High yield bonds can be an attractive source of income and capital appreciation. Their prices are often driven more by company-specific idiosyncrasies than by macroeconomic interest rate risks. And depending on your situation, they can be a valuable addition to a diversified investment portfolio. This report highlights 20 high-yield bonds that are down big, and then reviews 5 specific bonds that we believe are worth considering.

The Market Rover is all about idea generation. Each week we screen the market, focusing on a different investment theme, in search of interesting investment opportunities. We then highlight a few of our favorites from the list. Readers are encouraged to chime in with comments and feedback. This report is intended to be a resource for investment idea generation.

This Week:

20 High Yield Bonds Down Big, These 5 Are Worth Considering...

Considering interest rates remain very low by historical standards (and they’re also rising—not good for bond prices), many investors have been focusing almost entirely on healthy dividend paying stocks with some capital appreciation potential (or at least less volatility and less downside risk than many non-dividend paying stocks). However, many investors often completely overlook high-yield bonds which can offer not only high yields but also significant capital appreciation opportunities (when they’re trading at a discount). To be clear, high-yield bonds are generally riskier that low-yield bonds (that’s why the yields are high), but not always (the rating agencies are often reactive in their ratings, not proactive), plus high yield bonds can often offer asymmetric return opportunities that are skewed in your favor.

For your consideration, here is a list of 20 high yield bonds that are currently trading at discounted prices and offer interesting return opportunities.

Also for your consideration, here are three bonds from the list that we currently find very interesting.

1. CBL & Associates (CBL) 2023 Bonds, Yield: 7.5%

CBL is a retail shopping mall REIT, and it is one of those “battleground” equity ideas where investors argue passionately on both the “buy” and “sell” sides of the isle (For example, bull Rida Morwa and his team have been beating the table for months about the attractiveness of CBL equity here and here). We have no interest in owning CBL’s 16.8% dividend yield equity, but the bonds are interesting to us.

What’s interesting to us about the bonds, is that despite all the turmoil in the equity space (CBL equity is down about 80% in the last 5 years), the bonds have held up relatively well until the last week whereby they’ve just finally sold off (they currently trade at around 90 cents on the dollar as shown in the following chart).

CBL announced dismal earnings earlier this month and the equity sold off again, and importantly Moody’s just finally cut the credit rating to “junk” status. However, per managements earnings call, when asked about debt covenants, CFO Farzana Khaleel explained:

We still have plenty of room. The lines of credit, similarly, we have plenty of room. So I don't - when we do add - when we pay off a loan and added to the unencumbered pool, it gives us more capacity. So I don't necessarily think that we have any concern that we are hitting any of these metrics

Yes. Our debt level has come down. We're at $4.7 billion. A year ago, we were at $4.9 billion. So yes.

For 2018, the debt number will come down by the fact that we'll give back Acadiana Malls, that's $125 million. And amortization brings the debt level down. So it does come down, yes. And it will continue to go down, particularly with the amortization. We have all $50 million in amortization each year.

In our view, CBL debt is now very interesting after the credit rating downgrade (finally), the recent sell-off (a lot of institutions must sell when a bond falls below investment grade--thereby contributing to the recent sell-off), and management’s continued focus on improving. Said differently, these bonds offer an attractive yield and may actually have more upside potential than down at this point. These bonds are worth considering, and we are watching them closely.

2. Teva Pharmaceutical (TEVA) 2022 Bonds, Yield: 4.9%

Teva develops and markets generic and specialty medicines, it offers a 4.1% dividend yield, and the stock price is down about 70% in the last 30 months. The company has struggled in recent years considering it’s had some pipeline missteps, its branded segment is shrinking, and it faces a lot of low-cost competition. However the bonds are interesting…

With only a 2.95% coupon, the yield on these bonds has currently risen to over 4.9% as the price has fallen, as shown in the above chart. However, despite the decline, there are reasons to believe this company will improve, and bondholders will continue to receive coupon payments and capital appreciation as the bond price will eventually recover to par (it traded over par as recently as mid-2017).

For example, just a few days ago we received news that Warren Buffett’s Berkshire Hathaway has taken a position in the equity (which caused the equity share price to jump significantly).

And aside from Buffett, Teva does have continuing strong revenues, and opportunities to improve its debt and earnings via its large operating scale and resources. According to CEO Kaare Schultz during last week’s earnings call:

“we're deleveraging and reducing our debt on an ongoing basis.”

We suspect the bonds are far safer than their discounted price suggests.

3. Energy Transfer Equity (ETE) 2023 Bonds, Yield: 4.9%

If you’re not comfortable with the risks of owning shares of Energy Transfer Equity, you might consider the lower risk bonds, currently offering a 4.9% yield and trading at a discounted 97 cents on the dollar (these bonds were trading at a premium earlier this year).

The company owns interests in energy assets (crude oil, natural gas, natural gas liquids) through 100% ownership interests in Energy Transfer Partners (ETP) and Energy Transfer LNG.

The bonds sold off modestly this year as the market sold off and after a negative article is the Wall Street Journal on February 8th...

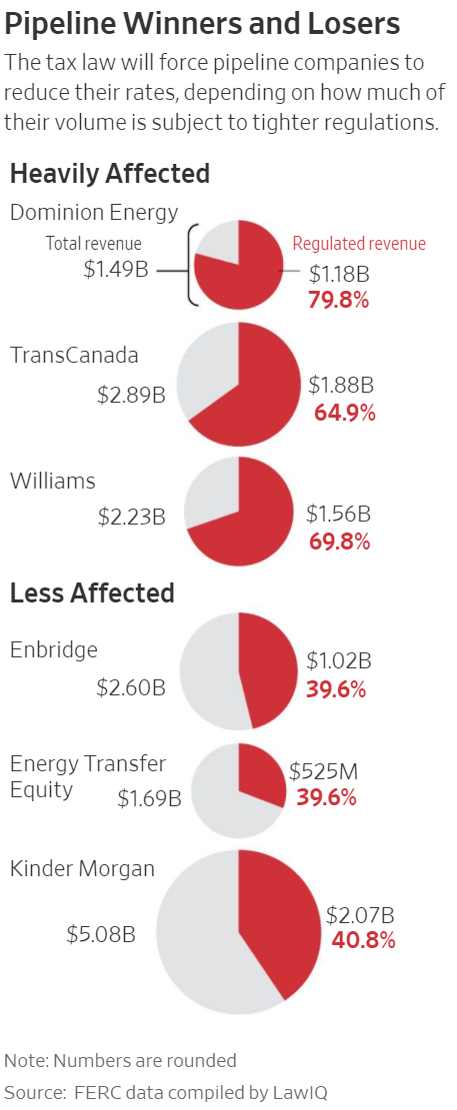

We believe fears and the sell-off are overblown with regards to the equity and especially with regards to the debt sell-off. Even the article itself suggested Energy Transfer Equity would be less affected than other companies, per the following graphic.

In our view, these 2023 bonds are safer than their 4.9% yield suggests, the fears are overblown, and the recent sell-off creates an attractive discounted price for new fixed income buyers to consider.

4. Ferrellgas Partners (FGP) 2020 Bonds, Yield: 13.9% Yield

We own these bonds in our Blue Harbinger CVI portfolio, and we believe they continue to be attractive for new purchasers.

The price of these bonds has perked up nicely so far this because the latest spat of cold weather across the US will help revenues for this propane distributor. We believe these bonds have continued price appreciation potential, in addition to big coupon payments. We've provided more information on Ferrellgas in this recent members-only article.

5. Teekay (TOO) 2019 Bonds, Yield: 6.3% Yield

Teekay Offshore Partners is a provider of marine transportation, oil production, storage, long-distance towing and offshore installation and maintenance and safety services to the offshore oil industry. We recently wrote about the attractiveness of Teekay’s preferred shares (TOO-B) in this article, however, we also believe the bonds are attractive too for many of the same reasons (plus the bonds are safer because they’re higher in the capital structure).

Our basic thesis on Teekay is that the market is incorrectly extrapolating recent bad news, and missing the supply and demand market cycle forces that will drive this company’s value (and safety) higher. The economy is strong, and these Teekay bonds will benefit.

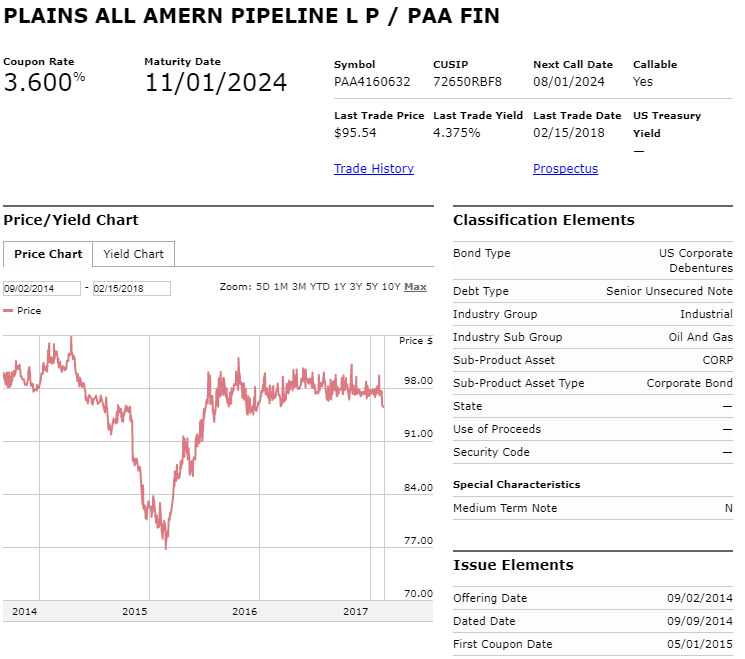

6. Plains All American (PAA), Yield: 4.4%

Plains bonds are another example of energy sector bonds that have incorrectly sold off with the recent market pullback and especially the negative Wall Street Journal article on February 8th.

The recent pullback on these bonds isn’t as sharp as some of the others, but they are trading at a discount to par, and they offer attractive coupon payment if you’re looking for relatively lower risk income that’s far better (higher) than a US treasury bond (for example, a five year treasury currently yields only 2.6%). If you don’t know, Plains owns and operates midstream energy infrastructure and provides logistics for crude oil, natural gas liquids (NGL), natural gas and refined products. The company was recently upgraded by Morgan Stanley.

Technical Trading Ideas: Stock Exchange

In addition to fundamentals, we pay attention to short-term technical indicators when entering new positions. For example, Valeant was on our list of 20 bonds above, and it’s one we follow from both a debt and equity standpoint. For more information on Valeant’s recent stock price technicals, check out Jeff Miller’s Stock Exchange report from this week: Were You Stopped Out? We help Jeff edit this weekly report, and Valeant’s stock was covered. We also have more to say about Valeant’s bonds later in this report.

More Perspective on the Market:

Outside of Blue Harbinger, we manage investment accounts for individuals and institutions. And these in-person interactions often provide very good perspective for the things we write about at Blue Harbinger. For example, here is the feedback we gave to a long-term investor a week ago when asked about the sharp market sell-off.

“The market did have the biggest volatility in years over the last few days! When that happens, a lot of people try to get clever with their “buys” and “sells,” and that’s when a lot of costly mistakes get made! People often end up selling everything and then they miss out on the subsequent rebound. You guys are back in the positive, and the best thing to do is remember you’re in it for the long-term, and you’re going to do better than all the dummies that sold everything out of fear yesterday.”

In our view, the perspective provided in the above quote also corroborates well with the technical trading article referenced earlier (Were You Stopped Out?).

Case Study: Valeant (VRX) Bonds

Valeant bonds were among the 20 ideas listed in the table earlier in this report. We also covered Valeant’s equity, briefly, from a technical standpoint, as described earlier in this report (i.e Were You Stopped Out?). However, we believe the strong performance of Valeant’s bonds over the last year is a good case study.

For example, we contribute research and portfolio management services to a private investment vehicle, and Valeant bonds have been one of the more interesting investment ideas within that fund, as described in this Barron’s video and this CNBC video. More specifically, the videos provide some very good ideas about what to look for when investing in high yield bonds.

Conclusion:

High yield bonds are risky. And they are not for everyone. However, if you’re interested in wading into this space, there are some very interesting opportunities to pick up attractive yield, and price appreciation, with risk-versus-reward profiles that are often skewed in your favor.