We purchased shares of this high-growth small-cap stock in our Disciplined Growth Portfolio in 2015 (when the share price was under $30 and the market cap was around $1.4 billion). It just announced another quarter of strong earnings on Friday, and the shares now trade at around $260 (and the market cap is over $14 billion). What’s more, we continue to like its exceptionally strong growth trajectory going forward (the shares have a lot more upside ahead). This report reviews the business and 10 things we like about it going forward.

*For reference, here is our first report on Paylocity from 2015.

Paylocity (PCTY)

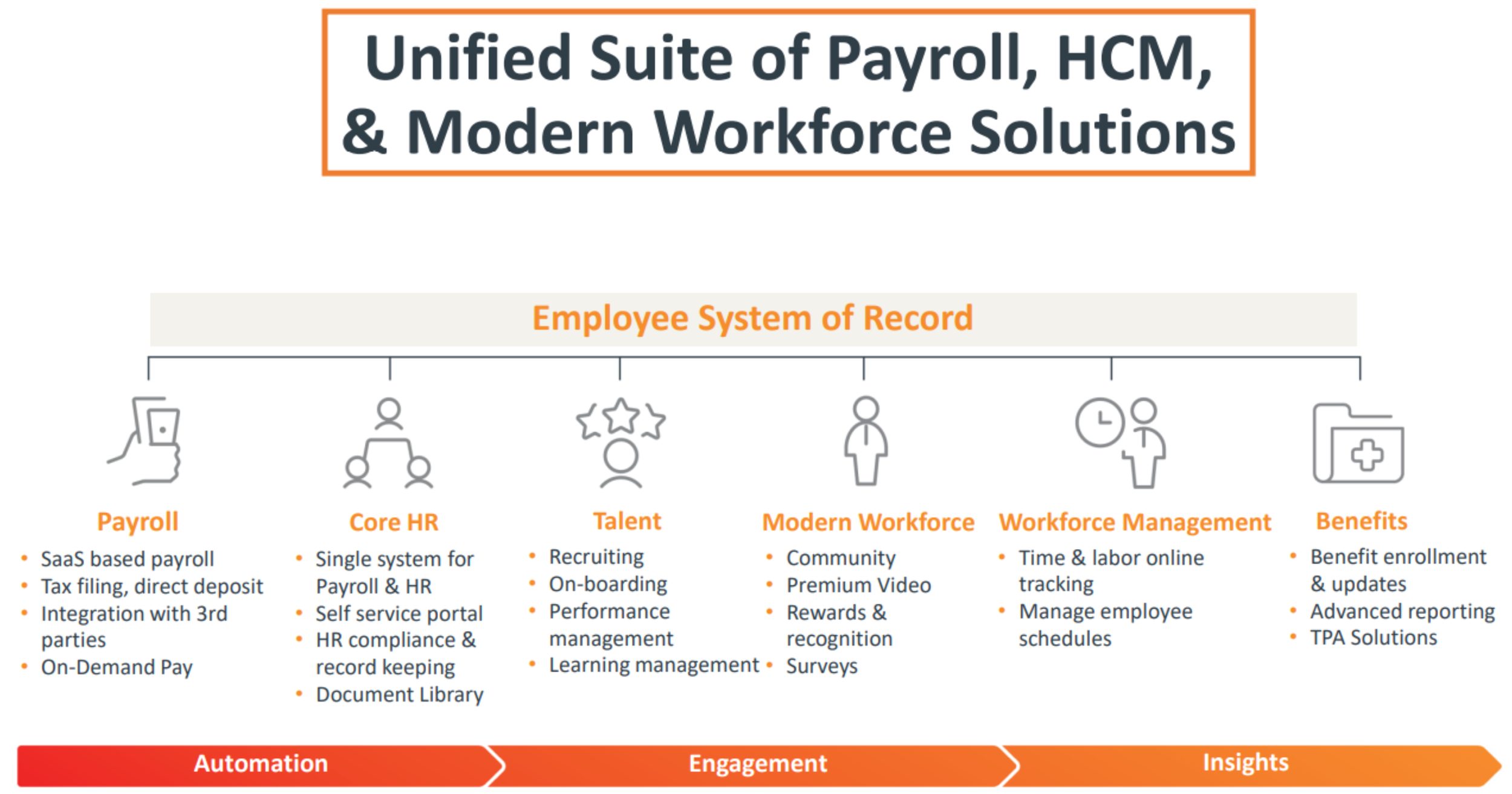

Paylocity is a payroll and human-capital-management Software-as-a-Service (“SaaS”) company. Its comprehensive product suite delivers a unified platform for professionals to make strategic decisions in the areas of benefits, core HR, payroll, talent, and workforce management, while cultivating a modern workplace and improving employee engagement.

And here is how Paylocity currently fits into the marketplace against competitors.

Paylocity differentiates itself based on its products and service. It claims its products are “built for the modern workforce” and that they offer “best in class client support.”

10 Things We Like About Paylocity:

1. Large Total Addressable Market

Paylocity has a large total addressable market opportunity, which mean it still has a long runway for more growth. Specifically, Paylocity is focused on taking share in its target market of 1.3 million businesses, as you can see in the graphic below.

And having such a large total addressable market makes it possible for Paylocity to keep growing very rapidly (considering it has currently only penetrated 2% of the TAM).

2. High Revenue Growth

Paylocity is a high-growth business. As you can see in the chart below—the revenue growth rate has consistently been above 20% (except during the unprecedented period of covid-19 lockdowns).

A revenue growth rate this high for this long is exceptionally attractive. And considering the large TAM and business trajectory—Paylocity can continue to grow rapidly.

3. Competitive Differentiation

As mentioned, Paylocity differentiates itself based on its products and service. It claims its products are “built for the modern workforce” and that they offer “best in class client support.”

Its impressive to see Paylocity continue to win a large percentage of its business from a competitor—industry stalwart, ADP.

4. Strong Sales Team

A big part of Paylocity’s high revenue growth rate and business success track record is attributable to its strong sales teams. The company hires experience sales professionals with strong B2B sales experience. Paylocity also works through its own direct sales channel, which helps maintain its strong brand.

5. High Customer Retention Rate

Also important to note, Paylocity has a high customer retention rate (currently over 92%). The company attributes this success to its industry leading product suite (technology) combined with strong focus on client service. Not to mention, as a Software solution, Paylocity gets ingrained into its customers’ business and then becomes hard (and expensive) to replace. Paylocity’s SaaS business model is attractive.

6. Profitable

A lot of high-revenue-growth business have high gross margins (sales minus cost of goods sold), but NEGATIVE net margins (because they spend so much money trying to grow their sales. However, Paylocity has high gross margins AND high net margins—this is very attractive, especially in our current market environment where investors are increasingly paying a lot more attention to bottom line profit (instead of just top line revenue growth like they were during the pandemic—when interest rates were still near zero).

Furthermore, Paylocity announced strong quarterly earnings numbers on Friday, whereby they exceeded expectations and raised guidance. And in reality, Paylocity has a long history of exceeding expectations (a good thing).

7. No Long-Term Debt

Also important, especially considering interest rates (i.e. the costs of debt) are rising, Paylocity currently has zero long-term debt. This is another indication of the strength of the business. Paylocity has strong margins, no long-term debt, and it is still able to spend generously to grow its business as well as to continue to innovate.

8. Strong Innovation

Here is a look at Paylocity’s Research & Development Margin (i.e. how much of its revenue it spends on innovation).

Paylocity has always maintained a high R&D budget, and this is part of the reason the company has been a constant innovator and a constant strong revenue growth producer.

9. Strong Leadership

Paylocity currently has Co-CEOs: Steven Beauchamp has been with Paylocity since 2007 and became Co-CEO in 2022. Steven was originally the only CEO from 2007 to 2022, when he was joined in the Co-CEO role by Toby Williams. Toby joined Paylocity as CFO in 2017. Both Steven and Toby have extensive experience in payroll and human capital roles both inside and outside of Paylocity.1

10. Attractive Valuation

Paylocity’s valuation metrics have come down since the peak of the pandemic bubble, as you can see in the following chart.

However, despite the declines in valuation metrics, the business (and its growth) have remained very strong. Some investors believe that the current valuation multiples are still high, however they’re really not compared to the ongoing strong revenue growth trajectory and growing profits, especially considering the business has no long-term debt.

One of the reasons many high growth stocks have sold off in the last year (besides their high valuations—many of which were much higher than Paylocity’s) is because interest rates are rising—which means it will be more expensive for those businesses to fund future growth (because their cost of capital has increased). However, because Paylocity has strong free cash flow generation and no long-term debt—the business is in much better shape than a lot of its peers.

And even though the share price has risen this year (and especially after Friday’s earnings announcement), Paylocity is still about 17% below its 52-week high—even though the busines has continued to improve.

Conclusion

We continue to own shares of Paylocity because we continue to believe the shares have a lot more long-term price appreciation potential—especially considering the large TAM, competitive advantages and financial strength of the business. Shares of Paylocity are one of our top 10 largest holdings within the Disciplined Growth Portfolio. And while we may trim back the size of the position from time-to-time (for portfolio risk management reasons) we have no intention of eliminating our position, and we continue to look forward to years of strong growth and gains ahead.

Paylocity is a stock that doesn’t get much attention, but the shares are absolutely worth considering for investment if you are a long-term growth investor.