From time to time, we like to share disciplined growth opportunities--stocks that don't necessarily pay a dividend, but do have significant long-term price appreciation potential, albeit with some volatility. This morning we share one such opportunity. These shares have tremendous growth opportunities, and they're high on our watch list. If the share price pulls back, we could buy.

Without further ado, here is the write-up on this disciplined growth stock idea...

ServiceNow (NOW), Yield: 0.0%

We rate ServiceNow (NOW): HOLD, and would consider buying shares on a price pullback.

- NOW expects to continue experiencing rapid sales growth, as the market environment is strong, the total addressable market (“TAM”) is large, and there is little competitive pressure.

- NOW spends heavily on investments and SG&A, and valuation multiples (price-to-earnings, price-to-sales) are already very high.

A Summary of the business and the industry

- ServiceNow, Inc. (NOW) is provider of enterprise cloud computing solutions. The company uses its service-oriented workflow platform to provide out-of-the-box apps, alongside custom development tools, to manage and automate internal processes such as customer support, human resources, security operations and other enterprise departments. Its business segments are subscriptions and professional services.

- Sales have been growing rapidly, as shown in the following graphics.

- Business Getting Better: NOW’s business is growing rapidly as the IT spending environment is strong and the TAM is large. NOW estimates the TAM to be $60 billion, and expects sales to reach $4 billion by 2020. The company is spending heavily to develop and grow its solution offerings internally.

- Risks and Bear Case: The main risks and bear case stem from the possibility of slower growth than anticipated by the market. Price multiples are already high, and if economic or industry growth slows, or if competition increases, then NOW’s valuation multiple (i.e. price) could fall significantly. The top two risks listed in NOW’s 10K are: (1) “We expect our revenue growth rate to continue to decline, and we expect to continue to incur losses in accordance with U.S. Generally Accepted Accounting Principles (GAAP).” And (2) “We have recently introduced products in new markets that are important to our growth prospects and for which we do not have a substantial operating history. If we are unsuccessful in competing in these new markets, our revenue growth rate, business and operating results will be adversely affected.”

- Brief History of the Company and its founding: headquartered in Santa Clara, California, NOW was founded in 2004 by Fred Luddy, the previous CTO of software companies Peregrine Systems and Remedy Corporation.

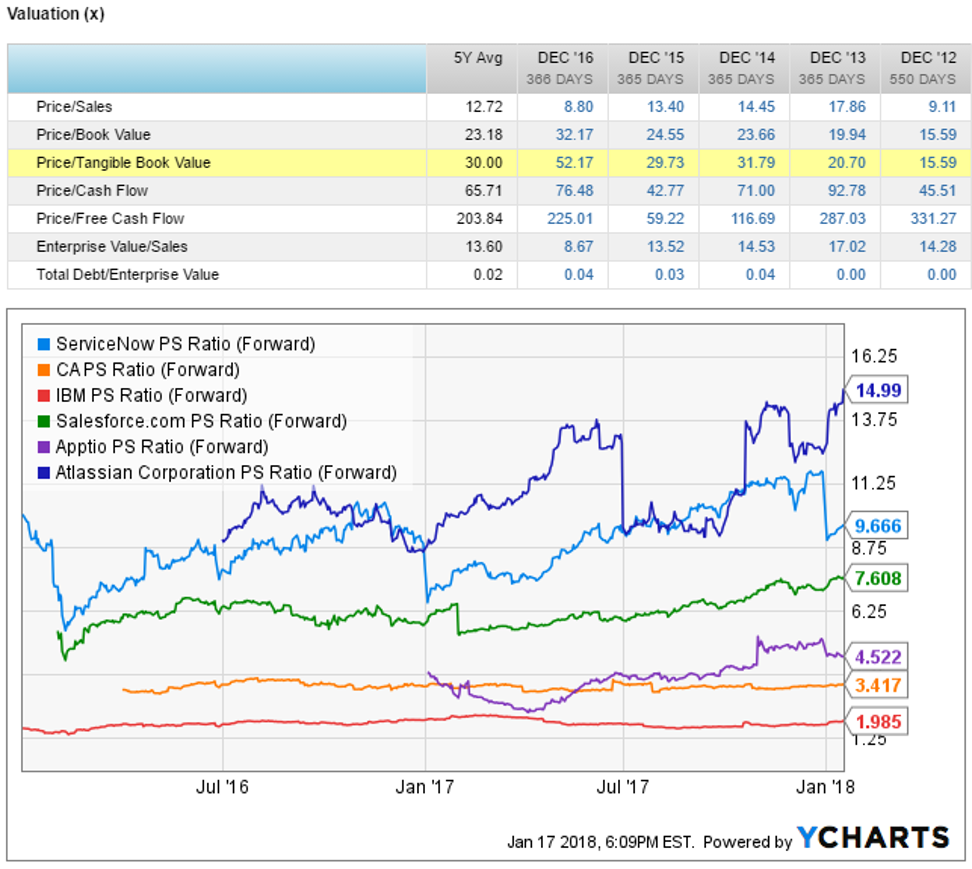

- Valuation- ServiceNow shares have 67% upside over the next 3 years. Specifically, the company believes it can achieve $4 billion in annual sales by 2020. If the shares were to trade at 10 times sales, that implies a market cap of $40 billion, which is approximately 67% higher than the current market cap of $23.95 billion. For reference, the current price to sales multiple is 13.5x. Additionally, here are the company’s historical price valuation multiples, as well as its forward price-to-sales multiple relative to peers.

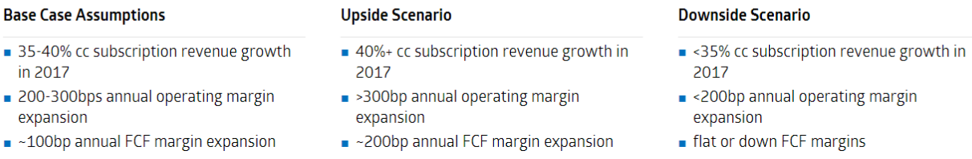

Per a December Cowen research report, here are bull and bear case assumptions :

Cowen also notes, they see the company exceeding its $4 billion 2020 revenue guidance.

- Competition- According to Cowen research “there is virtually no other company that resembles NOW’s platform approach to the market. With such a weak legacy competitive field sitting on such large amounts of IT spend, and with a visionary position to help companies transform their business processes, we think NOW is positioned to gain significant wallet share.”

- TAM: NOW estimates the TAM to be $60 billion, and expects sales to reach $4 billion by 2020.

- Management- (Capital Allocation)- NOW pays no dividend, but did increased shares outstanding modestly in 2017, as shown in the following capitalization table from FactSet.

Total debt is approximately $1.16 billion and was increased in 2017, as shown in the following graphic.

- Catalyst- At nearly $24 billion, it seems unlikely NOW will be acquired, but not impossible. The main driver of a higher share price will simply be continued economic and industry strength followed by strong execution by NOW. Valuation multiples are already high, therefore it seems sales and earnings growth will be needed to support the share price and to potentially drive it higher.

- Recent Price action: NOW’s share price has increased significantly, as shown in the following chart.

Here is a history of analyst revisions:

According to YCharts, the percent of shares sold short is 6.44%.

- Special/Unique: NOW is special because it has a strong reputation in an expanding industry, and essentially no competitive pressures.

- The Last Downturn- NOW went public after the last economic downturn, and the shares have consistently gained in price. This stock has a beta of just over 1.0, but the shares did experience a decline from $90 to $50 in late 2015 / early 2016, and the shares have experienced >10% pullbacks at times when the market was closer to flat. According to the company’s 10K: “Our stock price can be volatile, including if we fail to meet the financial performance expectations of investors or securities analysts and the price of our common stock could decline substantially.”

- Quality: According to Cowen research, “demand is healthy across the board as customers increasingly consider NOW as a strategic partner platform.” Customers typically start with the basic (ITSM) and expand into others applications from there.

- Insider Activity:

- Capital Structure: NOW has zero coupon bonds that mature in November 2018. The bonds initial offering was in 2014, and the original offering amount was $575 million. As shown in the earlier management section, NOW has in the money convertible bonds. The last trade price of the following bonds was $190.37.

Conclusion:

ServiceNow is NOT our normal low-risk high-income investment idea. ServiceNow is a rapidly growing company that does NOT pay a dividend, but it does have very significant long-term price appreciation potential, albeit with more volatility.

We do NOT currently own shares of NOW in any of our Blue Harbinger portfolios, but it is high on our watch list, and we'd consider purchasing on a significant price pullback.

For reference, you can view all of our current holdings here.