If it is safe high income you seek, this alternative strategy may be worth considering. Rather than investing only in big-dividend stocks, this article highlights three specific corporate bonds, and an advanced-strategy to generate high income with relatively low risk. We believe these three specific bonds offer an attractive risk-versus-reward opportunity to boost your income and diversify your portfolio.

The Strategy (and the Bonds):

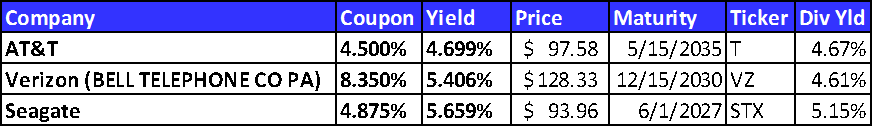

The three corporate bonds we are considering are issued by AT&T (T), Verizon (VZ) and Seagate (STX) (we will provide more details on these bonds in a moment). And the strategy is to purchase them on margin (i.e. if your brokerage account is approved, you can borrow money to invest in these extremely safe corporate bonds). We believe this strategy is safer than investing is most stocks (because these companies have plenty of cash to pay their bonds). In fact, because the bonds are higher in the capital structure than the stocks, the companies will cut their stock dividends to free up cash to pay the bonds long before they ever default on the bonds. And all three of the companies have a steady history of paying and increasing their dividend payments which adds credence to the safety of the bonds, in our view. In fact, this strategy of borrowing money to invest in bonds is used by the largest hedge fund in the world (Bridgewater Associates’ “All Weather” strategy).

Here are the specific bonds we like…

And as you may be aware, both AT&T and Verizon have a long-history of increasing their dividends, and they are considered among the safest dividend stocks in the world. Additionally, this recent article explains why we like the Seagate bonds.

The “nuts and bolts” of this strategy work as follows… If you have $100 to invest, you can buy $200 worth of bonds using the margin you are approved for in your brokerage account (some accounts are approved for a higher level of margin, but we’ll stick with $200 for this example). Using the margin allows you to basically double the coupon payments you receive on each of the bonds (i.e. 9% for AT&T, 16.7% for Verizon, and 9.75% for Seagate). Depending on your broker, you’ll likely be able to borrow at less than 1% (for example, it is currently 0.9% in our Interactive Brokers). And after deducting the cost of borrowing, you’re still walking away with a very attractive return.

Also, in the case of AT&T and Seagate, the bonds trade at a discount to par (i.e they trade at less than 100). If your hold the bonds to maturity, their value will thereby increase the value of your investments (i.e. you get to keep the price appreciation gain in addition to the coupon payments). In the case of the Verizon bonds, they’re actually old bonds issued by Bell Telephone Co Pa that Verizon is now on the hook for. The special provision about these bonds is that they are ‘”non-callable” which means Verizon has to keep paying them until they mature in the year 2030 (i.e. Verizon cannot pay them off early). And considering the coupon payment is so big relative to current interest rates, the price of the bonds has increased. Factoring in the coupon and the steady price declines between now and maturity (the bonds will trade down to their 100 par value when they mature), the all in yield (coupon minus price change will be 5.406% x2 (around 10% after adjusting for the borrowing cost).

Risks:

Of course there are risks to this strategy. Perhaps the greatest risk is that something goes terribly wrong with AT&T, Verizon or Seagate, and as a result they default on their bonds (i.e. you don’t get your money back when the bonds mature). In this case, you’d have lost your initial investment, and you’d also be on the hook to repay the borrowed money (i.e. the leverage you used). However, realistically, the chances of these bonds defaulting on their debts is very very low. They’re all “investment grade” bonds with plenty of business and financial wherewithal to keep paying their bonds until they mature. We believe the risk involved in this bond strategy is lower than the risks involved in investing in most stocks, and the bond strategy offers a higher long-term total return (stocks have historically returned around 8% per year with far more risk and volatility than bonds).

Conclusion:

Overall, we believe this is an attractive strategy within a diversified investment portfolio. Not only does it increase your income, but it can also diversify your risks away from an all stock portfolio (often when stocks go down, bonds go up). Also, the steady high income payments help keep the volatility of your total portfolio down. This strategy is NOT for everyone, but if you’re interested in a more advanced strategy to increase your income and lower your risk, this might be just what you are looking for. You should be able to locate all three of these bonds (and utilize leverage) within most brokerage accounts.

And finally, if this strategy isn't right for you, you can still consider investing in all three of the bonds WITHOUT the leverage, because all three of them still offer attractive coupon payments, very low risk, and can add important diversification to your overall investment portfolio.