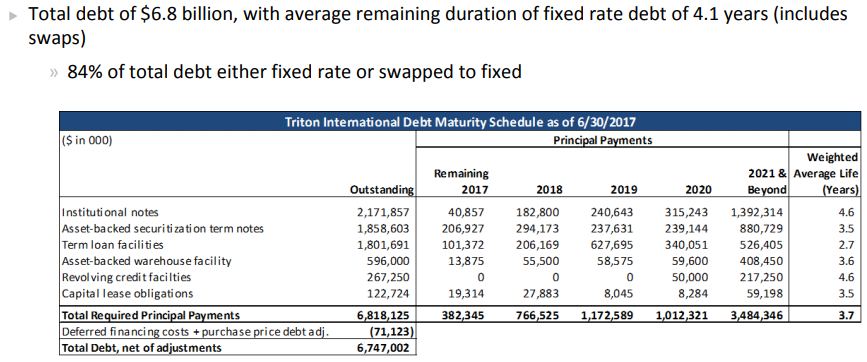

Another attractive quality is the longer-term nature of many of Triton’s leases. Even though the industry can be very cyclical, Triton is able to reduce some of this impact by extending its lease terms. For example, the average remaining duration of long-term & finance leases was approximately 39 months as of March 31, 2017. And very importantly, Triton has been matching its debt maturities with its lease maturities, which will help further minimize the impacts of any industry cyclicality. For reference, here is a look at the company’s upcoming debt maturity schedule.

Fixed Rate Debt:

Further, the majority of Triton’s debt is fixed rate or interest rate hedged, which helps minimize the risks of market volatility particularly from rising interest rates.

Market Cycle Improvements:

Further still, Triton benefits as the overall industry continues to improve and grow, especially considering they are now the market leader in terms of scale. For example, here is a look at container trade growth relative to GDP growth.

And as noted previously, the industry is expected to strengthen and Triton will continue to grow with GDP.

Risks Triton Investors Should Consider:

Industry Cyclicality:

One of the biggest risks Triton shareholders should consider is industry cyclicality. Specifically, market cycles can cause large swings in the amount of business these industrial container companies have (or don’t have). Triton and its peers (CAI International and Textainer) all have betas well above one.

Shareholder Dilution:

Another big risk shareholders should be aware of is shareholder dilution. Triton has been issuing a significant amount of new shares to fund growth and this can be dilutive to existing shareholders. For example, in September the company issued over 6 million new shares to fund growth. According to the 8K, Triton “expects to use the net proceeds of the offering… for general corporate purposes, including the purchase of containers.”

Current Market Conditions:

Another risk factor is simply that the market isn’t out of the woods yet. The industry is recovering, and as we described earlier, management is unsure of the rate and duration of future recovery. If the extent of the recovery management is looking for does not materialize, then Triton could face challenges maintaining its dividend. Regarding the industry, Triton’s management said (in their recent quarterly call) that they will…

“face elevated risks of default until the bulk of our shipping line customers return to sustained profitability.”

Further, Triton management explained during the quarterly call that “some little leases are on watch list, but they don’t expect any big defaults.” For reference, Hanjin already did file bankruptcy, but fortunately this had a minimal impact on Triton, and Triton was able to maintain a high overall companywide leasing rate as we described earlier.

Credit Ratings:

For perspective, Triton International Limited currently maintains a “BB+” corporate rating from S&P, a “BBB-” secured debt rating at TCIL, and an “A” senior tranche ratings in term ABS.

Steel Prices:

Another risk factor for Triton is Steel pricing. For example, low steel prices can hurt leasing because new containers become less expensive.

For perspective, steel prices in China have been volatile and could pressure container prices and lease rates if they fall sharply again. Also, when leasing companies become active investors in new containers, it hurts Triton further down the road because that eventually leads to more aggressive competition. And with regards to competition, Triton could will deal with more competition when its peers finally stabilize.

Valuation:

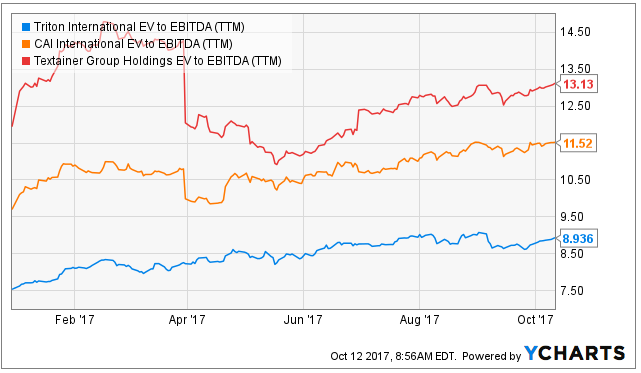

From an Enterprise Value to forward EBITDA standpoint, Triton is inexpensive relative to peers, as shown in the following chart.

For perspective, here is a look a look at current EV to EBITDA, and again Triton is relatively inexpensive.

As we mentioned earlier, Triton has been spending on growth. For some perspective, the following table shows the company’s recent leasing revenue growth in recent quarters (i.e. it’s on an upward trajectory, as is net income).

Further still, here is a look at Triton’s forward P/E ratio which has been climbing, but pulled back slightly following the recent issuance of new equity shares in September.

With regard to Triton’s peers, here is a look at some recent performance and valuation metrics.

As the table shows, Triton is the largest in terms of market cap. Also, noteworthy, Triton’s debt to equity ratio is the highest, driven by its spending on growth opportunities. Also noteworthy, Triton is the only one that offers a dividend at all.

Importantly, from a return on equity (“ROE”) standpoint, Triton has been very strong relative to peers (as shown in the table above), and the company expects that strength to continue going forward. For example, the company’s most recent investor presentation (see graphic below) explains ROE is expected to be in the high teens going forward.

Generating Attractive Income by Selling Put Options:

If you believe Triton is an attractive company, but you’re not comfortable purchasing after this year’s stock price rally, you might consider generating income by selling put options. For example, as the following table shows, you can generate $0.30 now by selling the November expiration $30 strike price put options, as shown in the following table.

This may be attractive if you’re an income-focused investor because it generates very significant income for you now (this is roughly 12% extra income on an annualized basis ($0.03/$30.00, annualized), and the puts are a full 16% out of the money!), but it also gives you the possibility of buying the shares in the near future at a lower price (i.e. $30) if the shares get put to you.

Important to note, this premium income for selling the puts is considerably higher than the premium income available for selling puts on many other stocks because of the market’s perception that Triton is risky. Triton’s price has certainly been volatile this year (to the upside).

Also very important to note, Triton is expected to announce earnings on November 8th, and that could add significant volatility to the stock price (i.e. the price could go up or down significantly depending on the results). Also, Triton is expected to pay its next dividend in late November, so would-be put sellers need to be cognizant of the ex-dividend date because that could impact the value of the put options.

At the very least, it may be worthwhile to consider selling Triton put options to generate income in late November (after the ex-dividend date, and after the earnings announcement), especially if the price pulls back in an unwarranted fashion as we often like to do (this is often the most attractive time to sell put options for income, in our view).

Conclusion:

Overall, Triton is a powerful and growing leader with distinct competitive advantages (and a big dividend) in an industry that is struggling from significant cyclicality but improving. If you purchase the shares now, you could benefit as the share price continues to rise according to management expectations (i.e. management expects the dividend yield to shrink to a more normalized level not from a dividend cut, but rather simply from future price appreciation). Alternatively, you could put Triton on your watch list, and then add the shares in the future if/when there is a share price pullback (i.e. wait for a dip buying opportunity). Or, if you are an income-focused investor, and you’re comfortable with the idea of selling put options, then you may consider selling out of the money put options that generate significant income for you now and also give you the possibility of owning shares of Triton at a significantly lower price if they fall far enough and get put to you before the option expires (as we have described in this article).

We have not yet purchased shares of Triton, but it is on our watch list, and it is also an attractive potential future candidate upon which to sell put options for income.

For reference, you can view all of our current Blue Harbinger holdings here.