All Blue Harbinger strategies delivered healthy gains in February, thereby continuing their long-term track records of outperformance. The strategies have been positioned correctly for the market rebound, and they are positioned correctly to achieve their long-term goals, ranging from attractive high income to powerful long-term growth. This report reviews performance (including specific holdings) and where we’re seeing the best opportunities going forward. Most importantly, as always, be opportunistic, but for goodness sake don’t lose sight of your long-term goals.

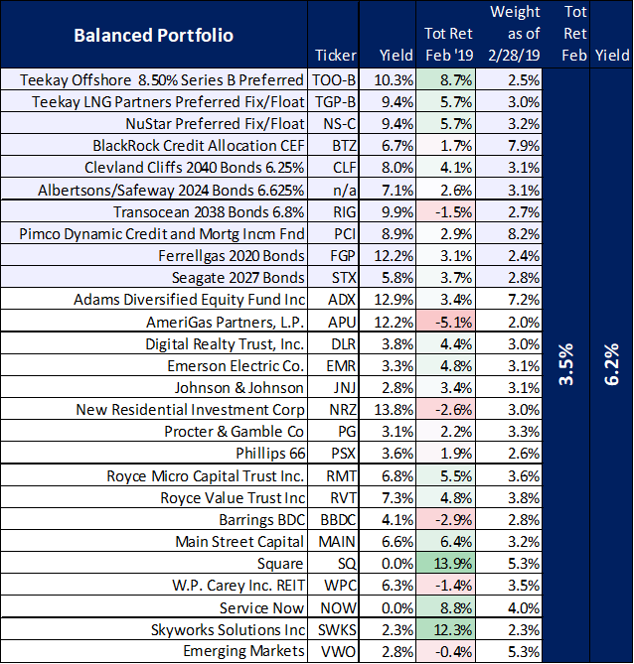

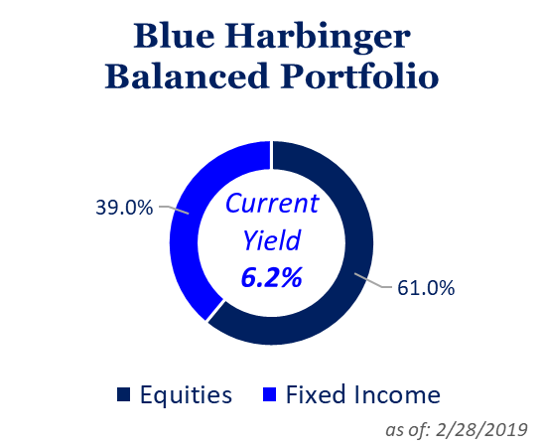

Holdings and Performance:

For starters, here is a look at the performance and holding of each of our Blue Harbinger strategies, which continue to deliver market beating performance.

And for perspective, here is a look at the recent performance of various market sectors and styles.

The Rebound Continues:

One of the key takeaways from the above broad market performance table is that the market is off to a great start in 2019 as the rally continues. In case you have short-term memory problems (we don’t think you do), the market performed absolutely terribly in the fourth quarter of 2018 (see chart below), and that’s when a lot of investors made a lot of mistakes (mainly fear-induced bad decisions).

For example, many fearful investors sold their stocks in a fear-driven attempt to avoid further market declines. However, as is usually the case, all they really did was miss out on the rebound. It sounds ridiculous and cliché, but to paraphrase Warren Buffett, be fearful when others are greedy, and be greedy when others are fearful. Investors were fearful at the end of 2018.

Know Your Goals, Be Opportunistic:

The ugly sell off during the fourth quarter provided plenty of opportunities for investors to be opportunistic, but for goodness sake that doesn’t mean ditching your long-term investment goals. For example, if you are an income-focused investor, the fourth quarter sell-off provided attractive opportunities to pick up attractive stocks at discounted prices, but that doesn’t mean ditching all your carefully selected long-term holdings and betting the farm on volatile FANG stocks or risky biotech startups. It does mean doing a little buying if you have extra cash in your account (perhaps from unreinvested dividends).

A Little Advice:

We say it all the time, and we’ll say it again. No one, and that means absolutely no one, knows where the market is going tomorrow, next week, or even next month; but over the long-term it’s very likely going higher, and probably much higher. Buying and holding attractively valued investments for the long-term is your best chance for success. It avoids expensive (often hidden) transaction costs, trading fees, proselytizing charlatans, costly mistakes, and the chances of sitting in cash (instead of being invested) when the next big rebound comes (like many investors have unfortunately done so far this year).

So Where Are We In The Rebound?

The 2019 rebound has been very powerful thus far, but we’re still not back to the levels we were at before. Further, forward price-to-earnings ratios are below where they were, and credit spreads (a measure of perceived risk) are not absorbitant (and they’ve been coming down).

From a rudimentary standpoint, and considering unemployment remains low and GDP remains strong, this rebound likely still has legs. Plus, there are catalysts on the horizon, such as continuing optimism to US/China trades talks and stock specifics.

Let’s Talk Stocks (and Bonds and Options):

Here is some commentary on our biggest percentage movers among our current holdings over the last month.

Paylocity (PCTY):

Paylocity was up more than 23% in February. We’ve owned it for several year as its price has increased dramatically, and we believe it has a lot more dramatic price appreciation potential in the years ahead. The company basically does cloud-based payroll processing (and other HR functions) for small and mid-sized companies. Paylocity knows they can’t realistically steal much business away from the big kid on the block (Automatic Data Processing (ADP)) because once a company sets up payroll processing it become very hard to switch so they almost never do. However, Paylocity is also smart enough to recognize that smaller business that are just starting out will often choose Paylocity because it’s less expensive and in many ways better (Paylocity’s cloud-based solution has many great advantages such as convenience and ease of use), and the business is also sticky (once a company chooses Paylocity, they almost never switch). And Paylocity is also smart enough to realize that many small companies eventually become big companies thereby generating much more revenue for Paylocity. And that’s why Paylocity is such a great long-term investment opportunity… it has tons of room for continuing long-term growth.

Paylocity’s profitability is small right now because they spend so much on sales and marketing to attract new customers. However that generates a fantastic long-term return on investment because customers rarely leave. One day, when Paylocity is all grown up it will stock spending so much on sales and marketing, and it will become an enormous cash cow. It’s a volatile stock, as we saw it sell off during the fourth quarter, but we’re willing to endure the volatility in exchange for the huge price appreciation potential (plus we hold it within a broadly diversified portfolio, which reduces our overall volatility anyway).

Zillow Group (ZG):

Zillow was up 19% in February as the market rebounded but also because the company announced co-founder Rich Barton would return to the CEO role. Zillow is another growth stock as it is in the early innings of a new initiative known as instant offers whereby they allow homebuyer and sellers to use the company’s industry leading network of home information to buy and sell homes entirely online. The strategy is still unproven, but it’s new and staring to gain traction, and it has enormous long-term growth potential. Plus, the company’s existing advertising business is strong and growing thanks to Zillow’s high and focused internet traffic that results in real estate agents willing to pay up for valuable advertising space.

Automatic Data Processing (ADP):

Simply put, ADP is a blue chip bet on the US (and global) economy. It continues to trade at an attractive price and it was up 9.4% in February. In the same generally industry as Paylocity (which we discussed earlier) ADP is the very well established leader in the payroll processing industry. And virtually all the fortune 500 companies are willing to pay up big time for all of ADP’s bells and whistles. And this is extraordinarily “sticky” businesses because there is very little chance ADP customers will ever switch to someone other than ADP (simply way too much risky re-word and headaches… plus no company wants to mess with people paychecks/direct deposits). ADP yields 2.05%, and the dividend has been steadily increasing for annually for decades. As a general rule, one of the safest dividends is the one that was just increased.

Skyworks (SWKS):

Double panic during Q4 made Skyworks doubly attractive as it gained 12.3% in February (it was up significantly in January too). Skyworks is a big chip supplier to Apple, and as Apple had been weak on China concerns, so too was Skyworks weak. Apple weakness and the q4 selloff made Skyworks doubly attractive from a valuation standpoint as fearful investors wrongly hit the sell button. On a go forward basis, Skyworks remains attractive because its continuing long-term growth (Skyworks chips are a staple of a long-term secular industry growth trend) is underappreciated by Moody Mr. Market. Apple’s growth prospects may not be as powerful as they once were, but industry growth remains strong, and Skyworks will continue to be a staple building block of that growth.

Teekay Offshore Preferred Series B (TOO-B)

Yield: 11.2%

The preferred shares of this marine transportation/shipping company gained 8.7% in February, but they still trade at an attractive (below par) price. The business and industry are healthier than they were a few years ago, and the backing by Brookfield gives us added confidence. We also appreciate that the market may not be giving the company enough credit for its evolving shuttle tanker business. Further, a resolution to the trade spat between US and China, as well as stabilization in energy prices, could be a powerful catalyst for the company and these preferred shares. Cash flows have been steady, and are based on multi-year contracts. We continue to own the shares.

Square (SQ):

Another volatile growth stock, shares sold off dramatically in Q4 and have rebounded dramatically this year, as they added another 13.9% gain in February alone. Meanwhile, and despite the volatility, the long-term growth story remains intact. Somewhat similar to Paylocity, Square is solving a big problem for small and mid-size businesses (Square basically invented a way to address a market that was traditionally ignored by credit card acceptance thereby creating a new addressable market), and the total addressable market is large (i.e. there is A LOT of room for Square to grow). The company is basically building a payment processing network encompassing payments, receipts, payroll, analytics, finance and marketing, and they’re starting with small and mid-sized businesses (an area ripe for disruption and filled with long-term growth potential).

Safeway/Albertsons Bonds:

We’re adding our Safeway/Albertsons bonds to our watchlist because we might sell them.

We purchased these bonds almost 1-year ago at the discounted price of around $90 per bond, and we purchased them in anticipation of price appreciation (in addition to the big coupon payments). Here we are, almost 1-year later, and the price has recovered to par (i.e. $100). When we bought the bonds, we wrote:

“Safeway went private in 2015 after being acquired by Albertsons, but the bonds still trade publicly, and they offer an attractive yield with upside price potential. The bonds have sold-off lately as Albertsons' planned acquisition of RiteAid is making some investors nervous, particularly regarding antitrust. In our view, the discounted price on these bonds makes them attractive either way considering a cancellation of the deal would likely cause a relief rally, and a completion of the deal would actually benefit Albertsons as described in this recent investor presentation. Significant yield and price appreciation potential make these bonds attractive.”

Once we hit long-term capital gain status (i.e. after 1-year the gains are taxed at a lower rates), we may look to sell the bonds and rotate the cash into something else. In the meantime, the big coupon payments remain very nice.

REITS:

As we wrote here, the current valuation of the REIT sector remains a little frothy, and we recently sold our shares of big dividend Omega Healthcare (OHI) at $38 per share (and the share price has dropped since we sold the shares. As such we have a little extra cash in our Income Equity portfolio which we are looking to reinvest opportunistically over the coming weeks.

Conclusion:

Did you miss out on the big market rally in January and February? Perhaps you are okay with that if you have tons of extra assets and you’re simply looking to preserve the wealth you’ve got (or maybe you’re just trying to keep up with inflation?). However, if you have a longer-term horizon, and you want to generate some investment portfolio growth and income—staying invested, without panicking, and according to your long-term strategy, is usually the right decision because it will help you avoid mistakes. It’s okay to invest your extra cash opportunistically, but for goodness sake don’t ditch your long-term plan.