If you are an income-focused investor, boring can be very attractive. And the utility-sector closed-end fund (“CEF”) we review in this report has many boring and many attractive qualities. And considering our ongoing low interest rate environment (combined with the increasing trajectory of inflation), this monthly high-income producer is worth considering. In this report, we review the investment strategy, holdings, valuation, fees, pricing and conclude with our opinion on investing.

Utility Sector Overview:

Utility stocks are generally boring. And while the media constantly focuses on the most volatile investments, the electric, gas and water companies within the utilities sector generally keep ho-humming along and paying steady dividends. For a little perspective, here is a look at the beta of the utility sector ETF (XLU) versus the overall market (SPY). If you don’t know, beta is a measure of the volatility—or systematic risk—of a security or portfolio compared to the market as a whole.

By definition, the overall market beta is basically 1.0, while the utility sector beta was recently only 0.26 (see chart above). And if you are looking for boring, utility stocks can be quite attractive. especially considering the dividends they provide.

Reaves Utility Income CEF (UTG)

Yield: 6.2% (paid monthly)

The Reaves Utility Income Fund is a high-income producing fund focused on the Utility sector. Specifically, according to the fund’s website:

The Fund's objective is to provide a high level of after-tax total return consisting primarily of tax-advantaged dividend income and capital appreciation. It intends to invest at least 80% of its total assets in dividend-paying common and preferred stocks and debt instruments of companies within the utility industry. The remaining 20% of its assets may be invested in other securities including stocks, money market instruments and debt instruments, as well as certain derivative instruments in the utility industry or other industries.

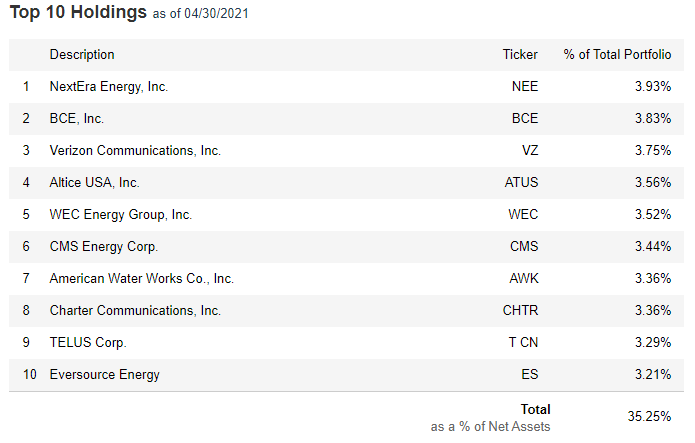

So UTG is basically a Utility Sector fund, and you can see the top 10 holdings (for perspective) below (i.e. they are clearly utility stocks).

Steady Performance:

Another interesting trait of this fund that you may want to consider right up front, is the consistency of its returns. Past performance is absolutely no guarantee of future success, but this utility-focused fund has not surprisingly provided very consistent strong returns since its inception (an attractive “low beta” quality for investors that like to sleep well at night). Specifically, check out the average historical annual returns in the table below.

Tax Considerations:

Another important thing to consider about this fund is that it focuses on tax-advantaged (or qualified) dividends. The fund does a good job explaining on its website:

The Jobs and Growth Tax Relief Reconciliation Act was signed into law on May 28, 2003. One provision of the Act provides that qualifying dividend income received by individual taxpayers will now be taxed at long-term capital gain tax rates which are a maximum of 15%. Currently, interest income and non-qualifying dividend income can reach federal tax rates as high as 35%.

Qualified dividend tax rates have fallen dramatically (to 15%), yet only certain dividends qualify for this tax treatment. Dividends from real estate investment trusts (REITs), master limited partnerships and trust preferred securities generally do not qualify. Also, the period in which the investor holds a security can determine whether or not a dividend is qualified. The Reaves Utility Income Fund is managed with these taxation issues in mind in seeking the objective of maximizing qualified dividend income.

Qualified dividends are particularly important if you are going to own this one in a taxable account (because you’ll end up paying less tax on the qualified dividends the fund focuses on).

Another attractive tax consideration is the fund’s healthy history of paying distributions out of income and capital gains (instead of short-term gains or return of capital), as you can see in the table below.

source: CEF Connect

This is important because it is indicative of a well-managed fund, and because it has more attractive tax consequences for many. For example, short-term gains can be less desirable because they can be taxed at your ordinary income tax rate, and ROC (return of capital can be less attractive because it reduces your cost basis and can increase your capital gains tax when you do sell). UTG does a compelling job pursing tax-advantage income (for those holding it outside of an IRA).

Leverage to Enhance Yield

Another compelling characteristic of this fund is that it uses what we consider a prudent amount of leverage (or borrowed money) to magnify the income (yield) it offers to investors. Specifically, the fund recently had 15.8% leverage, which means (all else equal) the yield you earn as an investor is magnified by a multiple of 1.158 (i.e. the dividends paid by the underlying utility stocks, for example, are 15.8% larger than they would be without leverage). According to the fund website:

“One advantage of closed-end mutual funds is the ability to use financial leverage as part of the overall investment strategy. The Fund expects to use financial leverage through the issuance of preferred shares and/or through borrowings, including the issuance of debt securities. The Fund intends to use leverage initially of up to approximately 38% of its total assets.”

We like this fund’s use of leverage. Of course there are costs associated with Leverage.

Fund Expenses

One common complaint about closed-end funds is the high fees. However, in the case of UTG—the overall expense ratio is reasonable at 1.5%. First of all, only 0.72% of the total fee is management fees, another 0.37% is fund expenses and 0.41% is interest expense (or the cost of borrowing on the leverage described above). In our view, the overall expense ratio is reasonable for this fund considering the other attractive qualities (e.g. active management, attractive utility sector exposure, and prudent use of leverage to magnify the income, to name a few).

Pricing:

Another unique characteristic of closed-end funds (such as UTG) is that the market price is determined by supply and demand (buying and selling) and therefore can deviate (sometimes significantly) from the value of the underlying holdings (or NAV). CEFs differ from open-end funds and ETFs in this regard because there is no immediate mechanism to bring the market price back in line with the NAV. For perspective, you can see the historical market price versus NAV of UTG in the following chart.

In our view, the current tiny premium is acceptable (were it a large premium—it would give us pause). We consider the price particularly given the attractiveness of the Utility sector—especially with inflation starting to tick higher in recent weeks. The “easy money” monetary policies of recent years theoretically should lead to significant future inflations, and utilities prices will likely rise with inflation.

Also, because many readers like to see it, here is a chart of the historical performance (total returns—dividends plus price appreciation) of UTG versus the S&P 500 (SPY) and the Utility sector ETF (XLU).

Since inception, UTG has outperformed both, but it is important to recognize that the over/under-performance story changes depending on what timeframe you use. Going forward, we like utilities considering they have still not recovered from the initial pandemic sell-off to the same extent as the rest of the market. And we also like utilities going forward from the standpoint of an increasing inflation trajectory in recent readings.

Dividend Income Growth

Also worth noting, this fund has a very solid history of growing the dividend (including occasional special dividends) as you can see in the chart below.

And considering the health of the market (and the recently increased trajectory of inflation) we expect these dividends to continue rising in the future.

Conclusion:

If you are an income-focused investor, there’s lots to like about the Reaves Utility Income Fund, including its big monthly dividend (it currently yields 6.2%), the steadiness of the utilities sector, the prudent use of leverage, the tax-advantages (particularly if you’re going to own it in a taxable account), and the current price (considering inflation may bode well for the utilities sector in general). Overall, it’s attractive, and we recently added shares of UTG to the Blue Harbinger Income Equity Portfolio.