Despite a variety of headwinds (such as a declining coal business, a challenged auto industry, tariffs, unexpected competition from trucking, rising debt levels and network congestion), Union Pacific (UNP) continues to generate healthy cash flows, whereby the excess is prudently returned to shareholders via growing dividends and share repurchases. Plus, based on growth expectations, the shares have steady and continuing upside potential. This article reviews the business, risks, strategic initiatives, cash flows and valuation, and then concludes with our opinion about investing.

Overview:

Union Pacific (UNP) is one of America’s most recognizable railroad companies. It links 23 states in the western two-thirds of US, and it provides a critical link in the global supply chain. The company has a base of roughly 10,000 customers with a diversified business mix including agricultural products, energy, industrial and premium (see chart below). UNP serves many of the fastest-growing US population centers, operates from all major West Coast and Gulf Coast ports to eastern gateways, connects with Canada's rail systems and is the only railroad serving all six major Mexico gateways.

And after generating $21.4 billion in freight revenue in 2018, the company has already generated $15.4 billion so far this year. The company’s four primary operating groups are described below:

Premium: Premium franchise includes three segments - international intermodal, domestic intermodal, and finished vehicles

Industrial: The industrial group includes categories such as construction, industrial chemicals, plastics, forest products, specialized products (primarily waste, lime, salt and government), metals and ores, and soda ash

Agricultural Products: Transportation of grains, commodities produced from these grains, fertilizer, and food and beverage products

Energy: The company’s energy shipments are grouped into the following three categories - coal, sand, and petroleum, liquid petroleum gases and renewables

The company’s share price has performed extremely well in recent years, see chart below. However, the business does face increasing risks (as described in the next section).

Risks

UNP’s business faces a variety of risks including a declining coal business, a challenged auto industry, tariffs, unexpected competition from trucking, rising debt levels and network congestion.

With regards to coal, that’s an industry that continues to be in secular decline. It has historically been a big part of UNP’s business, but it declined again in the most recent quarter. According to Kenny Rocker, Executive VP, during the most recent quarterly call:

“Coal and coke volume was down 17%, due to the softer market conditions resulting from lower natural gas prices and weak export demand.”

And regarding the auto industry (which falls under UNP’s “premium” segment), it has been facing more near-term challenges. Finished vehicle sales declined in the most recent quarter, and according to Kenny Rocker during the quarterly call:

“Although, we remain encouraged by the tentative agreement between General Motors and their autoworkers, we are still keeping a close watch on it and the associated volume impact.”

Tariffs are also a risk for UNP, considering its access to strategic west coast ports means they are involved with the US-China trading supply chain. Again, according to Rocker:

“International intermodal volume was down 12% during the quarter, reflecting weak market conditions related to trade uncertainty, escalating tariffs, and challenging year-over-year comparisons, driven by accelerated shipments seeking to avoid tariff in September 2018.”

Further still, competition from trucking is now posing new challenges. Once thought to be non-threatening, trucking has extra capacity. And according to UNP’s CEO, Lance Fritz:

“Trucks are pretty darn loose right now, which means the capacity is readily available and widely reported that truck pricing has been dropping. So we are looking forward to seeing a bottom of that and then an upturn.

And I anticipate that will occur. I don’t know when. But you see truck orders substantially down, you see production starting to turn negative and that all bodes well for competition as we look forward.”

UNP’s rising debt levels are another metric to keep an eye on. For example, within the last two years, UNP announced changes to its capital structure in that it would be increasing its targeted debt-to-EBITDA ratio to 2.7x (up from its historic average of around 2.0x). As of September 2019, the company’s adjusted debt stood at $28.0 billion, with debt-to-adjusted EBITDA ratio being 2.6x. Leverage is expected to pick up further as the company executes it $20 billion share repurchase program (more on this later), however, UNP is still comfortably in compliance with its debt-to-EBITDA coverage covenants, which allow UNP to carry up to $38.8 billion of debt.

Also worth considering, UNP’s average interest rate of ~4.2% is healthy. And considering the business generated roughly $5.1 billion in free cash flow over the past twelve months, refinancing on favorable terms should not be even remotely problematic (UNP has a strong cash position). And while the debt level is not problematic at this time, it’s worth keeping an eye on.

Finally, network congestion is another challenge UNP has been dealing with, and it has been impacting the company’s operating margins. However, the company has somewhat reently launched its “Unified Plan 2020” which is addressing this challenge among others, as we will cover in the next section.

Unified Plan 2020

After suffering from widespread congestion on its network that slowed down trains resulting in inefficiencies, in October 2018, UNP initiated its Unified Plan 2020 directed at lowering the company’s operating ratio (“OR”) - a closely watched metric that measures the percentage of revenue consumed by expenses. The company adopted an operating plan that implements Precision Scheduled Railroading (“PSR”) principles, first implemented by late railroading legend E. Hunter Harrison at Canadian Pacific Railway (“CP”) and Canadian National Railway (“CN”) which saw multiple positive results in both companies in the form of lower operating ratios, improved service, record amounts of reinvestment into networks, as well as creating significant shareholder value.

The strategy involves a significant overhaul where the company is running fewer, longer trains, sorting railcars less frequently and reworking operations across its network. Other freight railroads, including Norfolk Southern Corp. and Kansas City Southern, are on similar paths, mirroring the changes that Mr. Harrison began implementing at CSX Corp, after the success at CP and CN. The company expects the benefits of Unified Plan 2020 to result in 60% OR by 2020, with an ultimate goal of 55% OR. The key principles of Unified Plan 2020 cited by UP include:

Shifting the focus of operations from moving trains to moving cars

Minimizing car dwell, car classification events, and locomotive power requirements

Utilizing general-purpose trains by blending existing train services

Balancing train movements to improve the utilization of crews and rail assets

Results So Far (Unified Plan 2020)

Improvement in operational efficiencies:

It has been a year since the company implemented the Unified Plan 2020, and key performance indicators have improved significantly. Continued improvement in asset utilization and fewer car classifications led to a 20% improvement in time spent by freight cars at terminals and a 10% improvement in the daily miles covered by each car, compared to Q3 2018.

Locomotive productivity improved 18% compared year-over-year, as efforts to use the fleet more efficiently enabled the company to park units (~2,600 locomotives stored as of September). Driven by a 13% decrease in workforce levels, workforce productivity increased 4% year-over-year. The on-time performance of the company’s cars improved by 10 points year-over-year driven by increased freight car velocity and lower terminal dwell.

As a result, the company’s OR improved to 59.5% as compared to 61.7% a year ago. This represents an all-time best quarterly OR for UNP and the second consecutive quarter with a sub-60% operating ratio.

Substantial cost cutting:

In April 2019, the company halted construction of a $550 million facility in Brazos, Texas which was the largest capital project in the 156-year-old company’s history, meant to help with the expected growth in rail cargo moving through the region. UNP also closed two other train-sorting yards, further embracing the precision railroad strategy that calls for fewer, longer trains. Citing the challenging environment, UNP cut its annual capital spending budget to $3.1 billion from $3.2 billion.

Further UNP is shrinking its workforce (in part due to efficiencies such as running fewer locomotives), targeting 15% fewer employees in the fourth quarter as compared to last year.

Such cost cutting measures are helping the company sustain profits during challenging times, which we view as prudent. And as of the end of Q3 2019, UNP reiterated its guidance of achieving sub-61% OR for full year 2019 through $500 million of productivity savings.

Cash Flow Remains Strong:

After generating free cash flow of ~$4 billion in 2016 and 2017, UNP’s free cash flow increased to $5.2 billion in 2018. And per Wall Street estimates, free cash flow is expected to stay stable at this level in 2019 (owing to economic conditions), but then rise to ~$6 billion by 2021 (thanks to expectations for higher margins, lower cash taxes and lower capital expenditures).

And as a result of the strong cash flows, the company has been able to return more cash to shareholders through share repurchases and increased dividends. UNP pays quarterly dividends which have been increased by 10% twice this year already, resulting in an annualized dividend of $3.88 per share at a yield of 2.3%. To quote CEO Lance Fritz (see Q3 2019 earnings call):

“We remain squarely focused on driving long-term shareholder value by appropriately investing in the railroad and returning excess cash to our shareholders through dividends and share repurchases.”

Also, as mentioned earlier, UNP remains in a very strong cash flow position relative to its debt levels.

Valuation:

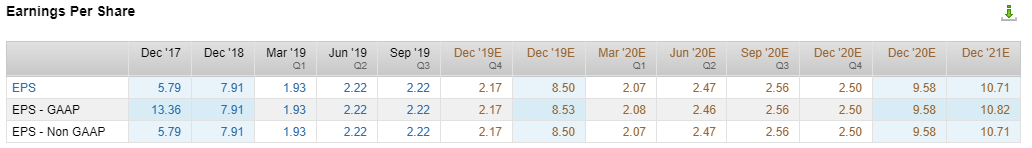

UNP shares remain reasonably valued in the near-term relative to historical and peer valuation metrics, as shown in the table below. However, based on continuing growth expectations (see Wall Street analyst estimates for forward EPS figures in the table below), the shares have continuing steady upside in the years ahead. For example, if the company were to achieve the Street’s 2021 $10.71 EPS estimate (which is not unreasonable), the shares could easily trade 30% higher with valuation multiples still remaining reasonable. And that is in addition to the company’s strong, growing, quarterly dividend payments to investors.

(Source: Factset)

Conclusion:

Despite the strong gains for UNP in recent years, we continue to own the shares because it is a strong and relatively steady cash flow generation machine. Plus, UNP has a history of prudently returning cash to investors via dividends and share repurchases. Further still, when auto worker strikes and trade tariffs get resolved (as well as when the company is able to further transition from more coal to more natural gas and alternative energy transportation), the business and shares will have further upward trajectory (not to mention, as excess trucking supply declines, that too will give the business and the shares an upward push). We appreciate UNP improving operational efficiency via the continued execution of its “Unified Plan 2020.”

In our view, if you are looking for a strong cash-flow, shareholder-friendly, dividend-paying business, with price appreciation potential, and an attractive economic moat (e.g. strategic railroad locations where new competition simply cannot gain share), Union Pacific is absolutely worth considering.