Annaly Capital (NLY): 11.6% Yield

Annaly Capital Management (NLY) is a real estate investment trust (“REIT”), that invests in securities that are tied to the residential and commercial real estate market, in order to generate stable income. In this article, we analyze the company’s business model, growth and income prospects, balance sheet, risks, and finally conclude with our opinion on whether (and how) income-investors might want to consider investing in this stock.

Overview:

Annaly Capital Management’s core business is a mortgage real estate investment trust (mREIT) that invests in and finances residential real estate related investments. Its portfolio primarily consists of mortgage-based securities that are created out of a pool of similar type of mortgages from banks through the process of securitization. The company has overtime diversified into other asset classes as well also detailed below.

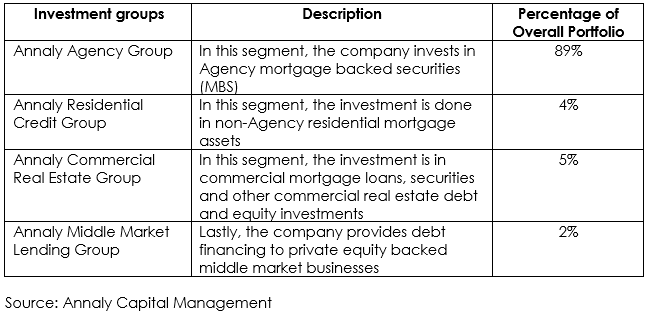

The company operates through four investment groups:

What are mREITs?

Mortgage REITS or mREITS as they are commonly referred to are entities that hold mortgages or mortgage backed securities. The financing of the MBS portfolio primarily happens through short term debt, especially in the case of residential mREITS. These entities often tend to tap the highly liquid and large repo market for short term funding. Since short term debt interest rates are lower than the yield on longer term MBSs that these entities hold, mREITs earn a positive interest margin. Usually, short term debt is floating and tied to LIBOR while MBS on the asset side has a large fixed rate component. As a result, in a rising interest rate environment, their net interest margins shrink and vice versa.

Annaly’s business model

Annaly is a leading mREIT that came into existence in 1997. 89% of the company’s assets are invested in agency residential mortgage backed securities. Underlying mortgages that these securities represent are guaranteed by US government sponsored enterprises (GSEs) Fannie Mae and Freddie Mac or Ginnie Mae, and as such there is negligible risk of a default given the quasi-government nature of the backers. This is the reason the company’s leverage ratio is 7:1. In other words, for every 1 dollar in equity, the company has $7 in debt. Low net interest margins on highly secured assets but high financial leverage at the same time combines to produce strong risk adjusted returns for equity holders.

Measured diversification of the portfolio underway

After the great recession (‘08 - ’09) and systemic issues that surfaced with Fannie Mae and Freddie Mac, the company changed its strategy from focusing just on the agency residential MBS market to include non-agency residential, commercial real estate and middle market assets. In 2014, 96% of the company’s assets were in Agency residential segment while in 2018 this number reduced to 89%. The charts below show that nearly 20% of the company’s equity capital was deployed in non-agency segments in 2016 and this number has increased to 28% in 2018. While addition of businesses such as middle market lending adds some pro-cyclicality to the company, these businesses will also reduce the volatility in net interest margins the company has experienced in the agency business around fed rate cycles.

Source: Annaly Capital Management

Temporary interest rate volatility has caused some earnings erosion

During the second quarter of 2019, the company as well as its peers faced increasing costs of funds as a result of higher repo costs as well as Agency MBS spreads widening due to expectation of increased prepayment activity as 30-year mortgage rates drop and stay below 4%. Essentially, borrowers that availed mortgage loans in 2018 will be tempted to refinance their loans given fall in 30-year mortgage rates from nearly 5% in 2018 to 3.5% currently, impacting yield that MBS holders earn. Additionally, inversion in the yield curve has also impacted short term borrowing rates.

Source: Annaly Capital Management

Reduced net income margin spread impacted earnings and dividends. In fact, the company cut its quarterly dividend rate for the first time since 2014 from 30 cents per share to 25 cents per share. Unfortunately, the core EPS for the second quarter was 25 cents and hence further erosion in EPS will translate into reduced dividend unless the company chooses to increase financial leverage. Having said that, even if there is another cut in the near term, we expect it to be temporary in nature.

Medium to long-term view positive as a dovish Fed is good for Annaly’s earnings

Since its founding in 1997, the company has seen two recessions, a tech bubble burst and the great recession in 2008 which dislocated the very core of the company’s segment. Fannie Mae and Freddie Mac had to be bailed out due to the extent of losses in the housing market and the short-term credit markets froze for many companies as a result of the Lehman bankruptcy. The business of Annaly during both times did quite well on the other hand. The company’s core business model of agency backed MBS has strong counter cyclical elements as when the fed reduces interest rates, the company’s cost of funds (largely floating) falls more than the yield on its assets (largely fixed). Not surprisingly, during the period of the great recession, the company actually saw its margin spread expand and dividends increase over 300% as can be seen below.

Source: Annaly Capital Management

Valuation appealing

As a result of the recent volatility in interest rates and cut in dividends, the company is currently trading below its median price to tangible book value since 2017. We believe the valuation discount should normalize once the interest volatility subsides and as fed interest rate cutting cycle takes hold.

Source: Blue Harbinger Research, Seeking Alpha

Share repurchases & recent insider buying highlights value

The company earlier this year announced up to $1.5B share repurchase program that will be executed by December 31, 2020. The repurchase program accounts over 12% of the current market capitalization of the company. Additionally, the management team has bought nearly $5.2M in stock in the recent months further highlighting value in the stock.

Risks

Stress in the short-term funding market could erode earnings

As indicated before, the company’s business model is highly reliant on access to short term funding at reasonable rates. Stress in the system could further increase costs of repo financing which will have a negative impact on the company’s earnings power. While the company does undertake hedging activity, it is usually not enough to totally insulate the company from the negative impact.

Diversification strategy could fail

The company is entering and expanding into areas that it has limited experience in for the purpose of diversification. Failure to appropriately consider risks associated with the new businesses could put pressure on the balance sheet. Having said that, so far the company has been measured with its expansion. For example, on the middle market lending side, the majority of its portfolio is made up of safer first lien secured loans.

Conclusion

There are not many dividend-paying companies that see growth in dividends and cash flows as a federal reserve interest rate cutting cycle takes centerstage (because that often happens when the economy is going south). The countercyclical nature of the Annaly’s business, coupled with its attractive valuation, makes this an attractive addition to an income-focused portfolio.

Note: we do not currently own shares of Annaly, but it is on our watch list. We do currently own another mortgage REIT, New Residential (NRZ). You can view all of our current holdings here.