As contrarian income-investors, we are seeing a variety of interesting investment opportunities among real estate investment trusts (“REITs”). The group has been beat up over the last year as investors fear the possible negative impacts of rising interest rate expectations, and they’ve shunned most REITs in favor of higher growth sectors of the market (such as aggressive growth technology stocks).

In our view, this has created some very attractive investment opportunities. This article highlights eight attractive big-dividend REITs that we believe are worth considering. Before getting into the list, we first share an honorable mention…

Honorable Mention…

Washington Prime Group (WPG), Yield: 11.9%

Like many retail-related stocks, WPG has sold off sharply over the last year.

This company owns retail shopping mall properties, and they are not the highest quality prime locations retail properties that other mall REITs own. As a result of the specific property types, WPG has sold off particularly hard. And if you are a contrarian, income-focused investor, WPG is hard NOT to notice. For your consideration, we have highlighted many of the most significant risks that investors may want to consider before dipping their toe in this opportunity, in this article…

And without further ado, here is our top 10 list…

8. Apollo (ARI), Yield: 10.4%

Apollo Commercial Real Estate is a Mortgage REIT that is catching the eye of many income-focused investors because of its big yield (10.4%) and recent price decline (-8%) since June. For your consideration, we have highlighted many of the challenges and opportunities ARI faces, and then conclude with our views on whether or not it’s a good investment (hint: we think the positives outweigh the negatives) in this detailed write-up...

7. Welltower (HCN), Yield: 4.7%

This big-dividend healthcare REIT (focused mainly on senior housing) is absolutely worth considering if you are a conservative income-focused investor. The price is down over the last year (while the S&P 500 is up) thereby creating an attractive contrarian opportunity, and the dividend is very safe, in our view. For your consideration, here is our recent detailed write-up on Welltower:

- 10 Reasons Ventas Is Better Than Welltower

6. Ventas (VTR), Yield 4.5%

Similar to Welltower in the sense that it’s a healthcare REIT focused mainly on senior housing, we like Ventas slightly more than Welltower, and we have highlighted ten specific reasons why in this article:

- 10 Reasons Ventas Is Better Than Welltower

5. (Tied) Gramercy Property Trust (GPT)

Yield: 5.0%

We believe this REIT is not getting enough credit from the market for its decision and progress to convert from mainly an office REIT to an industrial REIT. GPT (and industrial real estate, in general) is performing very well, yet GPT isn’t yet being valued properly, in our view. You can read our complete detailed write-up here:

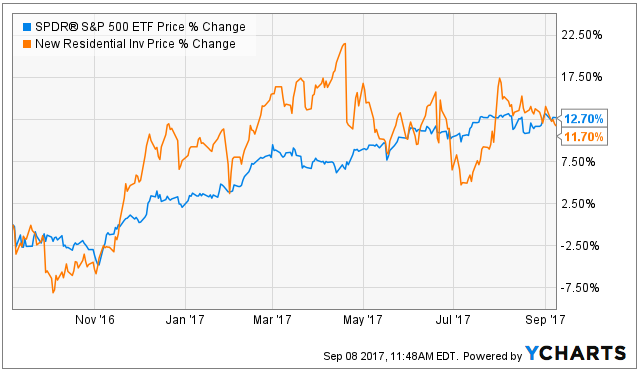

5. (Tied) New Residential (NRZ)

Yield: 12.2%

This is another big dividend REIT where we believe the risks (and there are risks) are outweighed by the rewards (i.e. the big dividend and price appreciation potential). Before you go chasing after this big dividend yield, it’s worth taking the time to understand the risks, and for your reference we have highlighted what we consider to be NRZ’s biggest risks in this recent article:

And as a reminder, we do currently own shares of NRZ within our Blue Harbinger portfolio (you can view all of our current holdings here).

4. Simon Property Group (SPG): Yield: 4.5%

(Selling PUT Options for Income)

Like Washington Prime Group (honorable mention, above), SPG is a retail REIT. However, unlike WPG, SPG has higher quality properties and is a much safer investment. Yet despite SPG’s attractiveness, the shares have sold-off significantly with the death of retail narrative. However, rather than purchasing shares of SPG outright, we have been generating attractive income by selling put options. If the price falls far enough, then we get to buy SPG (an attractive REIT) at a lower price. And if the shares don’t get put to us then we simply keep the attractive income we generated for selling the puts. You can read all about our recent SPG trades in these articles:

3. Omega Healthcare Investors (OHI)

Yield: 7.9%

Omega is a healthcare REIT focused on Skilled Nursing Facilities. We have recently attempted to give a balanced view of Omega (instead of the usual one-sided cheerleading articles) in this detailed OHI write-up, and in our recent idea of the month video:

We also believe selling put options on Omega (to generate income) is attractive if you don't already have a full position in the stock. Because uncertainty in Omega is high, so is the income (premium) available for selling puts. We haven’t yet sold puts in Omega (in part because we already own some OHI shares). However, we consider selling puts to be an attractive strategy, and it’s high on our watch list. From a technical standpoint, we’d like to see OHI’s price pullback closer to $30 before selling puts because fear goes up as price goes down, and this means the income (premium) available for selling puts is even more attractive. Stay tuned!

------------------------------------------------------

2. EastGroup Properties (EGP), Yield: 2.8%

EastGroup has rallied significantly since the start of 2016 when we first bought shares, and we believe this prime location industrial REIT has more room to run. You can read our recent detailed write-up on EGP here.

And worth noting, EGP properties are located in the southern US states (which have been particularly attractive). The company’s Houston properties were not damaged from the recent hurricane, and the company may actually benefit from increased business as that area rebuilds. And depending on the outcome of the hurricane expected to hit Florida, we may see some volatility in this stock price in the coming days potentially creating a more interesting buying opportunity. And it goes without saying, the hurricane’s are no joke, and best thoughts/prayers to everyone affected.

1. W.P. Carey REIT (WPC), Yield: 5.7%

WPC has been on fire this year, and we believe there is still more room to run considering its improved business strategy and the fact that (despite this year’s rally) it’s still underperforming over the last 1-year. The performance has been helped by the weak US dollar considering WPC has significant operations in Europe. Further, we like WPC’s decision to exit its non-traded retail business which was a distraction and arguably a conflict of interest. This clears the path for the company to focus more fully on shareholders. For your reference, the following graphic shows WPC’s property-type and tenant industry diversification.

And here is a look at the geographic diversification.

And very impressively, here is a look at the historical occupancy.

During its most recent quarterly earnings call, management affirmed 2017 AFFO guidance of $5.10 to $5.30 per diluted share, which means it currently trades at only 13.45 times, an attractively low price to AFFO ratio, in our view (and compared to peers). It also means the dividend payout ratio is only 76.9%, thereby providing a healthy cushion on its current dividend payments.

Overall, We believe WPC is an attractive big dividend REIT, and we continue to own it in our Blue Harbinger Concentrated Value & Income (“CVI”) portfolio.

Conclusion:

Given the pullback in many real estate investment trusts, the strong well-covered dividend yields, and our contrarian value-focused investment nature, we believe there are currently lots of attractive opportunities such as those highlighted in this article. And for for your reference, you can view all of our current holdings here.