The closed-end fund (“CEF”) we review in this report is compelling for a variety of reasons, including its big monthly distributions, discounted price and attractive investment strategy (it invests in infrastructure securities, both stocks and bonds). In this report, we review the important details and risks that investors should consider, and then conclude with our strong opinion on investing.

Cohen & Steers Infrastructure Fund (UTF), Yield: 8.2%

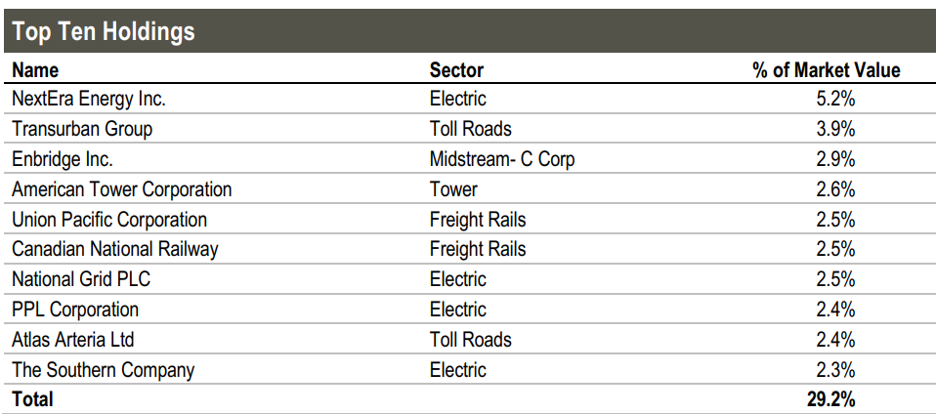

The Cohen & Steers Infrastructure Fund has been around since March 27, 2004 (inception date) and has ~$3.2 billion in managed assets (large by CEF standards). The fund’s objective is total return with an emphasis on high current income by investing in infrastructure securities (both stocks and bonds) including utilities, pipelines, toll roads, airports, railroads, marine ports, telecoms and other infrastructure companies. UTF recently held 240 individual positions, and you likely recognize some of the top 10 positions (in the following table).

And for reference, here is a look at the fund’s recent holdings breakdown by sectors and stocks versus bonds.

Discounted Price Versus NAV:

One of the unique characteristics of closed-end funds is that they can trade at significant discounts and premiums in the market versus the value of their underlying holdings (or NAV), thereby creating unique risks and opportunities (these wide deviations generally do not exists for open-end mutual funds and exchange traded funds). And in UTF’s case, it currently trades at a small discount, which is better than a premium (we prefer to buy things at discounted prices). Specifically, here is a look at the recent price and NAV performance of UTF.

Infrastructure Is Attractive:

Many investors find infrastructure investments attractive because of their steadier nature (e.g. utility and railroad stocks generally tend to be a lot less volatile than zero-profit growth stocks, for example). And UTF’s combination of investing in utilities through stocks and bonds can make the strategy even less volatile over time as compared to a pure stock market investment strategy.

Infrastructure may also be attractive from a growth-versus-value style perspective. Specifically, a lot of investors notice near and mid-term performance leadership changes between growth stocks and value stocks as the market cycle ebbs and flows. And infrastructure stocks tend to be more “value” stocks. As you can see below, value stocks have underperformed growth stocks this year, and some investors consider this a more attractive “contrarian” time to “buy low”

Bonds Are Attractive

As mentioned, UTF also invests in bonds, which can reduce volatility as compared to pure stock market investments—something many investors find attractive. Further, bond yields have risen over the last year (i.e. higher income is available now). And interest rate hike increases may finally be over this year as per the fed—which is also good for bonds (because as rates rise, bond prices fall). Many investors consider UTF’s bond allocation very attractive, especially where we are now—at this point in the interest rate market cycle.

Leverage

The leverage ratio on UTF was recently 29.4%. This means the fund borrows money. Leverage can magnify returns (and income) in the good times, but can increases losses and risks in the bad times. However, given the lower volatility of many infrastructure investments (combined with the lower volatility of bonds) we view the leverage as prudent and attractive (especially as interest rate hikes appear to be over, for now)..

Expense Ratio

One of the common complaints about CEFs (such as UTF) versus many ETFs (including passive ETFs), is the higher fees and expenses of CEFs. For example, UTF’s recent total expense ratio was 2.19% (which is significant and detracts from your total returns). However, bear in mind, the fee includes the cost of leverage (the fee falls to 1.59% on a total “managed asset” basis), and the fees cover the costs of the management team (UTF has five highly-experienced portfolio managers managing the fund). Nonetheless, investors should be aware of this cost (even though many claim to not mind as long as the big steady income keeps coming in every month via distributions to shareholders).

Sources of Distributions

Many investors love UTF because they have come to trust the big steady monthly distribution payments. However, it is important to understand that those distributions don’t come entirely from dividends and interest payments on the underlying holdings. Rather, a portion also comes from capital gains (both short-term and long-term) as well as an occasional “return of capital” (i.e. when the fund just gives you back some of your own original investment dollars as part of the distributions—to keep that monthly distribution so high). For example, you can see in the following chart that the distribution for UTF has recently been sourced from a combination of income, short and long-term gains, and return of capital (“ROC”).

We are comfortable with the management team’s use of various sources to fund the distributions, and believe it is prudent (and sustainable) to maintain the big monthly distributions (i.e. the reasons so many investors invest in UTF in the first place).

The Bottom Line

Despite the risks (such as higher fees, leverage, sources of distribution, and the fact that the discount to NAV could still get wider), we view UTF as highly attractive if you are an income focused investor. We like the diversified stock and bond infrastructure exposure (especially now from a sector and interest rate standpoint), and we like the big steady monthly income. We do NOT currently own UTF, but it is included on our watchlist for the High Income NOW portfolio, and we may purchase shares in the near future. If you are looking for a big 8.2% monthly distribution payment, UTF is absolutely worth considering.