General Dynamics is increasingly attractive. Both revenues and earnings per share continue on an upward trajectory, yet the share price is down, thereby making this dividend champion look like a steal from a valuation perspective. This article reviews the business, the valuation, and the outlook, as well as an explanation for the discounted share price (including the “social irresponsibility” factor, among others) and concludes with our opinion about investing in this blue chip 2.4% yield global aerospace and defense company which has increased its dividend for 27 consecutive years running.

Overview:

General Dynamics is a global aerospace and defense company. Its broad portfolio of products and services include business aviation; combat vehicles, weapons systems and munitions; IT and C4ISR solutions; and shipbuilding and ship repair. According to FactSet (see table below) each of its three largest business segments contribute 23% of total revenues, with mission systems and combat systems contributing the other 30% (13% and 17%, respectively).

(source: FactSet)

Valuation:

General Dynamics share price hasn’t been keeping pace with the dramatic and ongoing increases in revenues and earnings per share, as shown in the following chart.

And beyond, revenues and earnings per share, General Dynamics is also starting to look like a steal on other valuation metrics too when compared to historical metrics, especially when you consider its growth trajectory and powerful return on invested capital.

(source: FactSet)

More specifically, here is a look at expected sales growth and the aggregate price target of the 23 Wall Street analysts covering the stock (they believe the shares have at least 20% upside, and they are notoriously too near-term focused thereby generally ignoring the even greater long-term value of companies such as General Dynamics).

(source: FactSet)

Dividends and Capital Allocation:

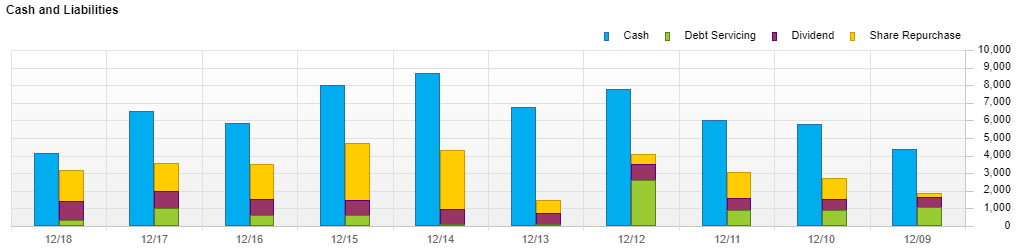

What’s further, General Dynamic is one of those very rare “Dividend Champion” stocks, meaning it has increased its dividend every year for 25+ consecutive year’s (27 in General Dynamics case). What’s more, General Dynamics is a very efficient allocator of capital, including not only raising its dividend, but also its return of capital to shareholder’s via share repurchases, its balance of debt and equity (it has a very strong A2 and A+ credit rating from Moody’s and S&P, respectively), and its extra cash left over for capex and growth, as shown in the following “uses of cash” chart.

(source: FactSet)

Competitive Advantages: Further still, General Dynamics has significant competitive advantages versus its peers and would-be competitors thanks to it scale and the high switching costs for its customers.

Healthy Margins: And even further, General Dynamics has worked hard to strengthen its operating margins under CEO Phebe Novakovic (who took the helm in January 2013) as shown in the following chart.

(source: FactSet)

Why Have the Shares Sold Off?

So perhaps you’re left wondering, if the business and the financials keep improving so dramatically, why have the shares been falling instead of rising? Three big things have contributed, in our view, as follows.

1. Wall Street is being overly skeptical about the causes of revenue growth

The easy narrative is to say that the markets still haven’t accepted that pro-military Donald Trump won the election in 2016, and he may win again in 2020. According to Morningstar Senior Equity Analyst, Chis Higgins:

“The U.S. defense budget will continue to grow, and the Trump administration's focus on naval shipbuilding, the nuclear triad, and army end strength will benefit General Dynamics.”

We say this is the “easy narrative” because you can see in our early chart that General Dynamics revenue was essentially flat during the Obama years, but immediately spiked when Trump won the election. But of course, there is a lot more to the story than that (especially considering spending contracts realistically cannot get approved overnight).

Another reason the market is skeptical of the dramatic revenue growth is because a significant portion of it came inorganically through the acquisition of CSRA, which closed during the second quarter of 2018. The transaction was valued at $9.7 billion (i.e. it was big) and is expected to improve General Dynamics IT segment. For example, it’s expected to be accretive to EPS and free cash flow starting this year, and to generated cost savings starting in 2020, so the jury is still out (i.e. the market is uncertain and taking a “wait and see / show me the money” approach).

Another reason the market is skeptical of the growth is because the expected increase in international sales (e.g. The UK and Saudi Arabia) is unproven, and particularly subject to the winds of politics (even though the Washington DC area, where General Dynamics is headquartered, remains a consistently growing area, government spending contracts are subjective to political winds).

2. Value stocks have been out of favor for way too long.

Unlike many periods throughout the history of markets, value stocks have been significantly underperforming their growth stock counterparts for a significant period of time, as shown in the following chart.

And as contrarians, we like this. We’re labeling General Dynamics a value stock because its valuation multiples are relatively low, and because it has a higher weight in the Russell 1000 Value index than it does in the Russell 1000 Growth Index. Plus, defense stocks are often considered value stocks anyway.

We could argue that growth stocks keep dominating because of the post-financial crisis highly stimulative meddling by the Federal Reserve (e.g. the QE’s and really low interest rates for a long-time), but even from a more objective valuation standpoint, the valuation gap between growth and value stocks is similar to where it was (very wide) when the tech bubble burst in the early 2000’s.

Further still, from this author’s perspective, when trying to decide where to allocate capital, it’s hard not to consider large blue chip value stocks considering REITs seem expensive, utility stocks have been unusually strong this year, and growth stocks have already come roaring back this year after Q4’s sell off. We’d always rather pick good stocks than make style bets, but large value blue chips are due for some outperformance sooner or later, and names like General Dynamic are going to keep making money practically regardless of what the overall market does.

3. Socially Responsible investors don’t like General Dynamics.

This third point is more speculative, philosophical, and less material, but Socially Responsible investors have been contributing to inefficiency in the market because they refuse to own “weapons” companies like General Dynamics. Years ago, there used to be a great blog post from Nobel Prize winner Eugene Fama featured on the Dimensional Fund Advisors website about the inefficiency of excluding “sin stocks” from an investment portfolio. I assume the post was removed from the website because Dimensional manages billions of dollars for institutional investment plans that mandate “socially irresponsible” stocks be excluded from their investment portfolios for “moral” purposes (such as “weapons” companies like General Dynamics). Said differently, it would not be “good business” for Dimensional to suggest to its clients that they might not be making the best investment decisions for their plan participants. If you’re curious, here are some thoughts and findings, including those from Fama, on the subject: Sin Stocks Revisited (spoiler alert: there is an alpha-producing anomaly for having exposure to sin stocks, but it’s even better explained by simply having exposure to the quality factor, such as owning the General Dynamics of the world).

Conclusion:

There are obviously risks to owing General Dynamics, including political headwinds (and tailwinds), as well as the fact that it’s just one stock subject to company specific idiosyncrasies. However, we believe it’s a risk worth considering so long as it’s consistent with your individual investment goals, and as long as you’re comfortable with the social responsibility considerations. More plainly, General Dynamics is a powerful cash generating machine, trading at an attractive valuation, with more healthy growing business on the horizon. It could benefit significantly if market wide sentiment makes the long overdue shift from favoring growth stocks to favoring value stocks, plus General Dynamics is the type of low beta blue chip that’s going to be profitable under practically any market conditions anyway. And oh, by the way, it returns lots of cash to shareholders via share repurchases and a healthy growing dividend that has increased every year for the last 27 years and counting.