The payment processing software company we review in this report has a lot of attractive qualities and a few question marks (i.e. risks). After reviewing the business, the growth opportunity, the valuation and the risks, we conclude with our opinion on investing.

Shift4 Payments (FOUR):

Shift4 Payments is a software-based solution that allows for in-person and online payments serving a wide and growing variety of industries, including restaurants, websites, hospitality (e.g. hotel/vacation destinations), specialty retail, sporting events and others.

The company was founded by its current CEO (Jared Isaacman) in the 1999 (when he was 16), and has grown from serving small businesses to mid and large business too (it has moved across the foodchain through a variety of strategic acquisitions.

Shift4 started trading publicly in 2019, has a market cap of over $5 billion and processes over $200 billion in transactions each year (through over 100 payment methods and over 500 technology integrations). The comapany has 200,000+ customers.

There is a great 5 minute video on the company’s website about its history and current business here.

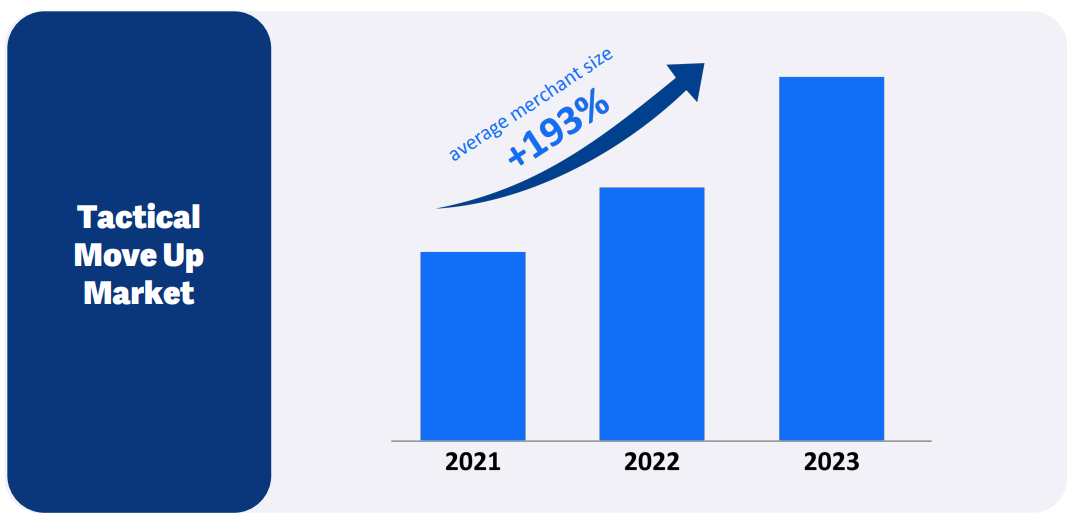

High Growth Trajectory

Shift4 recently reported Q4 results, and the company continues on a trajectoy of high growth, in terms of payment volume, revenue, gross profits and Adjusted EBITDA.

The payments market is truly enormous, and currently being distrupted by innovative “fintech” companies, such as Shift4 Payments.

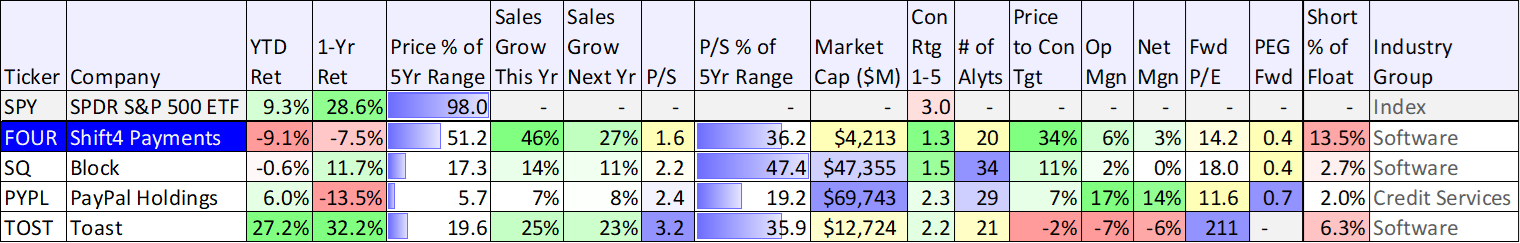

You can get a feel for Shift4’s expected high revenue growth rate (for this fiscal year and next) in the following table (and as compared to peers).

Valuation:

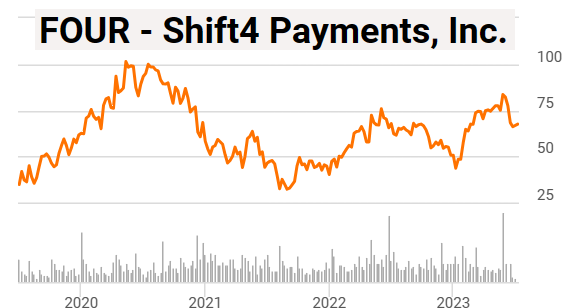

Shares of Shift4 have fallen this year after speculation it was to be acquired (at a heafty premium) fell through (see price chart below).

Importantly, Shift4 now trades at an attractive valuation in terms of price-to-sales (in the lower half of its 5-year range) and PEG ratio (Price/Earnings to Growth) which is only 0.4x (attractive), see our earlier table above.

Also important, FOUR is already GAAP profitable (and free cash flow positive), which will help the company survive our current higher interest rate enviornment (as compared to two years ago when rates were near 0%) (FOUR has debt maturing in Dec 2025, more on this later).

Also noteworthy, fintechs have fallen greatly out-of-favor with the market (after the panemic bubble) and the market currently presents some very attractive contrarian opportunities in fintechs (especially FOUR as revenues and profits continue to grow).

Additionally, as you can see in our earlier table, the 20 Wall Street analysts covering FOUR have an aggregate “strong buy” rating and believe the shares have 34% upside (we think it’s much more over the long term).

The Risks:

Of course there are risks that should be considered.

Competion: For example, FOUR doesn’t really have any strong competitive advantage over its peers other than existing customers tend to have a high renewal rate (i.e. once you land a customer, they don’t easily switch to someone else). So continuing to aggressively gain customers through both sales and acquisitions is critical in growing, but also adding to economies of scale and competitive advantages. Notably, FOUR is smaller than some of its competitors (including private companies like Stripe).

Debt: Another risk is interest rates. The company does have $1.75B in long-term debt on its balance sheet beginning to mature in December of 2025. The good thing is it’s at a very low average interest rate (1.35%), but the bad news is FOUR will have to use cash to pay it off when it comes due (FOUR is cash flow positive) or refinance it at (likely) a much higher rate.

Shares outstanding is another risk in terms of dilution and voting rights. First, the company sharecount has continued to grow over the last year, but the growth rate has been reasonable (7.5%) and typical for a growing company. However, FOUR also has three different share classes, whereby the founder/CEO maintains control of the company though voting rights (even though he doesn’t own the majority of the shares). This creates some additional risks because he can basically make whatever decisions he wants, which a typical board might not have allowed or agreed with. Here is how the company’s website describes the shares:

Shift4 has three classes of common stock outstanding: Class A common stock, Class B common stock and Class C common stock. Each share of our Class A common stock entitles its holder to one vote per share and each share of each of our Class B common stock and Class C common stock entitles its holder to ten votes per share on all matters presented to our stockholders generally. Class B shares have no economic value but the votes, while Class C shares have the economic value and the votes.

Currently Isaacman (founder CEO) controls more than 80% of Shift4's voting power and roughly a third of the company.

Acquisitions are another risk, both in terms of the company’s history of acquisitions (which creates risks versus organic growth, but also creates synergies for the new larger post-merger entity) and FOUR’s potential to be acquired by someone else (in which case, current shareholders would either get cash or shares of the new company whereby they’d likely lose significant upside price appreciation in both scenarious).

High Short Interest: The short interest (or people betting against and/or hedging with, Shift4) was recently as high as 13.5% (as you can see in our earlier table). Short interest is difficult to use to predict future share price, but it is often an indication that there will be higher share price volatility ahead.

The Bottom Line:

Shift4 Payments appears to be an attractive high-growth company, with a large market opportunity (fintech) and currently trading at an attractive valuation. We don’t currently own shares, but it is high on our watchlist, and we may add shares of FOUR to our Disciplined Growth Portfolio in the near future. Stay tuned.