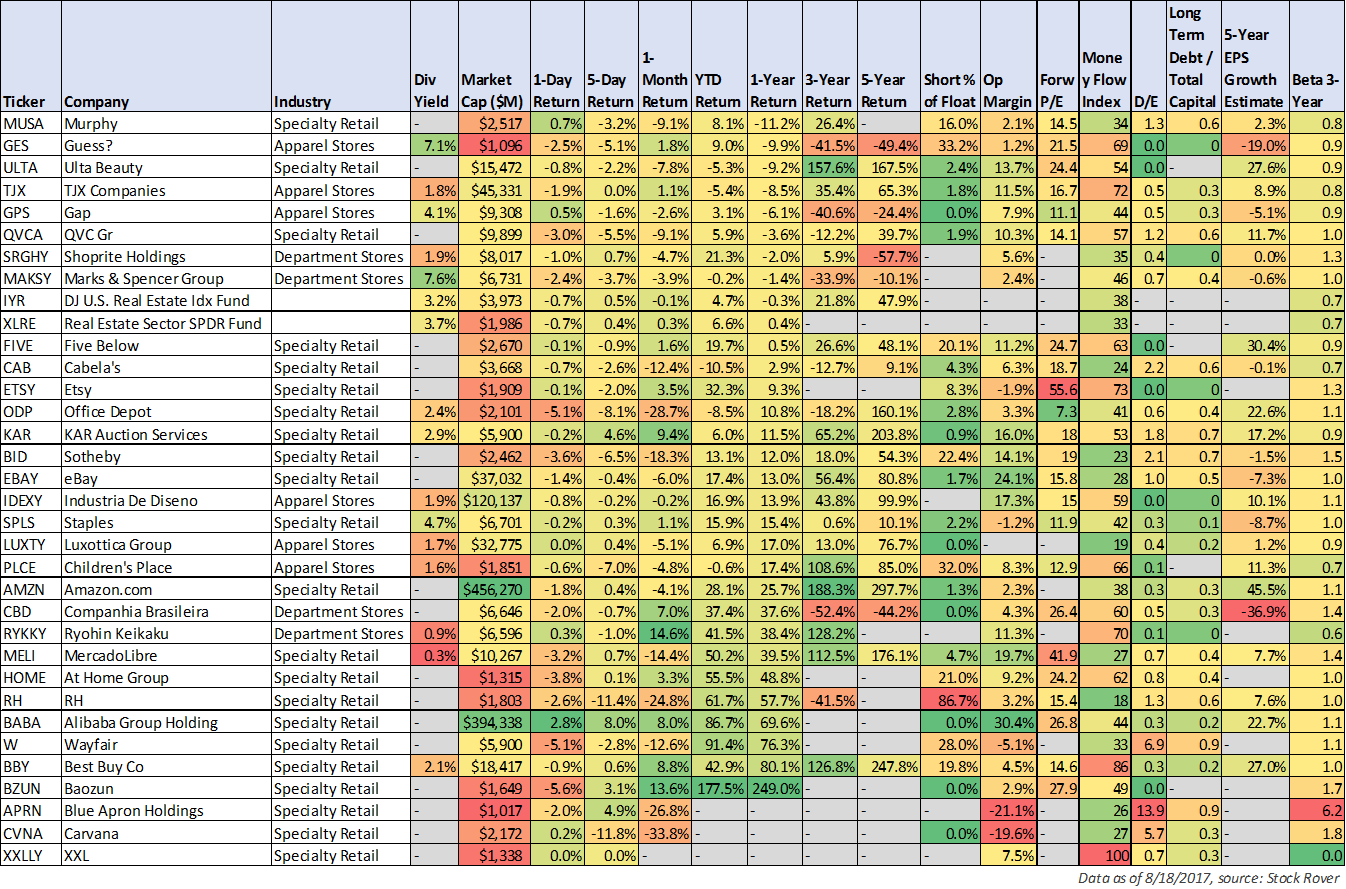

As the “Death of Retail” narrative grows, and investors fear that online retailers (like Amazon) will put all “brick and mortar” stores (like Sears, Macy’s and shopping malls) out of business, we are starting to see some interesting opportunities. This article reviews our current exposure to “brick and mortar” retail, and then shares two interesting investment ideas for brave contrarian investors to consider.

The Death of Retail:

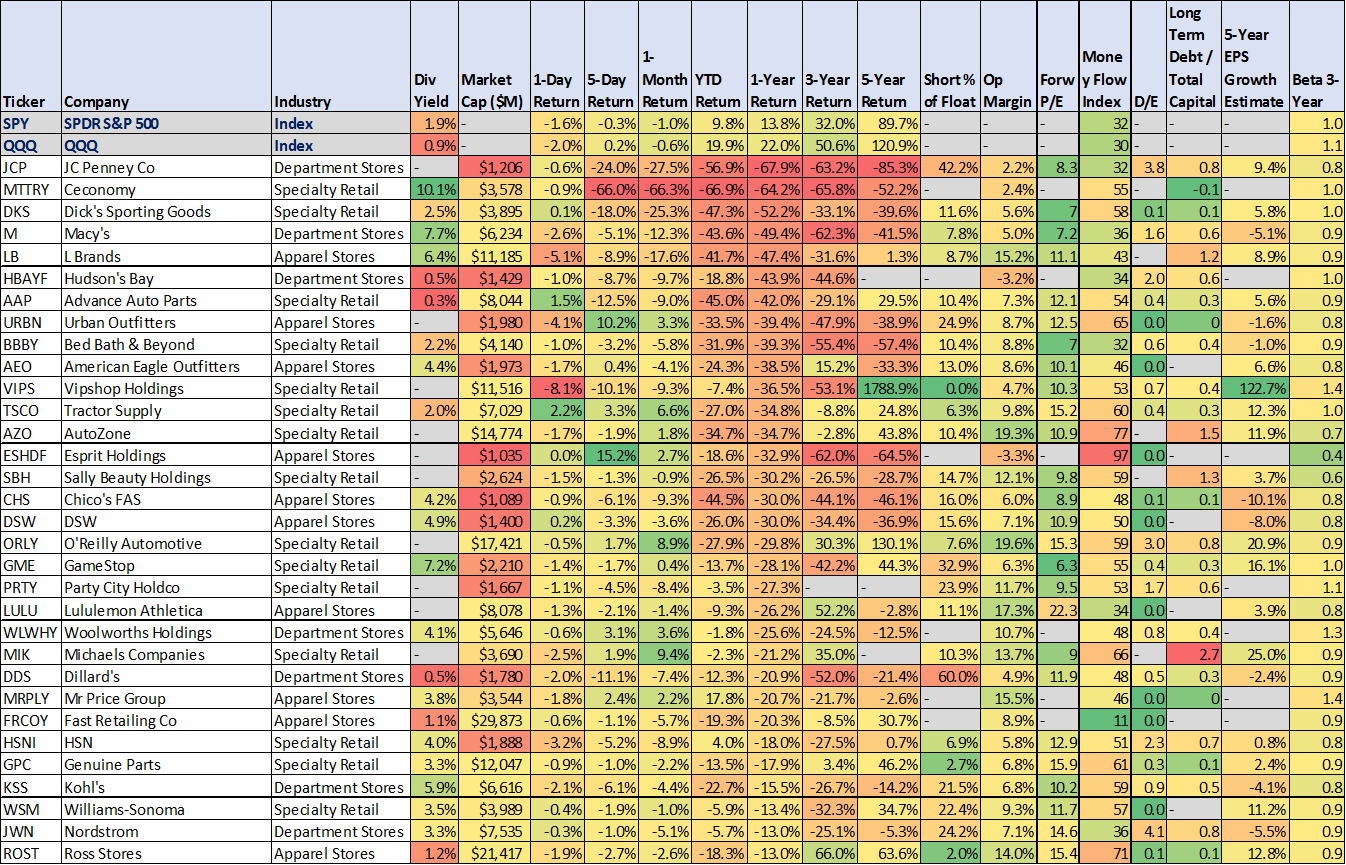

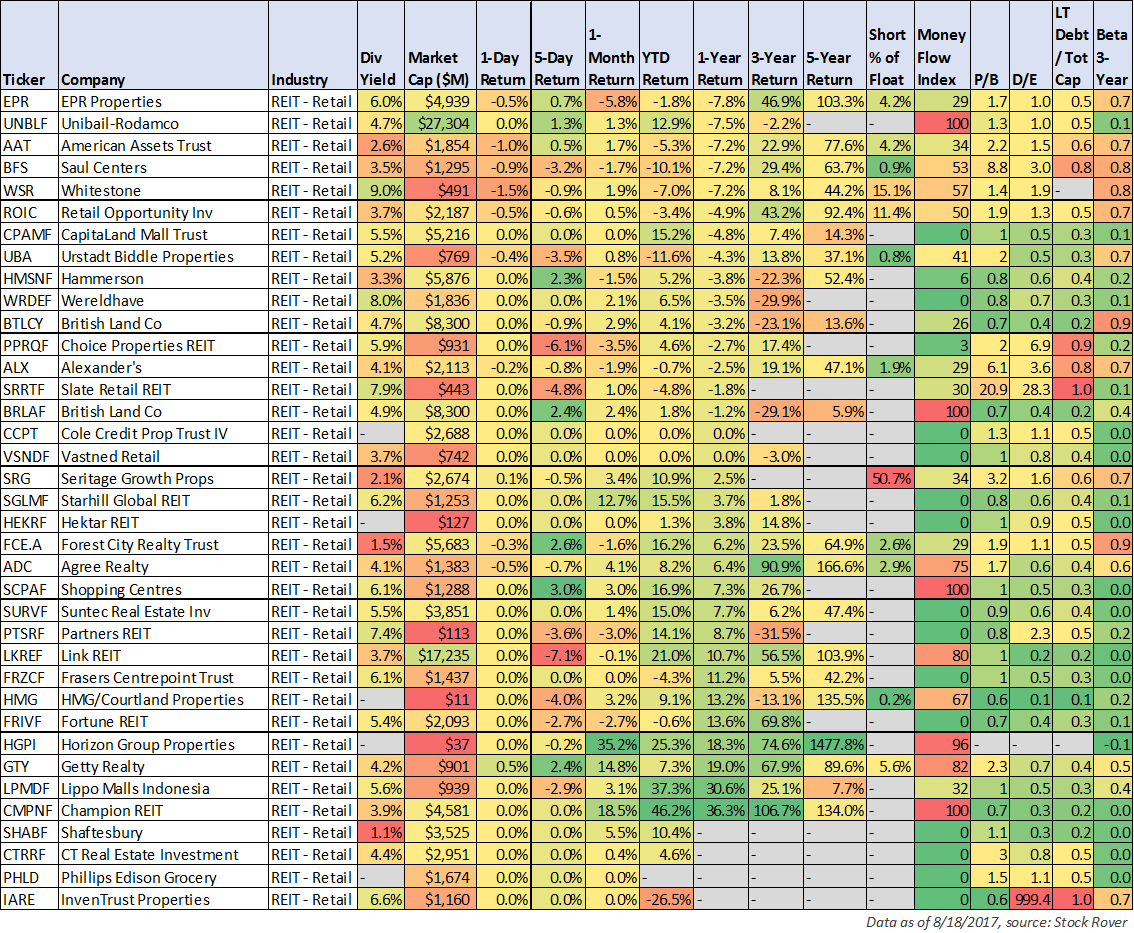

To put things in perspective, the following table shows the terrible recent performance of retail stores.

As you can see, the 1-year performance of “brick and mortar” stores like J.C. Penny’s and Macy’s has been absolutely terrible. But if you look near the bottom of the above chart, you will see online retail companies like Amazon and Alibaba have performed extremely well. It is this divergent performance that has contributed to the narrative that retail is dying. And to be clear, the sales and profits of many brick and mortar retail stores has been bad, while online sales has been strong.

Our Current Exposure to Brick and Mortar Retail:

Within our Blue Harbinger portfolios, we don’t currently have any direct exposure to brick and mortar retail stores. However, we do have some indirect exposure within our index fund holdings (for example, there are some small allocations to retail names within our Small Cap Value ETF (IWN) and our International ETF (IXUS)). And we also have some small indirect exposure to brick and mortar retailers via our industrial REIT holding, EastGroup Properties (EGP). Specifically, EGP has some warehousing and logistics centers that get business from brick and mortar retailers (however, EGP also has exposure to online retailer distribution centers, as well).

Interesting “Brick and Mortar” Retail Investment Ideas:

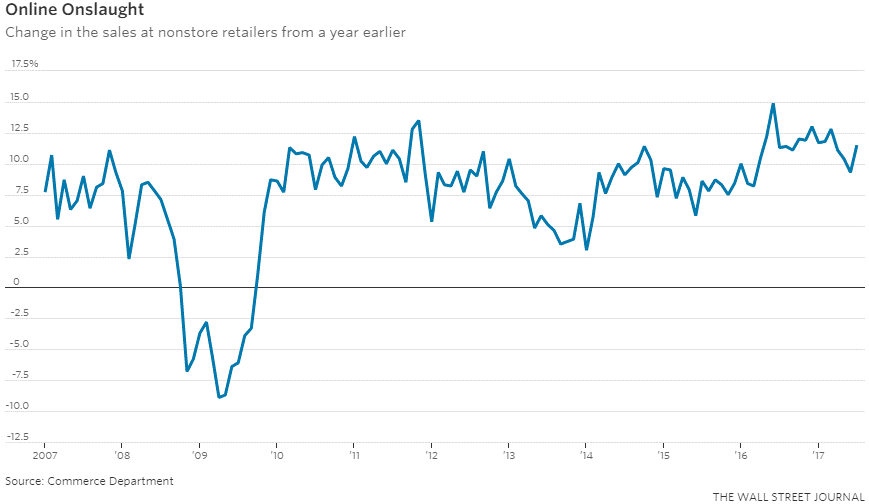

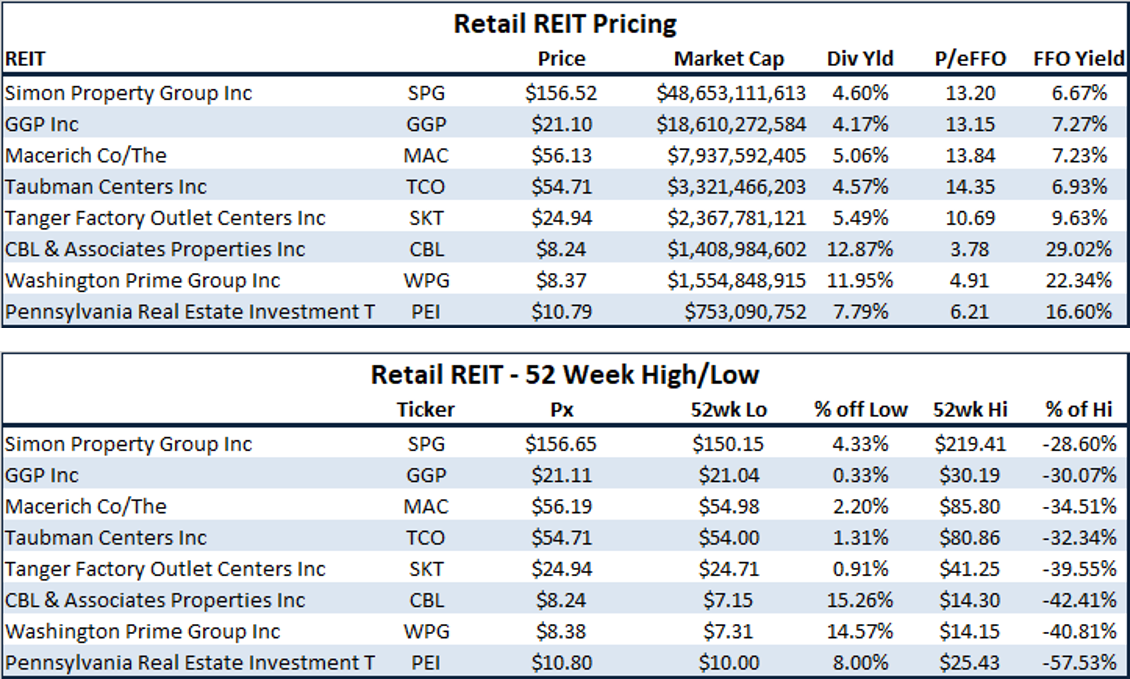

Given the significant underperformance of retail stores over the last year, we have been “bargain hunting” (i.e. searching for attractively-priced contrarian investment opportunities). And while many of retail stores still seem risky to us, some of the retail REITs are starting to get attractive. Specifically, here is a look at the recent performance of retail REITs (real estate investment trusts).

Simon Property Group (SPG), Yield: 4.7%

Selling PUT Options

Our first retail investment idea is Simon Property Group. This is a retail REIT (a shopping mall owner) we have written about previously (see: Simon Property Group is Hated), and today we are highlighting another SPG trading opportunity that may be attractive to some income-focused investors. Specifically, the options market is currently offering attractive premium income to anyone willing to sell Put Options on SPG. By selling an SPG Put Option, you receive attractive income today, and you may get to buy the shares at an even lower price if the shares are “put” to you before the option expires.

For example, we like the $2.29 of premium income that is available for those willing to purchase the shares if they fall to $145 (they currently trade for around $153). Specifically, we like the idea of selling the October 20, 2017 put options with a strike price of $145. If the shares fall below $145 before expiration, you get to buy a high-quality big-dividend REIT (SPG) at an even lower price than the current market price. And if the shares don’t get put to you, then you simply get to keep the $2.29 of premium income (this equates to an approximately 9.5% income yield, annually).

Now before you go jumping into “selling SPG Put Options,” it is very important to understand how this might fit into your overall portfolio. In the first place, your brokerage account needs to be approved to sell options. And secondly, you have to keep enough cash on hand to buy the shares if they are put to you. Alternatively, if your account is approved for margin trades, then you may be able to execute this trade without having the cash on hand, but just be aware you could end up borrowing money from your broker to buy the shares if they are put to you. We generally, recommend selling puts in amount that equates to 2% to 5% of your total account value if the shares are put to you (i.e. you don’t want to end up owning an amount of SPG that is more than 2% to 5% of your total investment account value—this is just for “risk management” purposes).

We believe SPG is an attractive, well-managed, financially strong, big-dividend, retail REIT that has simply oversold as a result of the overblown “death of retail” narrative (SPG just recently raised its dividend again, and the company has the highest investment grade credit rating of any retail REIT). We wouldn’t mind owning shares of SPG at a price of $145 (if they fall that far, and they are put to us). However, if you don’t like the idea of selling put options, then you might considering simply buying and holding SPG for the long-term. Or, you might also consider this next “retail” investment idea…

Washington Prime Group (WPG), Yield: 11.9%

Washington Prime Group (WPG) is a retail REIT that has sold off dramatically in recent years.

For some background, WPG was spun out of Simon Property Group (SPG) in 2014 mainly to separate the Tier 1 properties from the tier 2 properties (Simon is still higher quality than WPG today, more on this later).

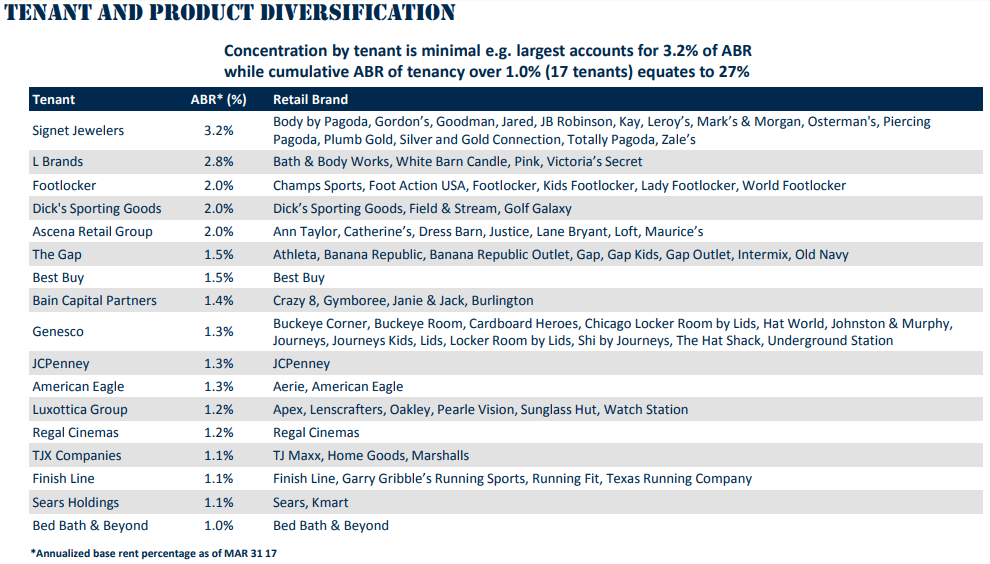

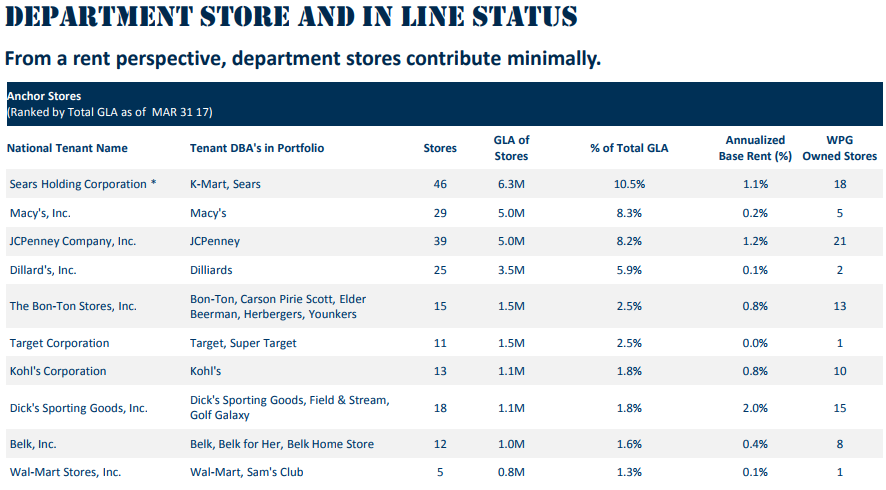

For some perspective, here is a graphic showing Washington Prime’s current tenants.

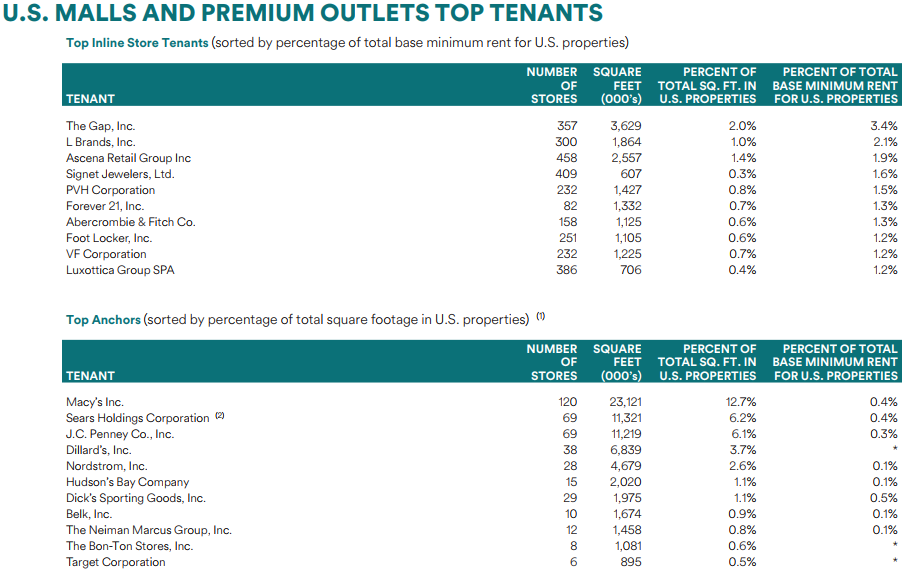

And for comparison purposes, here is similar information for Simon Property Group.

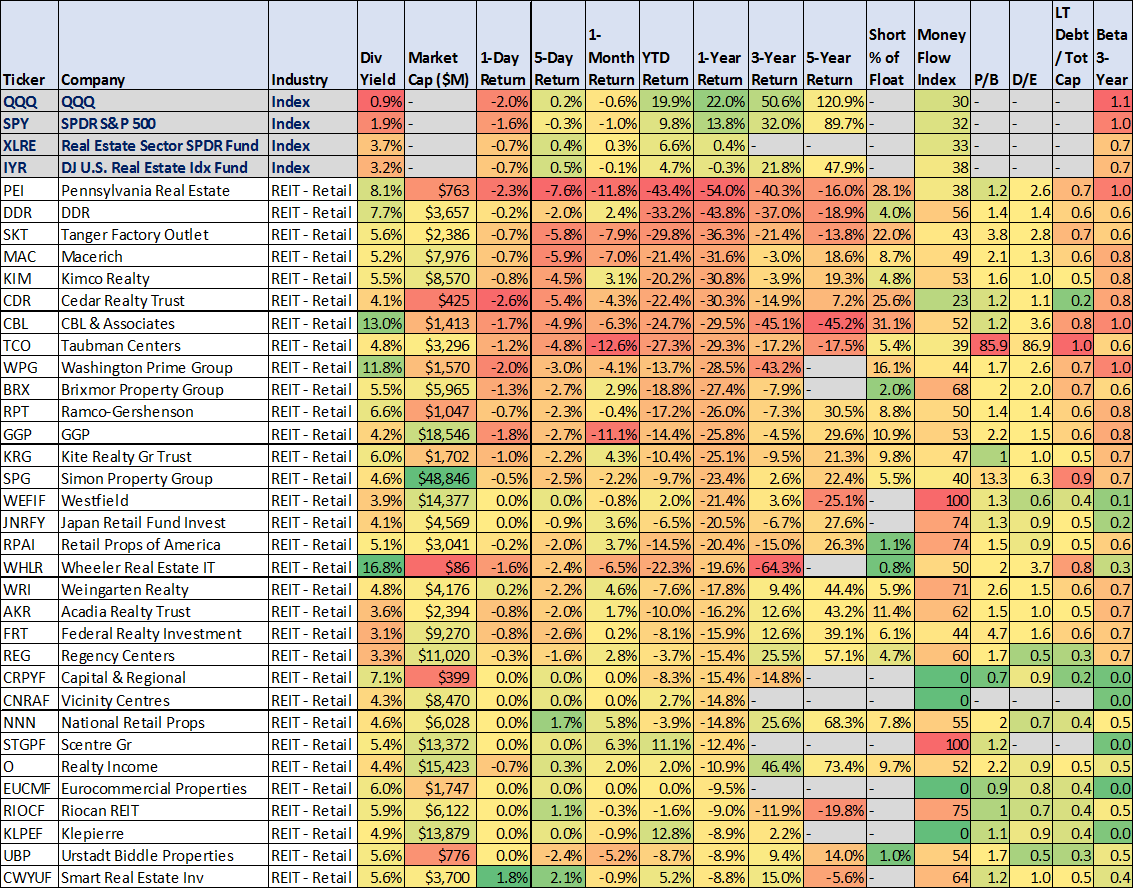

To help further compare Washington Prime to Simon Property Group (as well as a few other retail REITs) here is some recent data

(source: Rubicon Associates)

One of the things that stands out in the above table (besides the big price discounts versus 52-week highs) is the price to expected FFO ratios (P/eFFO). (Note FFO is a common cash flow generation metric used for valuing REITs—It’s basically Net income - Interest income + Interest expense + Depreciation - Gains on asset sales + Losses on asset sales). As first glance, WPG looks very inexpensive, but there is really more to the story here (i.e. WPG faces a lot of risks in terms of the quality of its portfolio and its balance sheet).

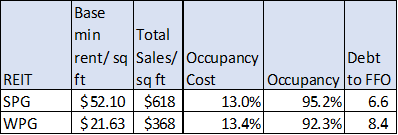

To help demonstrate the WPG risks this next table includes some important metrics comparing WPG to SPG.

For example, SPG’s higher quality properties are on display via its higher base minimum rents, its higher sales per square foot, and its higher occupancy ratio. This is a big part of the reason SPG receives a higher P/eFFO ratio than WPG. Specifically, all of the metrics in this table demonstrate the higher value of Simon’s properties versus Washington Prime.

And critically important is the debt to FFO ratio. The fact that WPG’s debt to FFO is much higher than SPG’s is a big risk factor that we’ll consider more in the next section about WPG’s debt.

WPG’s Debt Situation

For starters, Washington Prime Group is rated BBB- and it was recently downgraded to a “negative outlook” by Moody’s. Moody’s explained:

“The negative outlook reflects the potential cash flow risk associated with the REIT's mall portfolio due to an increasingly challenging retail environment, especially for mall owners such as Washington Prime that own portfolios with relatively low sales per square foot (below $400). Moreover, the REIT has significant upcoming debt maturities as $938 million comes due in 2019 and an additional $947 million in 2020 (including extension options).”

It’s important to remember, a BBB- rating is still investment grade (i.e. it’s less risky than “non-investment grade”). In fact BBB- is still several steps above non-investment grade. Also, important, WPG was recently able to refinance a portion of its debt ($750 million) earlier this month, and this is an indication that the market has confidence in the company’s cash generation power.

Joint Ventures: However, there are debt and cash flow related challenges that investors should be aware of. For example, WPG’s expanding joint venture deals are a significant risk. For example, WPG has been selling off a less than 50% ownership positions of some of its assets to joint ventures. However, even though they’re less than 50% sales, they are giving away control. According to WPG’s annual report, there are significant risks involved with the joint ventures, and even though this is a long quote from the annual report, it is worth the read:

“We have limited control with respect to some properties that are partially owned or managed by third parties, which could adversely affect our ability to sell or refinance or otherwise take actions concerning these properties that would be in the best interests of WPG Inc.'s shareholders. We may continue to co-invest with third parties through partnerships, joint ventures, or other entities, including without limitation by acquiring controlling or non-controlling interests in, or sharing responsibility for, managing the affairs of a property, partnership, joint venture or other entity. We do not have sole decision-making authority regarding the six properties that we currently hold through joint ventures with third parties at December 31, 2016. Additionally, we might not be in a position to exercise sole decision-making authority regarding any future properties that we hold in a partnership or joint venture. Investments in partnerships, joint ventures or other entities could, under certain circumstances, involve risks that would not be present were a third party not involved, including the possibility that partners or co-venturers might become bankrupt, suffer a deterioration in their financial condition, or fail to fund their share of required capital contributions. Partners or co-venturers could have economic or other business interests or goals that are inconsistent with our own business interests or goals, and could be in a position to take actions contrary to our policies or objectives. Such investments also have the potential risk of creating impasses on decisions, such as a sale or financing, because neither we nor our partner or co-venturer would have full control over the partnership or joint venture. Disputes between us and partners or co-venturers might result in litigation or arbitration that could increase our expenses and prevent our officers and/or directors from focusing their time and efforts on our business. Consequently, actions by, or disputes with, partners or co-venturers might result in subjecting properties owned by the partnership or joint venture to additional risk. Additionally, we risk the possibility of being liable for the actions of our third-party partners or co-venturers.”

Also important to note, WPG’s high debt to expected FFO ratio (as described previously) gives an idea of the added risk. The company’s properties are not as high quality and they don’t generate as much income as higher quality REITs, but WPG is still on the hook for coming up with a higher ratio of cash (relative to FFO) to support its debt, which is especially challenging considering it has a lower credits rating than its higher quality competitors (for example, SPG was recently assigned the highest investment grade ratings among U.S. retail real estate companies, and was one of only two U.S. REITs with an “A”, “A2” stable outlook credit rating from Standard & Poor’s and Moody’s, respectively).

Washington Prime Final Thoughts:

If retail real estate gets much worse, WPG could turn south fast. The value of its properties is already low, its debt to FFO ratio is high, its joint ventures convey risk, and its credit rating is on negative watch. Nonetheless, the company’s bonds still maintain an investment grade credit rating, the debt market has shown continued confidence (WPG recently and successfully refinanced a portion of its debt), and there are some signs that the equity market has been overly pessimistic relative to the debt market considering the dramatically different yields even after considering their different locations in the capital structure.

We believe there could be significant upside for WPG if retail turns around. However, investors should understand there are also significant risks. We do not currently own shares of WPG, but is on our watch list, and if the shares go much lower, our interest in owning will likely increase.

Conclusion:

We believe “The Death of Retail” narrative is overblown, but that doesn’t mean shares can’t still go even lower. If you’re not comfortable investing directly in brick and mortar retail stores, then retail REITs may be worth considering. We like high quality retail REIT Simon Property Group. However, we also know the “Death of Retail” narrative could still drive share prices even lower, and that’s why we believe selling put options on SPG is an interesting strategy to generate income that is worth considering. And if you a very brave, and you believe the market is closer to a bottom than a top, you might also consider an investment in the 11.9% dividend yield offered by Washington Prime Group.

For your reference, you can view all of our current holdings here.