All three Blue Harbinger strategies posted positive returns in January, and continue their long-term track records of outperforming the S&P 500. This week’s Weekly reviews four attractive stock ideas. We currently own all four of them.

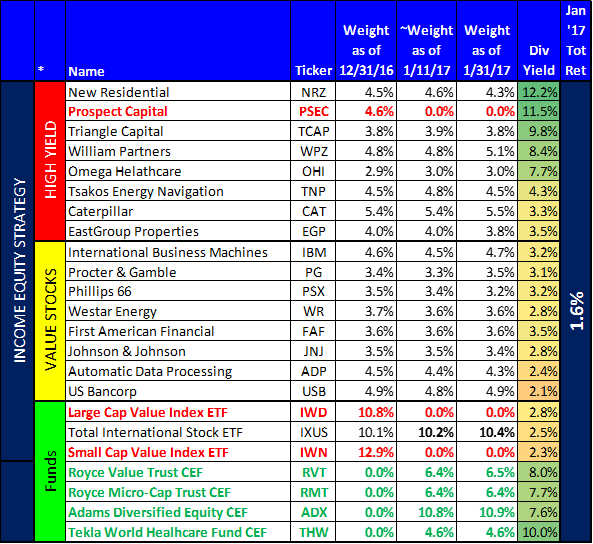

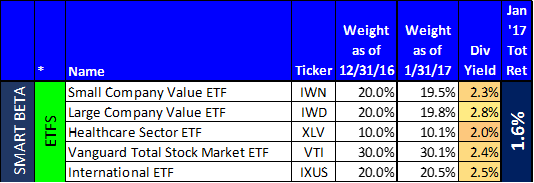

For starters, here are the current holdings within each strategy...

Our only trades so far this year were in our Income Equity portfolio (see the red and green font holdings). Specifically, we replaced Prospect Capital for risk management purposes after a great gain, and we replaced a couple ETF holdings for CEFs (closed-end funds) that offer significantly higher yields, compelling discounts, and other attractive respective qualities.

The first holding we review this week is...

Paylocity (PCTY):

Paylocity is a cloud-based provider of payroll and human capital management (HCM), software solutions for medium-sized organizations. The company's services are provided in a software-as-a-service delivery model utilizing its cloud-based platform.

We like Paylocity because of its continuing opportunities for tremendous growth. The stock took a big hit following the November election because a significant part of its growing business was related to implementing the Affordable Care Act mandates, and that business has been called into doubt with President Trump’s "repeal and replace" agenda. However, the good news is that the company beat analyst earnings expectations this past week, and it was up nearly 17% on Friday.

We certainly were NOT happy with the November hit the company took, but we are happy with its continuing growth in its main non-ACA related business. And we continue to own the stock.

Our thesis is essentially that the company’s cloud-based payroll processing services will continue to grow, and the negative impacts of the likely ACA changes are already baked into the price. Further, we will not be surprised to see a larger company like ADP purchase Paylocity sometime over the next five years, in which case shareholders would be rewarded with a healthy premium acquisition price. This stock has impressive growth opportunities ahead, and its price is attractive.

US Bancorp (USB):

While Paylocity took a hit following the November election, larger banks such as USB have been experiencing significant gains (this is the benefit of having some sector diversification).

The gains for banks have been related to two main things. First, interest rates are expected to continue to rise, and this helps banks profit with widening net interest margins. US bank is a very well run business, and as a matter of market cycle, it should continue to rise.

Secondly, this week we receive word that President Trump intends to roll back pieces of the Dodd-Frank Act. This was the regulation passed following the financial crisis to reduce risk. It also dramatically reduced the profitability of banks because of all the expensive regulation. Further, the banking sector became the personal whipping boys of President Obama and his Justice Department as the industry was continually hit with extraordinarily expensive lawsuits. This appears to be ending under Trump, and it is a very good thing for banks. We continue to own US Bank (USB).

New Residential (NRZ):

And regarding the Dodd-Frank regulatory rollback, another financial sector company that will be impacted in big-dividend payer New Residential (NRZ) which is a mortgage REIT that we own in our Blue Harbinger Income Equity portfolio. We continue to own this one, and we wrote about it in more detail a few days ago (read that write-up here).

Caterpillar (CAT):

Finally, Caterpillar (CAT) is another stock we own that has experienced a great run following the November election.

We received news this week that Caterpillar will be moving its headquarters out of Peoria, Illinois and into Chicago. Caterpillar was a popular stock for Trump to talk about during his campaign. Specifically, he often decried US policies making it too tough for Caterpillar to compete internationally. Caterpillar’s sales are largely outside the US, and there are a lot of Trump supporters in the Greater-Peoria area (central Illinois). It’ll be interesting to see how the move impacts the Trump narrative (if at all). However, we continue to own this one as we believe we’re still early in the cycle, and Caterpillar has more upside ahead. Further, it’s still a US-based company that Trump will want to support (i.e. “made in the USA.”). We also like CAT’s big dividend, and we continue to own the stock in our Blue Harbinger Income Equity portfolio.