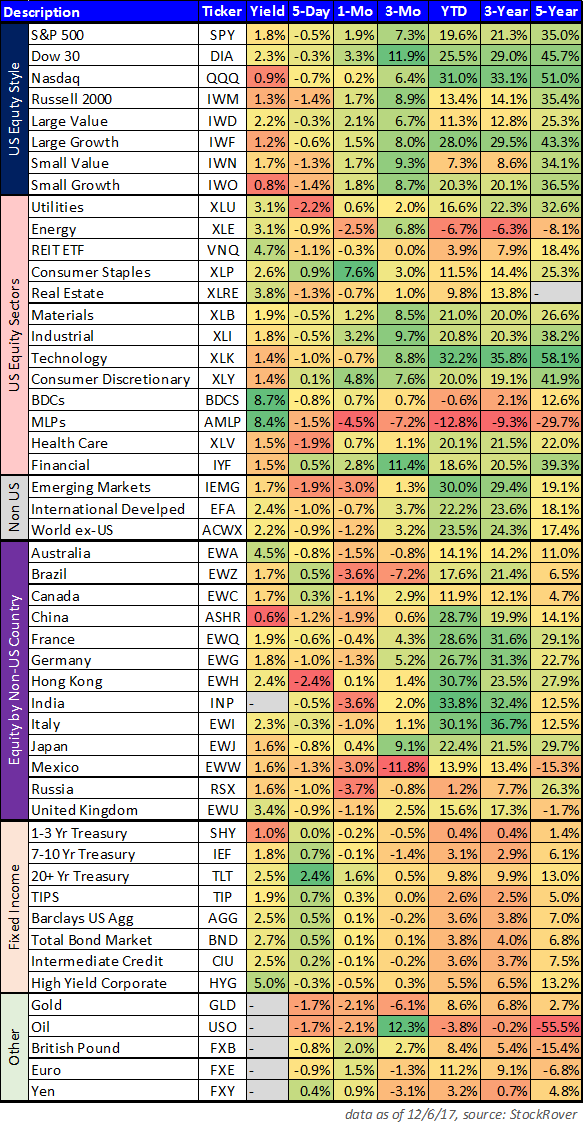

This report provides an update on our current holdings (all Blue Harbinger strategies delivered strong positive returns again in November), and the market in general. We share some specific ideas and risks on stocks (e.g. Omega Healthcare, General Electric, and others) and sectors (e.g. REITs, BDCs and MLPs). The following color-ranked table provides an overview of broad market performance as of mid-day today.

Sectors, Styles and Asset Classes:

For your reference, the following table shows broad market sector and style performance as of mid-day today. It’s been ugly this year for certain high-yield sectors such as REITs, BDC, and MLPs, which have all significantly underperformed the market (SPY). And It’s been a great year for large growth and tech stocks, which have significantly outperformed the S&P 500.

We continue to maintain a diversified approach across all our strategies, catering them to pick the best opportunities that meet our needs for income and growth. We happen to believe REITs in general are oversold, and MLPs face challenges as the overall energy industry continues to adjust to much lower prices than just a few years ago. BDC’s also face challenges as the great multi-year opportunities that existed coming out of the financial crisis are all but rolling off the books, and BDC management teams are forced to adjust to less risk and more competition from banks (some BDCs, however, are oversold, in our view).

Not included in our table is Bitcoin, the cryptocurrency that has risen dramatically in recent weeks. We’ve been wrong on plenty of things in the past, but Bitcoin seems like an unsafe bubble, and we’re not investing or trading it.

Investment Portfolio Updates…

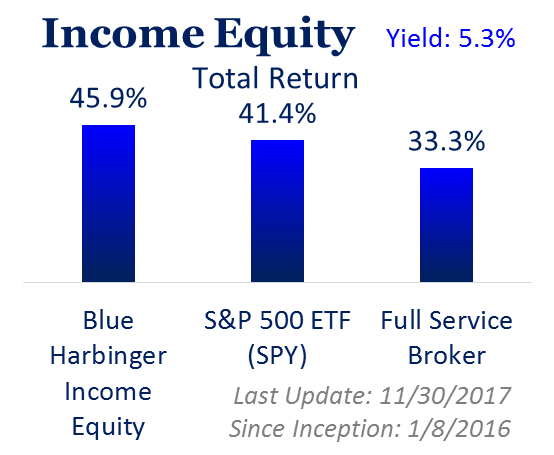

Income Equity:

The Blue Harbinger Income Equity strategy currently yields 5.3% on an annualized basis, and the strategy gained 0.3% during November, thereby increasing its growing track record of long-term outperformance.

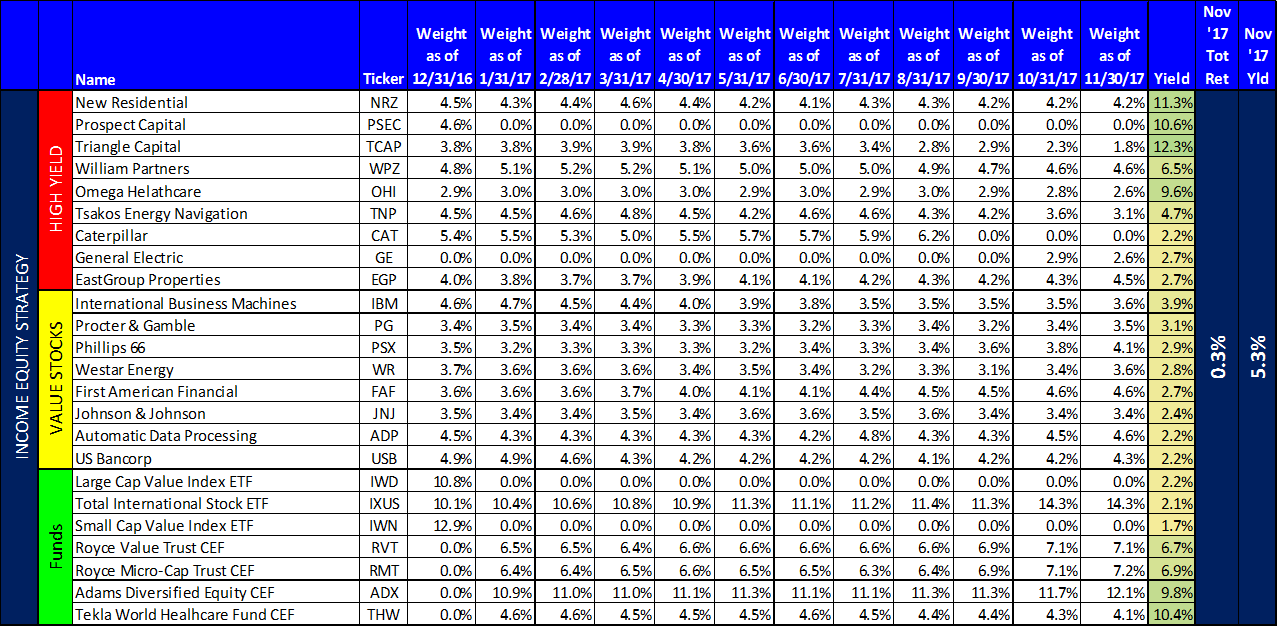

The holdings of the strategy are listed in the following table.

Big winners during the month were the Adams Diversified Equity Fund (ADX) and Westar Energy (WR). For example, ADX paid its big year-end annual dividend, and it was even larger than expected. As described in this press release, ADX declared a $1.23 dividend, bringing the annual yield to an impressive 9.8% (congrats to those that own this one). And with regards to Westar Energy, it was up an impressive 8.3% during November as shareholders approved its revised merger transaction with Great Plains Energy.

Regarding attractive opportunities within our Income Equity strategy, three stocks stand out in particular. First, we purchased shares on General Electric (GE) in October. Our thesis was that we expected a possible dividend cut would help “right the ship” for this enormous revenue generator that had been performing poorly due to bad management. New management did finally announce the dividend reduction in November, the shares sold off further, and we believe now is an even more attractive opportunity to “buy low.” In our view, GE simply has too much revenue, and too much earnings power for the shares NOT to go much higher. We view GE as a very attractive long-term contrarian investment.

Omega Healthcare (OHI) is one of our Income Equity holdings, and OHI shares continued to decline after a concerning earnings release back on October 30th. Specifically, the shares were down after the company missed earnings estimates and reported troubles with one of its health care properties, Orianna Health Systems. Orianna has been placed on a cash basis, and Omega is in discussions regarding moving some or all of the Orianna portfolio to new operators. Omega expects current annual contracted rent to fall once the transition is complete. However, getting this investment off the books may be the best things for investors (in terms of maintaining a quality portfolio). We continue to own our shares of this big 9.6% dividend yield healthcare REIT (but we also recognize it is risy, and we wouldn't fault anyone for considering moving into a safer healthcare REIT like Ventas (VTR) or Welltowner (HCN), as we wrote about here).

And finally, Triangle Capital (TCAP) had a terrible earnings announcement in November thereby driving the shares significantly lower and causing management to reduce the dividend (the yield is currently around 12.9%). Triangle is a risky investment, but may be worth considering for the higher risk portioin of your income-focused portfolio. It now trades at a significant discount to its Net Asset Value, and management’s exploration of moving from internal to external could actually improve the situation and provide more cash to the company. We continue to own our shares as one of our higher-risk high-yield investments with the potential for upside. And as you can see in our earlier sector/style table, BDCs have been hurting this year in particular (recall, we reduced our exposure to BDCs by half earlier this year by liquidating of position in Prospect Capital before its big sell-off).

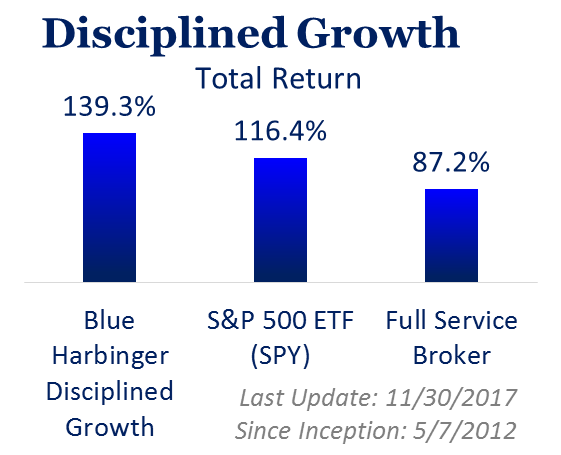

Disciplined Growth:

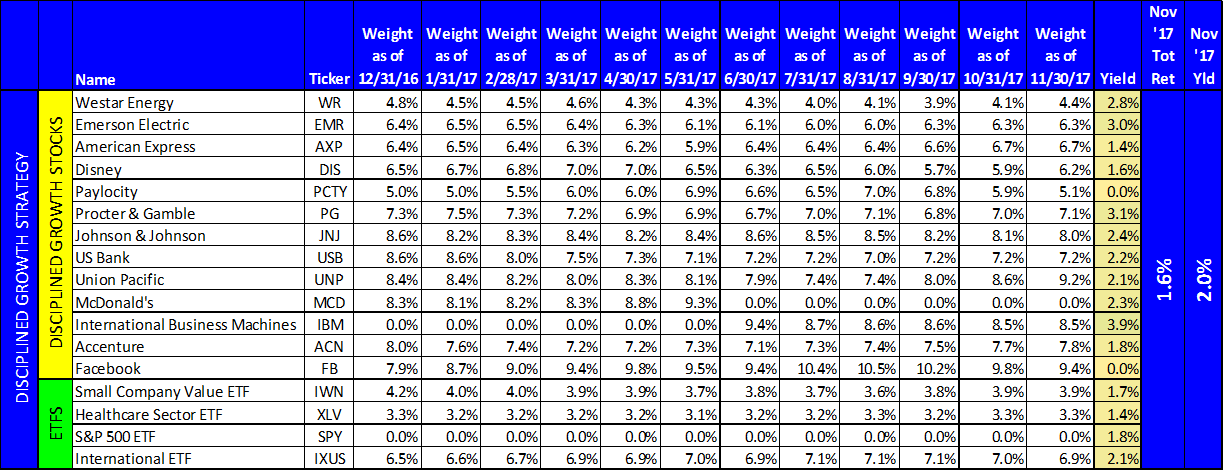

Our Blue Harbinger Disciplined Growth portfolio also delivered positive returns in November (+1.6%), and it continues to significantly beat the S&P 500 over the long-term.

This portfolio also holds Westar Energy (as described previously). Also, Union Pacific (UNP) was another top-performer, gaining 8.7% during the month after announcing strong earnings and a dividend increase.

Paylocity (PCTY) is an attractive “Disciplined Growth” holding that declined sharply during the month and now provides a more attractive entry point for long-term investors, in our view. Even though Paylocity beat earnings expectations (and revenue and earnings are up sharply year-over-year) the shares sold off. The company beat expectations by a lot, but it was still the smallest margin beat since the company went public (they have a history of beating expectations by a lot), and this caused the shares to decline. Further, later in November, news of possible changes to the Affordable Care Act caused the shares to selloff (some of Paylocity’s business is helping customers implement ACA requirements). Overall, we continue to view Paylocity as a powerful revenue grower with continued upside price potential, and we consider it more attractive now that the shares have sold off.

Conclusion:

As we approach year-end, we are happy with our investment results so far this year, and we continue to watch the market closely for opportunities to make changes to our investments. We are long-term investors, and we believe strongly that many investors fail because they trade too much (racking up high trading costs, and inadvertently being out of the market (sitting in cash) at opportune times). We also believe many investors make the mistake of chasing returns (for example Bitcoin, and many of the top-performing sectors and styles in our earlier table). Long-term investing is a proven strategy for success.