If you are turned off by huge dividend stocks that are also hugely risky, you might want to consider the stock highlighted in this article. This particular company has reformed itself, strengthening its balance sheet, and is on a trajectory for conservative, safe, dividend growth.

Kinder Morgan, Inc (KMI)

Yield: 2.6% and growing! (more dividend hikes on the way!)

Like many midstream companies, Kinder Morgan (KMI) faced challenges as energy prices turned south in 2014, and have stayed low since then. However, unlike other midstream companies, KMI took the dramatic step of relinquishing its Master Limited Partnership (“MLP”) status so it could have more flexibility in using its cash. Instead of being forced to pay almost all profits out as distributions, KMI can now choose between dividends, growth, and/or saving for a rainy day.

The company has announced plans to steadily increase its dividend in the coming years, and if you are looking for a conservative, healthy, blue-chip, midstream company, Kinder Morgan’s common shares are worth considering. For your consideration, our latest Kinder Morgan report is included below. However, please keep in mind we like Kinder Morgan’s Common Stock, NOT the Preferred Stock (we’ve written about the preferred shares previously in this article).

Kinder Morgan, Inc (KMI)

Stock Price: $19.36

Market Cap: $43.2B

Fwd P/E: 26.7

ROE: 1.9%

Dividend Yield: 2.6% (and expected to increase)

EV/(Fwd)EBITDA: 11.35

Overview and Highlights:

- Because of its large size and vast reach, Kinder Morgan has a seat at the table for most new midstream projects in North America. However, also because of its large size, KMI must invest heavily in new projects each year to maintain a growth rate competitive with smaller pipeline owners.

- In 2014, KMI converted to a corporation (formerly an MLP), and then cut its divided in 2015. This move helped give the company more flexibility with its cash flows, and helped the company shore up its balance sheet. However, KMI has given up the tax advantage it formerly had as an MLP.

- We expect KMI to experience lower volatility than most stocks. Ninety-one percent of KMI’s revenues are fee-based (thereby reducing exposure to volatile commodity prices), and the company has a 5-year growth project backlog that is ~86% fee-based for a combination of pipelines, terminals and associated facilities.

- KMI recently announced plans to increase the dividend from $0.50 per year (current), to $0.80 in 2018, and to $1.25 by 2020. KMI also announced a plan to buyback $2billion of shares, expected to begin in 2018.

A Summary of the business and the industry:

Kinder Morgan is the largest midstream energy company in North America. The company spans the continent, transporting a significant fraction of the nation’s crude oil, refined products, and natural gas, and is involved in virtually every link of the midstream energy value chain.

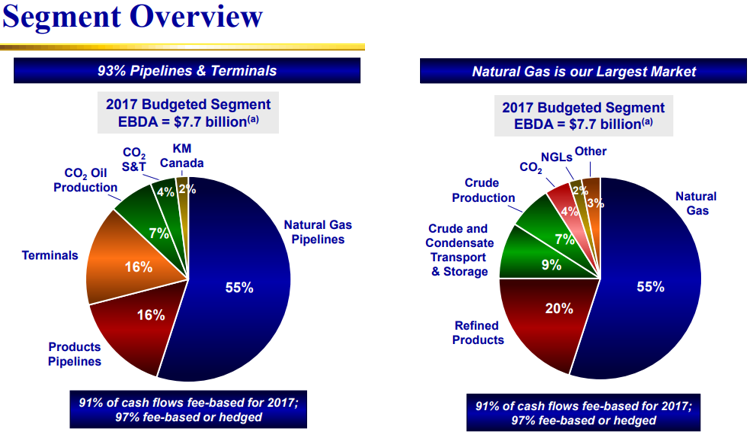

Kinder Morgan’s assets encompass mainly natural gas pipelines, but also other products pipelines, terminals, CO2 and Kinder Morgan Canada.

And the company is well-diversified across its customer base.

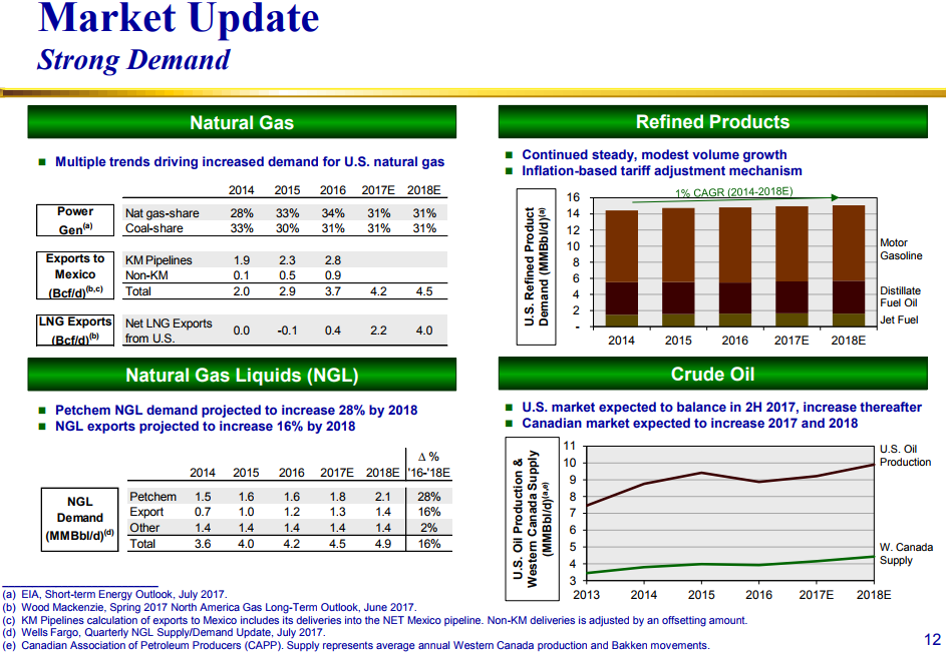

Importantly, Kinder Morgan continues to experience strong demand across its segments as described in the following graphic.

Since reorganizing as a corporation (instead of an MLP) the company is now focused on providing investors with growth and income (instead of only income). KMI has shored up its balance sheet and is able to fund growth capex needs internally (instead of with new debt and equity offerings).

Brief History of the Company and its founding

Kinder Morgan Energy Partners (KMP) was founded in 1997 when a group of investors acquired the general partner of a small, publicly traded pipeline limited partnership (Enron Liquids Pipeline, L.P.) later renamed Kinder Morgan Energy Partners, L.P.

In 1999, Kinder Morgan conducted a reverse merger with KN Energy, a utility and pipeline company. Natural Gas Pipeline Company of America (NGPL), which serves the Chicago market, was acquired through this deal. KN Energy became Kinder Morgan's second publicly traded company, Kinder Morgan, Inc. (KMI).

In 2001, Kinder Morgan's third publicly traded company, Kinder Morgan Management, LLC (KMR) was formed to facilitate institutional ownership of KMP equity.

In October 2011, Kinder Morgan Inc. agreed to buy El Paso Corp. (EP) for $21.1 billion and gave the combined company 67,000 miles (107,000 kilometers) of gas lines, eclipsing Enterprise Products Partners LP (EPD) as the biggest U.S. pipeline operator. The transaction paid with shares of Kinder Morgan, Kinder Morgan warrants, and all of cash portion $11.5 billion through Barclays Plc (BARC) borrowing.

On August 10, 2014, Kinder announced it was moving to full ownership of its partially owned subsidiaries Kinder Morgan Energy Partners, Kinder Morgan Management, and El Paso Pipeline Partners in a deal worth $71 billion. The transaction closed on November 26, 2014.

Prior to November 26, 2014, the Kinder Morgan group publicly traded companies included Kinder Morgan, Inc. (NYSE: KMI), Kinder Morgan Energy Partners, L.P. (NYSE: KMP), Kinder Morgan Management, LLC (NYSE: KMR) and El Paso Pipeline Partners, L.P. (NYSE: EPB); a merger transaction combined all under Kinder Morgan, Inc. (NYSE: KMI), on November 26, 2014.

Valuation:

As shown in the following chart, Kinder Morgan currently trades at 11.35 times Enterprise Value to forward EBITDA.

This rate is competitive with peers, especially considering its lower expected growth rate, as shown in the following table.

Worth noting, KMI has consistently delivered a strong return on invested capital across all of its operating segments, although the rate has come down in most segments in recent years, as shown in the following table.

Competition:

Kinder Morgan’s energy infrastructure assets would be very difficult to replicate, thereby affording the company a competitive advantage and almost monopoly-status among pipeline operator competition. However, because of KMI’s already large size, it may be difficult to achieve high levels of growth in some situations relative to peers. Kinder Morgan’s peers include other midstream companies such as Energy Transfer Partners (ETP), Enbridge (ENB), Williams Partners (WPZ), Enterprise Products Partners (EPD) and TransCanada (TRP) as shown in our earlier table and chart. The peers are smaller, and operate largely as MLPs.

Management- (Capital Allocation):

Kinder Morgan is in a unique position relative to its midstream peers because it has the ability to focus on growth and income, whereas peers are organized as Master Limited Partnerships and therefore must return excess capital in the form of distribution (dividend) payments. KMI can be more opportunistic, as explained by CEO Steve Kean on the Q2 quarterly call:

“So we think that we are generating cash that’s in excess, that’s surplus. So it's in excess of our needs for our capital projects while we are building them out and so we see the room to return essentially all of that excess cash to shareholders. And which shows a significant dividend increase. I think that’s a very positive for shareholders, but also a share repurchase which is kind of unique in our sector that gives us the ability to be opportunistic when we see an opportunity to purchase -- to return value to shareholders through a share repurchase rather than locking it all in on the dividend increase. So we think it's a good mix of ways to return capital to shareholders, return value to shareholders. Substantially growing dividends, still very well covered, extremely well covered as Rich pointed out, with a buyback program as the backstop which gives us some flexibility to take advantage of opportunity.”

KMI’s operating structure changed when it consolidated multiple entities into a corporation in 2014, and the company then dramatically reduced its dividend, and has been working to strengthen its balance sheet since that time.

Catalyst:

The catalyst for KMI in the coming years is the strength of energy markets. If demand increases then KMI will have more opportunities to grow. Additionally, the company’s investor base may increase as the company follows through on its plans to significantly increase the size of the dividend (plus $2 billion in upcoming share repurchases, starting in 2018, could help the share price).

Recent Price action:

Kinder Morgan was most recently ranked 675 in Jarvis. It was ranked 710 in the week prior, and 445 the week prior to that. KMI has underperformed the S&P 500 this year, and it has underperformed significantly in recent years, as shown in the following chart.

The current level of short interest is 1.4%.

Special/Unique:

Kinder Morgan is unique among its peers for two reasons. First, it is the biggest North American midstream comapany providing it access and scale that others do not have. And second, KMI is not an MLP so it has more flexibility to be opportunistic in how it uses its excess capital (i.e. it doesn’t have to pay it all out as a distribution).

The Last Downturn:

Kinder Mogan was hit hard when energy prices declined in 2014, and also cuts its distribution in 2015 as energy prices have remained low for longer. The energy market downturn also led to the combination of several KMI entities as one non-MLP corporation.

Quality:

Kinder Morgan’s size and scale afford it the resources to deliver on projects. However, midstream services are largely a commodity industry.

Insider Activity:

The percent of insider ownership is significant at 12.64%.

Capital Structure:

Kinder Morgan has strengthened its balance sheet in recent years. Following its 2015 dividend cut, KMI has reduced its debt to assets and debt to equity ratios as shown in the following chart.

Further, the company has excess distributable cash flow and plans to return to shareholders opportunistically in the form of dividend increases and share buybacks depending on market conditions and opportunities. For example, KMI recently announced plans to increase the dividend from $0.50 per year (current), to $0.80 in 2018, and to $1.25 by 2020. KMI also announced a plan to buyback $2billion of shares, expected to begin in 2018. However, this may not be enough to satisfy shareholders with higher yield opportunities available from other midstream companies.

Risks:

Kinder Morgan faces a variety of risks including tax or regulatory changes; interest rate risk; changes in regulated pipeline tariffs; capital investment risks; and pipeline spills, explosions, or ruptures.

Also, roughly one third of the company’s current project backlog is tied to the Trans Mountain expansion project in Canada, which is facing opposition from local stakeholders and a delay in gaining regulatory approvals. If this project is deferred or canceled, Kinder Morgan would need to develop additional alternative projects to fuel cash flow growth into the next decade.

Other risks include commodity prices and demand, (the company’s 2017 budget assumes a $53/barrel average strip price for crude, and $3.00/MMBtu average strip price for

natural gas. The company estimates price sensitivities (annually) as follows:

- $1/Bbl change in oil price = ~$6 million DCF impact.

- 10¢/MMBtu change in natural gas price = ~$1 million DCF impact.

- 1% change in NGL/crude ratio = ~$3 million DCF impact.

Conclusion:

In our view, Kinder Morgan doesn't have the huge risky upside price potential (or the huge dividend) that many investors like to "chase" after. On the contrary, Kinder Morgan is a healthy company, with a strong balance sheet, and with an above average dividend that is expected to increase 150% over the next three years. It'll also likely experience lower volatility than many of its midstream peers not only because of its high fee-based revenue streams (that are not impacted by energy prices), but also because it has more flexibility in how it uses it cash after relinquishing its MLP status. If you are looking for a safe, conservative, dividend growth opportunity, Kinder Morgan is worth considering.