Perhaps one of the most overused analogies from all of sports (because it's so good) is from legendary hockey player Wayne Gretsky: "I skate to where the puck is going to be, not where it has been." This week's Blue Harbinger Weekly shares an attractive, growing, opportunity, that is becoming increasingly tempting as the shares have sold-off. This is one that backward-looking industry professionals may never see coming, until it's too late...

If you are looking for a high-income opportunity, this investment idea is not for you, and you can stop reading right now (unless you're considering selling income-generating put options on this investment, but that is a discussion for another day).

Grubhub (GRUB), Yield: 0.0%

Grubhub (GRUB) is a third-party food delivery service, where orders are placed online, and then the food (from your choice of many different restaurants) is delivered to your home, offices, or where ever else you want it. To many grown-ups, this service may sound like a ridiculous idea that will never go anywhere. But millions of millennials believe this is a fantastic service that provides convenience and saves time. What's more, Grubhub is growing like wildfire, and there is an enormous amount of room for Grubhub to keep growing, according to many analysts forecasts. Plus, for those of you who are "dip-buyers," the shares have recently sold-off from over $120 to under $105.

Stock Price: $105 MktCap: $9.4B PEG (Fwd): 1.1x Fwd P/S: 9.7x

Div Yield: 0.0% Fwd P/E: 59.4x EV/EBITDA (Fwd): 35.1x

Bull Case:

- Grubhub is growing rapidly by partnering with many new restaurants (both independent and chain restaurants), by acquiring smaller competitors (such as Eat24, Foodler, and LABite), and through strong advertising. Also, the total addressable market for 3rd party food delivery is growing and evolving rapidly.

- Grubhub is the leader in the market, it enjoys first mover advantages, and it has a strong brand name.

Bear Case:

- Street estimates for Grubhub’s future share of TAM seem very aggressive. Grubhub’s valuation is high as the market continues to factor in very high future growth rates.

- Competition (and potential competition) from large competitors (e.g. Square/Caviar, UberEats, Amazon) poses a risk. Grubhub could eventually become a buyout target for a larger FinTech player.

A Summary of the business and the industry

Founded in 2004, Grubhub provides an online takeout food platform for consumers, or diners, and restaurants. The firm generates revenue by charging restaurants a commission based on each order amount. It also charges consumers a delivery fee for orders where the firm handles the delivery. Grubhub has over 50,000 restaurant partners.

The Company has a powerful two-sided network that creates additional value for both restaurants and diners as it grows:

- For restaurants, takeout enables them to grow their business without adding seating capacity or wait staff. Advertising for takeout, typically done through the distribution of menus to local households or advertisements in local publications, is often inefficient and requires upfront payment with no certainty of success. In contrast, Grubhub provides restaurants on its platform with an efficient way to generate more takeout orders.

- For diners, the traditional takeout ordering process is often a frustrating experience—from using paper menus to communicating an order by phone to a busy restaurant employee. In contrast, ordering on Grubhub is enjoyable and a dramatic improvement over the “menu drawer.” The Company provides diners on the platform with an easy-to-use, intuitive and personalized platform that helps them search for and discover local restaurants and then accurately and efficiently place an order from any Internet-connected device.

Business Getting Better:

Grubhub’s business is getting better as sales grow rapidly as it aggressively expands to more independent restaurants, chain restaurants (such as Yum Brands) and grows through acquisitions (such as Eat24, Foodler, and LABite).

The company’s growth strategy includes:

- Growing the Takeout Marketplace: The Company intends to continue to grow the number of independent restaurants and restaurant chain outlets in existing and new geographic markets by providing them with opportunities to generate more takeout orders and by offering delivery services.

- The Company intends to continue to grow the number of diners and orders placed on the platform primarily through word-of-mouth referrals and marketing that encourages adoption of the Company’s ordering platform and increased order frequency.

- Enhance the Platform. The Company plans to continue to invest in its websites and mobile products and its independent delivery network, develop new products and better leverage the significant amount of order data that the Company collects.

- Deliver Excellent Customer Care. By meeting and exceeding the expectations of both restaurants and diners through customer service, the Company seeks to gain their loyalty and support for the platform.

- Pursue Strategic Acquisitions and Partnerships. The Company intends to continue to pursue expansion opportunities in existing and new markets, as well as in core and adjacent categories through strategic acquisitions and partnerships that help accelerate the growth of the takeout marketplace.

- On October 10, 2017, the Company acquired all of the issued and outstanding equity interests of Eat24, LLC (“Eat24”), a wholly-owned subsidiary of Yelp Inc. and provider of online and mobile food-ordering services for restaurants across the United States.

- On August 23, 2017, the Company acquired substantially all of the assets and certain expressly specified liabilities of A&D Network Solutions, Inc. and Dashed, Inc. (collectively, “Foodler”), a food-ordering company headquartered in Boston.

- On May 5, 2016, the Company acquired all of the issued and outstanding capital stock of KMLEE Investments Inc. and LABite.com, Inc. (collectively, “LABite”), a restaurant delivery service.

- In February 2015, the Company acquired the assets of DiningIn.com, Inc. and certain of its affiliates (collectively, “DiningIn”) and the membership units of Restaurants on the Run, LLC (“Restaurants on the Run”),

- In December 2015, the Company acquired the membership units of Mealport USA LLC d/b/a Delivered Dish (“Delivered Dish”).

- On September 14, 2017, the Company acquired certain assets of OrderUp, Inc. (“OrderUp”), an online and mobile food ordering company and wholly-owned subsidiary of Groupon.

Risks and Bear Case:

Grubhub faces a variety of risks including:

- Competition from larger companies (e.g. Square and Caviar, Amazon, UberEats).

- Pressure to lower commissions and/or delivery rates as competition increases.

- The lack of exclusivity deals with restaurants make switching costs low.

- The TAM may be smaller than estimated.

- Grubhub may not be able to expand into less densely populated areas with the same high margins.

Brief History of the Company and its founding:

Grubhub was founded in 2004 by Mike Evans and Matt Maloney, looking for an alternative to paper menus. Two years later, in 2006, Maloney and Evans won first place in the University of Chicago Booth School of Business's Edward L. Kaplan New Venture Challenge with the business plan for Grubhub. After winning multiple rounds of financing, Grubhub went public in April 2014 and trades on the New York Stock Exchange. Founder Matt Maloney is current CEO.

Valuation:

Competition:

Grubhub has been acquiring much of its smaller competitors to fuel growth, such as Eat24, Foodler, LABite and OrderUp. However, Grubhub has been facing growing competition from Uber Eats, DoorDash and others, as shown in the TAM section below. Also, switching costs are low (because there are no exclusivity deals), and competition may eventually eat into margins.

A March 2018 market share report indicates that Grubhub remains the national market share leader among 3rd party delivery providers at ~50%, down from ~60% in August 2017 (see Exhibit 1). Uber Eats is the only competitor showing sizable market share gains expanding to ~21% from 12% over the same time period, narrowing the gap primarily in the lower tier top 22 markets.

Total Addressable Market:

Grubhub’s Gross Food Sales are forecast to exceed $15.5bn in 2023 versus 2017 sales of $0.76 billion. Delivery is expected to account for 15% of all restaurant sales by 2023, and Grubhub is forecast to have 12% of the 15% (and Gross Sales approaching ~2% of all domestic restaurant spending by 2023).

Management- (Capital Allocation): Grubhub does not pay a dividend, has engaged in only a very small amount of share repurchase, and the debt servicing outflows are very small when compared to its cash. The company has been spending on acquisitions. For example, $333.3 million in 2017, $65 million in 2016, and $74 million in 2015.

Catalyst:

The catalyst is continued rapid growth in the online 3rd party food delivery market, which is expected to achieve a 35% CAGR over the next five years.

Special/Unique:

Grubhub is the market leader, the first mover (in many of its markets), and has a strong brand name.

Quality:

Delivering excellent customer care is a strategic growth priority for Grubhub, and will be a key to success. Grubhub continues to build a strong brand.

Insider Activity:

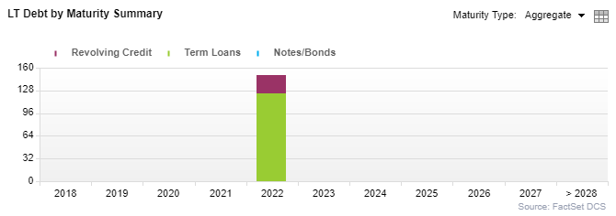

Capital Structure:

Conclusion:

If you are looking to add some growth to your portfolio, you might consider initiating a small position in Grubhub. The shares are increasingly attractive, and we're tempted to pull the trigger on a buy soon. Grubhub is one of those industry disruptors that many people never see coming. Many millennial-aged people don't know how to cook, and feel they don't have time to go the grocery store, or even to a restaurant to pickup carryout. Grubhub continues to grow rapidly, and there is a lot more room for this company to run. And perhaps what's best about Grubhub, is it's starting to look like one of those huge secular trends that can forever change an industry--and we're still in the early innings. Enormous potential for Grubhub.