If you are an income-focused investor, big-dividend Business Development Companies (“BDCs”) are hard to ignore. However, not all BDCs are created equally. In this report, we review one BDC Capital Southwest (including its business strategy, dividend safety, valuation as compared to 40+ other BDCs, and the risks). We conclude with our strong opinion on investing in Capital Southwest in particular and BDCs in general.

Overview: Capital Southwest (CSWC)

Capital Southwest is a big-dividend BDC focused on lower middle market companies, providing mainly first lien loans, across a variety of industries. Based out of Dallas, TX, CSWC is internally managed (good for less conflicts of interest for shareholders) and has diversified investments across the US.

The company’s investment strategy includes both core and opportunistic investments, as you can see below.

Core Portfolio: The BDC’s core portfolio consists of lower middle market CSWC led Deals, typically companies with EBITDA between $3 million and $20 million (fairly small by BDC standards). Leverage is typically 2.0x – 4.0x Debt to EBITDA, and commitment sizes are up to $50 MM (with hold sizes generally $5 MM to $35 MM). CSWC offers both sponsored and non-sponsored deals, and they frequently make equity co-investments alongside debt.

Opportunistic Portfolio: CSWC’s opportunistic portfolio consists of upper middle market (club, first and second lien), typically companies have in excess of $20 million in EBITDA. Leverage is typically 3.5x – 5.0x Debt to EBITDA (and hold sizes are generally $5 million to $20 million). They provide floating rate first and second lien debt securities.

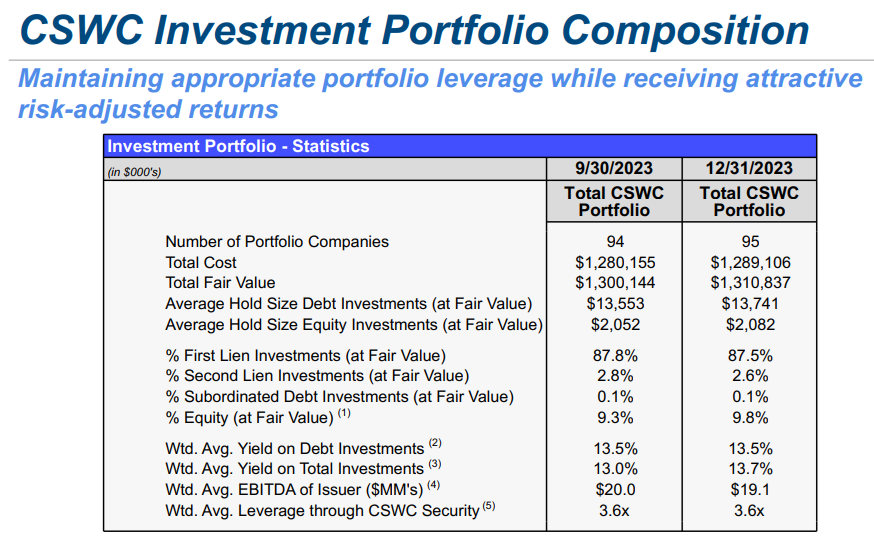

Approximately 97% of the CSWC’s credit portfolio is in first lien senior secured loans with an average investment hold size of 1.2% (as of 12/31/23). Additionally, CSWC has one main fund, I-45 SLF, a loan portfolio of $118 million (95% first lien senior secured debt).

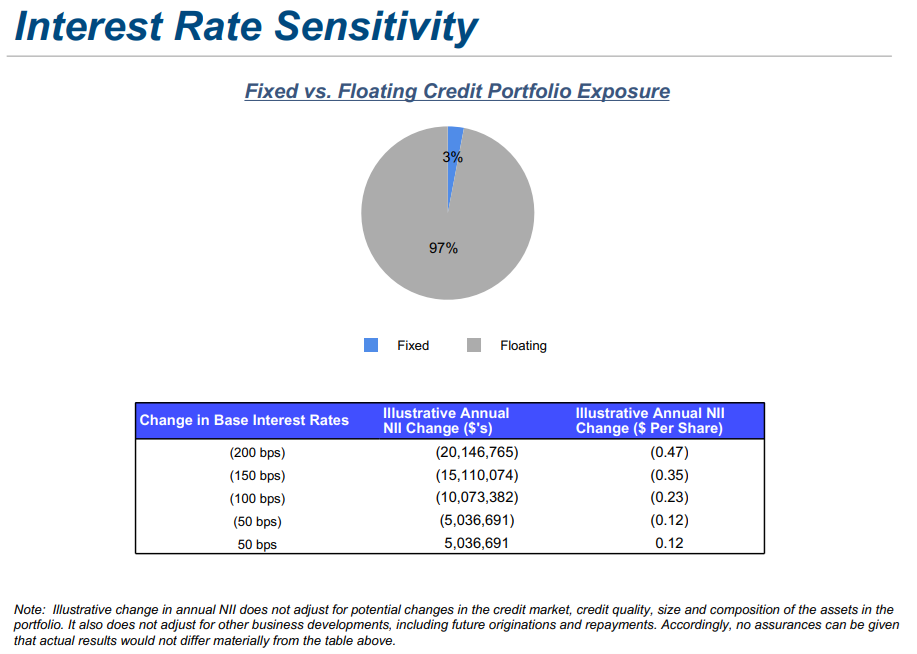

Floating Rate Loans: Notable, CSWC’s portfolio is mostly based on floating rates, which can be good now that interest rates are higher than they have been.

Publicly-Traded Bonds:

For investors seeking more certainty for their investment dollars, CSWC also has publicly-traded 7.75% Notes due in 2028 (CSWCZ). The notes recently have experienced a small bit of volatility following the announcement of a new $150 million secured credit facility in March. However, as management explained, they are keeping their total commitments under credit facilities in loackstep with asset growth (so basically, the notes recovered from their initial sell off and now trade at around $25.75 versus a $25 “face value”).

3 Reasons BDCs are Special:

Before getting into more details on CSWC, it’s worth considering a few reasons why BDCs, in general, are special…

1. No Corporate Taxation: For starters, BDCs don’t pay tax at the corporate level as long as they pay out their income as dividends. This gives BCDs a big advantage over other companies, and this advantage was created by an act of Congress in the 1980’s because they wanted to make it easier for the small businesses BDCs serve to thrive.

2. Less Regulation: Another reason BDCs are special is because they are allowed to take on “risks” that traditional banks are not allowed to due to stricter banking regulatory rules (and reserve requirements) following the great financial crisis.

Generally speaking, this enables BDCs to invest in attractive opportunities that traditional banks are not able to. This is amazing because (as you will see in our later table) some BDCs have actually outperfomed the market (e.g. the S&P 500 over the last 5 and 10 years) which is a lot more than you can say for other big-yield investment categories (such as bond closed-end funds and many REITs). It’s doubly amazing because the S&P 500 includes many top growers like the “Magnificent 7” megacaps (which have dominated market performance).

3. Mostly Non-Qualified Dividends: In some cases, it can be helpful if you own BDCs in a non-taxable account (e.g. IRA) because most of their dividends are generally NOT qualified (meaning they don’t qualify for the lower dividend tax rate). For example, in 2023, approximately 8% of the dividend of popular BDC Main Steet Capital (see our later table) was taxed as qualified and approximately 92% was taxed as ordinary income.

So with that backdrop in place, let’s get into more detail on CSWC….

Dividend Strength:

CSWC currently offers an ~10.3% dividend yield, and has an investment grade credit rating from Fitch (BBB-) and Moody’s (Baa3) (and both company’s reaffirmed their ratings following the recent credit facility described earlier).

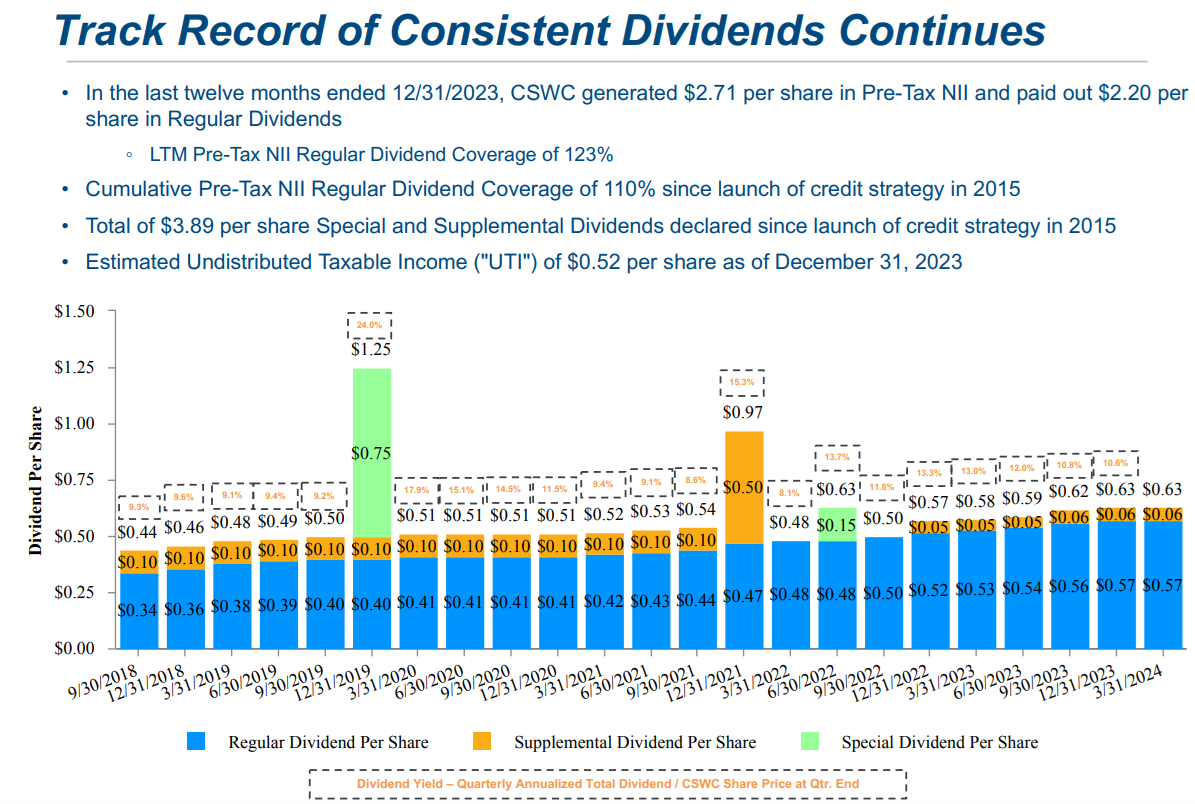

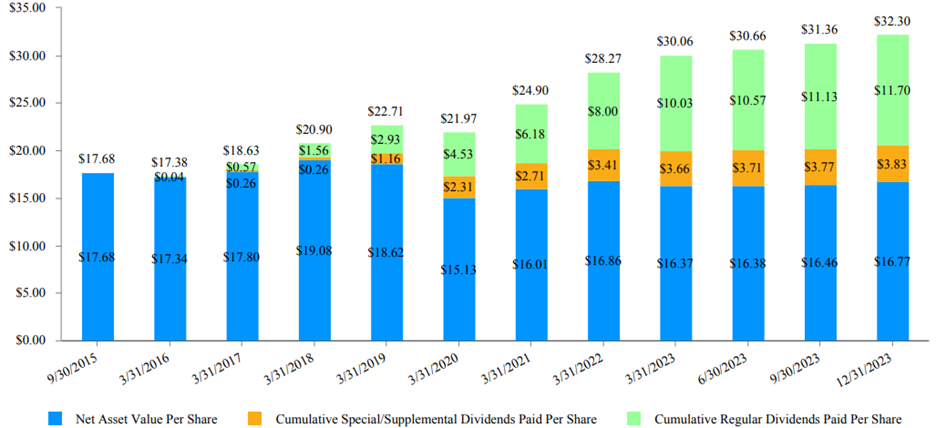

The company has paid dividends since 2016 (including special/supplemntal dividends). Notably, 2016 is when the company spun off Capital Southwest Industries (mainly equity investments) to focus CSWC on mainly debt investments).

Also important, CSWC is able to pay such large dividens because their investments (mainly loans) yield over 13% on average (as you can see in the table below).

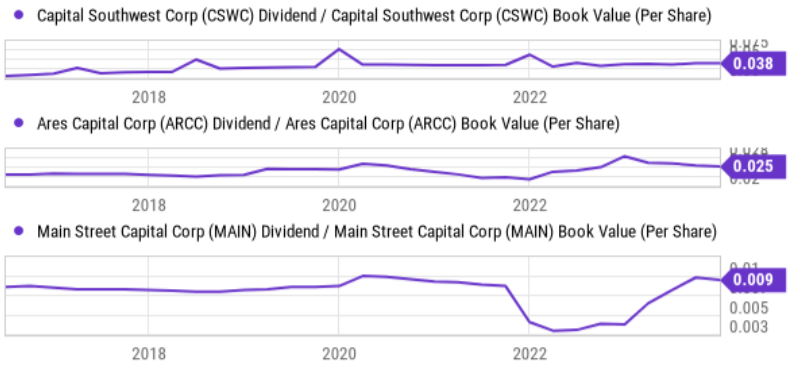

Interestingly, CSWC pays a higher dividend as compared to book value (versus other BDCs, such as Ares Capital and Main Street Capital) as you can see in the chart below.

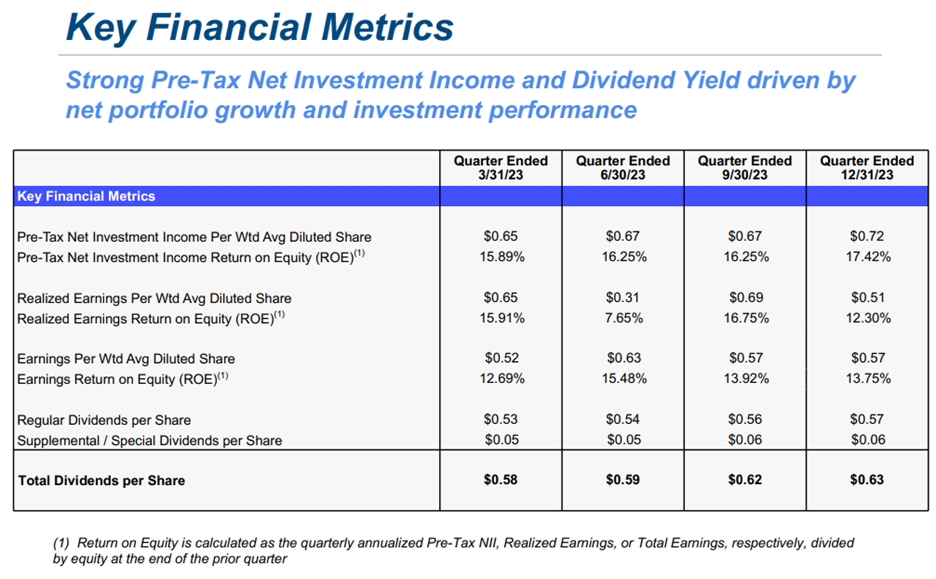

This higher yield vesus book value makes some sense as CSWC focuses on lower middle market (a bit riskier with higher rates). And the company’s dividend also continues to be covered by Net Investment Income (an important BDC metric) and by Earnings Per Share (EPS), as you can see in this next table.

Valuation

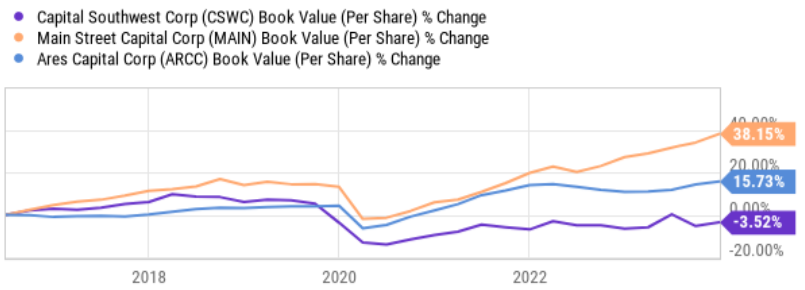

Book value is a common high-level BDC valuation metric, and CSWC’s book value (currently ~1.5x) is high as compared to other BDCs (see our table later in this report) and CSWC’s P/B growth per share has lagged other peers, as you can see in the chart below.

However, CSWC’s total retun has been very strong as the dividend is large and as the price-to-book value ratio has expanded as investors have increasing faith in the business and the lower middle market business model.

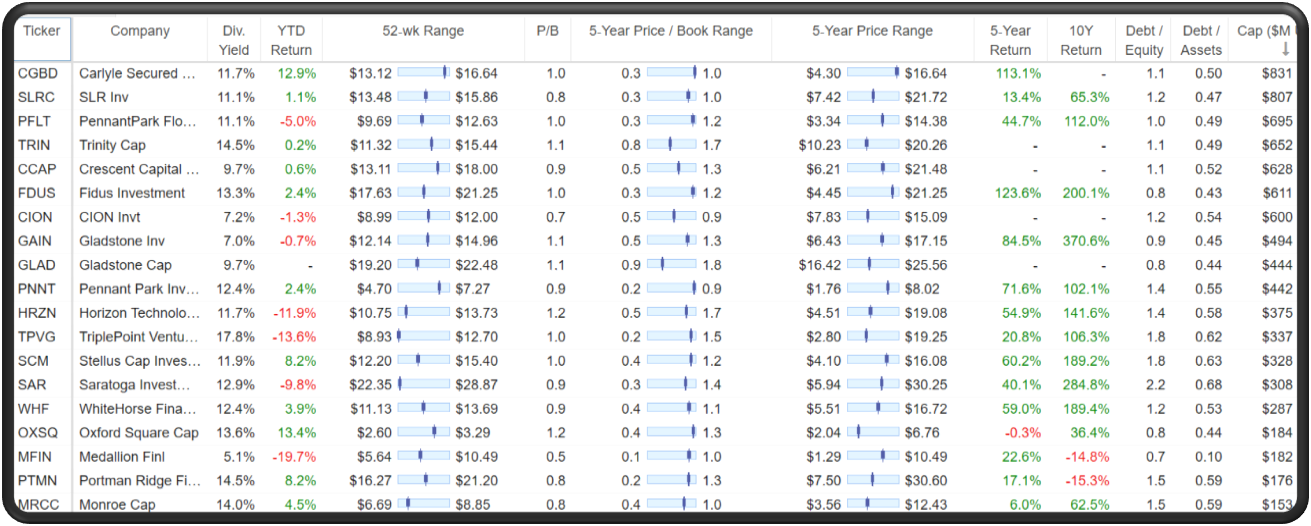

40+ Big-Yield BDCs Compared:

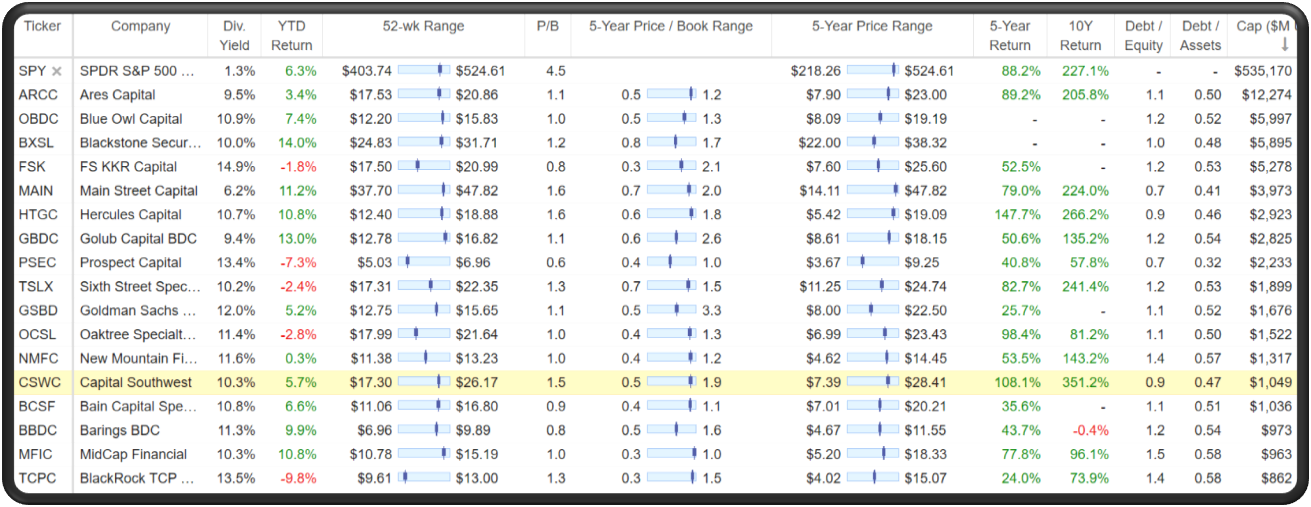

For more detail, here is a comparison to 40+ other BDCs, and you can see CSWC returns have been very strong over the last 10 years as the price to book value has risen (i.e. mainly through multiple expansion as the business model has evolved and strengthened).

The above table also includes a variety of additional BDC metrics for you to compare and consider, such as histoical returns, dividend yields, market caps and more.

Risks:

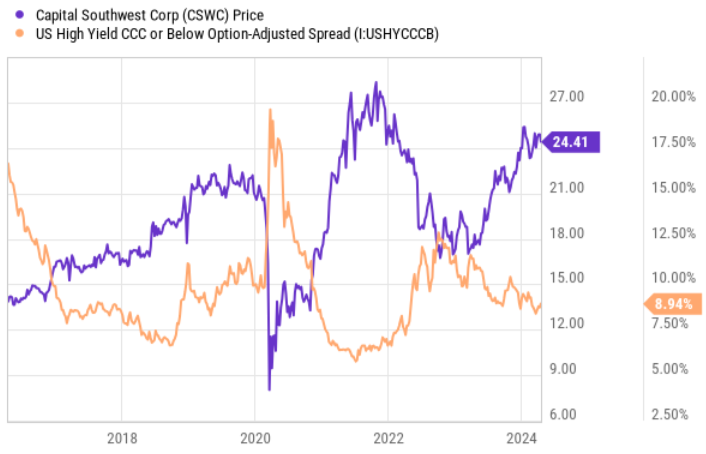

Credit Spreads are Low:

For starters, credit spreads are currently low, as you can see in the following chart. This basically means the market is NOT currently pricing a lot of risk into BDC prices. As you can see, when credit spreads widen, BDC prices tend to fall. Credit spreads are basically the difference in yield on safe investments (such as US treasurieis) versus riskier high-yield and/or “junk” bonds.

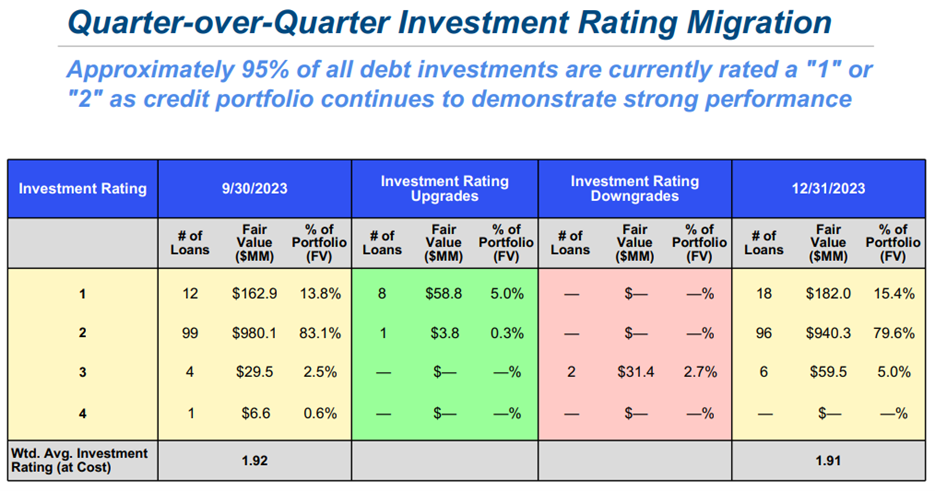

But with regards to the safetfy of CSWC’s loans, most of them have strong/healthy internal ratings, as you can see in this next graphic.

And again, CSWC’s own credit profile, in aggregate, is relatively healthy, as measured by its ongoing “investment grade” credit ratings.

Interest Rate Risk:

Interest rates are another risk for CSWC. Specifically, considering the majority of its loans are floating rate, if rates fall so will CSWC’s interest income (all else equal). For example, you can see our interest rate sensitivity chart from earlier in this report. And considering uncertainty around interest rates (some investors believe rate cuts are coming, others do not), interest rates are a risk for CSWC in particular (they have more floating rate loans than other BDCs).

BDCs Are Risky Business in General

BDCs make loans that banks generally cannot (they don’t have the competencies) or that banks are not allowed to make (they are too risky following increasingly stringent banking regulations and reserve requirements following the Great Financial Crisis in 2008-2009).

BDCs tend to be great businesses, but the weaker ones tend to get wiped out during market extremes (this is why banks are not allowed to make these types of loans—too risky). For example, many BDCs were formed and/or restructured following the 2008-2009 financial crisis. And remember, even CSWC had a big strategy change in 2016 when they spun off CSW Industries and realligned their overall business model to focus more exclusively on debt/lending investments.

The Bottom Line

Select BDCs can be great investments, but only in moderation and within the constructs of a prudently diversified goal-focused investment portfolio. In aggregate, BDCs are not particularly “cheap” right now (recall credit spreads are low an price-to-book values are not particularly compelling), but select dividends (such as the big divided offered by CSWC) are healthy and attractive.

We currently have no position in CSWC (we currently own ARCC, MAIN, OCSL and HTGC), but CSWC is attractive and high on our watchlist. The dividend looks healthy and quite attractive. If you are an income-focused investor, CSWC shares are absolutely worth considering.