We like to share a mix of safe high income ideas and higher-risk/higher-reward income ideas, so investors can choose for themselves and cater their investment portfolios to meet their own specific needs and preferences. This article focuses on a higher-risk/higher-reward 11% yielding bond that we currently own. The price has recently sold off, thereby making the yield more attractive, plus we believe investors will also earn price appreciation on this bond as its price moves back to par (e.g. $100) versus its current price of $78.75. Very importantly, we only own this bond as one small piece of a larger diversified investment portfolio. Owning a diversified portfolio helps keep returns (and income) high, while simultaneously reducing risks. Without further ado, here is the bond…

FerrellGas Partnters (FGP) Bonds:

And for perspective, here is the stock price…

To be clear, we have zero interest in owning the stock. However, we like the 2020 bonds, and we currently own them. Before getting into what caused the dramatic sell-off in both the stock and the bonds, here is a brief summary of the business and the industry.

Business and Industry:

The precursor to Ferrellgas was founded in 1939 in Atchison, Kansas by AC Ferrell. His son and current CEO James Ferrell joined the struggling business in 1965, eventually consolidating all holdings under the current name. Since then, the company has purchased more than 300 local propane dealers in a bid to increase market share gradually. Today, the company has an 8% share of the US propane distribution market, mostly concentrated in the delivery of propane tanks to rural customers that lack access to natural gas. In present day, Ferrellgas is strictly a propane distributor, having divested from all other business units as of 2018.

A key event in Ferrellgas’s history is the company’s unsuccessful acquisition of Bridger Logistics in 2015 for a price of $837.5 million dollars. Given the seasonality of the propane business, Ferrellgas sought to diversify its revenue mix and purchased Bridger to create a presence in the midstream petroleum operations business. Unfortunately, the purchase came during a violent downturn in the oil markets. Ferrellgas was forced to claim an impairment on its Bridger asset the next year (2016) in excess of $650 million dollars. At that time, the board dismissed the CEO, Steve Wambold, and long-time chief Ferrell returned to the company in 2016. Most likely, the ill-fated Bridger purchase, along with a few consecutive warm winters, have put Ferrellgas in financial distress.

Ferrellgas is a Master Limited Partnership, so it is required to distribute to unitholders the amount of income delineated in the partnership agreement. In the last three years, the amount of distributions to unitholders has decreased sharply from more than $2 per year in 2015 to $0.00 per year today. In addition to the rural distribution business, Ferrellgas owns Blue Rhino, which is the US leader in small retail propane tank exchange.

The propane distribution industry is a fragmented business, which is subject to inconsistent revenue, given its seasonal nature. As a result, consolidation is the norm, as larger firms tend to buy small, local distribution businesses as they look to increase market share and create economies of scale. Propane comprises 3-4% of US energy consumption. As the nation’s natural gas infrastructure continues to expand into the rural areas, the market for propane continues to shrink, causing even more consolidation activity. Prices for propane depend on two key factors: severity of winter weather and general energy prices. Warm winters over the past few years have caused strain to propane distributors. In addition, the correlation (see chart below) with WTI crude is quite strong, so a selloff in the broader energy market can affect the propane industry’s profitability quite directly.

What Caused The Recent Sell-Off?

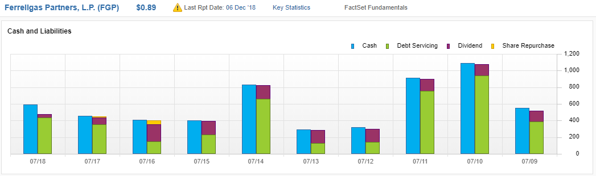

The winter weather in the past 2-3 years has been mild, which caused Ferrellgas’s revenue to decrease as the price of propane has been depressed. More significantly, the disastrous purchase and subsequent sale of Bridger cost Ferrell in excess of $900 million in losses, which corresponds almost exactly to the level of negative equity on the company’s balance sheet. To make matters worse, Ferrell persisted in paying a distribution to unitholders of $2 per year per share until September 2016. Ferrell recently cut the distribution to $0.40 and then to $0.00 as of this month. Further still, S&P lowered the credit rating and high-yield credit spreads have widened across the board (more on this below).

Recent Earnings:

Per a note from Clearview Trading (12/.10/18):

“Ferrellgas Partners L.P. shares surged 67.11% Thursday then dropped 17.19% Friday to close at $1.06 (down 75.23% YTD) after the company reported F1Q19 results and said it is in the process of hiring a financial adviser to evaluate options to deal with its high leverage. Adjusted EBITDA was $17.8 million compared to $26.2 million in the prior year. “We are not interested in doing a deal for the sake of doing a deal if it does not position the company for the long term,” Chairman and interim CEO James Ferrell said on the earnings call. “We have liquidity. We generate cash flow and we’re growing the business.” Leverage is forecast to climb to 8.6x debt to earnings in 2019, according to S&P, which earlier this month lowered its credit rating to CCC from B- on increased likelihood of a restructuring. The company cuts its distribution payment after it exhausted limits for such payments under its MLP bond indenture, the company said on the call. Ferrellgas’ CFO and COO resigned last month. The company’s $182 million 8.625% senior unsecured notes due 2020 on Thursday fell 1.50 points 77.00 but rallied back Friday to 78.50. The $500 million 6.75% senior unsecured notes due 2023 on Thursday dropped about 1 point to 83.50, albeit in odd lot trade, then rallied Friday to 84.50.”

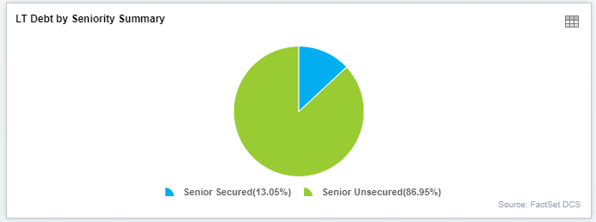

Debt, Uses of Cash and Asset Coverage:

Ferrell’s asset coverage ratio is a scant 0.45. The company holds $1.36 billion in total assets, $367 million of which are intangible assets. The resulting total is $1 billion in tangible assets, the majority of which are PP&E(~$600 million), accounts receivable, and inventories. Total debt stands at $2.2 billion.

Because the business continues to generate significant cash flow, and this cash flow will not disappear overnight, we believe FGP will be able to restructure the debt when it matures. These 2020 bonds are not secured, but they do mature earlier compared to other outstanding bonds, which is a good thing. Cash generation, management's focus on deleveraging, and the continuing industry life all lead us to believe the company has the strength to pay off the 2020 maturity bonds in full.

Conclusion:

Even though FGP is facing very significant challenges, they have the liquidity and cash flow to support the debt beyond 2020. The distress has been caused in part by warmer weather, but largely by the disastrous purchase and subsequent sale of Bridger. And more recently, the S&P downgrade (from B- too CCC) has caused fearful investors to drive bond prices lower. Further still, the recent sell-off in energy has caused credit spreads to widen across the spectrum of high-yield bonds, and this has pushed FGP’s bond prices even lower in the short-term (too low in our opinion). And even though the propane business is shrinking, the company is now focused on deleveraging (that’s why they hired an advisor and cut the equity distribution—a good thing for bondholders), and FerrellGas has the cash flow and liquidity to support the debt beyond 2020. This could be a volatile ride for current bond holders, but we believe the bonds offer an attractive yield and will pay in full at maturity in 2020. We own these bonds as one small part of our larger diversified portfolio.