Here is a look at the S&P 500 for last week, and it was not pretty (down 4.1%).

However, the future looks bright for a variety of reasons (e.g. upcoming earnings, low valuations, and rates are still low). This article shares a few “do’s” and “do not’s” for investors during and after a big sell-off (like this past week), and we review a few more specific investment ideas that are attractive (for income and capital appreciation).

Why The Future Looks Bright

Despite the onslaught of fear-mongers in the media proclaiming this is the end of the world for stocks, they’re wrong. The economy and many, many, businesses are healthy. Here is a look at S&P 500 earnings expectations.

Specifically, earnings have been rising, and they are expected to keep rising. This is NOT a situation that warrants an imminent market collapse. To the contrary, it warrants a market going higher.

From a valuation standpoint, the market isn’t expensive. According to the Wall Street Journal, the S&P 500 trades at only 17.08 times forward earnings estimates, and this is LOWER (more attractive) than just a year ago when it was 24.55x. Plus, quarterly earnings announcements are just starting and earnings are expected to largely increase (also a good thing). These are NOT the metrics of a market that is about to collapse.

Despite rising interest rates, they’re still near historic low levels, and this is good for the economy and continued growth.

Specifically, low rates is economically stimulative because it makes it easier for businesses to fund growth.

The “Do’s” and “Do Not’s” of a Market Sell-Off

Just like the first snow storm of the season, investors freak out when the market sells-off for the first time in a while (we haven’t seen this much volatility for months). Here are a few “Do Not’s” for investors right now:

Do NOT freak out and sell everything.

Do NOT change your long-term investment strategy because of short-term volatility.

Do NOT start making a bunch of spur of the moment, unnecessary, trades.

And here are a couple Do’s:

Do know you goals, and stick to your long-term investment strategy.

Do consider adding to your investment account if you have uninvested cash on the sidelines (it’s better to buy low than high).

Investment Ideas:

As you may be aware, we recently shared a list of high-yield securities that had declined significantly, and then highlighted 5 particularly attractive opportunities, in this report:

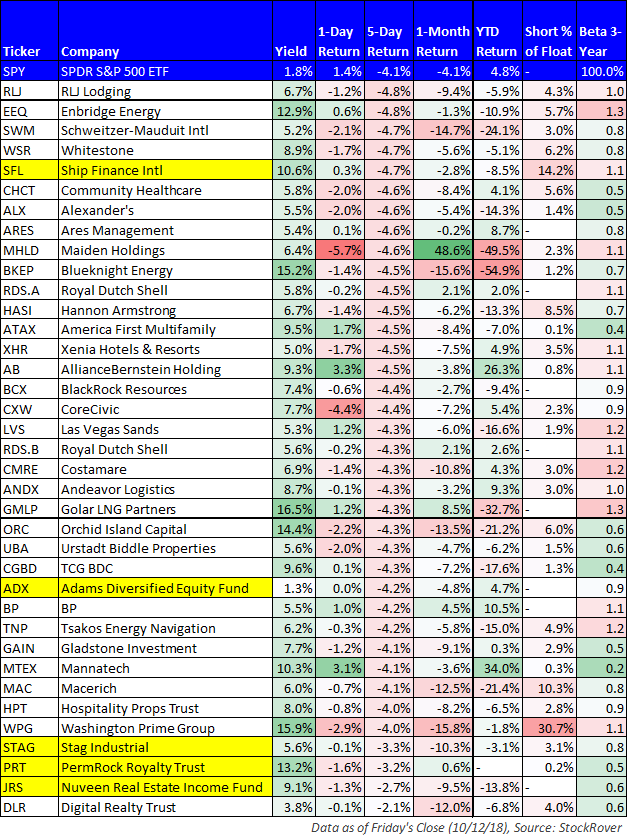

We have since updated the data in that report, and it is available in the following table.

You may also be able to identify a few more attractive opportunities based on the updated data in the above table. For example, we recently detailed two:

Conclusion:

We’ve been spoiled by very low market volatility in recent months, until the last week, or so. From a historical perspective, our recent bout of volatility is elevated, but it is not extreme (i.e. the markets have historically experienced significantly higher volatility). In our view, it’s important for investors to stick to their long-term strategy, avoid silly mistakes (for example, the “Do NOT’s” listed in this article), and to be opportunistic (as long as your actions are consistent with your long-term strategy). There continue to be plenty of attractive investment opportunities in the market, and despite last week’s sell-off, the future continues to look bright. Over the long-term, stocks are going higher.