As lithium demand grows (and supply remains limited), the basic materials stock we review in this report is increasingly attractive. The shares are down 35% from their 52-week high, but the business continues to strengthen (i.e. revenues are growing very rapidly, the market opportunity is huge and profit margins remain strong). In this quick note report, we consider the company’s latest strategic effort, its valuation and our opinion on investing (i.e. we own shares).

Albemarle (ALB), Dividend Yield: 0.72%

We first wrote up Albemarle back in May of last year (and we do currently own shares in our Disciplined Growth Portfolio). Albemarle is a basic materials company that has increased its dividend for 29 years in a row, but it has newfound GROWTH opportunities related to dramatically increasing lithium demand and pricing (courtesy of exploding demand for lithium-based batteries in electric vehicles, for example).

Strategic Acquisition:

Albemarle made an offer to takeover Liontown Resources (an Australian lithium miner) on March 29th. Liontown quicky rejected the offer, which means Albemarle may raise their offer price (and eventually runs the risk of overpaying for the assets). However, the takeover offer is consistent with Albemarle’s strategy to be a lithium leader with access to high-quality low-production-cost lithium assets (as the demand for lithium continues to grow). The acquisition would increase Albemarle’s leadership position and economies of scale.

According to a March 29th research note from Morningstar Analyst, Seth Goldstein:

Liontown is in the construction phase of its first lithium hard rock resource, named Kathleen Valley. The project plans to produce 3 million metric tons of lithium concentrate, which we estimate could be converted to roughly 375,000 metric tonnes per year of lithium chemicals on a lithium carbonate equivalent basis. Based on the project's development study, it is estimated to be the fifth largest hard rock resource in Western Australia, behind Albemarle's two current resources, Greenbushes and Wodgina, with an above-average lithium concentration. This should put the resource on the lower half of the spodumene cost curve.

And with regards to the Kathleen Valley project, according to StoneFox Capital:

The project already has off take agreements with LG Energy Solution, Tesla (TSLA) and Ford Motor Company (F). In fact, the major U.S. auto company agreed to extend a A$300 million debt facility to Liontown to ensure the company has the majority of capital to complete construction of the lithium mine.

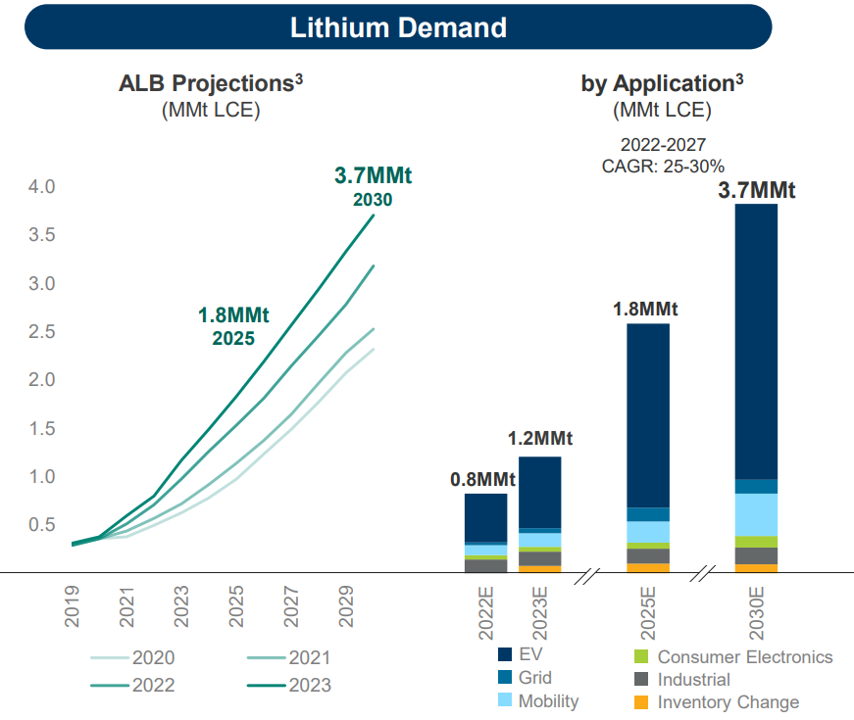

Here are a couple charts from Albemarle’s latest investor presentation showing the massive demand growth for lithium across end markets and for electric vehicles in particular.

Current Valuation:

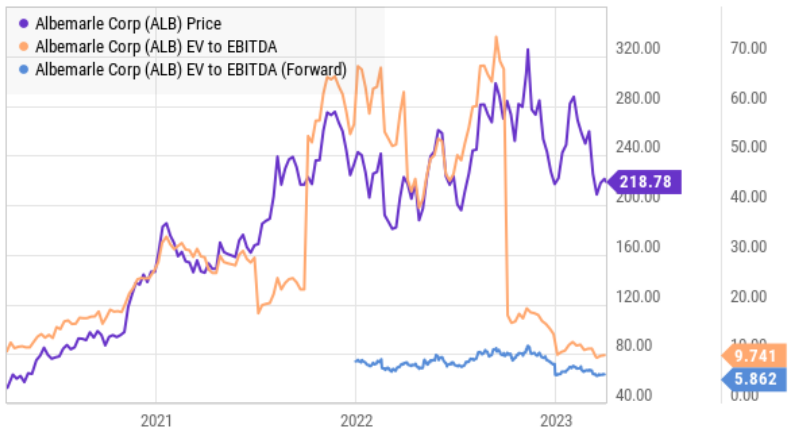

Albemarle is profitable (36% net margin), growing rapidly (119% revenue growth y/y and 53% forward expectations) and has a huge market opportunity ahead (see charts above). It also trades at an attractive valuation.

The Bottom Line:

Albemarle is an attractive growth stock. It is very profitable and it’s growing rapidly. It has a large market opportunity and an investment grade credit rating. The shares are 35% off their 52-week high, and the valuation (EV/EBITDA) is attractive. We currently own shares of Albemarle in our Disciplined Growth Portfolio.