Given the challenging macroeconomic backdrop (high inflation, recession looming), if you had to list the top characteristics you’d like to see in a stock market investment right now, it might include things like: high profit margins, no debt, tons of cash and a sticky client base that is economically non-cyclical. The healthcare stock we review in this report has all of those things, plus a very high revenue growth rate, a large total addressable market opportunity, a wide economic moat and basically no competition. Plus the shares have sold off significantly this year, thereby creating a more attractive entry point. This is NOT a dividend stock, but rather a very attractive long-term growth stock. Your future self may thank you profusely if you pick up a few shares now.

Veeva Systems (VEEV):

Veeva is the leading global provider of industry-specific, cloud-based software solutions for the life sciences industry. The company’s solutions enable pharmaceutical and other life sciences companies to realize the benefits of modern cloud-based architectures and mobile applications for their most critical business functions, without compromising industry-specific functionality or regulatory compliance.

Veeva dominates the industry with more than 1000 customers, ranging from the world's largest pharmaceutical companies to emerging biotech companies. To help explain the business and the attractiveness of the company, here is a list of 10 very attractive Veeva qualities for you to consider:

High Revenue Growth:

High-revenue growth stocks have sold off hard this year as the fed tightens monetary policies and pandemic stimulus wears off. However, not all high-growth companies are the same, and Veeva is a bit of a baby that’s been thrown out with the bathwater. Veeva’s revenue was growing rapidly leading into the pandemic, and it continues to growth rapidly right through the pandemic and going forward (as you can see in the chart below).

Large TAM:

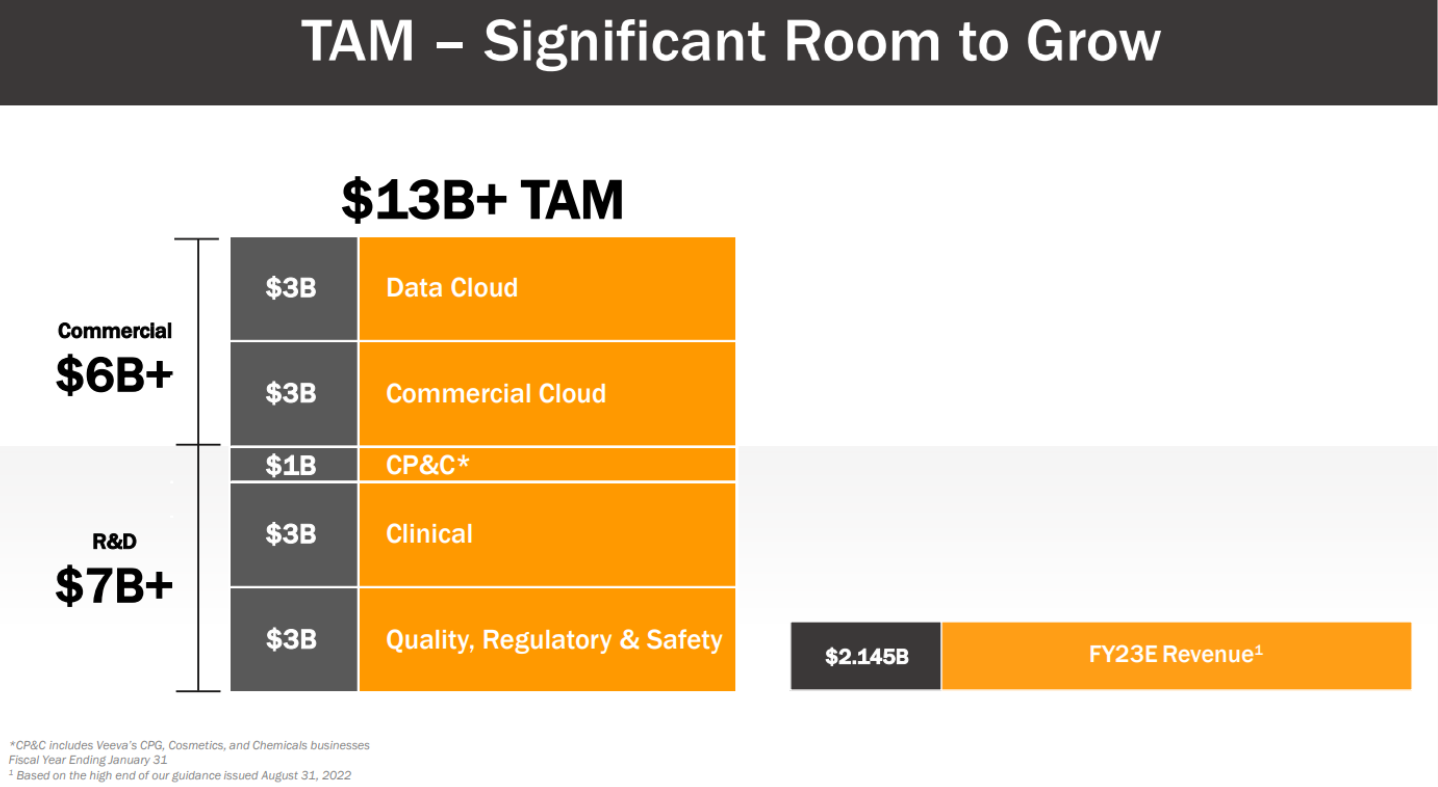

Next, Veeva benefits from a large total addressable market opportunity (“TAM”) which mean the company still has a lot of room to continue growing based on the large market opportunity (as you can see in the graphic below).

Highly Profitable

Very importantly, especially in an increasingly challenged market environment, Veeva is very profitable. As you can see in the data table (later in this report, in the valuation section), Veeva’s gross profit margin is an impressive 72% and its bottom line net profit margin is over 19%. This is extremely attractive considering many of the other high-growth companies still have NEGATIVE net profit margins. Thos other companies will feed they pain as they rely on borrowing and the capital markets to fund growth considering their stock prices are now depressed (harder to raise cash through share issuances) and the cost of borrowing has risen rapidly (making it more expensive to fund growth). On the other hand, Veeva is in a terrific cash position based on its successful highly-profitable business.

Tons of Cash

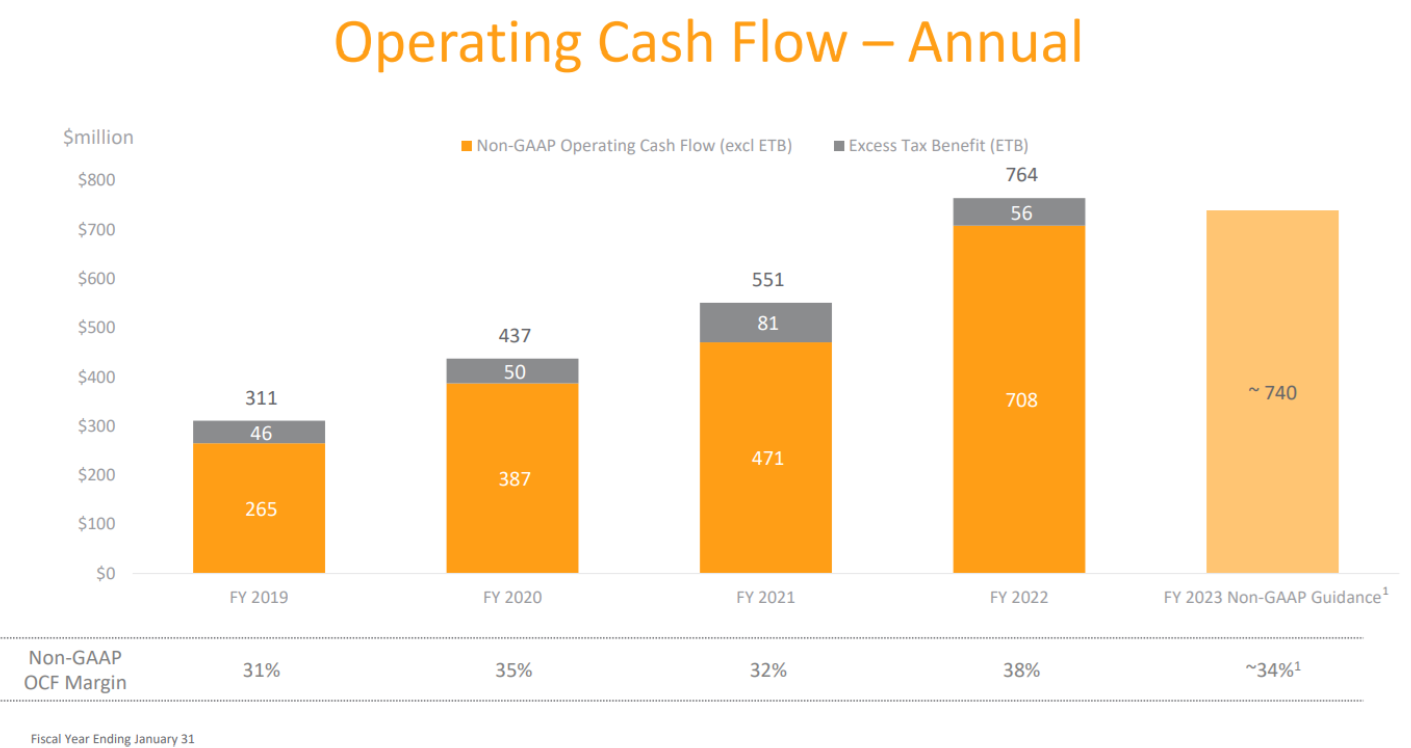

As mentioned, Veeva has tons of cash to help it fund continuing high-profit growth. For example, here is a look at the company’s strong cash flow from operations.

What’s more (and unlike many other companies), Veeva has a ton of cash on its balance sheet (as you can see in the chart below).

This strong cash position makes Veeva much more financially healthy than many other high growth companies (especially against the increasingly challenged macroeconomic backdrop.

No Long-Term Debt

Also really important to note, Veeva has no long-term debt. This is so important because while other companies struggle with the rising costs of debt (as interest rates rise) Veeva is dramatically less impacted. And instead Veeva is able to focus on growing and supporting its already strong business.

Sticky Non-Cyclical Customers

Another really important point is that Veeva’s customers are largely NOT sensitive to the economic cycle. For example, life sciences companies comprise roughly 90% of revenue, and these companies are significantly resistant to recessions because people need their drugs and medications regardless of the market cycle.

Also interesting to note, Veeva reports that it is still hiring as the companies expects its number of employees to continue expanding. This is notable because as other companies are laying off employees in large numbers, we view Veeva as in a much healthier position. Also notable, the company does expect to reduce its number of life sciences sales reps by roughly 10% by the end of fiscal 2024 as the industry becomes more digital, but this digitalization is also expected strengthen margins and profits.

Veeva also has a very high customer retention rate due to high customer satisfaction, a largely subscription-based business model (see our earlier revenue break down chart) and a “land and expand.” business.

Land and Expand

As you can see in the chart below, once Veeva gains a customer, that customer is likely to increase the number of Veeva products it uses over time, and thereby increase revenues for Veeva.

Land and expand has been a successful business model, and a big part of the reason is because Veeva has the budget to keep innovating. Specifically, Veeva spends roughly 20% of revenues on research & development, and this allows the company to continue to develop new products that are highly valuable to customers. And it is easier for Veeva to keep innovating because of its high margins and strong cash flow, as well as its strong existing relationships (to help better understand customer needs).

Wide Moat, Little Competition

When asked what is the most important characteristic in a business, Warren Buffett is reported to have once said “pricing power.” Veeva has strong pricing power considering its wide moat and little competition.

Veeva is unique in its approach because it has focused specifically on life sciences companies, which has allowed it to build unique industry-specific knowledge and competencies that competition does not have. And once customers select Veeva, they are unlikely to leave (due to the high switching costs). We believe this will support Veeva’s very strong profits for many years (decades) into the future.

Per a recent Morningstar report, In 2013 roughly one third of the global pharmaceutical sales representatives were using Veeva CRM, but that number has increased to over 80% by 2022.

From a competitor standpoint, Salesforce is the largest CRM softward provider, but their solutions are not catered to lifesciences. And the biggest direct competitor is the much smaller, IQVIA (focused on the biotech and pharmaceuticals space).

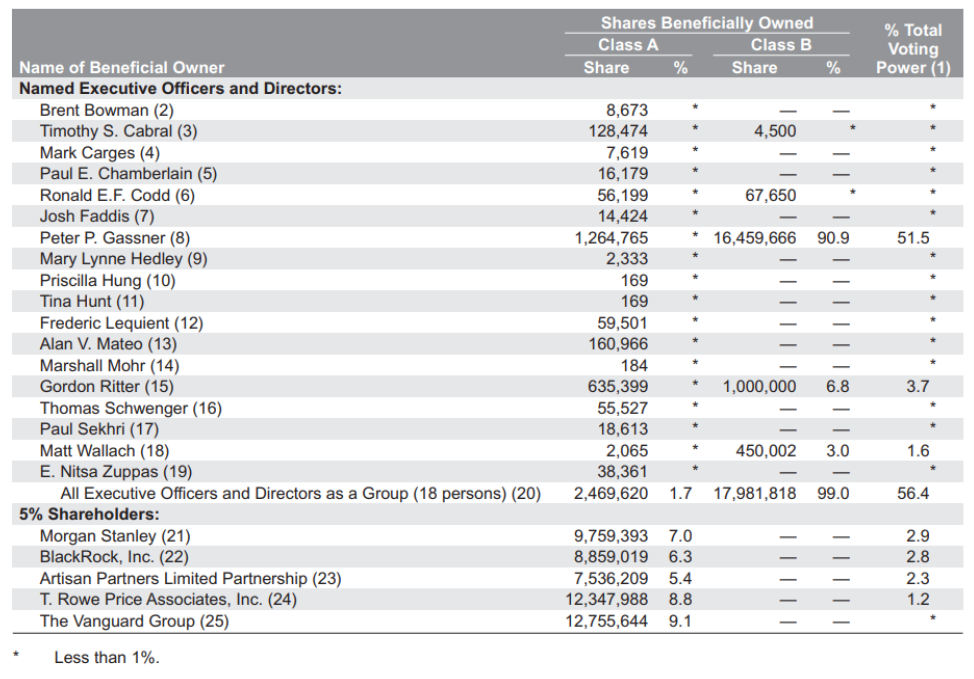

Founder and CEO owns a lot of shares

We like founder-run business, where the CEO has a lot of skin in the game. And that is the case with Veeva considering CEO Peter Gassner founded Veeva in 2007 and maintains voting control through his large share ownership (as you can see in the table below from the companies latest proxy report).

Valuation

Despite the recent steep share price declines for Veeva (as you can see in the chart below—it has sold off very hard in sympathy with other high-growth businesses and the increasingly challenged macroeconomic backdrop), some investors argue the shares are still expensive. We disagree (especially if you are a long-term investor).

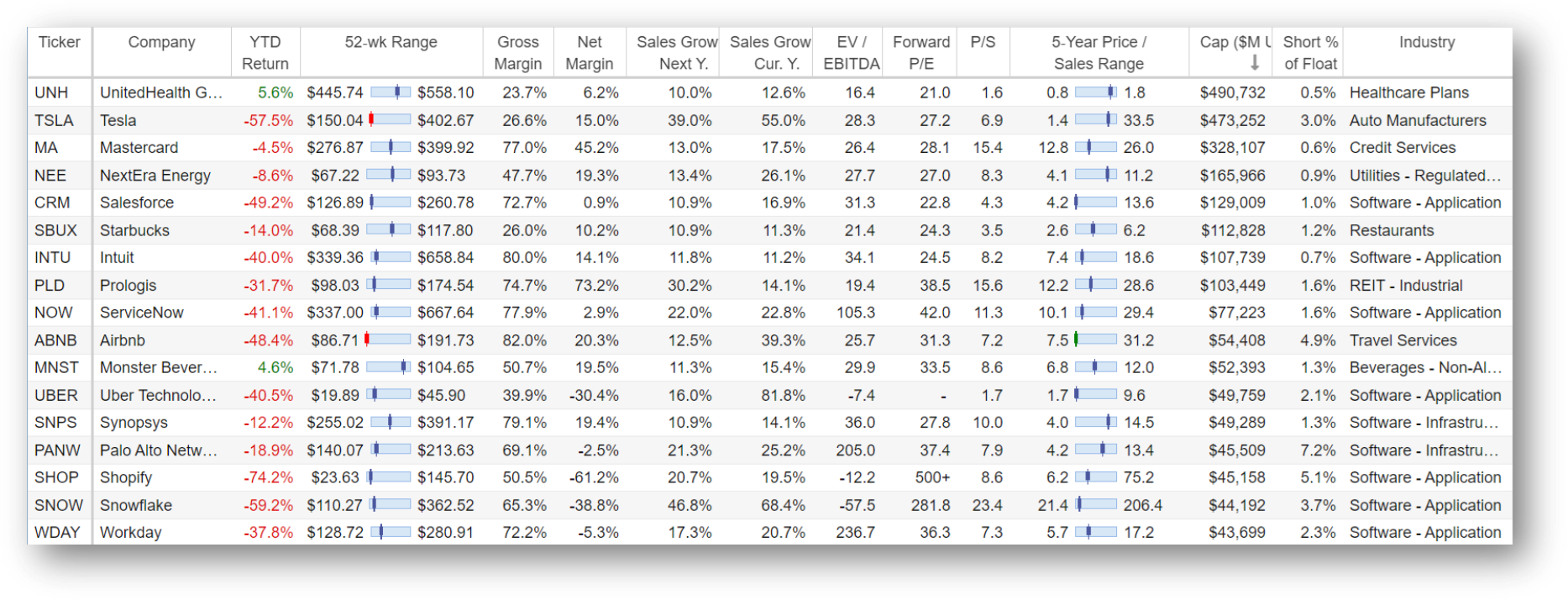

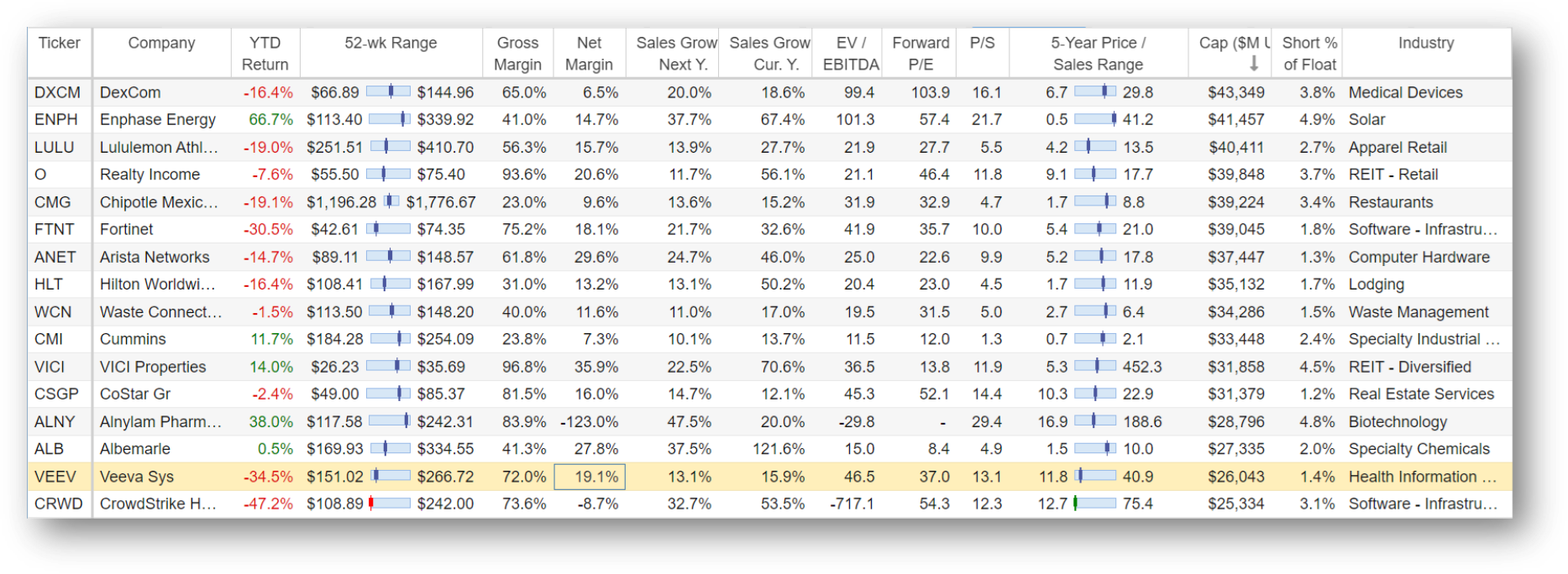

Here is a list of other high-growth companies sorted by market cap (Veeva is highlighted in yellow). To be included in the list we required at least 10% revenue growth (this year and next). And as you can see, Veeva stands out for its unique combination of highly-profitable high-margin growth (most other companies with as much growth as Veeva have little or negative profits and a lot of ugly debt).

Despite Veeva’s above market average valuation multiples (price to sales, price to earnings, EV/EVITDA) it is still dramatically undervalued relative to its long-term earnings potential (which seems highly likely given its wide moat competitive advantages). Also worth noting, Veeva’s $3.0 billion in cash (on its balance sheet) adds nearly $20 in value to the share price considering there are only around 156 million shares outstanding.

Risks

Of course Veeva does face risk factors that should be considered. For starters, it became the first “public benefit company” in the US in February of 2021. This basically means it remains a for-profit company, but is now legally responsibel to the interests of stakeholders beyond just shareholders (e.g. employees, customers and society as a whole). To a certain extent, this is largely window-dressing by a “woke” zeitgeist that most companies were largely already paying some attention to anyway. Nonetheless, it creates new risks that should be monitored.

Another risk is that Veeva is moving its CRM platform from Salesforce (CRM) to its own Vault platform. This could create some operational challenges and frustrations for customers.

Another risk is that Veeva is pushing into new verticals (such as medical device companies) and this could create new challenges and pressures on growth rates.

Further still, the company is always innovating and creating new products, but there is no guarantee that new products will be as successful as existing products.

Conclusion:

Our bottom line on Veeva Systems is simply that it is a very attractive long-term growth company. The shares have sold off hard this year as the market has been puking growth stock in general. However, Veeva is unique versus other growth stocks because of its high cash, high profits and wide moat / competitive advantages. We believe Veeva’s share price will remain volatile in the near term, but over the long-term (5-10 years) these shares are going much higher. If you are a patient long-term investor, Veeva shares are worth considering for investment (we are currently long Veeva shares).