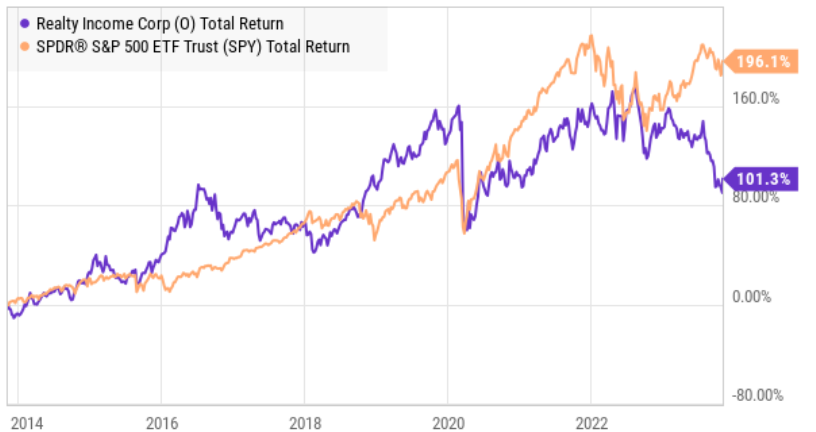

Realty Income shares are down 15% this year while the S&P 500 is up 15%. Aside from the strong performance of the “Super 7” mega-cap stocks that have driven the index higher, Realty Income (and REITs in general) have been plagued by higher interest rates and a changing real estate landscape. In this report, we review Realty Income’s business strategy (i.e. growth through acquisition), the big macroeconomic and secular headwinds the industry faces, dividend safety, valuation and risks. We conclude with our strong opinion on investing.

Overview

Realty Income, also known as “The Monthly Dividend Company,” is a real estate investment trust (“REIT”) that has paid monthly dividends for over 54 years. And the dividends have steadily grown over time. The company generates cash flow from over 13,250 properties, mostly owned under long-term net lease agreements with commercial (mainly retail) clients.

Business Strategy

Realty Income’s current strategy is based largely on growth though acquisition. And the company will become the fourth largest US REIT in the first quarter of 2024 when its latest very large acquisition (of Spirit Realty(SRC)) is expected to be complete.

The company’s acquisition strategy makes sense for two reasons. First, because of economies of scale and a stronger credit rating than most REITs, Realty Income is able to finance acquisitions at lower costs than competitors. This is a distinct (and valuable) competitive advantage. Second, the strategy makes sense because the market is highly fragmented, so there are a lot of opportunities for the company to pursue attractive acquisitions.

Current Macro Environment

Unless you’ve been living under a rock, you know that interest rates have climbed significantly higher over the last year (as the fed battles high inflation). Higher rates create problems for property owners simply because the ongoing cost to finance property purchases (and refinance existing loans when they mature) increases, in some cases to the point where it’s no longer profitable for investors to finance the properties. However, Realty Income has a lower cost of capital (as described above), thereby giving it a distinct advantage over other REITs.

Secular Changes in Retail Real Estate

Another big factor impacting REITs is secular change. For example, the internet has obviously changed the landscape for retail REITs (because consumers buy a lot more things online). Realty Income owns mainly retail properties, and even though the companies pursues opportunities that are less impacted by internet retail, Realty Income is still impacted.

Dividend Safety

One big reason investors love Realty Income is because they trust the steady growing monthly dividend.

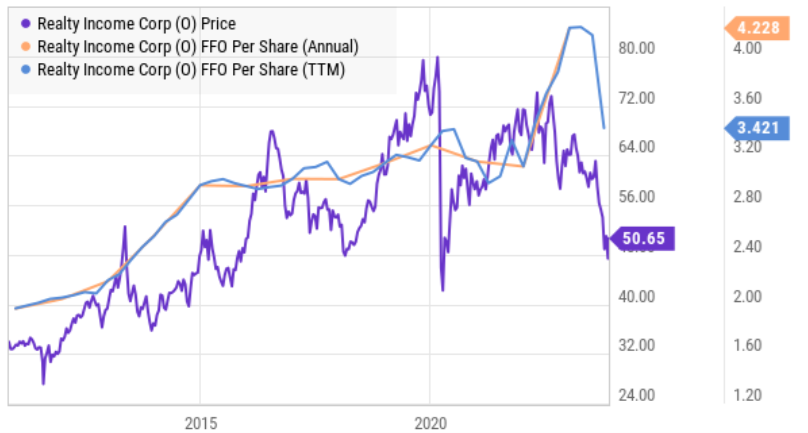

From a dividend safety standpoint, the current quarterly dividend (on a forward basis) is $0.77 per share. And this compares favorably to Realty Income’s Funds From Operations (“FFO”) of $1.04 per share (i.e. the dividend is well covered). The dividend is also well covered as compared to Adjusted FFO of $1.02 per share. Also important to note, AFFO has growth fairly consistently over time (i.e. a good thing) as you can see in the following chart.

Valuation

From a valuation standpoint, Realty Income currently trades at 12.6 times AFFO, which is low by its own historical standards. As you can see in the following chart, the share price has come down recently (contributing to the lower P/AFFO ratio) while the AFFO remains healthy.

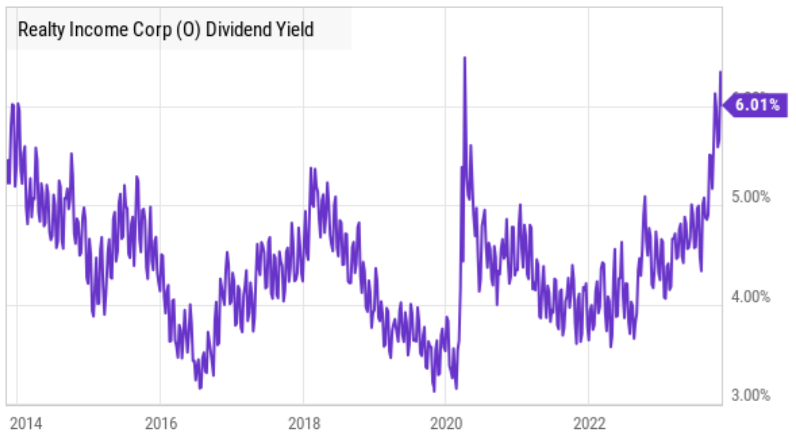

Also noteworthy from a valuation standpoint is that Realty Income currently offers a dividend yield of over 6% (high by historical standards).

We view the high dividend yield as a signal from management that they believe the shares are undervalued, and if/when the share price rises, the dividend yield will mathematically fall to more normal levels, as per history.

Risks

Rising interest rates present a risk for the entire real estate industry. For example, as described earlier, as rates rise it becomes more expensive (and more challenging) to profitably invest in real estate. In some regards, Realty Income is in better shape than peers (because of economies of scale, a strong balance sheet, and lower borrowing costs), however eventually Realty Income will have already acquired all the low hanging fruit competitors.

Sales-Leasebacks are a growing trend in the industry where Realty Income is a beneficiary. For example, property owners who can no longer afford the interest costs on their properties can sell to Realty Income to get some instant liquidity/cash, and then lease the properties back from Realty income. This is a good temporary fix, but also an indication of longer-term challenges for the real estate industry.

Another big risk could be investor (and management) over-confidence. For example, throughout the latest quarterly earnings presentation, management frequently references the company’s strong historical performance. But of course, past performance is not a guarantee of future success. And investors often also cite past performance, which can lead to over confidence in the future and ultimately poor results.

Further still, Realty Income’s concentration in retail properties (albeit many of the most attractive retail properties) still presents some concentration risk. The company has made some efforts to diversify into industrial properties, but industry concentration is still a risk, especially considering the ongoing secular changes to retail, as described earlier.

The Bottom Line

In our view, despite the challenges, Realty Income is an attractive investment for income-focused investors seeking the potential for price appreciation potential. The dividend yield is high (over 6.0%) and well covered by AFFO. And the valuation is low by historical standards. In our view, Realty Income’s “growth through acquisition” strategy is prudent, and only the strongest REITs (such as Realty Income) will survive longer-term industry disruption. We are currently long shares of Realty Income, and expect the share price and the dividend to both rise in the years ahead.