In the face of non-stop fake and misleading news headlines, we stuck to our long-term strategies and delivered another month of healthy gains and income across our investment portfolios, as usual. This report reviews the individual holdings and performance across each of our strategies. We also review the absurdity of a few recent news headlines that are designed specifically to eat away at your hard-earned nest egg. Finally, we highlight a few of our current holdings that are particularly attractive for new investment dollars right now.

Ignore The Fake News…

Prudently-diversified, goal-oriented, long-term investing has proven to be a winning strategy over and over again throughout history. We mention this because the media puts forth an enormous amount of misleading fake news headlines designed to frighten you into wasting your money. For example, the media constantly puts out click-bait fear-mongering headlines because the more you click, the more advertising dollars they’re able to generate. They’re not acting in your best interest—they’re trying to screw you over.

Similarly, Wall Street is also trying to get your money (i.e. they’re NOT acting in your best interest). They’re trying to frighten you into trading more (because the more you trade, the more trading dollars they generate). They’re also trying to frighten you into paying high fees to let someone else manage your nest egg investments for you (again, they just want your money—they’re NOT acting in your best interest).

One of my favorite recent misleading “fake news” headlines was from CNBC.com. They wrote: “Stocks rise to close out Dow’s biggest June gain since 1938, S&P 500′s best first half in 2 decades.” Well no kidding CNBC—that’s because stocks had a horrible May and a horrible Q4. It’s called mean version. While factually this headline may be accurate—it also creates a false narrative. If we look at May and June combined—the performance of the S&P 500 was completely boring in the sense that there was no big move from the beginning to the end of that period. And it’s a similar story when you combine the first 6-month of 2019 with the last 3-month of 2018—really not that huge of a move. Nonetheless, the headline is click bait designed to make feel like something dramatic is happening. In reality, fear and volatility (as measured by the VIX) remain very very low by historical standards. Don’t get duped by cnbc’s “fear of missing out” mongering.

Some unfortunate investors panicked and sold their investments when the market was down (e.g. May and Q4) because the fake news frightened them into doing so, and they ended up missing the subsequent, mean reversion rebounds. Yuck! Be smart—stick to your prudently-diversified, goal-oriented, long-term investment strategy.

Holdings and Performance:

Here is a look at the performance and holdings of each of our Blue Harbinger strategies, which continue to deliver powerful long-term performance.

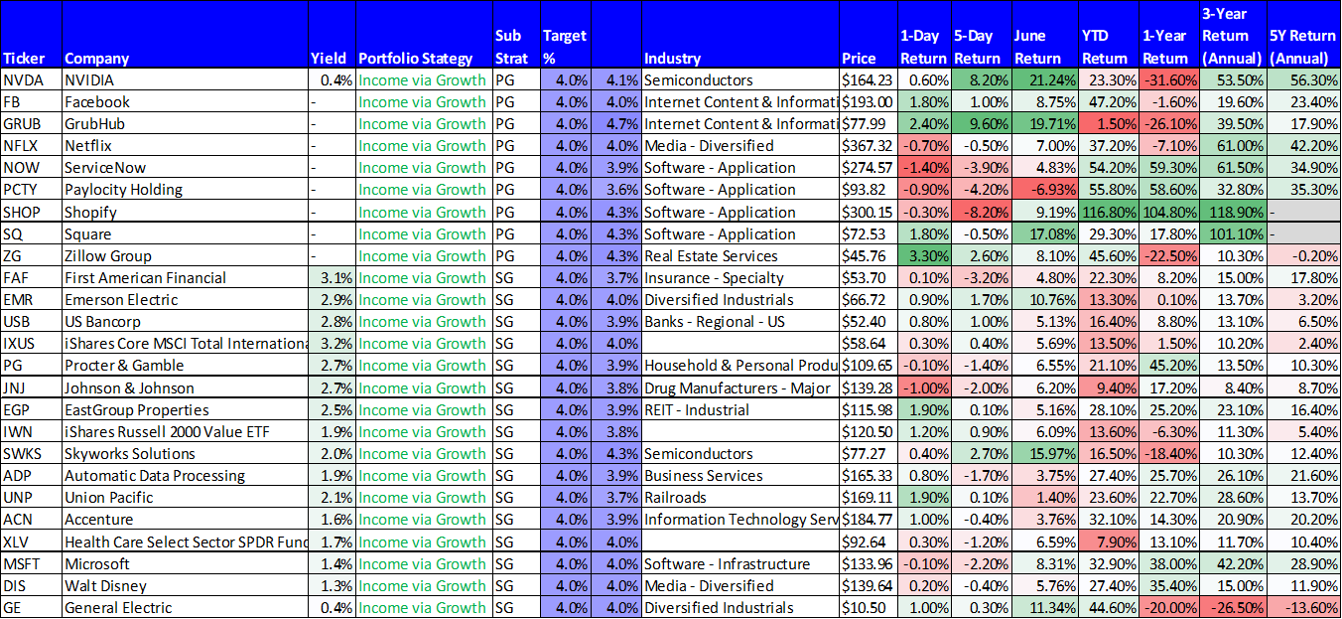

Income Via Growth:

Our Income Via Growth Strategy gained 7.6% in June versus a 6.96% gain for the S&P 500 (SPY).

This data is as of Friday’s close (6/28/19) the last trading day of June. A downloadable Excel spreadsheet copy of this data is available here.

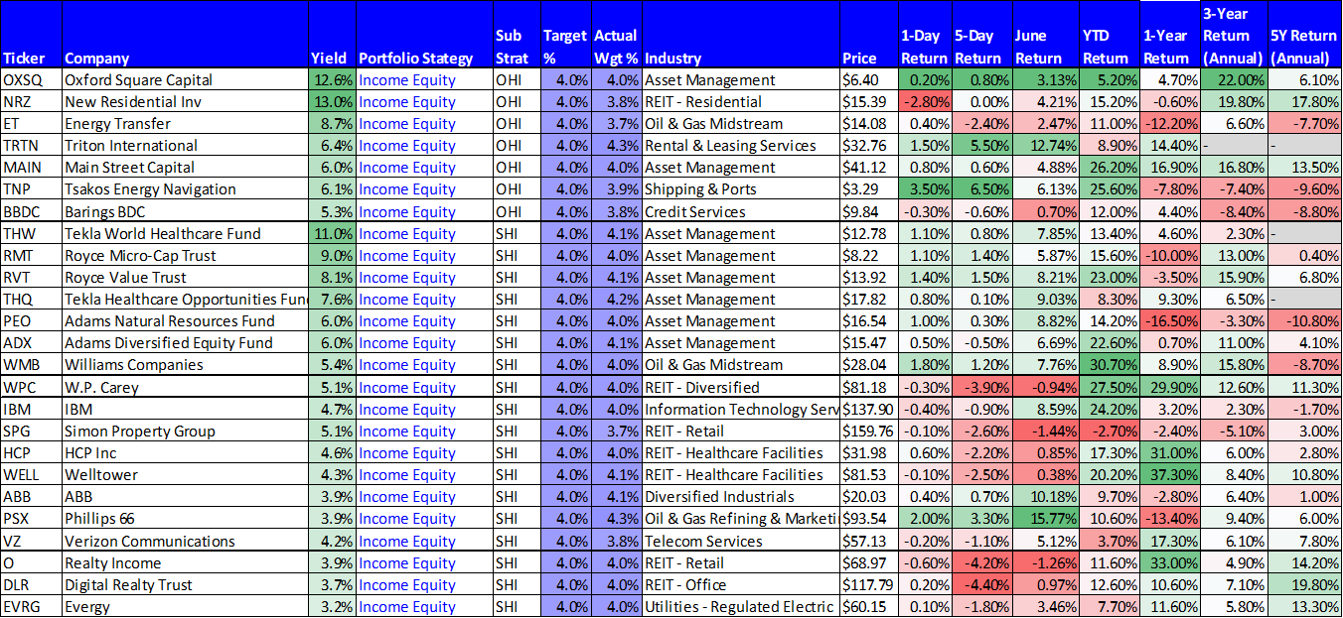

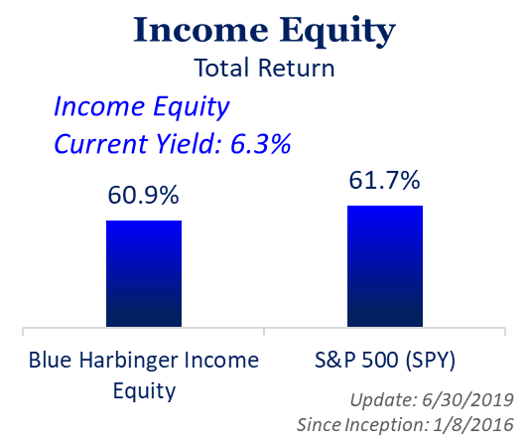

Income Equity:

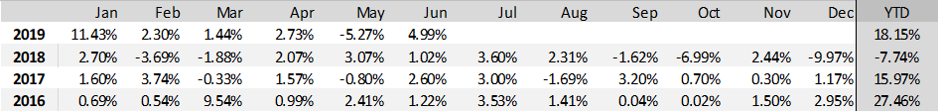

Our Income Equity strategy gained 5.0% during June and currently yields 6.3% (more than 3x the yield of the S&P 500).

This data is as of Friday’s close (6/28/19) the last trading day of June. A downloadable Excel spreadsheet copy of this data is available here.

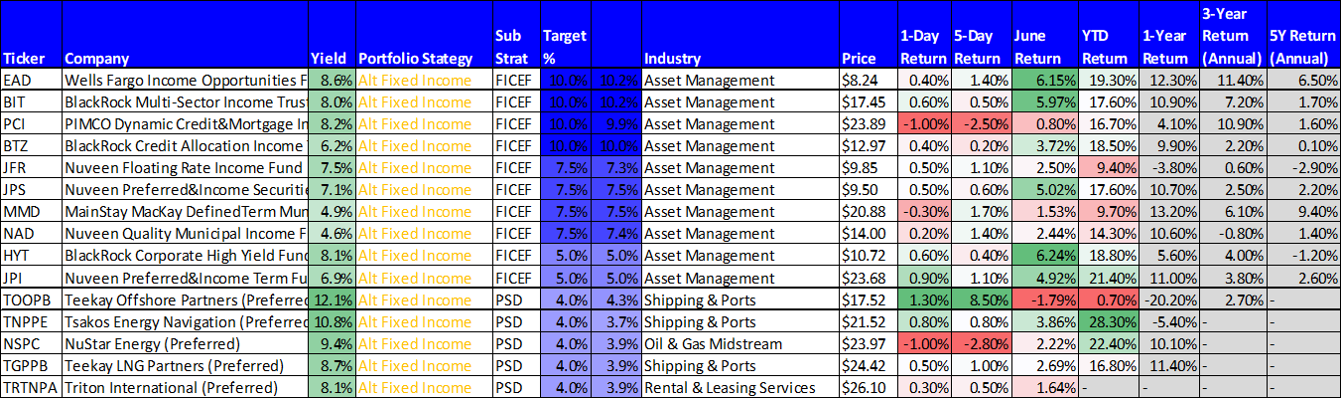

Alternative Fixed Income:

Our Alternative Fixed Income strategy returned a healthy 3.4% in June, and it yields a whopping 7.6% (nearly 4x the yield of the S&P 500!). As a reminder, this strategy is focused on generating high income.

This data is as of Friday’s close (6/28/19) the last trading day of June. A downloadable Excel spreadsheet copy of this data is available here.

Noteworthy Moves & Opportunities:

If you recall, we were beating the drum last month about the great opportunities available in Nvidia (NVDA) and Skyworks (SWKS). And if you notice in the table above, they gained 21% and 16% in June, respectively. We continue to hold them both because we believe these semiconductor chip makers (with very different strategies) continue to be outstanding long-term businesses and investments.

This month, we want to highlight Paylocity (PCTY) and a few select high-income generating REITs. Regarding Paylocity, this cloud-based payroll processing and HR company is growing sales like wildfire, and amazingly they have a very high recurring revenue rate (because once of company sets up payroll—they’re fairly unlikely to change it). Paylocity is having a fantastic 2019 (a fantastic last few years actually), however the shares sold-off a bit in June. If you’re a long-term investor—this is a buying opportunity. We continue to own the shares as you can see in the “Income Via Growth” table earlier in this report.

Select high-income REITs are also particularly attractive if your have some investment dollars to put to use right now. You’ll notice in our Income Equity table earlier in this reports—REITs did NOT perform as well as other sectors in June. That’s largely because REITs are higher-income, lower-volatility, lower-beta investment. And when the market goes up a lot, REITs tend to go up less. However, on the other hand, when the market goes down—REITs tend to go down less and they keep paying their big dividends regardless (if you select them right). And considering we had a big up month in June, we’re due for a little mean-reversion weakness in the weeks ahead—which bodes well for select REITs (we believe certain REITs present attractive long-term income-generating investment opportunities right now). In particular, we like the following REITs (which lagged the market in June as you can see in the table above): HCP Inc (HCP), WP Carey REIT (WPC), Welltower (WELL), Simon Property Group (SPG). In fact, we wrote about these REITs in great detail recently here: