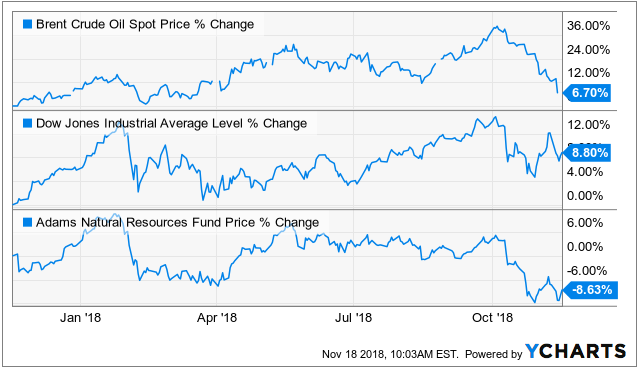

Oil Prices, which are often somewhat less correlated with the overall market, have sold-off, and so has the overall market, as shown in the following chart.

This article highlights three attractive equity investments that have just gotten less expensive: An energy-related closed-end fund managed by a company we like, a group of energy stocks with attractive dividend yields, and an attractive long-term “value play” tangentially related to the industry. Without further ado, here are the attractive opportunities for you to consider…

1. Adams Natural Resources (PEO), Yield: +6.0%

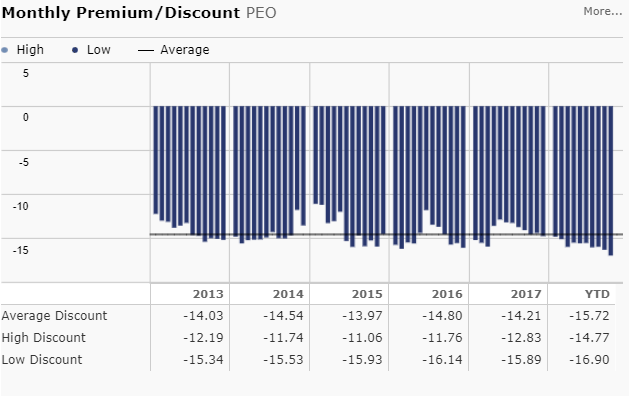

Adams Natural Resources is a closed-end fund, invested heavily in the energy sector, it offers an attractive yield (+6%), and it currently trades at an attractive discount to its net asset value (the discount is currently an unusually large 16.9% as shown in the following chart).

Because of the closed-end structure, the fund can trade at a discount to the market value of the underlying shares. As we can see in this next chart, PEO has sold off with oil and the overall market, but the selling pressure has been intense enough to cause the discount to NAV to increase (a relatively attractive buying opportunity, in our view).

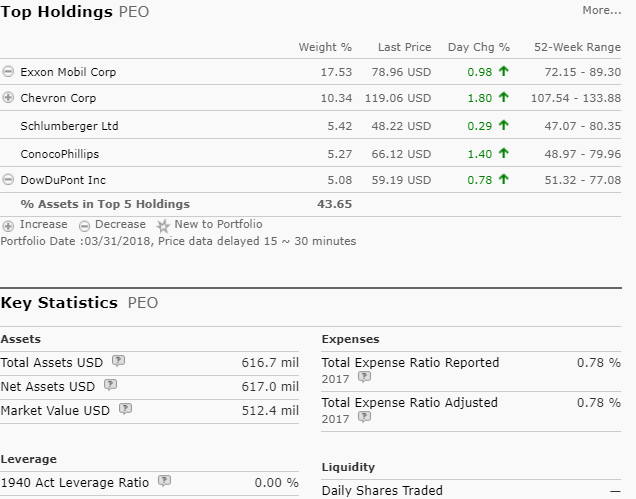

For reference, here is a look at the fund’s top holdings, largely energy companies that have sold off lately, but not as much as PEO has sold-off (the whole wide PEO discount to NAV thing).

The fund has a reasonably low expense ratio (a good thing), it’s not using risky leverage, and its big annual dividend is right around the corner. In fact the ex-dividend date is 11/23, so there’s still a few days to get in. You can read more about PEO on its website here. Here is more color on the big fourth quarter distribution from Morningstar:

“The Fund pays three interim dividends on or about March, June and September and a year-end dividend in late December, consisting of the estimated balance of the net investment income for the year and the net realized capital gain earned through to 10./31 Shareholders may elect to receive this last payment in stock or cash.”

2. Hexcel Corp (HXL), Yield: 0.91%

This is not a big-dividend payer, it’s a long-term “value play” on a growing business. Hexcel produces advanced composite materials. Specifically, the company develops and manufactures structural materials including carbon fiber, specialty reinforcements, resins, honeycomb, adhesives, engineered honeycomb composite structures, and prepregs. The shares have sold-off with the market, but there is reason to believe they are an attractive long-term investment (i.e. an attractive “value play”).

Here is an excerpt from an interesting write-up about Hexcel in Barron’s this weekend (the excerpt is from David Pearl, Co-CIO at Epoch Investment Partners, a firm that managed several hundred billions of dollars for me at my previous organization—I’ve met David several times, and he is very bright).

“What’s the investment thesis for Hexcel?

They make the carbon fiber that goes into all of the new airplanes from Boeing to Airbus, which are a duopoly. That carbon fiber replaces aluminum and makes the plane lighter; which makes it up to 25% more fuel efficient. They fabricate the main body and parts of the fuselage. This will become the standard for most airplanes over a period of time, and as the company transitions from spending a lot of money to build factories and perfecting the carbon fiber to selling into the new 787 and Airbus planes, they’re going to be a huge free-cash flow generator. Free cash flow per share will grow faster than earnings per share for the next 10 years because of all the noncash charges from the previous 10 years. So that’s the thesis… The stock is at $60. The target is $76. The P/E is 21, and it’s 16 times our analyst’s free-cash flow estimate. He’s the guy who talks to Hexcel and knows what’s discretionary. Free cash flow will grow faster for the next few years than earnings. Most people, looking at the company, don’t see it as inexpensive. This is a really good opportunity.”

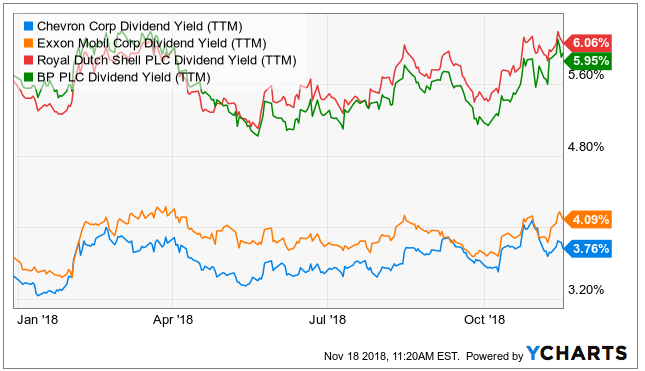

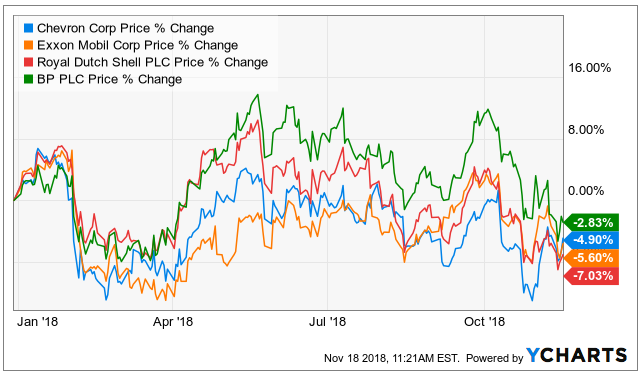

3. Big-Yield Integrated Energy Companies

Our third idea is simply the integrated energy companies, which have gotten inexpensive, and their dividend yields have increased, as shown in the following charts.

Of course, no one knows for certain where oil prices are headed, but the general street consensus is that all of these companies can somewhat comfortably cover their dividends even if Brent oil falls to $50 per barrel (it’s currently at $65, and was closer to $80 last month). On a valuation standpoint these companies are increasingly attractive.

Conclusion:

The market has sold-off. Energy has sold-off. Many investors are increasingly fearful. As counterintuitive as it may seem, the best times to invest are usually when other investors are fearful. The market remains healthy (GDP growth is high, unemployment is low), but market prices could still get worse before they get better. If you’re going to stay the course (i.e. if you’re a long-term investor then of course you should stick to your plan and goals, and keep holding your investments), and even if you are thinking of buying more, there are increasingly attractive opportunities out there (particularly in the energy-related sectors, as described in this article). However, don’t ever concentrate all your investments in one sector, and don’t panic and sell everything either. Be opportunistic, but stick to your long-term plan. Despite short-term fears throughout history, diversified long-term investing is a proven strategy for success. Be smart.