This week’s Weekly doubles as our monthly performance update. We first compare the dueling narratives on interest rates from the Federal Reserve versus the President, and then consider whether your investments where impacted by your decision to believe one story or the other. Next we review the recent performance of our three investment strategies (including every single position). All three strategies continue to deliver market-beating performance and deliver high income for investors. We also share several attractive investment ideas.

Sensationalized Narratives:

Everyone knows the media creates sensationalized stories in attempt to garner views and more advertising dollars. They’re absolutely not looking out for your best interest. In 2018, one of the top narratives was how the Fed was raising interest rates from exceptionally low levels and back up to more normal (higher) levels so they would have some dry powder to cut rates if/when the economy hit a few bumps in the road. That was the conventional wisdom and the popular narrative.

In 2019, the new interest rate narrative, led by the Twitter-In-Chief, has done a complete 180. The narrative has reversed course from the importance of raising rates, to the new course of lowering rates to make the US competitive with other economies around the world who continue to have interest rates near zero. The new narrative says it’s harder for US businesses to compete globally when they have to borrow at interest rates that are significantly higher than other international economies. And in case you’re wondering, lower rates (in many cases negative interest rates) for other international economies were happening in 2018 too, that just wasn’t the narrative focus back then—go figure!

Low Rates Punish Savers:

If you are an income-focused investor, low rates can be painful because your bank accounts, certificates of deposit, and investment-grade bonds all offer very low rates compared to what they have been historically (in the early 1980’s the 10-year Treasury offered a yield of around 15%!). Theoretically, this is the Fed’s way of encouraging investors to take their money out of their bank account (because rates are so low), and to instead invest in things like the stock market which will theoretically help grow the economy (the whole, a rising tide is good for all ships thing).

Have You Let The “Narrative Change” Hurt Your Investment Performance?

The big question is whether you’ve been able to stick to your long-term goal-oriented investment strategy throughout the big narrative change from 2018 to 2019, or have you haphazardly traded your account according to whatever sensationalized story the media punditry was spouting off at the time? Diversified, goal-oriented, long-term investing has proven to be a winning strategy over and over again throughout history, but it’s a lot easier said than done. For example, when the market was plummeting in the fourth quarter of 2018 did you panic, and hit the sell button, and then miss out on the powerful rebound in 2019? Or, did your “fear of missing out” cause you to forget your long-term goals and instead invest in all high growth stocks right before they sold off in August (we’ll review August performance momentarily).

The bottom line here is to stick to your goal-based investment strategy and not make foolish mistakes. For example, trading frequently is expensive due to commissions, fees, bid-ask spreads, and additional implicit and explicit trading costs. Not to mention people often make costly “fat finger” trading mistakes as well as end up sitting in too much cash when the market is rallying. If you are a diversified income-focused long-term investor, we often share attractive investment ideas for you to consider. For example, in the last week we shared the following ideas for readers to consider:

Forget ZIRP: Top 10 Big Yields (BDCs, CEFs and REITs)

MAIN’s 6.8% Yield: Consistent Dividends, Lower Middle-Market Investments

Ares Capital: 8.4% Yield, Stable Income Potential

Of the names above (including the ones on that “Forget ZIRP” list), we currently own several of them, including MAIN, NRZ and RVT. And if you are looking for more investment ideas, part 2 of this report (link below) reviews all of our current holdings (65 names) across all three our strategies, which continue to beat the market and offer high income to investors. We share a few high-income-generating options trade ideas too (one on New Residential and one on Simon Property Group).

Monthly Performance Review:

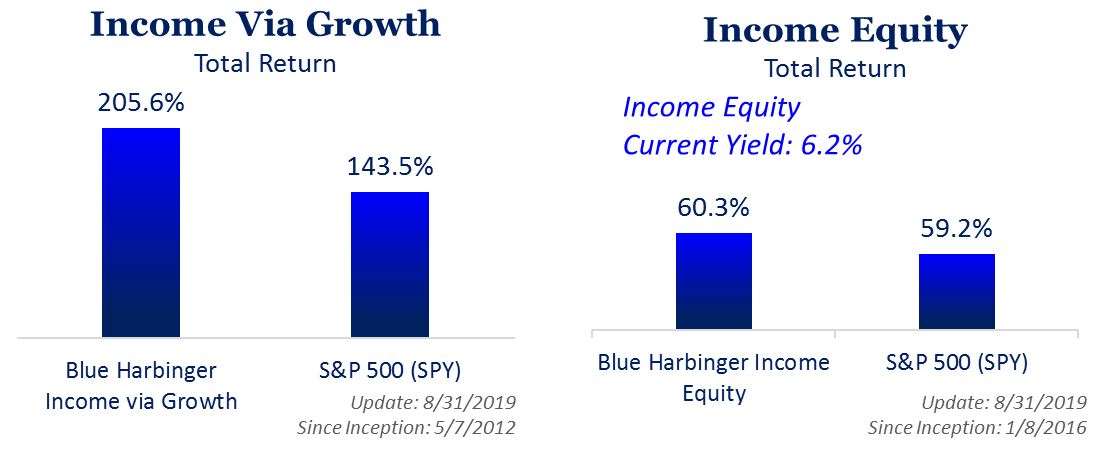

As of the end of August, all three of our investment strategies continue to deliver powerful, market-beating returns and income. Each of the strategies has a different goal. Specifically, the Income Equity strategy (currently yielding 6.2%) is a top ideas portfolio (25 stocks) designed for investors seeking high current income and powerful long-term returns. The Alternative Fixed Income strategy is designed for investors seeking high current income from “non-stock market” investments (it currently yields 7.6%, and has 15 holdings), and the Income Via Growth strategy (25 stocks) is designed to generate powerful long-term income through price gains (and it continue to crush the S&P 500). The following part 2 edition of this report reviews the recent performance of every single position, and shares some important investing takeaways as well as a few specific attractive opportunities.

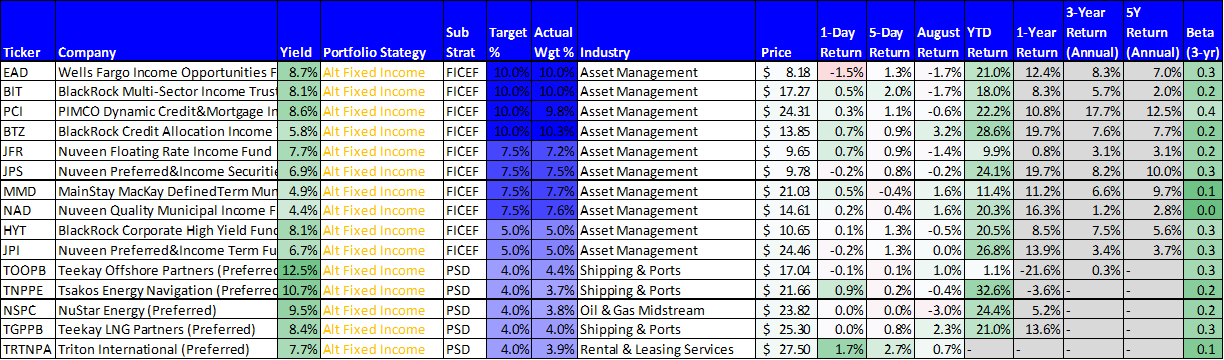

For starters, here is a look at the recent performance of each strategy, as well as the performance of every single position.

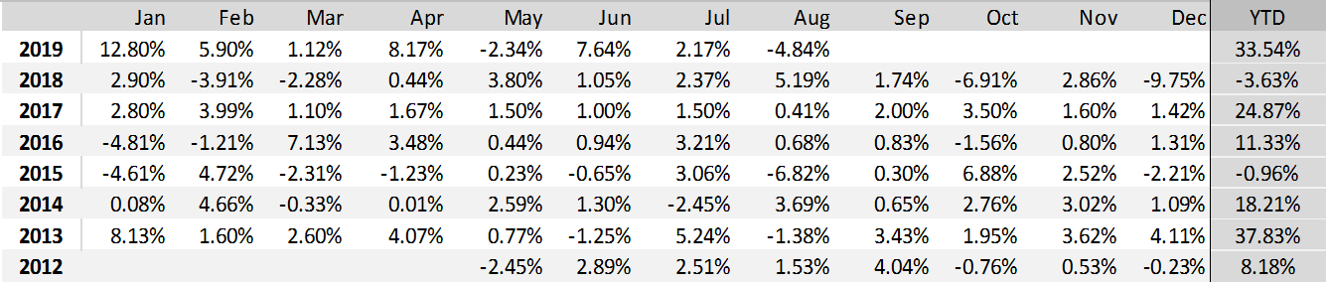

Income Equity Monthly Performance:

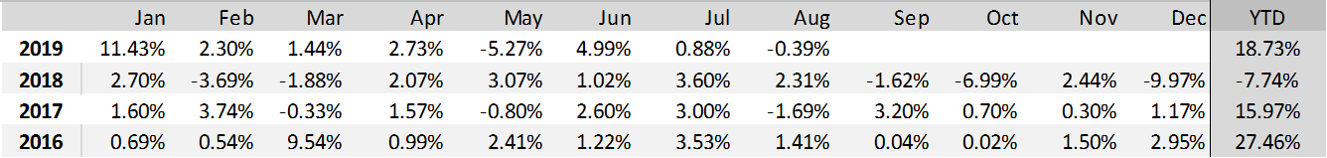

Income Via Growth Monthly Performance:

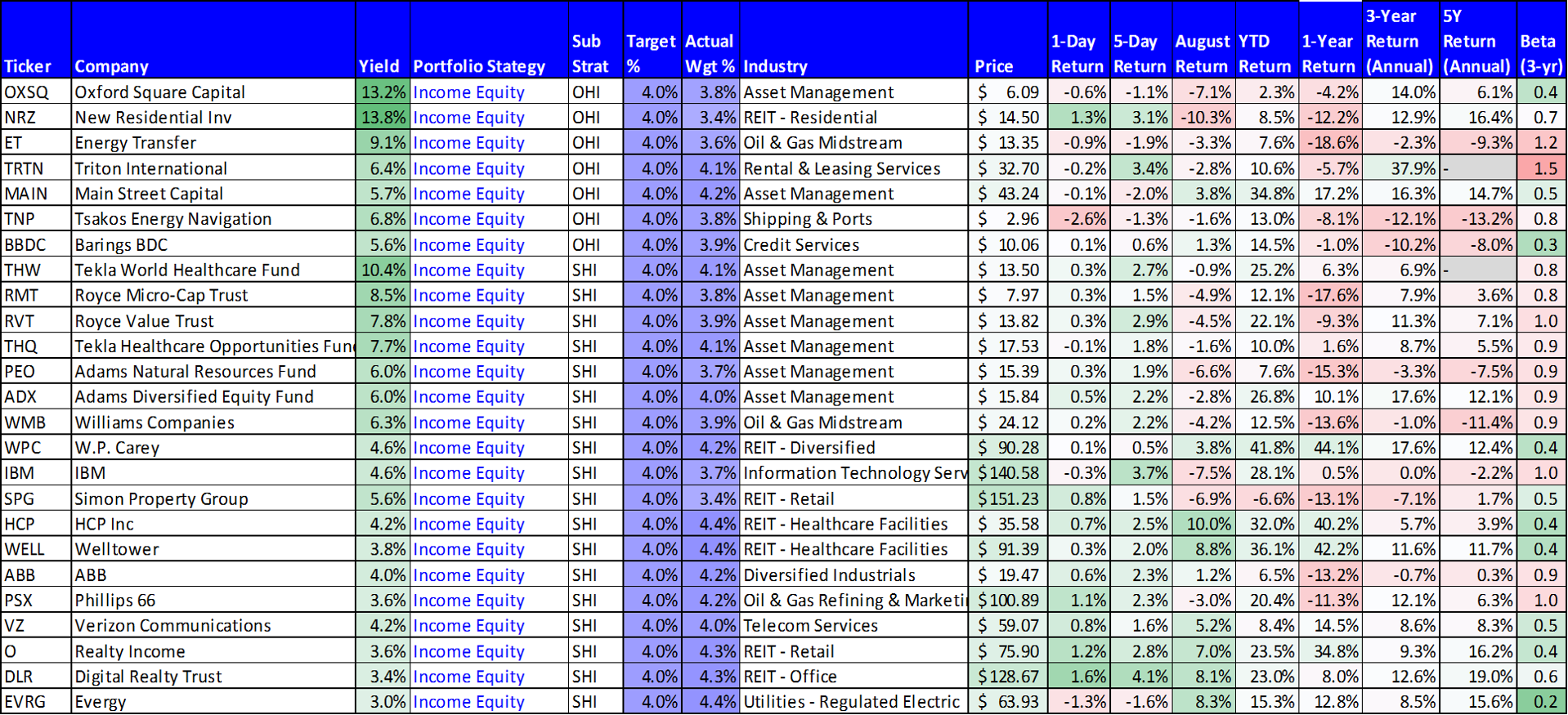

Current Holdings:

Note all data is as of Friday’s market close on September 6th, except “August Return” is the total return for August. A downloadable spreadsheet is available here.

Highlights and Opportunities:

Portfolios:

Income Via Growth sold off in August, but it’s a more volatile strategy, and it is still crushing the S&P this year and over the long-term. This strategy is more volatile than the others (as you can see in its higher “betas” in the table above) but over the long-term it has powerful growth potential, which you can ultimately turn into a lot of spendable dollars.

Alternative Fixed Income posted a gain in August even though the market (S&P 500) was down. Per it’s design, it holds very “low beta” investments, meaning they move less with the stock market, yet they continue to pay big yields (the strategy yields 7.6%).

Income Equity was down -0.39% in August (the S&P 500 was down more), and the Income Equity strategy continues to yield more than three times the yield of the S&P 500, as well as post impressive long-term returns (see the performance table above).

Individual Positions:

HCP Inc (HCP) is a big-dividend healthcare REIT that continues to turn the corner and put up a big 10% return in August (and it’s dividend yield is a healthy 4.2%). We continue to like this one, we own it, and we wrote about it in detail here.

Nvidia (NVDA) and Skyworks (SWKS) are two very different semiconductor chip makers (NVDA is high-end and innovative, Skyworks makes already developed chips in large quantities for other companies). They both had an unimpressive August, but were up significantly in the first week of September (see chart above) thanks to supposedly renewed upcoming US-China “Trade War” talks. As we’ve written in the past, they both continue to be dramatically undervalued, and if you just buy, cover your ears to the media narrative, and hold on, you’re going to be very happy in the long-term.

GrubHub (GRUB) is another “growth via income” stock we own, and there is a big disconnect between its current low price and its long-term potential. We own it, we’ve written about multiple times in the past, it sold-off hard in August (and over the last year as the media misinterprets the competition), and we consider now an attractive time to buy.

Income-Generating Options Trades:

New Residential (NRZ) is a big dividend mortgage REIT that struggled in August, but has made up some ground in September, so far. As we wrote about previously, NRZ’s main “Mortgage Servicing Rights” (“MSR”) assets do better in slowly rising interest rate environments because less people prepay their mortgages. NRZ has faced headwinds as the interest rate narrative has changed, however the news flow has calmed a bit so far in September, and so has NRZ’s price. You can read more about our recent NRZ options trade idea here:

Simon Property Group (SPG) sold off again in August. We believe the sell-off is unwarranted, and the shares are significantly undervalued. We recently shared an income-generating options trade on SPG and you can read about it here:

Options Trade: Simon Property Is Priced Right, Pays Lots Of Income

Options Trades for the Week Ahead: We like to collect premium income by selling out-of-the money put options on stocks we’d like to own (for example, see the NRZ and SPG write-ups above). In particular, we like to sell them on attractive shares that have sold-off because we like to buy low and because the volatility of the sell-off usually increases the premium income available for selling the puts. Based on last wee'k’s moves (as you can see in the table above—and in our watchlist if you open the excel file link below the table), we’re watching MAIN and SPG for potential income-generating options trade opportunities in the week ahead. Both pay big dividends, both have sold-off (see table above), and we wouldn’t mind owning shares of one or both for the long-term, especially at a lower purchase price, depending on the strike price of the contract). Stay tuned.

The Bottom Line:

Don’t buy into all of the latest media-driven market narratives. They are absolutely not acting in your best interest, and the narratives they share are generally worthless. Instead, stick to your goals and strategy, and try to avoid short-term mistakes as best you can (i.e. don’t make lots of “clever” short-term trades). Diversified, goal-oriented, long-term investing has proven to be a winning strategy over and over again throughout history.