Ferrellgas: Equity Vs Debt Vs Options (One Of Them Is Very Attractive)

Ferrellgas (FGP) is a big distribution MLP that had paid out at least $0.50 per quarter in distribution payments since 1994… until it cut the distribution to $0.08 in December! The unit price rightfully sold off, and the distribution yield now sits at around 6.4%. We believe Ferrellgas' distribution is now much safer than it was, but the MLP price won't get a lot of love from investors. This article reviews the options, debt, and equity, and then draws a conclusion about the most attractive way for income-focused investors to invest in Ferrellgas.

Overview

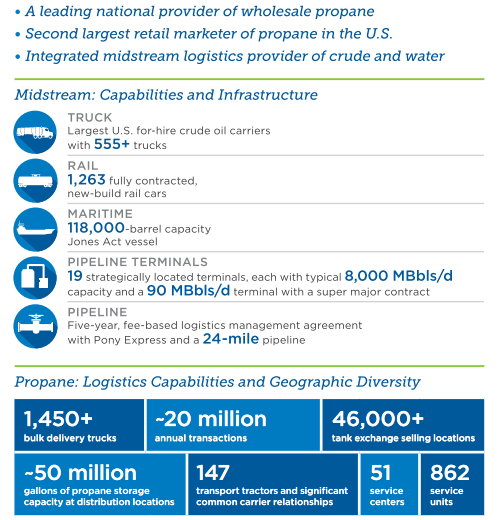

Ferrellgas Partners, L.P. is a retail marketer and wholesale provider of propane. The company is also an integrated midstream provider of crude and water.

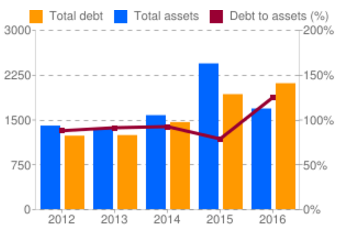

As shown in the following chart, Ferrellgas had been making efforts to diversify its business (into midstream energy) in order to support and grow its distribution.

However, this transformation got the company in trouble. Specifically, the company took on a lot of new debt in 2014 and 2015, just as energy prices started to nosedive.

And not only did energy prices dive, but the US experienced unusually mild winters which meant propane demand also declined sharply. The combination of these two declines proved too much, and the company was forced to cut its distribution.

Ferrellgas Equity Price Outlook

Based on the companies March 9th earnings release, Ferrellgas appears to be getting its debt situation under control, but they're not there yet. According to James E. Ferrell, the Company's interim President and Chief Executive Officer:

"At the end of the second fiscal quarter, the Company's leverage ratio was 5.81x, which was lower than the limit allowed under its secured credit facility and accounts receivable securitization facility, as amended in September 2016."

Mr. Ferrell added, "We were pleased to be able to upsize the Company's recent note issuance to $175 million. Our goal is to return to a leverage ratio of 4.5x or a level we deem appropriate for our business."

So Ferrellgas is making progress in getting its debt under control, but they're not there yet.

And in our view, Ferrellgas isn't going to get a lot of love from investors. Specifically, Ferrellgas lost a lot of investor trust when they cut the dividend so dramatically (MLPs are supposed to be safe). And the MLP units will likely continue to experience higher than normal volatility considering energy prices are still low, and weather has continued to be warmer than usual. And even if/when conditions improve, investors will still not have a lot of trust for this company's equity shares.

Ferrellgas Debt: An attractive contrarian opportunity…

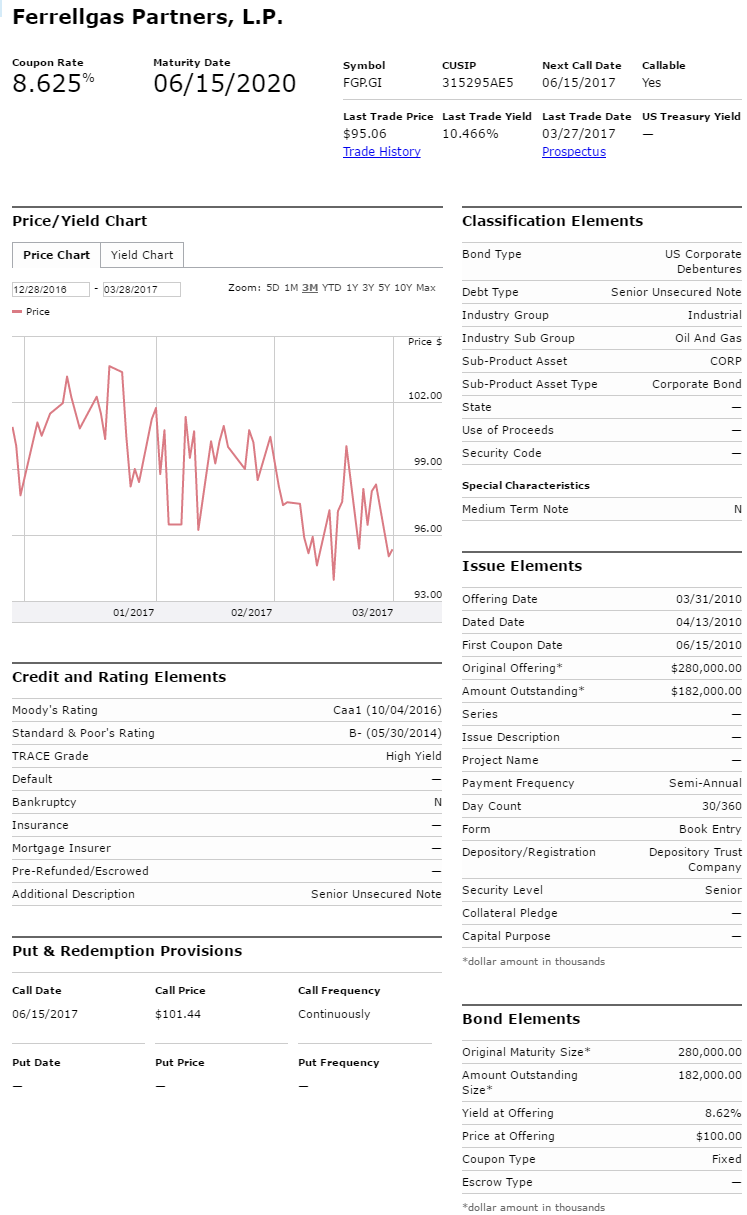

Income-focused investors are not happy with Ferrellgas, but they may be overlooking the very attractive debt. Specifically, Ferrellgas debt still trades at a discount and offers a very attractive yield. For example, the company's earlier maturing 6/15/2020 bonds offer an 8.625% coupon, trade at a discounted $95.06, and offer a double digit yield to maturity (and they're callable at a premium, $101.44).

Plus, we view these bonds as particularly safe for a few reasons. First, despite challenging energy market prices, and despite the fact that these are (senior) unsecured bonds, Ferrellgas still generates lots of cash from operations to support the debt. Second, Ferrellgas still pays a distribution, and if they get into trouble then they'll cut that distribution to support the bonds (debt is higher in the capital structure than equity). And third, more of Ferrellgas debt is due after 2020. Specifically, the company offers 2021, 2022 and 2023 bonds. The 2020 will get paid off first. If you are an income-focused investor, the bonds are for more attractive than the equity, in our view, because they offer a bigger yield, the price is more stable, and they are simply safer.

Ferrellgas Options

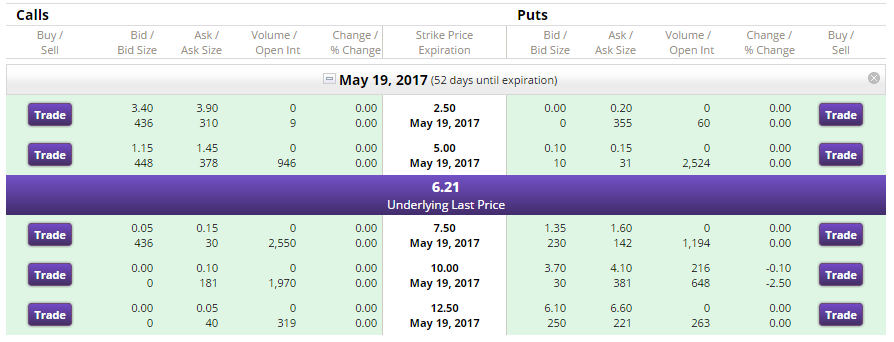

Worth noting, we did check the options market to see if there were any attractive premium (income) opportunities for selling Ferrellgas option. And the answer is no. As the following cart shows, the options market is almost non-existent (i.e. very small open interest, and very low premiums).

We are not interested in Ferrellgas options.

Conclusion

If you are looking for big safe income, Ferrellgas debt is worth considering. It offers a higher yield than the equity. Plus the debt is far safer considering it has lower volatility than the equity, and it is located higher in the capital structure. In particular, we like the double-digit yield on the Ferrellgas 2020 senior unsecured bonds.