The market has been especially ugly for high-growth stocks recently as the pandemic-trade pendulum now swings too far in the opposite direction. But that doesn’t mean all growth stocks are ugly. Quite the contrary.

Purple Line: PCTY, Orange Line: S&P 500

The attractive growth stock we review in this report offers a compelling high growth rate, a large total addressable market opportunity and an attractive valuation. Plus, it is supported by high recurring revenues, high customer retention and important research-and-development spending plus a strong sales team. In this report, we review the business, the value proposition, financial strength, valuation and risks, and then conclude with our opinion on investing.

Overview: Paylocity (PCTY)

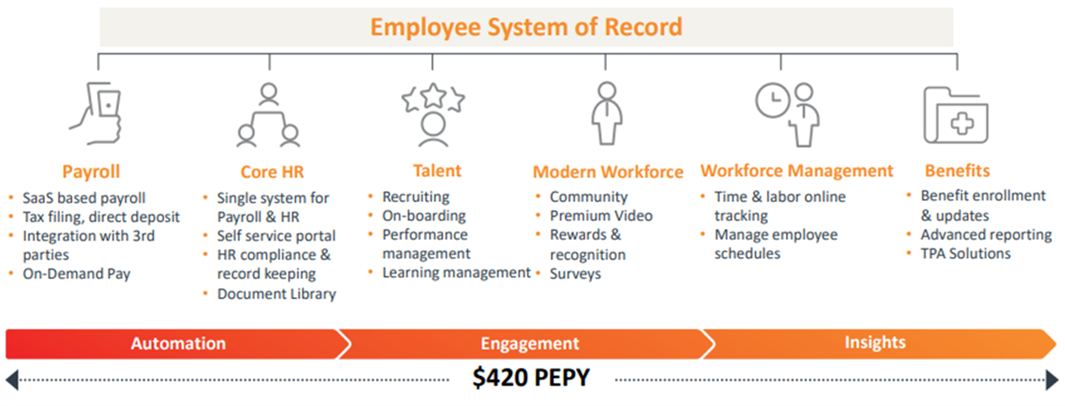

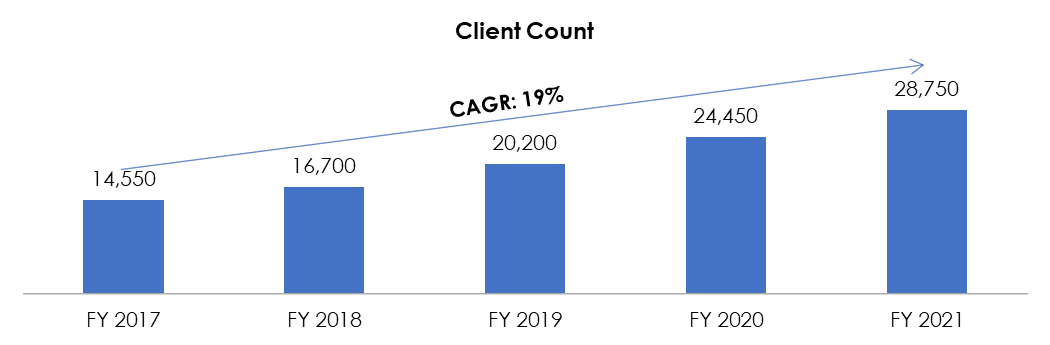

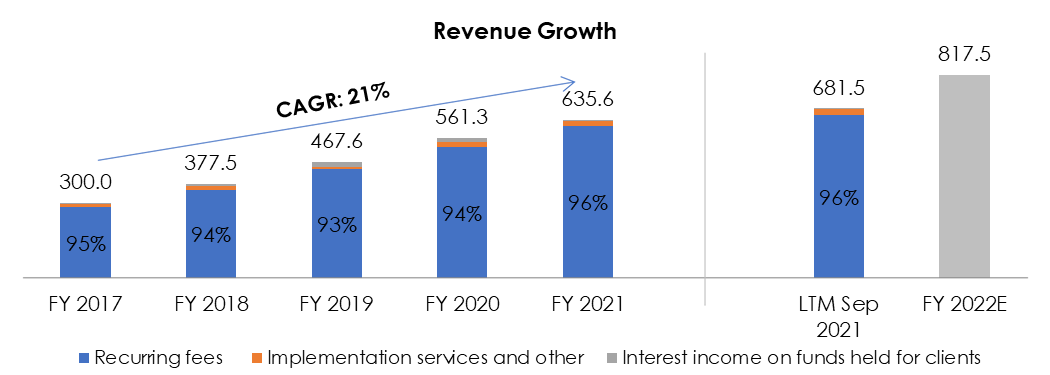

Paylocity Holding Corp (PCTY) is a Schaumburg, Illinois based provider of cloud-based payroll and human capital management (“HCM”) software solutions. The company’s product suite includes software solutions for payroll, core HR, talent, modern workforce and workforce management, and benefits, as well as analytics & insights, all under a unified platform. Paylocity delivers its solutions under a software-as-a-service (“SaaS”) model to clients across the US, which includes for-profit and non-profit organizations spread across industries such as business services, financial services, healthcare, manufacturing, restaurants, retail, technology and others. Paylocity serves ~28,750 clients, which on average have over 100 employees. It generated $682 million in revenue over the last twelve months (as of the September 2021 quarter-end), of which ~96% came from recurring fees.

Source: Company Presentation

Strong Value Proposition—Modern, Differentiated Product

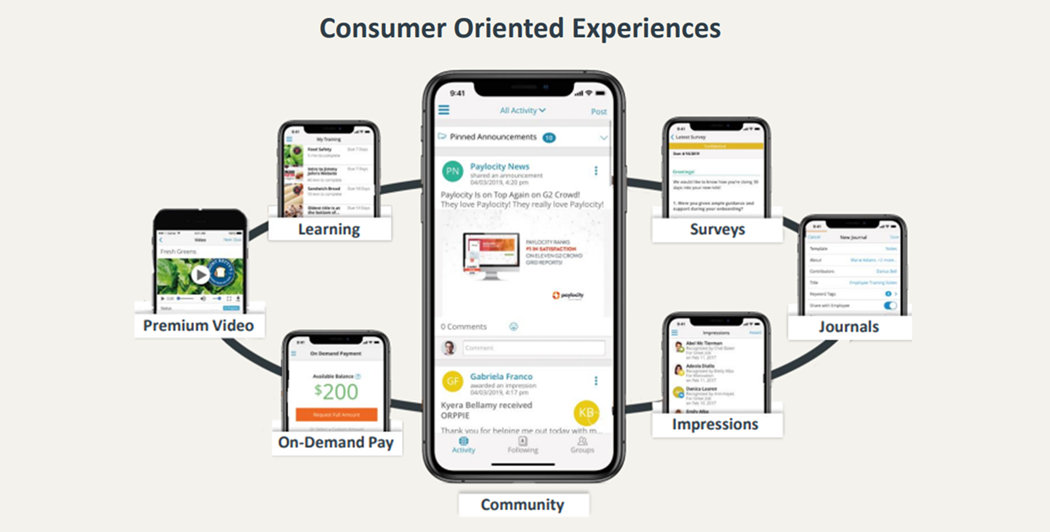

Paylocity believes it offers the most modern solution in the marketplace with unique features that go beyond automating payroll and HR functions. These features allow clients to communicate, collaborate and connect with their employees, and also to make sure that they're able to attract and retain the talent they need.

Source: Company Presentation

And Paylocity’s claims are largely validated by the fact that each of these unique features continues to achieve solid utilization among clients. For example, “Community,” the social collaboration platform, has seen monthly unique visitors double in fiscal 2021, with hundreds of thousands of user interactions per month and rapid adoption by companies with dispersed workforce (where employees may not have regular access to corporate email or computer terminals). Also, “Survey: has achieved an average of over 1 million Surveys launched each month. And “Premium Video” usage has surpassed half a million video plays across the product suite. Further, the “Learning Management” tool has seen over 200,000 learning courses completed per month.

Additionally, Paylocity has a strong direct sales force (consisting of ~588 experienced reps) that is supported by a strong referral channel (consisting of benefit brokers, 401k advisors, workers compensation brokers, and more recently CPAs and software companies). The sales force and referral channel has translated into a rapidly growing client base, which has almost doubled over the past five years to 28,750 (excluding clients acquired through acquisitions).

Source: Company filings

Strong Topline, High Recurring Revenues, Solid Long-Term Outlook

Paylocity’s compounded annual revenue growth over the past five years is tracking at an impressive 21% (and it is forecast to be ~29% next year too). Making this more impressive, the majority of revenue is recurring (recurring fees), and its annual revenue retention rate has consistently been in excess of 92%. Importantly, no client currently accounts for more than 1% of total revenues, thereby adding strength to healthy forward revenue guidance.

Source: Company filings

Going forward (in FY 2022), Paylocity expects revenue to be in the range of $815.0 million to $820.0 million (at mid-point, this represents an exceptional ~29% growth rate versus FY 2021). Importantly, over the longer-term horizon, Paylocity says that it is squarely focused on 20%+ revenue growth. And we believe the company can achieve this target for a variety of reasons, such as:

Expanding product offerings: Paylocity has historically spent ~13% to 15% of revenue on Research and Development (R&D), and continues to target 10% to 15% going forward. Further, Paylocity has doubled its product sweet since 2014, a strategy that continues to successfully add to growth.

Source: Company Presentation

Focused on growing client base: Historically, Paylocity has invested heavily in sales & marketing to grow its client base. And it remains focused on making incremental investments in this area in the coming years, and is target spending 20% to 25% of revenue on sales & marketing efforts in the longer term (to continue to grow its client base).

Blue Marble acquisition to drive expansion into larger clients: Paylocity has historically achieved much success and penetration with smaller companies (less than 50 employees) though its new products and adoption of its more modern tools. And while some of the newer offerings appeal to larger clients, it’s still not a formidable player in this category. The acquisition of Blue Marble (which is a global payroll provider for companies seeking more control and convenience in managing and paying their employees outside the US), will help Paylocity gain more traction with lager companies going forward.

Challenging labor market to increase demand for sophisticated hiring and retention tools: Despite the ongoing economic recovery over the past year, the labor market has remained challenged, and HR teams increasingly seek tools to help with hiring and retention. Paylocity CEO Steven Beauchamp used this backdrop to point out some of Paylocity’s strategic advantages during the most recent earnings call:

“Well, I think a lot of our customers would tell you this has been the most challenging hiring environment and employee retention environment that they've seen…I do think that it does raise the importance of what an HR team is doing for your organization. It becomes very strategic. You've got to be able to find the talent that you need to drive your business objectives.

And I think HR being part of those boardroom conversations and being more strategic has become very important for a lot of customers today. And I believe that, that certainly then translates directly to what are the tools that the HR team is actually using to be able to kind of engage with employees. What are the tools they're using to recruit people? And how are they differentiating themselves from the rest of the organization? The second trend I would tell you is on the retention side, which is ought to be able to find a way to really connect with employees and to engage with employees and to collaborate and hear their voice.

And more and more customers are also prioritizing tools like that. And this to me is just when you think about the future of work changing the pandemic accelerated a lot of these trends. And so we're just seeing our value proposition of having the most modern platform with all these not only HCM capabilities to automate, but also all of these modern workforce tools that really engage with our customers. And I'd tell you, that's one of the big reasons we're seeing the success in the acceleration of our revenue growth.”

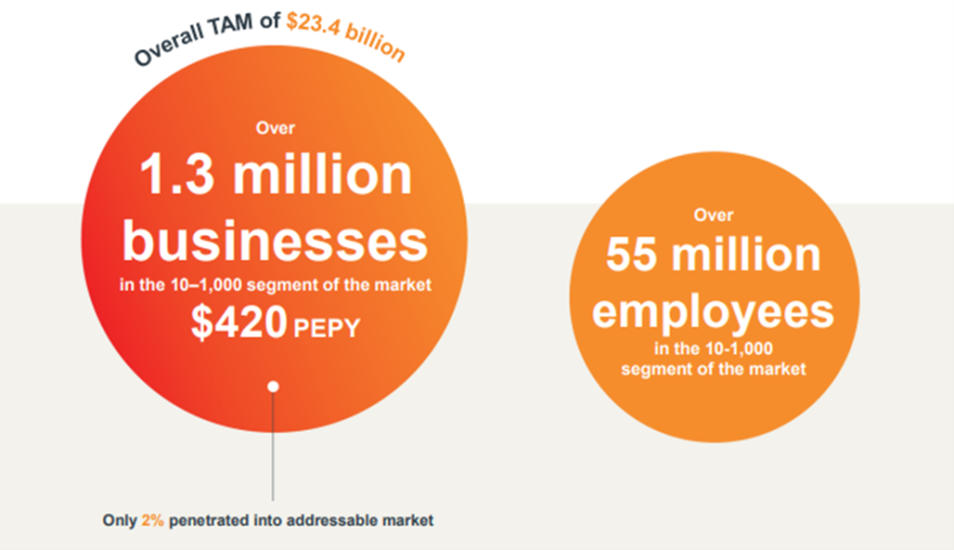

Vast, expanding TAM provides fairly large growth runway: Paylocity estimates it has a total addressable market (“TAM”) opportunity of ~$23.4 billion (based on the US Census Bureau employee data of medium-sized organizations in the US, and estimating that they spend $420 per employee annually on payroll and HCM solutions). This suggests Paylocity is only 2% penetrated, and has significant continuing runway for growth.

Source: Company Presentation

Also important to note, there will be continuing opportunities for growth as Paylocity’s offerings expand and as customer spend expands (companies don’t typically spend on the entire suite of products on day 1).

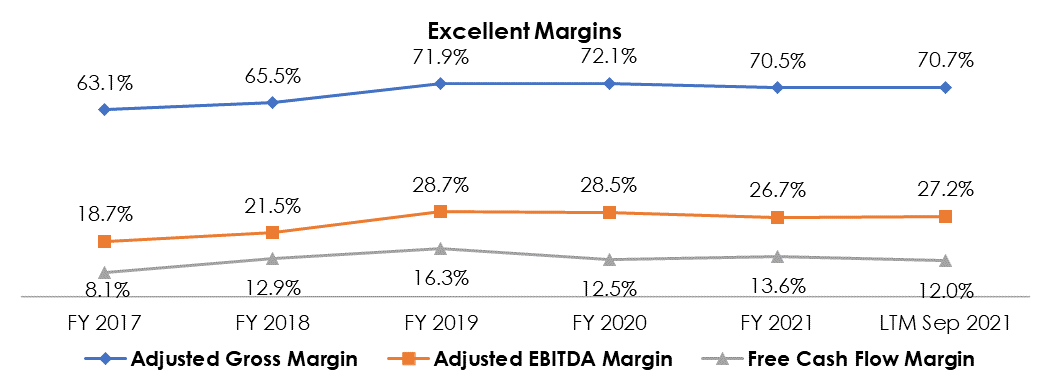

Strong Margins, Solid Free Cash Flows

Paylocity continues to growth with high margins and solid free cash flow. For example, it has reported over 70% adjusted gross margins in each of the past three years, and its adjusted EBITDA margins have been in the high twenties. Further, its free cash flow has remained strong and translated into low to mid-teens free cash flow margins over the years. Importantly, both the EBITDA and free cash flows have seen considerable growth over the past five years, with EBITDA growing at a CAGR of 28% and free cash flow growing at a CAGR of 21%.

Source: Company Filings

Going forward, for fiscal year 2022, the company has guided to an adjusted EBITDA range of $216 to $220 million, which at mid-point translates into a y/y growth of 28% (in line with historical averages) and an adjusted EBITDA margin of 26.7%. Longer term, Paylocity is targeting adjusted gross margins of 70% to 75%, adjusted EBITDA margins of 30% to 35% and free cash flow margin of 15% to 20%, which we believe is achievable and attractive.

Valuation

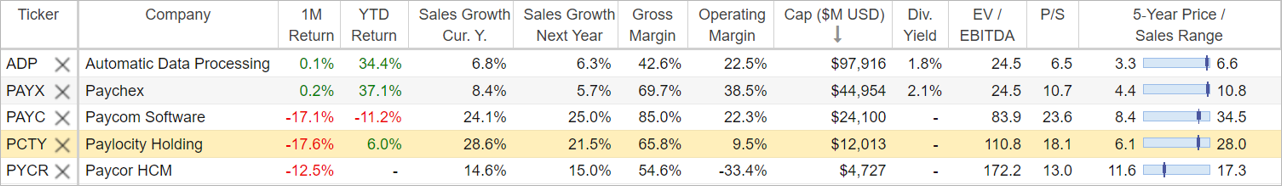

Shares of Paylocity have been volatile this year, similar to other high growth peers Paycom (PAYC) and Paycor (PYCR). As you can see in the table below, Paylocity shares (and the other high growth peers) trade at higher valuation multiples (price to sales, enterprise value to EBITDA) because the current share prices are factoring the higher future growth.

source: Stock Rover (as of 12/16/21)

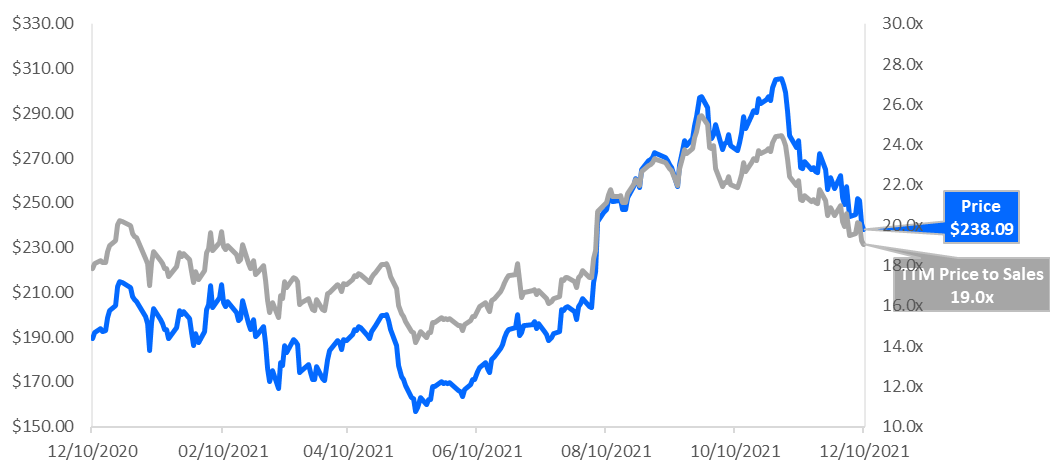

However, compared to its own historical valuation range, shares of Paylocity are more attractive considering the share price is down but the expected future growth remains high. In our view, Paylocity’s 18.1x price-to-sales multiple is reasonable considering the very high expected revenue growth and the very strong gross margin (as well as improving operation margin).

Source: Yahoo Finance

Another increasingly considered valuation metric for high growth software companies is the “Rule of 40.” This rules simply says that a company’s growth rate plus profit margin should exceed 40. Considering Paylocity had net income of $89 million versus revenue of $682 million, and a growth rate of 28.6, the company does exceed 40, which is attractive. Also noteworthy, as per Paylocity’s most recent earnings call, and according to CFO Toby Williams:

We are pleased to raise fiscal 2022 guidance to 29% revenue growth at the midpoint, which in combination with the adjusted EBITDA margin represented in our full-year guide, returns us to above the Rule of 50 in fiscal 2022.

Given Paylocity’s high growth rate, large TAM and heavy R&D + Sales expenditures, we view the company’s current price as very attractive versus its long-term value.

Risks

Competition: Paylocity faces competition from Paychex and Paycom, other smaller regional players, and from ADP (in the larger client space). The competition brings significant financial wherewithal as well as the ability to introduce new technologies at a rapid pace.

Dependency on channel partners: About 25% of Paylocity’s new client revenue comes from referrals (from a network of third-party service providers, including 401(k) advisors, benefits administrators, insurance brokers, third-party administrators and HR consultants). Should the company’s relationships with a few or more of these channel partners turn bad, it can have a negative impact on growth.

Conclusion

Don’t be fooled by the market’s short-term gyrations; rather, stay focused on whether your investments offer attractive long-term value. The market’s recent volatility has dragged shares of Paylocity lower, but we believe the long-term value is still firmly intact (and the shares trade at an increasing compelling price). If you are a disciplined long-term investor, and you are looking to add some powerful long-term growth to your portfolio, shares of Paylocity are worth considering.

*note: we have owned shares of Paylocity since 2015