The last week has been a rough one for stocks. The S&P 500 (SPY) was down 1.6%, the Nasdaq (QQQ) was down 4.2%, and a bunch of individual names were down A LOT more. The point of this article is to review a few of the names on our watch list that have sold-off significantly, and then discuss a few trades that we’re considering for the upcoming week.

We’ve divided this article into two parts. First we review attractive “disruptive” growth stocks on our watch list that sold-off, and second we review the attractive high-yield stocks that have sold-off.

Attractive Disruptive Growth Stocks:

Here are a few of the attractive disruptive growth stocks we follow (see table below), and as you can see—some of them were down A LOT in the last week.

Considering we already own Zillow (ZG), and Shopify (SHOP), we are strongly considering adding shares of Square (SQ) and Netflix (NFLX) to our Disciplined Growth portfolio this upcoming week. They’ve both just sold-off considerably, and they both are very attractive in the mid- to long-term, in our view.

Square (SQ) is a highly disruptive “Fin Tech” company, that has the potential to disrupt much of the financial and banking world over the coming years and decades. The company has started small (i.e. with micro-merchants), but they’ve been moving up the food chain to mid and larger companies, and they have an enormous amount of room to run, especially as technology makes old school banking and many financial services seem antiquated and inefficient.

We’re considering selling our American Express (AXP) shares, and replacing them with Square (they’re both essentially financials, although Square is a “heckuva” lot more modern). Fore reference, here is one of our previous write-ups on Square.

Regarding Netflix (NFLX), we haven’t written about this one before, but we do follow it, and we consider it a perennial and growing powerhouse with a lot more room to grow. And it is extremely tempting after last week’s sell-off, and quite honestly its sell-off over the last 3-months (the shares won’t stay down for long). Netflix’s low subscription cost, ease of use, and enormous and growing content library make it a very compelling company. Further, its subscriber base can easy quadruple from here, and it can also easily raise its subscription price without causing subscribers to even blink (Netflix has “pricing power”). Both of these attractive qualities give the shares a tremendous amount of upside from here, in our view.

Within our Disciplined Growth portfolio, we’ll likely trim our position in Johnson & Johnson (which has grown quite large over the years) to fund a possible new purchase of Netflix, very soon.

Regarding the other names in the table above, we consider them attractive, and here are a couple of our recent write-ups for you to consider.

GrubHub (GRUB): Want In On The Next Big Thing?... Consider This...

PagSeguro Digital (PAGS): A Powerful Growth Stock, On Sale

Attractive High-Yield Stocks:

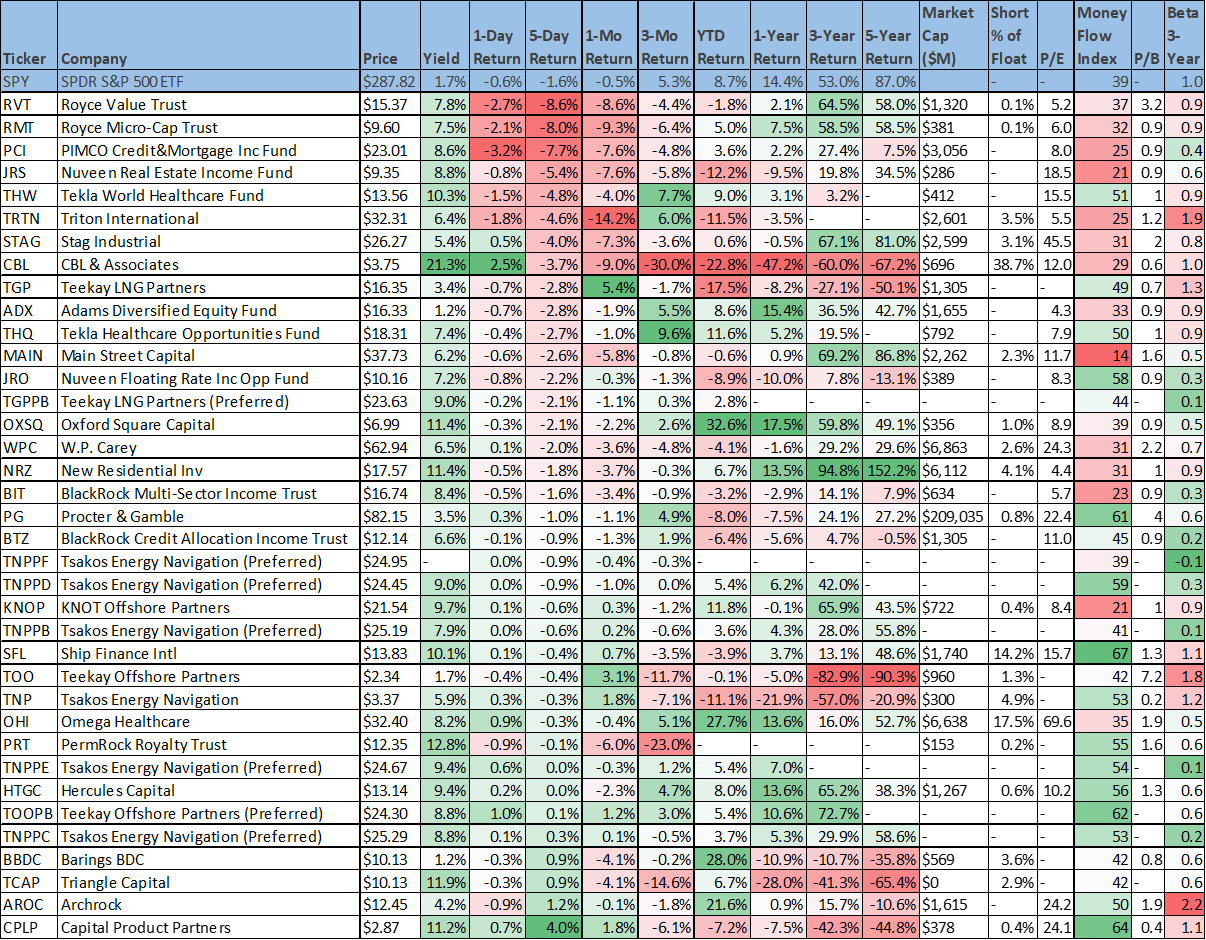

Regarding attractive high-income stocks, we wrote about them in detail a couple days ago in a Free Report (see: 100 High-Yielders Down Big: These 5 Are Worth Considering), but that data was only through Thursday. The following table is essentially our high-income “watchlist,” but the data has been updated through the end of this week (i.e. Friday’s close).

High-Income Watch List:

Of the names on the list, one that we consider particularly attractive right now is Triton International (TRTN). We wrote about this one in detail (see: Triton’s 6.3% Yield: Trade Wars and Economic Risks), however what we did not mention is that not only do we consider the shares to be attractively priced right now, but we also really like the idea of selling income-generating put options on Triton at this juncture. Specifically, the premium income available is attractive, and if the shares fall even further to your strike price then you get to own them at an even lower price. And you get to keep the attractive premium-income you generate for selling the puts, either way (if the shares do, and if they don’t, get put to you).

Specifically, depending on how the market opens to start the week, we like selling the November Puts with a strike price of $30 and premium income of around $1 dollar.

This comes out to annualized premium income of around 36% (e.g. $0.90/$30 x 12 months). That’s a lot of upfront income, and the big risk is that the shares get put to you at $30, which wouldn’t be bad considering we believe the shares are worth significantly more than $30.

Part of the reason for the high premium is the perceived volatility risk associated with Triton’s next earnings announcement which comes in November before this contract expires. Also important to note, Triton is expected to go ex-dividend AFTER this option contract expires, so you don’t need to worry about the dividend’s impact on the trade.

Options trade in contracts of 100 shares, so if you are going to participate in this trade, you’ll need to keep enough cash in your account ($30 x 100 = $3,000) if you don’t want to use margin in the case where the shares get put to you at $30.

The Bottom Line:

Market volatility (like we saw last week) can create opportunities. We certainly don’t try to time market bottoms (that’s basically a fool’s errand), but we do always prefer to buy attractive companies at lower prices, such as the ones described in this article.